Region:Asia

Author(s):Rebecca

Product Code:KRAC0246

Pages:83

Published On:August 2025

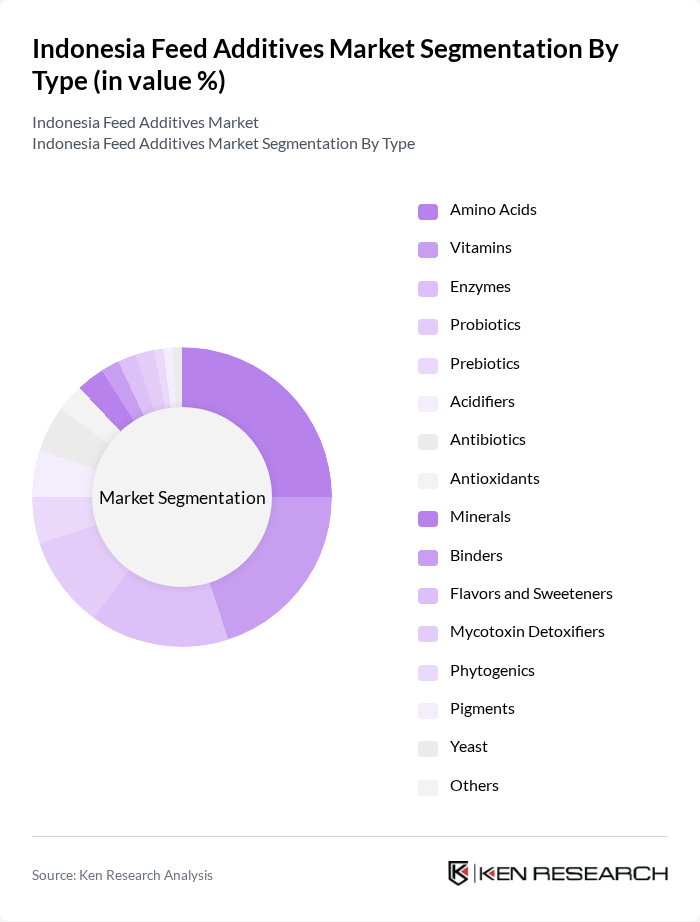

By Type:The feed additives market can be segmented into various types, including amino acids, vitamins, enzymes, probiotics, prebiotics, acidifiers, antibiotics, antioxidants, minerals, binders, flavors and sweeteners, mycotoxin detoxifiers, phytogenics, pigments, yeast, and others. Among these, amino acids (notably lysine and methionine) and vitamins are particularly significant due to their essential roles in animal nutrition and health. Acidifiers and probiotics are also gaining traction as alternatives to antibiotics, reflecting the shift toward sustainable and health-focused feed solutions .

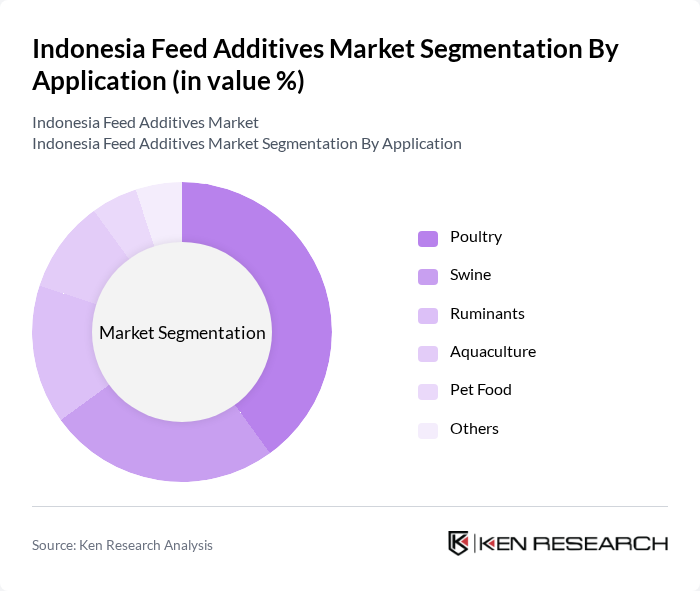

By Application:The applications of feed additives are diverse, including poultry, swine, ruminants, aquaculture, pet food, and others. The poultry segment is the largest due to the high demand for chicken meat and eggs in Indonesia, which drives the need for effective feed additives to enhance growth and health. Aquaculture is also a rapidly growing segment, reflecting Indonesia's significant fish and seafood production .

The Indonesia Feed Additives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill Indonesia, PT Charoen Pokphand Indonesia Tbk, PT Japfa Comfeed Indonesia Tbk, Alltech Indonesia, PT Sierad Produce Tbk, Nutreco N.V., PT Malindo Feedmill Tbk, PT Sinta Prima Feedmill, PT Greenfields Indonesia, PT Bina Agri Sejahtera, PT Sumber Bumi Agri, PT Sumber Sejahtera, PT Sari Bumi Agri, PT Sumber Agri Sejahtera, PT Sumber Makmur, DSM Indonesia, BASF Indonesia, Adisseo Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia feed additives market appears promising, driven by increasing livestock production and a growing focus on sustainable practices. As consumer preferences shift towards high-quality animal protein, the demand for innovative feed solutions will likely rise. Additionally, advancements in technology and research will facilitate the development of more effective and eco-friendly additives, enhancing productivity and animal health. This evolving landscape presents significant opportunities for growth and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Amino Acids Vitamins Enzymes Probiotics Prebiotics Acidifiers Antibiotics Antioxidants Minerals Binders Flavors and Sweeteners Mycotoxin Detoxifiers Phytogenics Pigments Yeast Others |

| By Application | Poultry Swine Ruminants Aquaculture Pet Food Others |

| By End-User | Feed Mills Commercial Farms Integrators Cooperatives Retailers Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | Java Sumatra Kalimantan Sulawesi Bali and Nusa Tenggara Papua Others |

| By Price Range | Low Price Mid Price High Price |

| By Brand Preference | Local Brands International Brands Private Labels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Livestock Feed Manufacturers | 80 | Production Managers, Quality Control Officers |

| Veterinary Clinics | 60 | Veterinarians, Animal Health Technicians |

| Livestock Farmers | 120 | Farm Owners, Livestock Managers |

| Feed Additive Distributors | 40 | Sales Representatives, Distribution Managers |

| Research Institutions | 40 | Animal Nutrition Researchers, Academics |

The Indonesia Feed Additives Market is valued at approximately USD 450 million, reflecting a significant growth driven by the increasing demand for high-quality animal feed essential for enhancing livestock productivity and health.