Region:Asia

Author(s):Shubham

Product Code:KRAB1152

Pages:84

Published On:October 2025

By Type:The market is segmented into various types of furniture, including living room furniture, bedroom furniture, dining room furniture, office furniture, outdoor furniture, custom furniture, eco-friendly furniture, luxury furniture, bathroom furniture, kitchen furniture, and others. Among these, living room furniture and bedroom furniture remain the most popular categories, driven by their essential roles in home decor, comfort, and daily functionality. The market is also witnessing a notable rise in demand for eco-friendly and modular furniture, reflecting a shift toward sustainability and customization .

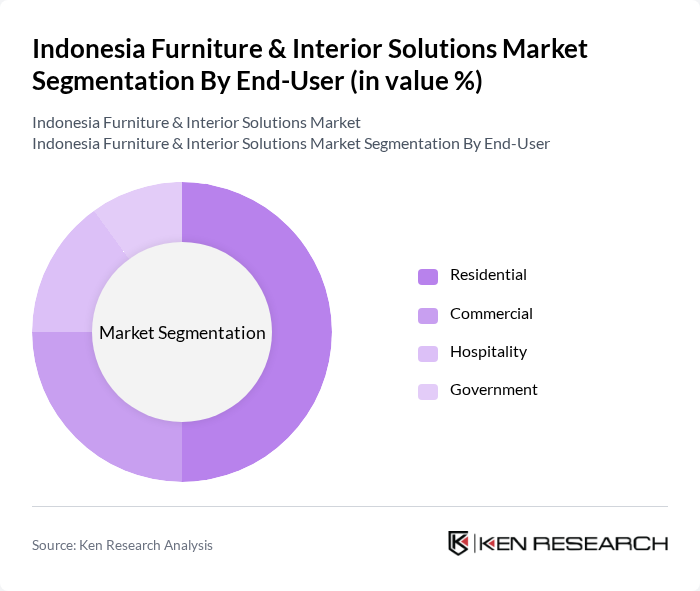

By End-User:The market is segmented by end-user into residential, commercial, hospitality, and government sectors. The residential segment is the largest, driven by increasing home ownership, renovation activities, and a growing preference for personalized and stylish interiors. The commercial segment is expanding due to the proliferation of office spaces, retail outlets, and hospitality establishments, while the government sector continues to invest in public infrastructure and institutional furniture .

The Indonesia Furniture & Interior Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Indonesia, Fabelio, Informa, Ace Hardware Indonesia, Kawan Lama Group, Vivere Group, Chitose Internasional Tbk, PT Integra Indocabinet Tbk, PT Selaras Citra Nusantara Perkasa Tbk (SCNP), PT Wisanka Indonesia, PT Wirasindo Santakarya (WISANKA), PT Olympic Furniture, PT Indorack Multikreasi, PT Rattanland Furniture, and PT Duta Cemerlang Furniture contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Indonesia furniture and interior solutions market appears promising, driven by urbanization and rising disposable incomes. As consumers increasingly prioritize home aesthetics, the demand for innovative and sustainable furniture solutions is expected to grow. Additionally, the integration of technology in manufacturing and retail processes will likely enhance efficiency and customer engagement. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Living Room Furniture Bedroom Furniture Dining Room Furniture Office Furniture Outdoor Furniture Custom Furniture Eco-Friendly Furniture Luxury Furniture Bathroom Furniture Kitchen Furniture Others |

| By End-User | Residential Commercial Hospitality Government |

| By Distribution Channel | Online Retail Offline Retail Wholesale Direct Sales |

| By Material | Wood (including Teak, Mahogany, Rattan) Metal Plastic Fabric Others |

| By Price Range | Budget Mid-Range Premium |

| By Design Style | Modern Traditional Contemporary Rustic Minimalist |

| By Application | Residential Use Commercial Use Institutional Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Market | 120 | Homeowners, Interior Designers |

| Commercial Furniture Solutions | 90 | Office Managers, Facility Coordinators |

| Custom Furniture Manufacturing | 60 | Craftsmen, Small Business Owners |

| Eco-friendly Furniture Segment | 50 | Sustainability Advocates, Product Designers |

| Online Furniture Retail | 70 | E-commerce Managers, Digital Marketing Specialists |

The Indonesia Furniture & Interior Solutions Market is valued at approximately USD 8.6 billion, driven by factors such as urbanization, rising disposable incomes, and the availability of quality raw materials like teak and rattan.