Region:Asia

Author(s):Geetanshi

Product Code:KRAB5239

Pages:95

Published On:October 2025

By Product Category:The product category segmentation of the Indonesia E-Commerce Cross-Border Trade Market includes Fashion and Apparel, Electronics and Gadgets, Home and Living Products, Health and Beauty Products, Sports and Outdoor Equipment, Food and Beverages, Groceries, Automotive Parts & Accessories, and Others.Fashion and Apparelremains the leading sub-segment, accounting for the largest share of imported baskets, driven by the increasing trend of online shopping for clothing and accessories, especially among younger consumers prioritizing style, variety, and international brands. Electronics and Gadgets also hold a significant share, with consumer electronics such as smartphones and wearables being major contributors. Food and Beverages, particularly groceries, are emerging as high-growth categories due to urban consumers' preference for convenience and scheduled delivery subscriptions .

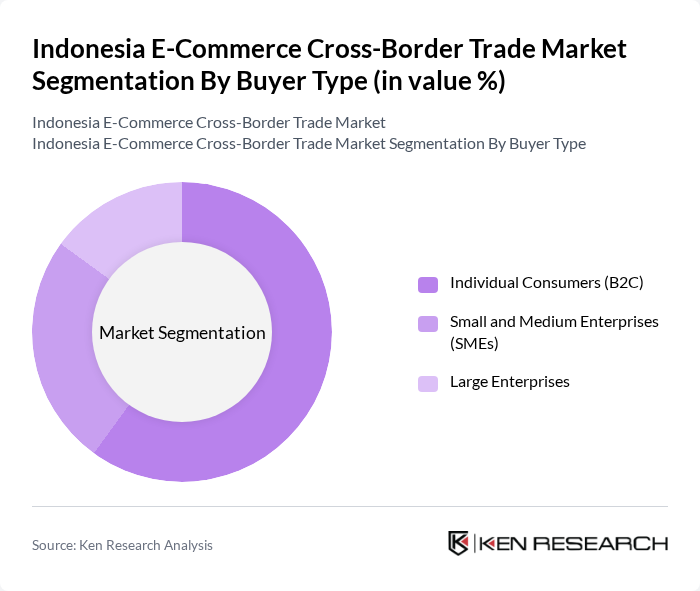

By Buyer Type:The buyer type segmentation includes Individual Consumers (B2C), Small and Medium Enterprises (SMEs), and Large Enterprises.Individual Consumers (B2C)represent the most significant segment, as the rise of e-commerce has made it easier for consumers to purchase products directly from international sellers. This segment is characterized by a growing preference for online shopping, especially among tech-savvy millennials and Gen Z consumers who value convenience, product variety, and digital payment options. SMEs are increasingly leveraging cross-border platforms to source products and expand their market reach .

The Indonesia E-Commerce Cross-Border Trade Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tokopedia, Bukalapak, Shopee Indonesia, Lazada Indonesia, Blibli, JD.ID, Zalora Indonesia, Orami, Ralali, Bhinneka, Elevenia, Kaskus, Fabelio, Qoo10 Indonesia, TikTok Shop Indonesia, Amazon Global Store (Indonesia), eBay (Indonesia Cross-Border), Alibaba.com (Indonesia Cross-Border) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's e-commerce cross-border trade market appears promising, driven by technological advancements and evolving consumer preferences. As mobile commerce continues to grow, with **over 60% of online transactions** expected to occur via mobile devices in future, businesses must adapt to this trend. Additionally, the increasing focus on sustainability and ethical sourcing will shape consumer choices, prompting e-commerce platforms to innovate and align with these values, ensuring long-term growth and competitiveness in the market.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Fashion and Apparel Electronics and Gadgets Home and Living Products Health and Beauty Products Sports and Outdoor Equipment Food and Beverages Groceries Automotive Parts & Accessories Others |

| By Buyer Type | Individual Consumers (B2C) Small and Medium Enterprises (SMEs) Large Enterprises |

| By Sales Channel | Online Marketplaces (e.g., Tokopedia, Shopee, Lazada) Direct-to-Consumer Brand Websites Social Commerce Platforms (e.g., TikTok Shop, Instagram Shopping) Mobile Applications |

| By Payment Method | Credit/Debit Cards E-Wallets (e.g., GoPay, OVO, Dana, ShopeePay) Bank Transfers Cash on Delivery Buy Now Pay Later (BNPL) |

| By Shipping Method | Standard Shipping Express Shipping Click and Collect International Shipping |

| By Product Origin | Domestic Products Imported Products (Cross-Border) Regional Products (ASEAN/Asia-Pacific) |

| By Customer Demographics | Age Group Gender Income Level Geographic Location (Urban/Rural, Java/Non-Java) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cross-Border E-commerce Retailers | 100 | Business Owners, E-commerce Managers |

| Logistics Providers for E-commerce | 60 | Operations Managers, Logistics Coordinators |

| Consumer Insights on Cross-Border Shopping | 120 | Frequent Online Shoppers, Demographic Segments |

| Payment Solutions for Cross-Border Transactions | 50 | Product Managers, Financial Analysts |

| Regulatory Impact on E-commerce | 40 | Policy Makers, Compliance Officers |

The Indonesia E-Commerce Cross-Border Trade Market is valued at approximately USD 120 billion, driven by factors such as rapid internet penetration, smartphone adoption, and a growing middle class with increasing disposable incomes.