Region:Asia

Author(s):Rebecca

Product Code:KRAA5837

Pages:81

Published On:September 2025

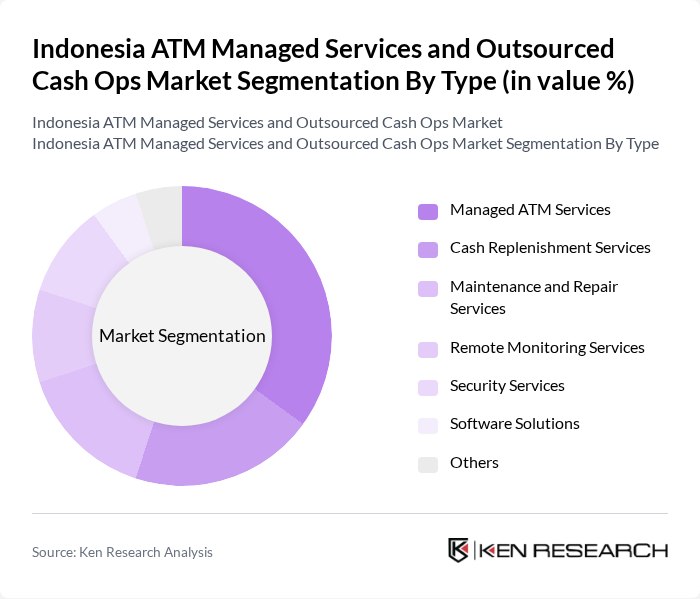

By Type:The market is segmented into various types of services, including Managed ATM Services, Cash Replenishment Services, Maintenance and Repair Services, Remote Monitoring Services, Security Services, Software Solutions, and Others. Among these, Managed ATM Services is the leading segment due to the increasing reliance of banks and financial institutions on outsourcing ATM operations to enhance efficiency and reduce operational costs.

By End-User:The end-user segmentation includes Banks, Financial Institutions, Retailers, Government Agencies, Hospitality Sector, Transportation Sector, and Others. Banks are the dominant end-user segment, as they require comprehensive ATM managed services to ensure operational efficiency, security, and customer satisfaction in their cash dispensing operations.

The Indonesia ATM Managed Services and Outsourced Cash Ops Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Astra Graphia Tbk, PT. Bank Mandiri (Persero) Tbk, PT. Bank Rakyat Indonesia (Persero) Tbk, PT. CIMB Niaga Tbk, PT. Danamon Indonesia Tbk, PT. BCA (Bank Central Asia) Tbk, PT. Indosat Tbk, PT. Telkom Indonesia Tbk, PT. Bank Negara Indonesia (Persero) Tbk, PT. Mega Financial Group, PT. Bank Panin Dubai Syariah Tbk, PT. Bank Permata Tbk, PT. Bank Syariah Indonesia Tbk, PT. Bank Jabar Banten, PT. Bank Victoria International Tbk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ATM managed services and outsourced cash operations market in Indonesia appears promising, driven by technological innovations and increasing cash transaction volumes. As the banking sector continues to expand, the integration of digital solutions will enhance operational efficiency and customer experience. Additionally, the focus on sustainability and compliance will shape service offerings, encouraging providers to adopt eco-friendly practices and advanced technologies to meet regulatory demands and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed ATM Services Cash Replenishment Services Maintenance and Repair Services Remote Monitoring Services Security Services Software Solutions Others |

| By End-User | Banks Financial Institutions Retailers Government Agencies Hospitality Sector Transportation Sector Others |

| By Service Model | Full-Service Outsourcing Hybrid Model In-House Management Others |

| By Payment Method | Cash Transactions Digital Wallets Credit/Debit Cards Others |

| By Region | Java Sumatra Bali Kalimantan Sulawesi Others |

| By Customer Segment | Individual Consumers Small and Medium Enterprises Large Corporations Non-Profit Organizations Others |

| By Contract Type | Long-Term Contracts Short-Term Contracts Project-Based Contracts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector ATM Operations | 150 | ATM Managers, Operations Directors |

| Third-party ATM Service Providers | 100 | Service Delivery Managers, Business Development Heads |

| Cash Management Solutions | 80 | Cash Operations Managers, Financial Analysts |

| Regulatory Compliance in Cash Ops | 60 | Compliance Officers, Risk Management Executives |

| Technological Innovations in ATM Services | 70 | IT Managers, Product Development Leads |

The Indonesia ATM Managed Services and Outsourced Cash Ops Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital banking services and the expansion of the ATM network across the country.