Region:Asia

Author(s):Dev

Product Code:KRAD0361

Pages:87

Published On:August 2025

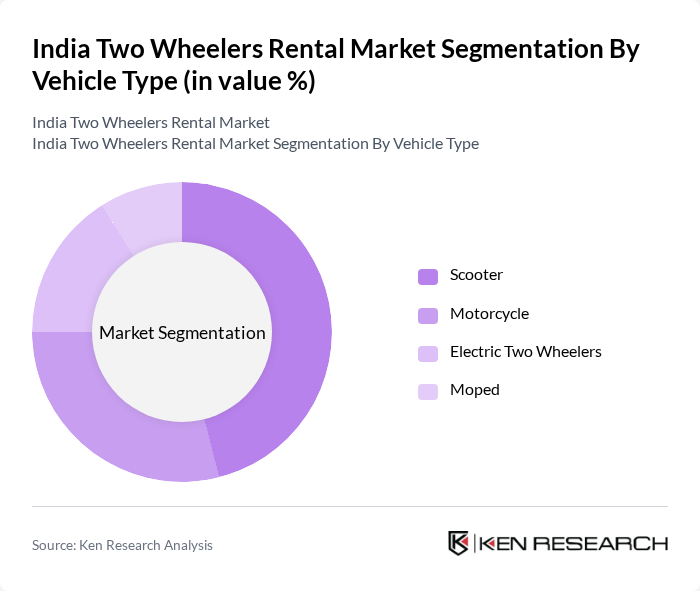

By Vehicle Type:The vehicle type segmentation includes scooters, motorcycles, electric two-wheelers, and mopeds. Among these, scooters are the most popular choice for rentals due to their ease of use, fuel efficiency, and suitability for urban commuting. Motorcycles cater to a niche market focused on performance and leisure riding, while electric two-wheelers are gaining traction as consumers become more environmentally conscious and as government incentives make electric options increasingly viable. Mopeds, although less common, serve specific needs in certain regions, particularly for short-distance and last-mile connectivity.

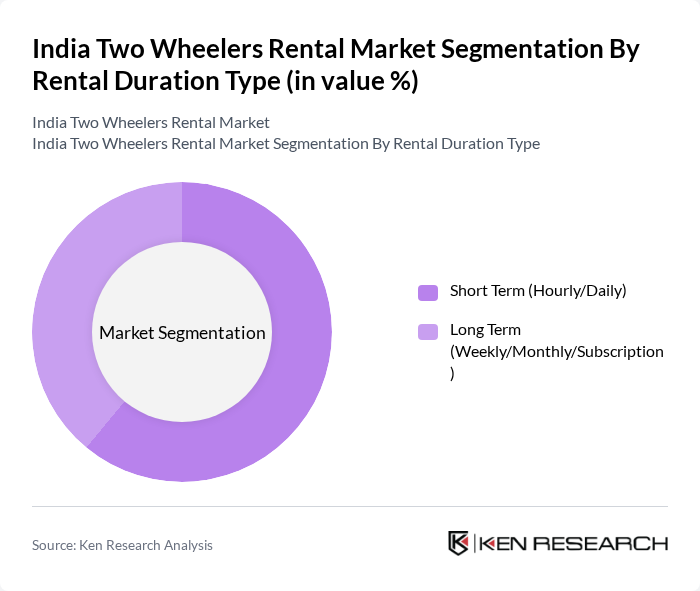

By Rental Duration Type:The rental duration type includes short-term (hourly/daily) and long-term (weekly/monthly/subscription) rentals. Short-term rentals are particularly popular among tourists and urban commuters who require flexible transportation for brief periods. Long-term rentals appeal to users looking for cost-effective solutions for extended periods, such as students or professionals who need reliable transportation for work or study. Demand for subscription-based models is also increasing, driven by the desire for hassle-free mobility and predictable costs.

The India Two Wheelers Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bounce, Vogo, Yulu, Royal Brothers, ONN Bikes, Wheelstreet, Drivezy, Rapido Rentals, RentOnGo, ZipHop, Mobycy, Zypp Electric, Ola Bike, Metro Bikes, Myles contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India two-wheelers rental market appears promising, driven by technological advancements and changing consumer preferences. The integration of mobile applications for seamless booking and payment processes is expected to enhance user experience significantly. Additionally, the shift towards electric two-wheelers aligns with the growing environmental consciousness among consumers. As urbanization continues and fuel prices remain volatile, the demand for rental services is likely to increase, creating a dynamic and evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Scooter Motorcycle Electric Two Wheelers Moped |

| By Rental Duration Type | Short Term (Hourly/Daily) Long Term (Weekly/Monthly/Subscription) |

| By Application | Commuting Touring/Leisure Delivery/Logistics |

| By Region | North India South India East India West India |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Two-Wheeler Rental Users | 120 | Frequent Renters, Occasional Users |

| Rental Company Owners | 60 | Business Owners, Operations Managers |

| Tourists Utilizing Rental Services | 50 | Domestic Tourists, International Visitors |

| Local Government Officials | 40 | Transport Policy Makers, Urban Planners |

| Industry Experts and Analysts | 40 | Market Analysts, Economic Advisors |

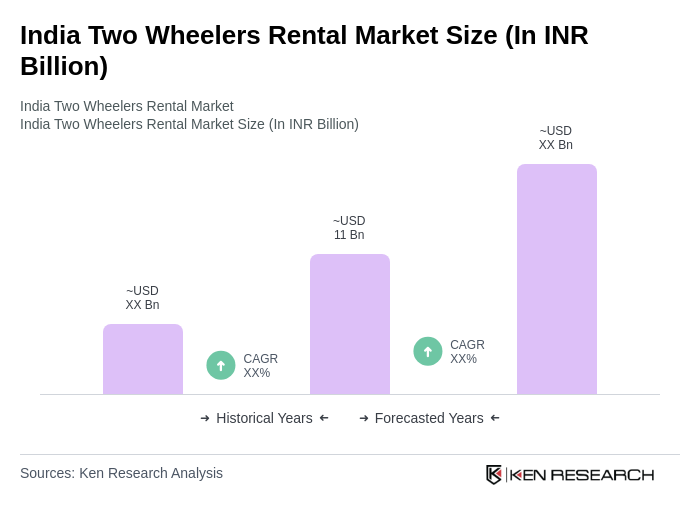

The India Two Wheelers Rental Market is valued at approximately INR 11 billion, driven by urbanization, traffic congestion, and a growing preference for cost-effective transportation solutions among consumers, particularly in metropolitan areas.