Region:Asia

Author(s):Rebecca

Product Code:KRAD7408

Pages:89

Published On:December 2025

By Service Type:The service type segmentation includes various laboratory services essential for clinical trials. The subsegments are Central Routine Safety Testing (clinical chemistry, hematology), Specialty & Esoteric Testing (endocrinology, immunology, oncology panels), Biomarker & Bioanalytical Services for Clinical Trials, Genomic and Molecular Diagnostics (qPCR, NGS, companion diagnostics), Histopathology and Anatomic Pathology Services, PK/PD and Pharmacogenomic Testing, Logistics, Kit Building & Sample Management Services, Data Management, Biostatistics & Central Data Review, and Others. Routine clinical chemistry and hematology testing typically account for the largest share of clinical laboratory service revenues in Indonesia and other markets, reflecting their use across almost all trial protocols and therapeutic areas. Among these, Central Routine Safety Testing is the leading subsegment due to its critical role in ensuring patient safety monitoring, eligibility assessment, and regulatory compliance during clinical trials.

By Trial Phase:The trial phase segmentation encompasses various stages of clinical trials, including Phase I Clinical Trials, Phase II Clinical Trials, Phase III Clinical Trials, Phase IV / Post-Marketing Studies, and Bioequivalence and Bioavailability Studies. Globally and in Asia–Pacific, Phase III Clinical Trials typically require the highest volume of central laboratory testing because of larger patient cohorts, longer follow-up, and extensive safety and efficacy monitoring before regulatory submission. Phase III Clinical Trials therefore dominate this segment due to their critical role in evaluating the efficacy and safety of new treatments before they receive regulatory approval, while Phase I–II and bioequivalence studies generate growing but comparatively smaller testing volumes.

The Indonesia Clinical Trial Central Laboratory Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Prodia Widyahusada Tbk (Prodia Clinical Laboratory), PT Kimia Farma Diagnostika (Kimia Farma Diagnostics), PT Bio Farma (Persero), PT Pramita Lab (Laboratorium Klinik Pramita), PT Quantum Laboratories Indonesia, PT Cito Putra Utama (Laboratorium Klinik CITO), PT Siloam International Hospitals Tbk – Central Lab Services, PT Mitra Keluarga Karyasehat Tbk – Hospital Laboratory Network, PT Bumrungrad Health Laboratory Indonesia (example international-affiliated central lab), Pusat Laboratorium Kesehatan (National Health Laboratory – Ministry of Health), Eijkman Institute for Molecular Biology – BRIN (clinical trial and genomic lab services), PT Nalagenetics Indonesia (genomic and pharmacogenomic services for trials), Parexel – Central Laboratory Services (Indonesia-supported operations), Labcorp Central Laboratory Services (regional APAC central lab serving Indonesia), Eurofins Central Laboratory (APAC hub supporting Indonesia clinical trials) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia Clinical Trial Central Laboratory Services market appears promising, driven by advancements in technology and increasing collaboration among stakeholders. The shift towards decentralized clinical trials is expected to enhance patient recruitment and retention, while the integration of AI and machine learning will streamline laboratory processes. Furthermore, as the government continues to invest in healthcare infrastructure, the market is likely to witness a surge in innovative research initiatives, fostering a more robust clinical trial ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Central Routine Safety Testing (clinical chemistry, hematology) Specialty & Esoteric Testing (endocrinology, immunology, oncology panels) Biomarker & Bioanalytical Services for Clinical Trials Genomic and Molecular Diagnostics (qPCR, NGS, companion diagnostics) Histopathology and Anatomic Pathology Services PK/PD and Pharmacogenomic Testing Logistics, Kit Building & Sample Management Services Data Management, Biostatistics & Central Data Review Others |

| By Trial Phase | Phase I Clinical Trials Phase II Clinical Trials Phase III Clinical Trials Phase IV / Post-Marketing Studies Bioequivalence and Bioavailability Studies |

| By Therapeutic Area | Oncology Cardiology and Metabolic Disorders Infectious Diseases (including HIV, hepatitis, TB) Vaccines and Immunology Neurology and CNS Disorders Rare Diseases and Orphan Indications Others |

| By Sponsor Type | Global Pharmaceutical Companies Local / Regional Pharmaceutical Manufacturers Biotechnology Companies Contract Research Organizations (CROs) Academic Medical Centers and Research Institutes Public Health Agencies and NGOs Others |

| By Central Lab Ownership | Independent Central Laboratories Hospital-Integrated Central Labs CRO-Integrated Central Labs University / Government-Affiliated Central Labs Others |

| By Technology Platform | High-Throughput Clinical Chemistry and Hematology Analyzers Molecular Platforms (PCR, RT-PCR, NGS) Immunoassay and Flow Cytometry Systems Digital Pathology and Image Analysis Laboratory Information Management Systems (LIMS) and EDC Integration Point-of-Care and Remote Sample Collection Technologies Others |

| By Region | Greater Jakarta (Jabodetabek) West Java East Java Central Java and Yogyakarta Sumatra Kalimantan Sulawesi and Eastern Indonesia Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratory Services | 120 | Laboratory Managers, Clinical Research Coordinators |

| Contract Research Organizations (CROs) | 100 | Project Managers, Regulatory Affairs Specialists |

| Pharmaceutical Sponsors | 80 | Clinical Trial Managers, Drug Development Scientists |

| Diagnostic Testing Providers | 70 | Operations Directors, Quality Assurance Managers |

| Biobanking Services | 60 | Biobank Managers, Research Scientists |

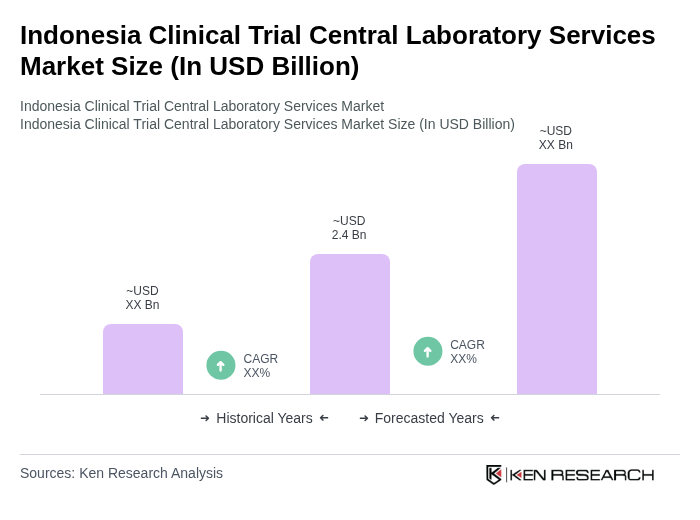

The Indonesia Clinical Trial Central Laboratory Services Market is valued at approximately USD 2.4 billion. This valuation is based on a five-year historical analysis of the broader clinical laboratory services market in Indonesia, reflecting significant growth driven by increased clinical trial activities.