Region:Asia

Author(s):Dev

Product Code:KRAD0593

Pages:81

Published On:August 2025

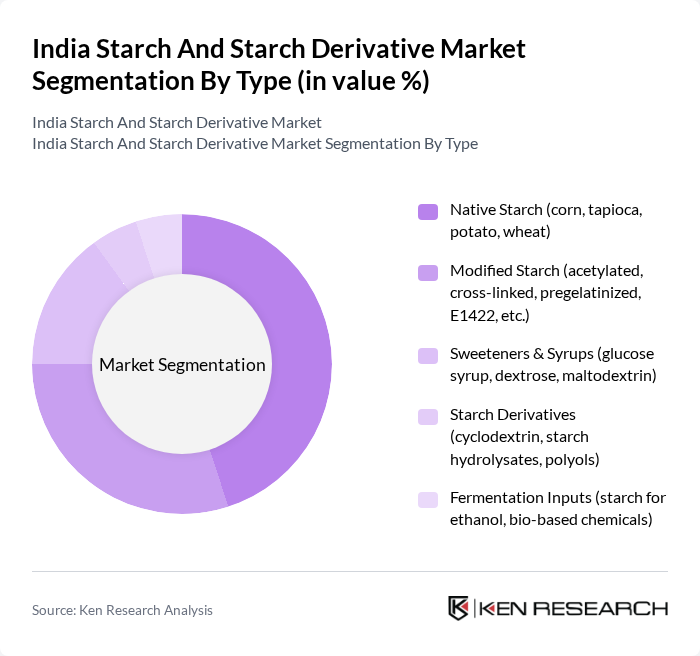

By Type:The market is segmented into various types, including Native Starch, Modified Starch, Sweeteners & Syrups, Starch Derivatives, and Fermentation Inputs. Among these, Native Starch, derived from corn, tapioca, potato, and wheat, is the most widely used due to its natural properties and versatility in food applications. The food industry holds the largest share of native starch usage in India, with significant volumes consumed in sauces, soups, snacks, and dairy . Modified Starch is also gaining traction, particularly in the food and pharmaceutical sectors, due to its enhanced functional properties such as improved viscosity, stability, and process tolerance in heat, shear, and acidic conditions . Sweeteners and syrups, such as glucose syrup and maltodextrin, are increasingly used in confectionery, beverages, and bakery as functional bulking and sweetness solutions .

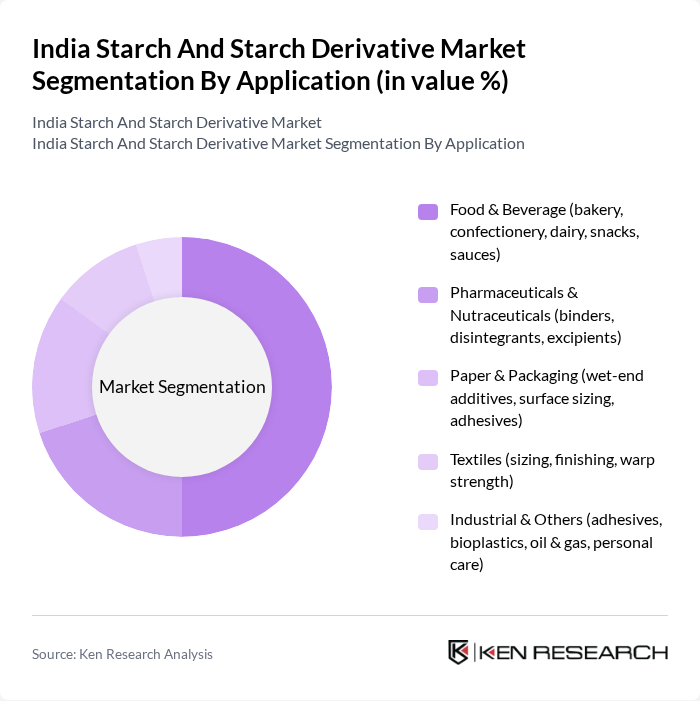

By Application:The applications of starch and its derivatives span across various sectors, including Food & Beverage, Pharmaceuticals & Nutraceuticals, Paper & Packaging, Textiles, and Industrial & Others. The Food & Beverage sector is the largest consumer, utilizing starch for its thickening, gelling, and stabilizing properties in products like sauces, dairy, and snacks; clean-label and plant-based trends further reinforce this usage . The Pharmaceuticals sector also significantly contributes to the market, using starch as a binder and disintegrant in tablet formulations and as an excipient across dosage forms . The growing demand for eco-friendly and strength-enhancing paper solutions is driving starch use in wet-end additives, surface sizing, and corrugation adhesives in Paper & Packaging .

