Region:Asia

Author(s):Shubham

Product Code:KRAB1302

Pages:89

Published On:October 2025

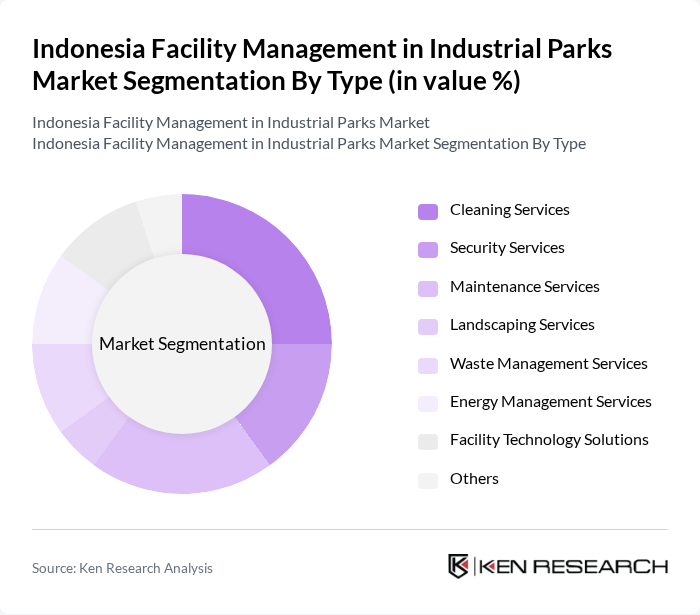

By Type:The facility management market in industrial parks is segmented into various types of services, including cleaning services, security services, maintenance services, landscaping services, waste management services, energy management services, facility technology solutions, and others. Among these, cleaning and maintenance services are particularly dominant due to the essential need for hygiene and operational upkeep in industrial environments. The increasing focus on workplace safety and employee well-being further drives the demand for these services.

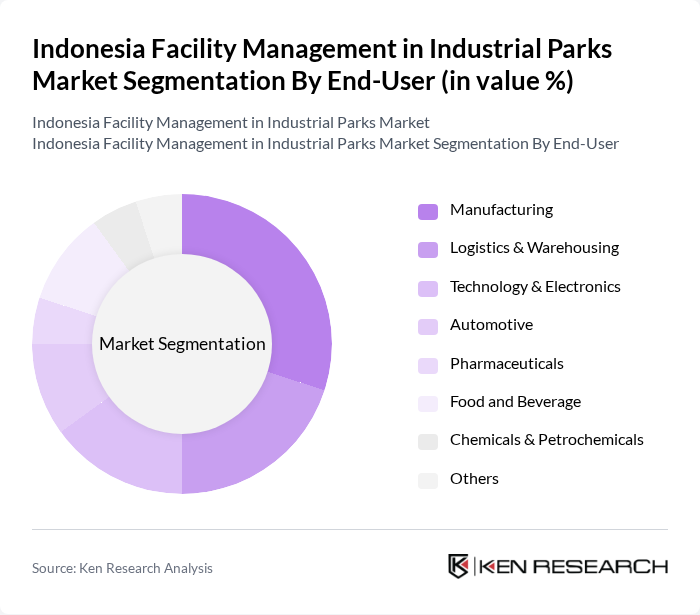

By End-User:The end-user segmentation includes manufacturing, logistics & warehousing, technology & electronics, automotive, pharmaceuticals, food and beverage, chemicals & petrochemicals, and others. The manufacturing sector is the largest end-user, driven by the need for efficient facility management to support production processes and ensure compliance with safety regulations. The logistics and warehousing sectors are also growing rapidly, necessitating effective management of facilities to optimize supply chain operations.

The Indonesia Facility Management in Industrial Parks Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Indonesia, CBRE Indonesia, JLL Indonesia, Cushman & Wakefield Indonesia, Savills Indonesia, Sodexo Indonesia, Knight Frank Indonesia, PT Shield-On Service Tbk (SOS), PT Spektra Solusindo, PT Patra Jasa, Atalian Global Services Indonesia, Colliers Facility Management Services Indonesia, Leads Property Services Indonesia, Maple Leaf Services Indonesia, AEON Delight Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the facility management market in Indonesia's industrial parks appears promising, driven by technological advancements and a growing emphasis on sustainability. As companies increasingly adopt smart facility management solutions, the integration of IoT and automation will enhance operational efficiency. Additionally, the government's commitment to developing new industrial parks will create further opportunities for facility management services, ensuring that the sector remains dynamic and responsive to market needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Cleaning Services Security Services Maintenance Services Landscaping Services Waste Management Services Energy Management Services Facility Technology Solutions Others |

| By End-User | Manufacturing Logistics & Warehousing Technology & Electronics Automotive Pharmaceuticals Food and Beverage Chemicals & Petrochemicals Others |

| By Service Model | Integrated Facility Management (IFM) Bundled Services Single Service Providers Others |

| By Contract Type | Fixed-Term Contracts Open-Ended Contracts Project-Based Contracts Others |

| By Geographic Location | Java Sumatra Kalimantan Sulawesi Bali Nusantara (IKN) Others |

| By Client Size | Large Enterprises Medium Enterprises Small Enterprises Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Facility Management | 100 | Facility Managers, Operations Directors |

| Logistics and Warehousing Services | 60 | Logistics Managers, Supply Chain Managers |

| Commercial Real Estate Management | 50 | Property Managers, Asset Managers |

| Environmental and Sustainability Services | 40 | Sustainability Officers, Compliance Managers |

| Security and Safety Management | 70 | Security Managers, Risk Managers |

The Indonesia Facility Management in Industrial Parks Market is valued at approximately USD 15 billion, driven by rapid industrialization, urbanization, and increased infrastructure investments. This growth reflects the rising demand for efficient facility management services in the region.