Region:Asia

Author(s):Shubham

Product Code:KRAB5009

Pages:86

Published On:October 2025

By Type:The market is segmented into various types, including Halal Meat & Poultry, Halal Dairy Products, Halal Grain Products, Halal Bakery & Confectionery Products, Halal Beverages (Tea, Coffee, RTD), Halal Supplements, Processed & Packaged Foods, and Others. Among these,Halal Meat & Poultryis the leading sub-segment due to the high demand for meat products in Indonesia, driven by cultural and religious practices. The increasing focus on quality and safety in food production, along with rising protein consumption and a shift toward packaged and processed meat, further enhances the growth of this segment .

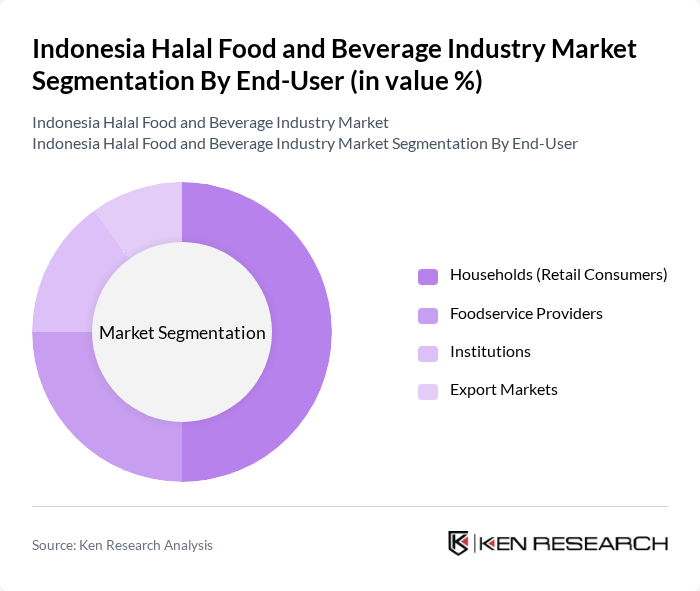

By End-User:The end-user segmentation includes Households (Retail Consumers), Foodservice Providers, Institutions, and Export Markets.Householdsrepresent the largest segment, driven by the increasing preference for halal products among Indonesian families. The growing awareness of health and nutrition, coupled with the cultural significance of halal food, has led to a surge in demand from retail consumers, making this segment a key driver of market growth. The expansion of modern retail, e-commerce, and the influence of halal certification in daily purchasing decisions further support this trend .

The Indonesia Halal Food and Beverage Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Indofood Sukses Makmur Tbk, PT Mayora Indah Tbk, PT Unilever Indonesia Tbk, PT Nestlé Indonesia, PT Sarihusada Generasi Mahardhika, PT Kalbe Farma Tbk, PT Danone Indonesia, PT Garudafood Putra Putri Jaya Tbk, PT Cisarua Mountain Dairy (Cimory), PT Ultrajaya Milk Industry & Trading Company Tbk, PT Sumber Alfaria Trijaya Tbk (Alfamart), PT Tiga Pilar Sejahtera Food Tbk, PT Wings Surya (Wings Group), PT Bina Karya Prima, PT Sumber Berkah Sejahtera, PT Fast Food Indonesia Tbk (KFC Indonesia), PT Rekso Nasional Food (McDonald's Indonesia) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the halal food and beverage industry in Indonesia appears promising, driven by demographic shifts and evolving consumer preferences. As the Muslim population continues to grow, the demand for diverse halal products will increase. Additionally, the rise of e-commerce platforms is expected to enhance accessibility, allowing consumers to explore a wider range of halal offerings. Innovations in product development, particularly in organic and plant-based segments, will further shape the market landscape, fostering sustainable growth and attracting new consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Halal Meat & Poultry Halal Dairy Products Halal Grain Products Halal Bakery & Confectionery Products Halal Beverages (Tea, Coffee, RTD) Halal Supplements Processed & Packaged Foods Others |

| By End-User | Households (Retail Consumers) Foodservice Providers Institutions Export Markets |

| By Distribution Channel | Supermarkets & Hypermarkets Specialty Stores Online Retail Convenience Stores Other Distribution Channels |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| By Certification Type | Halal Certified (BPJPH, MUI) International Certification Private Label/Self-Certification |

| By Region | Java Sumatra Bali Kalimantan Sulawesi Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Halal Food Manufacturers | 60 | Production Managers, Quality Assurance Officers |

| Halal Beverage Producers | 50 | Operations Managers, Marketing Directors |

| Retailers of Halal Products | 70 | Store Managers, Category Buyers |

| Consumers of Halal Food and Beverages | 120 | General Consumers, Health-Conscious Shoppers |

| Halal Certification Bodies | 40 | Certification Officers, Regulatory Compliance Managers |

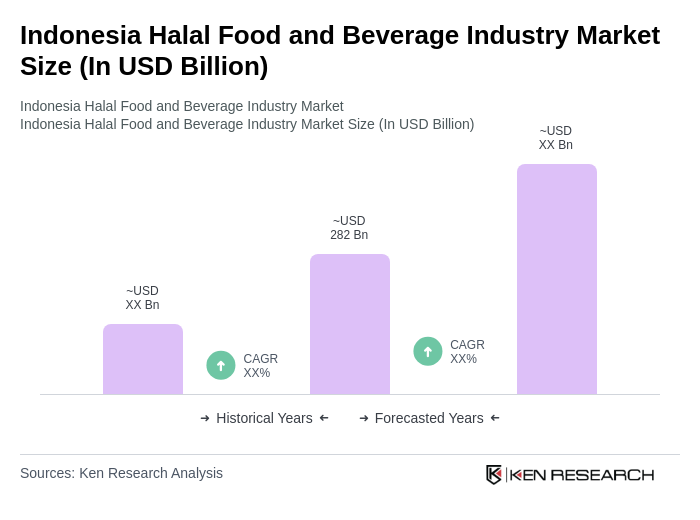

The Indonesia Halal Food and Beverage Industry Market is valued at approximately USD 282 billion, driven by a growing Muslim population, increased health awareness, and rising demand for halal-certified products among both Muslim and non-Muslim consumers.