Region:Asia

Author(s):Geetanshi

Product Code:KRAD4870

Pages:94

Published On:December 2025

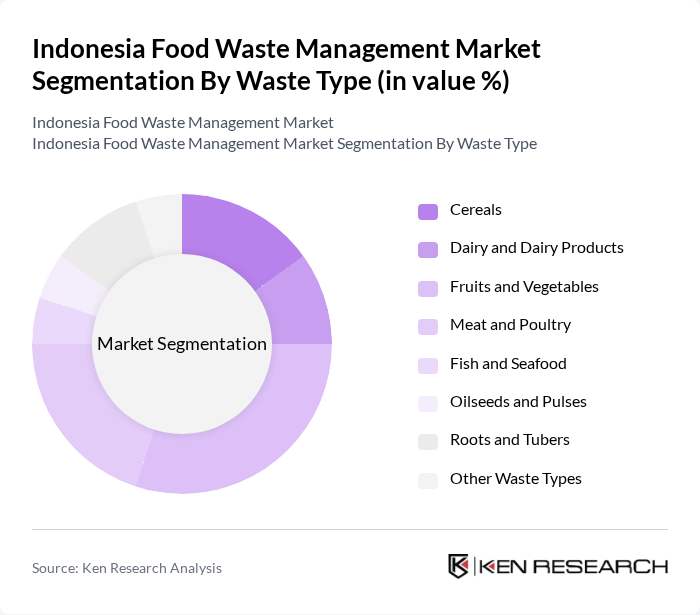

By Waste Type:The food waste management market can be segmented based on the type of waste generated. The primary categories include cereals, dairy and dairy products, fruits and vegetables, meat and poultry, fish and seafood, oilseeds and pulses, roots and tubers, and other waste types. Each of these categories contributes differently to the overall waste generated, with fruits and vegetables, roots and tubers, and cereals typically accounting for a significant portion of edible food loss and waste in Indonesia due to their high consumption volumes and perishability along the supply chain.

By Service:The market can also be segmented based on the services provided for food waste management, which include collection, transportation, disposal, and recycling. Each service plays a crucial role in the overall waste management process, with collection and recycling being particularly vital for reducing the environmental impact of food waste. Collection and transportation services are increasingly integrated with decentralized solutions such as community composting, small-scale material recovery facilities, and biogas units, while recycling and treatment services cover compost production, animal feed, co-processing in cement kilns, and other waste-to-energy options.

The Indonesia Food Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Waste4Change, Greeneration Indonesia, PT Reciki Solusi Indonesia (Reciki), PT Solusi Cipta Integrasi (EwasteRJ & organic waste services), PT Solusi Bangun Indonesia Tbk (Geocycle Indonesia), PT Pembangunan Jaya Ancol Tbk (Integrated Waste Management & Composting), PT Jakarta Propertindo (Perseroda) – Food and Organic Waste Handling, PT Unilever Indonesia Tbk – Food Waste Reduction & Valorization Programs, PT Nestlé Indonesia – Food Loss and Waste Management Initiatives, PT Indofood Sukses Makmur Tbk – Food Waste Reduction and By?product Utilization, PT Charoen Pokphand Indonesia Tbk – Conversion of Food Waste to Animal Feed, PT Pupuk Kalimantan Timur (Pupuk Kaltim) – Organic Fertilizer from Food and Organic Waste, PT Pupuk Indonesia (Persero) – Compost and Organic Fertilizer Programs, PT Dharma Satya Nusantara Tbk – Biogas and Organic Waste-to-Energy Projects, PT Astra Agro Lestari Tbk – Organic Residue and Food Waste Valorization contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's food waste management market appears promising, driven by increasing urbanization and government initiatives aimed at waste reduction. As the population continues to grow, the demand for innovative waste management solutions will likely rise. Additionally, the integration of smart technologies and sustainable practices will enhance efficiency in waste processing. Collaborative efforts between the government, private sector, and NGOs will be essential in overcoming existing challenges and capitalizing on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Waste Type (Cereals, Dairy & Dairy Products, Fruits & Vegetables, Meat & Poultry, Fish & Seafood, Oilseeds & Pulses, Roots & Tubers, Other Waste Types) | Cereals Dairy and Dairy Products Fruits and Vegetables Meat and Poultry Fish and Seafood Oilseeds and Pulses Roots and Tubers Other Waste Types |

| By Service (Collection, Transportation, Disposal and Recycling) | Collection Transportation Disposal Recycling |

| By Source (Residential, Commercial, Industrial) | Residential (Municipalities and Households) Commercial (Food Service Providers, Retail, Hospitality) Industrial (Primary Food Producers and Food Manufacturers) |

| By Application (Animal Feed, Fertilizers, Biofuel, Power Generation, Other Applications) | Animal Feed Fertilizers Biofuel Power Generation Other Applications |

| By Treatment Method (Prevention, Recovery, Recycling) | Prevention Recovery Recycling |

| By Technology (Anaerobic Digestion, Composting, Incineration / Combustion, Landfill, Other Processes) | Anaerobic Digestion Composting Incineration / Combustion Landfill Other Processes |

| By End-User (Primary Food Producers, Food Manufacturers, Food Distributors and Suppliers, Food Service Providers, Municipalities and Households) | Primary Food Producers Food Manufacturers Food Distributors and Suppliers Food Service Providers Municipalities and Households |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Household Food Waste Management | 150 | Homeowners, Renters, Family Heads |

| Restaurant Waste Reduction Practices | 100 | Restaurant Owners, Kitchen Managers |

| Food Processing Industry Waste Management | 90 | Production Managers, Sustainability Officers |

| NGO Initiatives on Food Waste | 70 | Program Directors, Community Outreach Coordinators |

| Government Policy Makers on Food Waste | 60 | Policy Analysts, Environmental Officers |

The Indonesia Food Waste Management Market is valued at approximately USD 1.6 billion. This valuation is based on a five-year historical analysis and reflects its share within the broader waste management market in Indonesia, which is valued at around USD 15.11 billion.