The India Starch and Starch Derivative Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roquette Riddhi Siddhi Private Limited, Gujarat Ambuja Exports Limited, Sukhjit Starch & Chemicals Ltd., Sayaji Industries Limited, Universal Starch-Chem Allied Ltd., Tirupati Starch & Chemicals Ltd., HL Agro Products Pvt. Ltd. (corn wet milling, starch & sweeteners), Bluecraft Agro Private Limited, Sanstar Bio-Polymers Ltd., Gulshan Polyols Limited, Anil Speciality Chemicals Ltd. (formerly Anil Ltd.), Angel Starch & Food Pvt. Ltd., Laxmi Starch Pvt. Ltd., Visco Starch (Mahalakshmi Tapioca), Cornex Agro contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India starch and starch derivative market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for clean label and organic products continues to rise, manufacturers are likely to invest in innovative starch solutions that meet these criteria. Additionally, the expansion of e-commerce platforms is expected to facilitate greater market access, allowing for increased distribution of starch-based products across diverse consumer segments, thereby enhancing market penetration and growth potential.

| Segment | Sub-Segments |

|---|---|

| By Type | Native Starch (corn, tapioca, potato, wheat) Modified Starch (acetylated, cross-linked, pregelatinized, E1422, etc.) Sweeteners & Syrups (glucose syrup, dextrose, maltodextrin) Starch Derivatives (cyclodextrin, starch hydrolysates, polyols) Fermentation Inputs (starch for ethanol, bio-based chemicals) |

| By Application | Food & Beverage (bakery, confectionery, dairy, snacks, sauces) Pharmaceuticals & Nutraceuticals (binders, disintegrants, excipients) Paper & Packaging (wet-end additives, surface sizing, adhesives) Textiles (sizing, finishing, warp strength) Industrial & Others (adhesives, bioplastics, oil & gas, personal care) |

| By End-User | Food Processors & FMCG Manufacturers Beverage & Brewery Producers Pharma & Healthcare Companies Paper, Packaging & Textile Mills Chemical, Adhesive & Bioplastic Manufacturers |

| By Distribution Channel | Direct Institutional/Industrial Sales Authorized Distributors & Traders Online B2B Platforms Wholesalers Others |

| By Region | North India (Uttar Pradesh, Punjab, Haryana, Delhi NCR) South India (Tamil Nadu, Karnataka, Andhra Pradesh, Telangana) East India (West Bengal, Odisha, Bihar, Jharkhand) West India (Maharashtra, Gujarat, Rajasthan, Goa) Central & Others (Madhya Pradesh, Chhattisgarh, Uttarakhand, etc.) |

| By Price Range | Economy Mid-Range Premium Others |

| By Packaging Type | Bulk Packaging (25–50 kg bags, jumbo bags) Retail Packaging (1–5 kg) Custom & Industrial Packaging (IBC, tankers, customized specs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Sector | 140 | Product Development Managers, Quality Assurance Heads |

| Pharmaceutical Applications | 100 | Formulation Scientists, Regulatory Affairs Managers |

| Textile Industry Usage | 80 | Textile Engineers, Production Managers |

| Biodegradable Plastics Sector | 70 | Research and Development Directors, Sustainability Managers |

| Animal Feed Additives | 60 | Nutritionists, Procurement Managers |

The India Starch and Starch Derivative Market is valued at approximately USD 6.6 billion, reflecting its extensive applications across various industries, including food, pharmaceuticals, and textiles, based on a five-year historical analysis.