Region:Asia

Author(s):Dev

Product Code:KRAD0459

Pages:99

Published On:August 2025

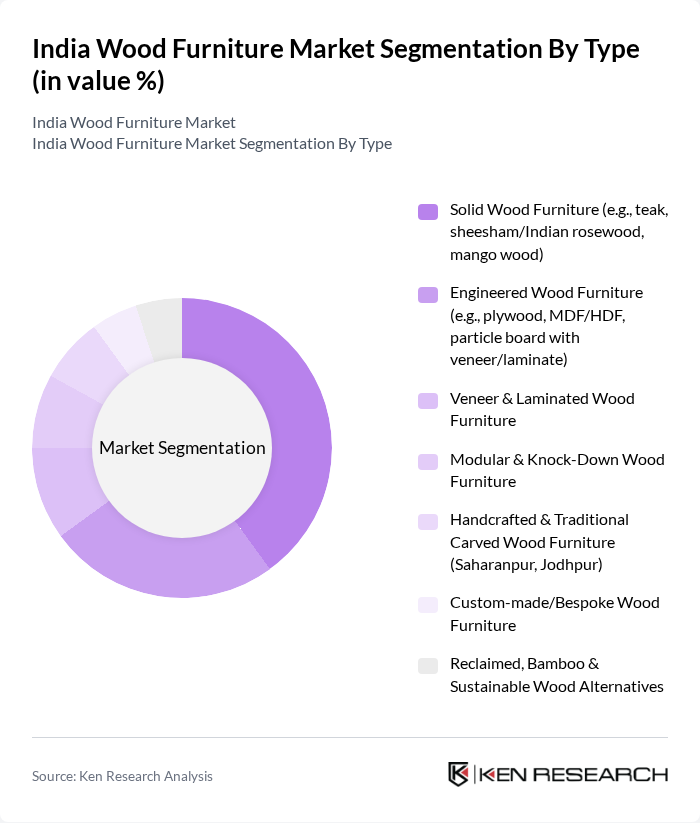

By Type:The wood furniture market can be segmented into various types, including solid wood furniture, engineered wood furniture, veneer and laminated wood furniture, modular and knock-down wood furniture, handcrafted and traditional carved wood furniture, custom-made/bespoke wood furniture, and reclaimed, bamboo, and sustainable wood alternatives. Among these, solid wood furniture is currently the leading subsegment due to its durability, aesthetic appeal, and the growing trend of investing in high-quality, long-lasting products. Consumers are increasingly inclined towards solid wood options, particularly teak and sheesham, which are known for their strength and beauty.

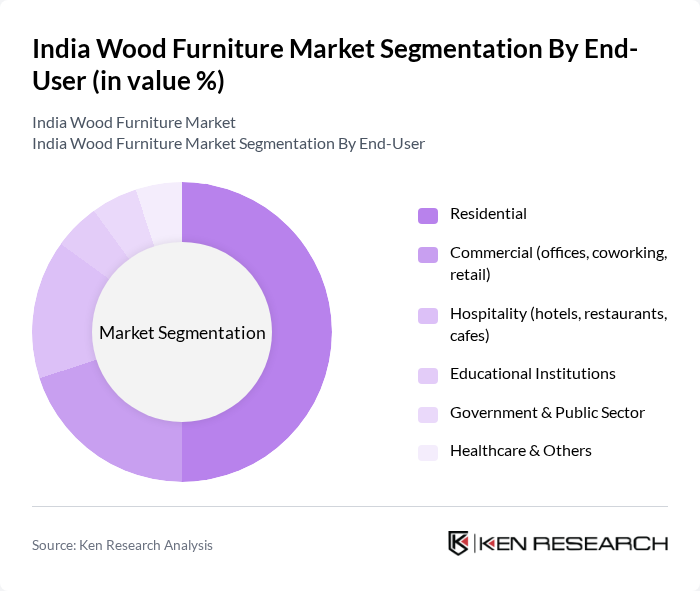

By End-User:The end-user segmentation includes residential, commercial, hospitality, educational institutions, government and public sector, and healthcare. The residential segment is the largest contributor to the market, supported by home improvement/renovation activity, higher discretionary spending, and the shift toward modular, space-efficient, and ergonomic home furniture for hybrid work.

The India Wood Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Godrej Interio, Durian, Wipro Furniture (Wipro Enterprises), Nilkamal, Urban Ladder, Pepperfry, IKEA India, HomeTown (Future Retail legacy brand), Royaloak, Spacewood, Featherlite, Evok (Hometown Retail), Furniturewalla (FWD), Style Spa (formerly GATIM), Saraf Furniture (Insaraf.com), Duroflex Furniture, Wakefit, WoodenStreet, HNI India (HON/Allsteel – office), Zuari Furniture contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India wood furniture market appears promising, driven by increasing urbanization and rising disposable incomes. As consumers become more environmentally conscious, the demand for sustainable and eco-friendly furniture is expected to rise. Additionally, the integration of technology in furniture design will likely create new market segments. Companies that adapt to these trends and focus on customization will be well-positioned to capture a larger share of the market, enhancing their competitive advantage in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Solid Wood Furniture (e.g., teak, sheesham/Indian rosewood, mango wood) Engineered Wood Furniture (e.g., plywood, MDF/HDF, particle board with veneer/laminate) Veneer & Laminated Wood Furniture Modular & Knock-Down Wood Furniture Handcrafted & Traditional Carved Wood Furniture (Saharanpur, Jodhpur) Custom-made/Bespoke Wood Furniture Reclaimed, Bamboo & Sustainable Wood Alternatives |

| By End-User | Residential Commercial (offices, coworking, retail) Hospitality (hotels, restaurants, cafes) Educational Institutions Government & Public Sector Healthcare & Others |

| By Region | North India (Delhi-NCR, Rajasthan, Punjab, Uttar Pradesh) South India (Karnataka, Tamil Nadu, Telangana, Kerala) East India (West Bengal, Odisha, Bihar) West India (Maharashtra, Gujarat, Goa) Central India (Madhya Pradesh, Chhattisgarh) Northeast India |

| By Application | Home Furniture (living, bedroom, dining, storage) Office & Workspace Furniture (desks, seating, conference) Outdoor & Patio Wood Furniture Institutional Furniture (schools, hospitals, govt.) Hospitality & Contract Furniture |

| By Sales Channel | Online D2C/E-commerce (own web, marketplaces) Offline Retail (exclusive brand outlets, multi-brand stores) Direct Project/Contract Sales (B2B) Distributors & Dealers Interior Designers/Architects & Others |

| By Price Range | Budget Mid-range Premium Luxury Value (organized-unorganized bridge) |

| By Material Type | Hardwood (teak, sheesham, oak, acacia, mango) Softwood (pine, cedar) Engineered Wood & Composites (plywood, MDF/HDF, particle board) Bamboo, Cane & Reclaimed Wood |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Wood Furniture Market | 150 | Homeowners, Interior Designers |

| Commercial Wood Furniture Sector | 100 | Office Managers, Facilities Managers |

| Export Market for Indian Wood Furniture | 80 | Export Managers, Trade Analysts |

| Online Furniture Retail Segment | 120 | E-commerce Managers, Digital Marketing Specialists |

| Custom Furniture Design Services | 70 | Custom Furniture Makers, Design Consultants |

The India wood furniture market is valued at approximately USD 2325 billion, driven by urbanization, rising disposable incomes, and a growing preference for ergonomic and aesthetically designed furniture. This market is expected to continue growing as consumer demands evolve.