Region:Asia

Author(s):Rebecca

Product Code:KRAA1337

Pages:82

Published On:August 2025

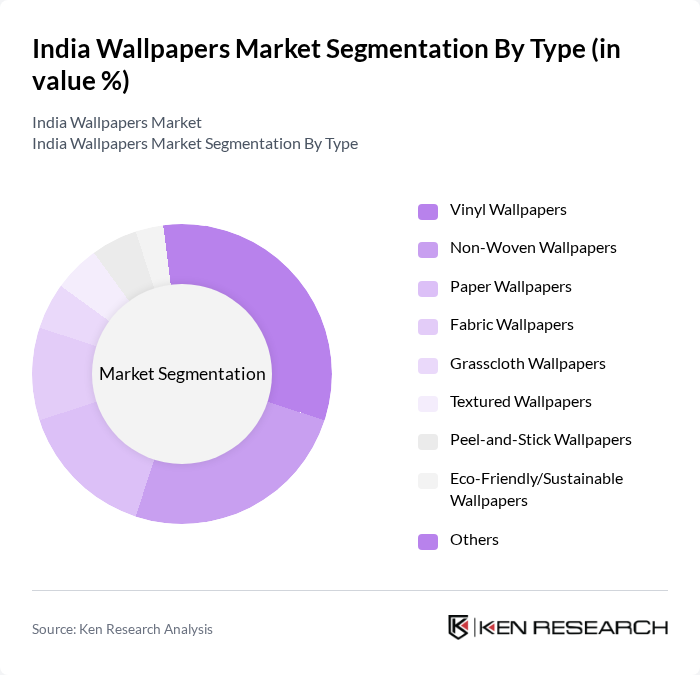

By Type:The market is segmented into various types of wallpapers, including Vinyl Wallpapers, Non-Woven Wallpapers, Paper Wallpapers, Fabric Wallpapers, Grasscloth Wallpapers, Textured Wallpapers, Peel-and-Stick Wallpapers, Eco-Friendly/Sustainable Wallpapers, and Others. Each type caters to different consumer preferences and applications. Vinyl and non-woven wallpapers are particularly popular due to their durability, ease of maintenance, and wide variety of design options. The increasing adoption of peel-and-stick and eco-friendly wallpapers reflects a shift toward convenience and sustainability .

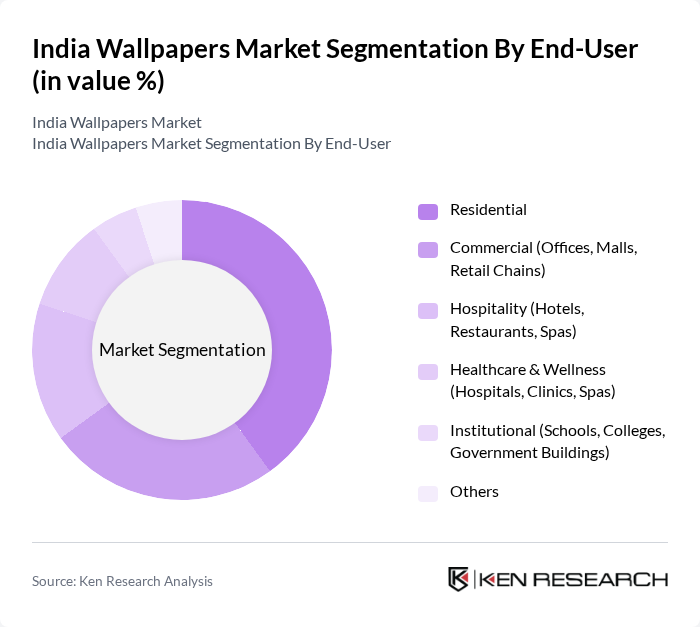

By End-User:The end-user segmentation includes Residential, Commercial (Offices, Malls, Retail Chains), Hospitality (Hotels, Restaurants, Spas), Healthcare & Wellness (Hospitals, Clinics, Spas), Institutional (Schools, Colleges, Government Buildings), and Others. The residential segment is the largest, driven by increasing home renovation projects, a growing interest in personalized interior design, and the rising influence of online retail channels. Commercial and hospitality segments are also significant, supported by the expansion of office spaces, retail outlets, and hotels .

