Region:Asia

Author(s):Geetanshi

Product Code:KRAA3819

Pages:80

Published On:September 2025

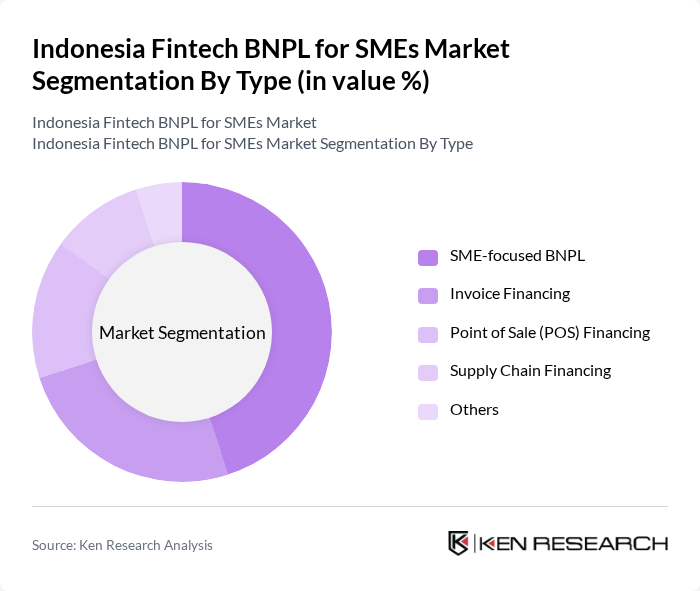

By Type:

The market segmentation by type includes SME-focused BNPL, Invoice Financing, Point of Sale (POS) Financing, Supply Chain Financing, and Others.SME-focused BNPLremains the leading sub-segment, driven by the growing number of SMEs seeking flexible, short-term payment solutions to manage working capital. This segment specifically addresses the unique cash flow needs of small businesses.Invoice Financingis also gaining momentum, as SMEs increasingly leverage receivables for immediate liquidity.POS Financingis popular in retail and omnichannel environments, supporting instant checkout and payment flexibility for business customers.Supply Chain Financingis expanding as SMEs look to optimize procurement and inventory cycles, while the Others category includes emerging digital credit models tailored for micro and small enterprises .

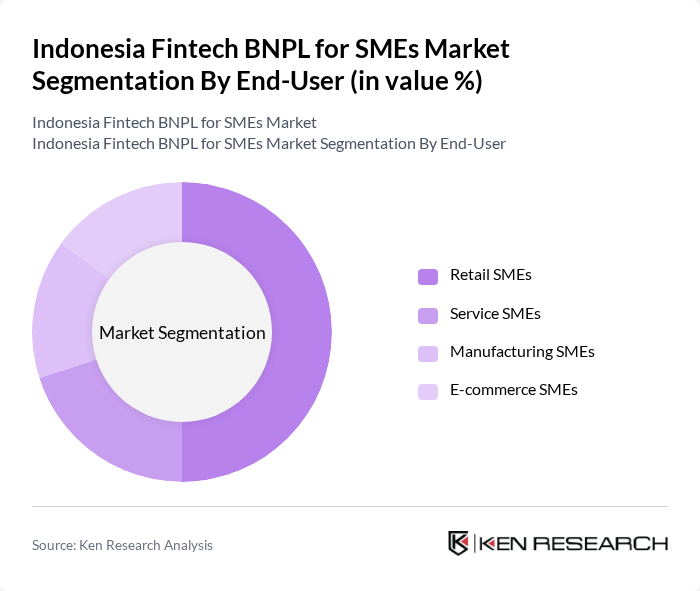

By End-User:

The end-user segmentation includes Retail SMEs, Service SMEs, Manufacturing SMEs, and E-commerce SMEs.Retail SMEsare the dominant users, leveraging BNPL to boost customer purchasing power and drive sales conversion, especially in omnichannel and offline retail.E-commerce SMEsare rapidly increasing adoption, using BNPL to improve online conversion rates and customer experience.Service SMEsare gradually integrating BNPL for client payments and project-based work, whileManufacturing SMEsremain more conservative, primarily relying on traditional financing but showing growing interest in supply chain-focused BNPL solutions .

The Indonesia Fintech BNPL for SMEs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kredivo, Akulaku, Atome, Shopee PayLater, GoPayLater (Gojek), Home Credit Indonesia, Kredit Pintar, Tunaiku, JULO, Modalku (Funding Societies), Investree, Bank Mandiri, Bank Central Asia (BCA), OVO, and DANA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia fintech BNPL market for SMEs appears promising, driven by technological advancements and increasing digital literacy. In future, the integration of AI and data analytics is expected to enhance credit assessment processes, allowing for more personalized financial products. Additionally, partnerships with e-commerce platforms will likely expand the reach of BNPL services, making them more accessible to a broader range of SMEs, particularly in underserved regions.

| Segment | Sub-Segments |

|---|---|

| By Type | SME-focused BNPL Invoice Financing Point of Sale (POS) Financing Supply Chain Financing Others |

| By End-User | Retail SMEs Service SMEs Manufacturing SMEs E-commerce SMEs |

| By Sales Channel | Direct Sales Online Platforms Partnerships with E-commerce Platforms Partnerships with Retailers Others |

| By Payment Method | Bank Transfer E-wallets Virtual Accounts Credit Card Others |

| By Loan Amount | Micro Loans ( |

| By Customer Segment | Startups Established SMEs Seasonal Businesses Informal Sector SMEs Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME Owners in Retail Sector | 100 | Business Owners, Financial Managers |

| SME Owners in Manufacturing | 60 | Operations Managers, CFOs |

| SME Owners in Services Sector | 50 | Service Managers, Business Development Heads |

| Fintech Executives | 40 | Product Managers, Strategy Directors |

| Financial Advisors to SMEs | 40 | Consultants, Financial Analysts |

The Indonesia Fintech BNPL for SMEs market is valued at approximately USD 7.5 billion, driven by the rapid adoption of digital payment solutions and the increasing demand for flexible financing among small and medium enterprises (SMEs).