Region:Asia

Author(s):Dev

Product Code:KRAA9571

Pages:82

Published On:November 2025

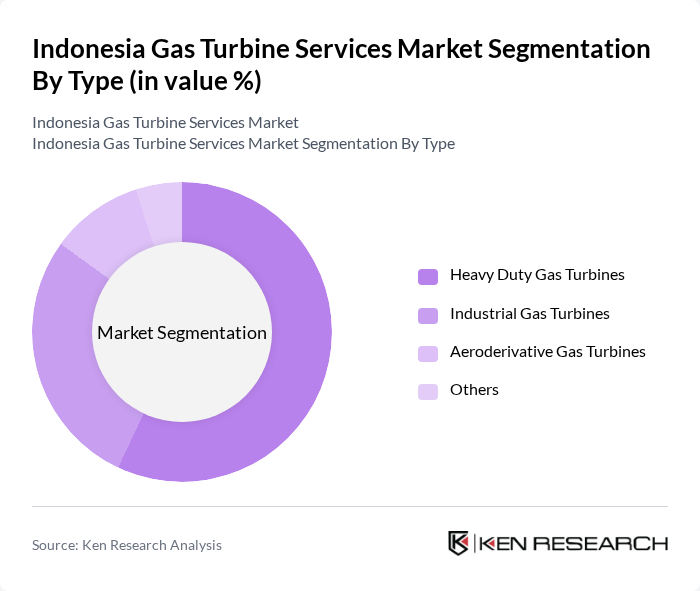

By Type:The market is segmented into Heavy Duty Gas Turbines, Industrial Gas Turbines, Aeroderivative Gas Turbines, and Others. Heavy Duty Gas Turbines dominate the market due to their efficiency and reliability in large-scale power generation applications, accounting for the highest revenue share. Industrial Gas Turbines are also significant, catering to diverse industrial applications, while Aeroderivative Gas Turbines are gaining traction for their flexibility and rapid deployment in peak load and distributed generation scenarios. The "Others" category includes specialized turbines for niche and emerging applications .

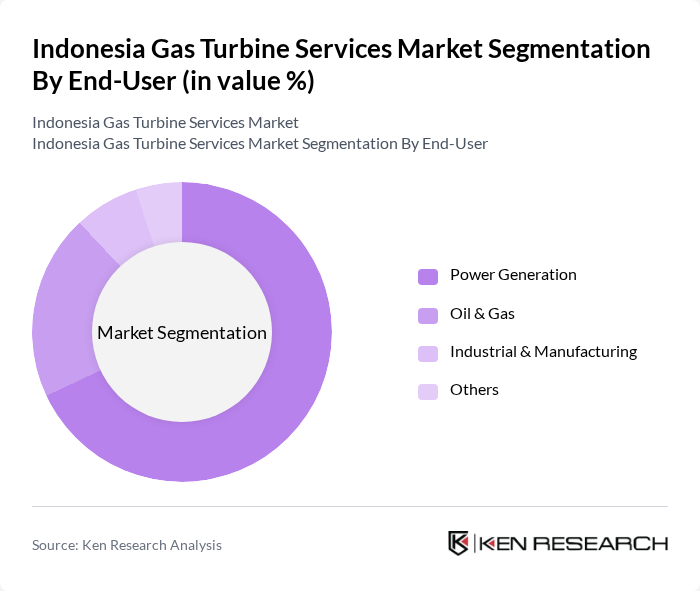

By End-User:The market is segmented into Power Generation, Oil & Gas, Industrial & Manufacturing, and Others. Power Generation is the leading segment, driven by the increasing demand for electricity, grid reliability, and the transition toward cleaner energy sources. The Oil & Gas sector also plays a crucial role, utilizing gas turbines for upstream, midstream, and downstream applications, including offshore platforms and LNG facilities. The Industrial & Manufacturing segment is expanding as industries seek efficient and flexible energy solutions for process heating and cogeneration. The "Others" category includes marine, aviation, and emerging distributed energy sectors .

The Indonesia Gas Turbine Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as General Electric (GE Vernova), Siemens Energy, Mitsubishi Power (Mitsubishi Heavy Industries Group), Kawasaki Heavy Industries, Ansaldo Energia, Baker Hughes, MAN Energy Solutions, Wärtsilä, PT PLN (Persero), PT Wijaya Karya (WIKA), Doosan Enerbility, Solar Turbines (a Caterpillar Company), PT Citra Tubindo Engineering, PT Truba Jaya Engineering, PT Rekadaya Elektrika contribute to innovation, geographic expansion, and service delivery in this space.

The Indonesia gas turbine services market is poised for significant transformation as the country prioritizes energy security and sustainability. With a focus on cleaner energy solutions, the integration of advanced gas turbine technologies will likely enhance operational efficiency. Additionally, the government's commitment to infrastructure development will create opportunities for new projects, fostering collaboration between local and international firms. As the market evolves, the emphasis on digital technologies and hybrid energy solutions will further shape the landscape, driving innovation and investment in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Heavy Duty Gas Turbines Industrial Gas Turbines Aeroderivative Gas Turbines Others |

| By End-User | Power Generation Oil & Gas Industrial & Manufacturing Others |

| By Application | Base Load Power Generation Peak Load Power Generation Cogeneration (CHP) Mechanical Drive Others |

| By Fuel Type | Natural Gas Biogas Diesel Others |

| By Service Type | Maintenance & Repair Services Overhaul Services Upgrades & Modifications Inspection & Testing Component Refurbishment Others |

| By Region | Java Sumatra Kalimantan Sulawesi Others |

| By Policy Support | Government Subsidies Tax Incentives Renewable Energy Certificates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Power Generation Sector | 100 | Plant Managers, Operations Directors |

| Industrial Gas Turbine Users | 80 | Maintenance Supervisors, Engineering Managers |

| Gas Turbine Service Providers | 60 | Business Development Managers, Technical Sales Representatives |

| Government Energy Regulators | 50 | Policy Analysts, Regulatory Affairs Managers |

| Research Institutions | 40 | Energy Researchers, Academic Professors |

The Indonesia Gas Turbine Services Market is valued at approximately USD 460 million, driven by increasing energy demand, industrial activities, and government initiatives aimed at enhancing energy infrastructure and efficiency.