Region:Asia

Author(s):Geetanshi

Product Code:KRAB5124

Pages:98

Published On:October 2025

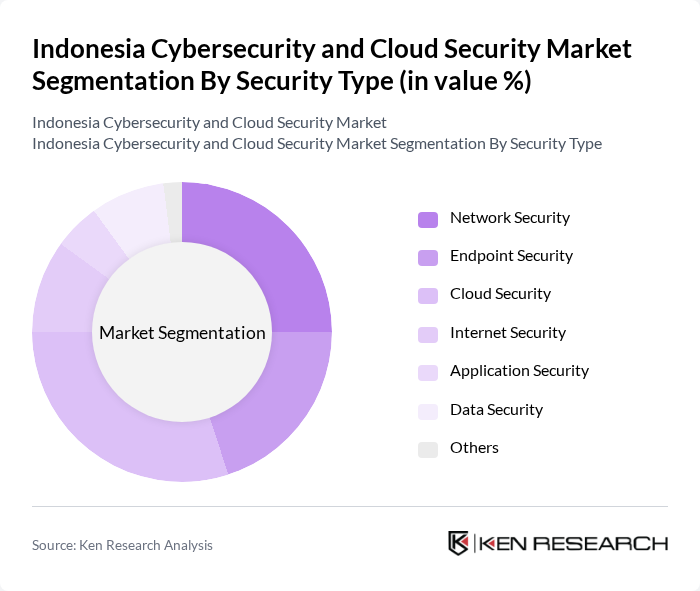

By Security Type:The market is segmented into various security types, including Network Security, Endpoint Security, Cloud Security, Internet Security, Application Security, Data Security, and Others. Cloud Security has emerged as the dominant segment, driven by rapid cloud adoption across Indonesian enterprises and the proliferation of digital payment and fintech solutions. Each of these segments plays a crucial role in protecting digital assets and ensuring the integrity of information systems.

By End-User Vertical:The market is also segmented by end-user verticals, including BFSI, Government and Defence, Healthcare, Retail, Manufacturing, IT and Telecommunications, Energy and Utilities, Transportation and Logistics, and Others. The BFSI sector leads market adoption due to stringent regulatory requirements and the critical nature of financial data protection, while the Government and Defence sector follows closely with significant investments in national cybersecurity infrastructure. Each vertical has unique security needs and compliance requirements that drive the adoption of cybersecurity and cloud security solutions.

The Indonesia Cybersecurity and Cloud Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Cyberindo Aditama (CBN), PT. Vaksincom, PT. Mitra Integrasi Informatika, PT. Dwi Tunggal Putra, PT. Solusi247, PT. Indosat Tbk (Indosat Ooredoo Hutchison), PT. Telkom Indonesia (Persero) Tbk, PT. Cyber Security Indonesia, PT. Synnex Metrodata Indonesia, PT. Aplikanusa Lintasarta, PT. Cipta Sarana Duta, PT. Infinys System Indonesia, PT. Astra Graphia Tbk, PT. Bhinneka Mentari Dimensi, PT. Multipolar Technology Tbk, IBM Indonesia, Cisco Systems Indonesia, Microsoft Indonesia, Fortinet Indonesia, Palo Alto Networks Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian cybersecurity and cloud security market appears promising, driven by increasing investments in technology and a heightened focus on regulatory compliance. As organizations continue to embrace digital transformation, the demand for advanced security solutions will likely escalate. Additionally, the integration of artificial intelligence and machine learning in cybersecurity practices is expected to enhance threat detection and response capabilities, positioning Indonesia as a competitive player in the regional cybersecurity landscape.

| Segment | Sub-Segments |

|---|---|

| By Security Type | Network Security Endpoint Security Cloud Security Internet Security Application Security Data Security Others |

| By End-User Vertical | BFSI Government and Defence Healthcare Retail Manufacturing IT and Telecommunications Energy and Utilities Transportation and Logistics Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Organization Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By Service Type | Consulting Services Managed Security Services Training and Education Incident Response Services Others |

| By Region | Java Sumatra Kalimantan Sulawesi Bali and Nusa Tenggara Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Cybersecurity | 60 | IT Security Managers, Compliance Officers |

| Healthcare Cloud Security | 50 | Healthcare IT Directors, Data Protection Officers |

| E-commerce Cybersecurity Solutions | 40 | eCommerce Managers, IT Infrastructure Leads |

| Government Cybersecurity Initiatives | 45 | Policy Makers, Cybersecurity Analysts |

| SME Cloud Adoption Trends | 40 | Small Business Owners, IT Consultants |

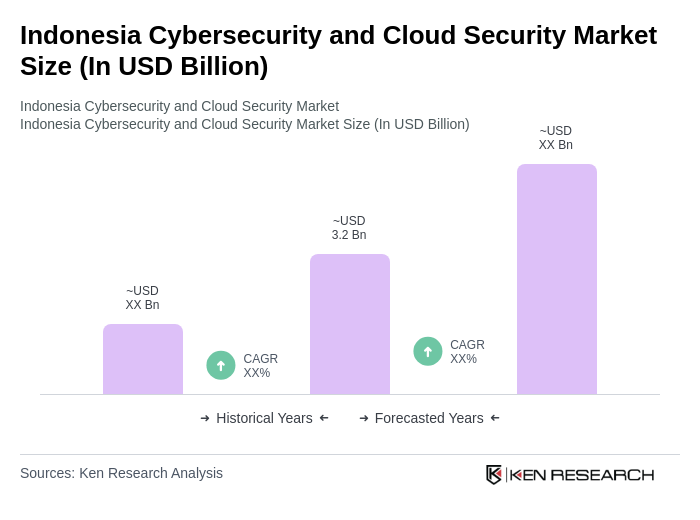

The Indonesia Cybersecurity and Cloud Security Market is valued at approximately USD 3.2 billion, reflecting significant growth driven by increasing cyber threats, cloud service adoption, and heightened awareness of data privacy among businesses and consumers.