The India Wallpapers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Asian Paints Ltd., Berger Paints India Ltd., Kansai Nerolac Paints Ltd., Dulux India (Akzo Nobel India Ltd.), Greenply Industries Ltd. (Greenteriors), Wallskin, Marshalls Wallcoverings, Excel Wallpapers, Nilaya by Asian Paints, 3M India Ltd., AICA Laminates India Pvt. Ltd., Ahlstrom-Munksjö, Maruti Wallcoverings Pvt. Ltd., D'Decor Home Fabrics Pvt. Ltd., Wonder Walls (Wonder Decor Pvt. Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India wallpapers market appears promising, driven by technological advancements and evolving consumer preferences. The adoption of digital printing technology is expected to enhance customization options, allowing consumers to create unique designs. Additionally, the growing emphasis on sustainability will likely lead to increased demand for eco-friendly wallpaper materials. As urbanization continues and disposable incomes rise, the market is poised for significant growth, particularly in tier 2 and tier 3 cities where awareness of interior design is increasing.

| Segment | Sub-Segments |

|---|---|

| By Type | Vinyl Wallpapers Non-Woven Wallpapers Paper Wallpapers Fabric Wallpapers Grasscloth Wallpapers Textured Wallpapers Peel-and-Stick Wallpapers Eco-Friendly/Sustainable Wallpapers Others |

| By End-User | Residential Commercial (Offices, Malls, Retail Chains) Hospitality (Hotels, Restaurants, Spas) Healthcare & Wellness (Hospitals, Clinics, Spalons) Institutional (Schools, Colleges, Government Buildings) Others |

| By Region | North India South India East India West India |

| By Application | Accent Walls Full Room Coverage Ceilings Bathrooms & Kitchens Retail Outlets Hospitality Sector Office Spaces Others |

| By Sales Channel | Online Retail (E-commerce Platforms, Brand Websites) Offline Retail (Home Décor Stores, Paint Shops) Direct Sales Distributors/Dealers Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Design Style | Modern Traditional Vintage Abstract Nature/Floral Geometric Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Wallpaper Market | 100 | Homeowners, Interior Designers |

| Commercial Wallpaper Applications | 60 | Facility Managers, Architects |

| Online Wallpaper Retailers | 50 | E-commerce Managers, Marketing Directors |

| Wallpaper Manufacturing Insights | 40 | Production Managers, Quality Control Officers |

| Trends in Eco-friendly Wallpapers | 40 | Sustainability Experts, Product Development Managers |

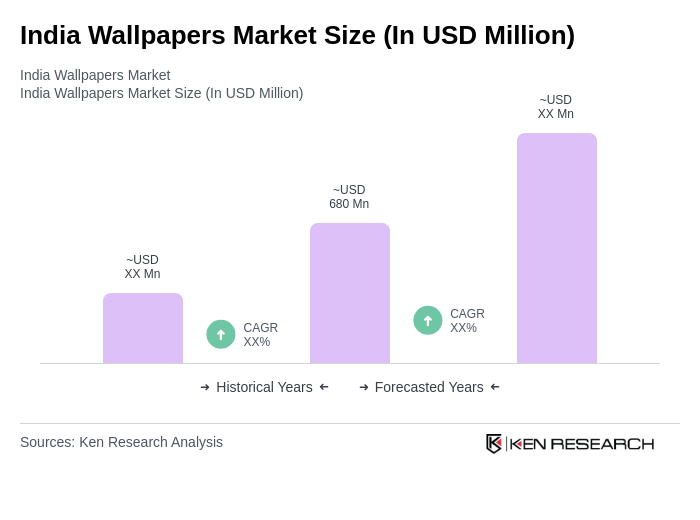

The India Wallpapers Market is valued at approximately USD 680 million, driven by urbanization, rising disposable incomes, and a growing trend towards home improvement and interior decoration.