Region:Asia

Author(s):Geetanshi

Product Code:KRAD5945

Pages:86

Published On:December 2025

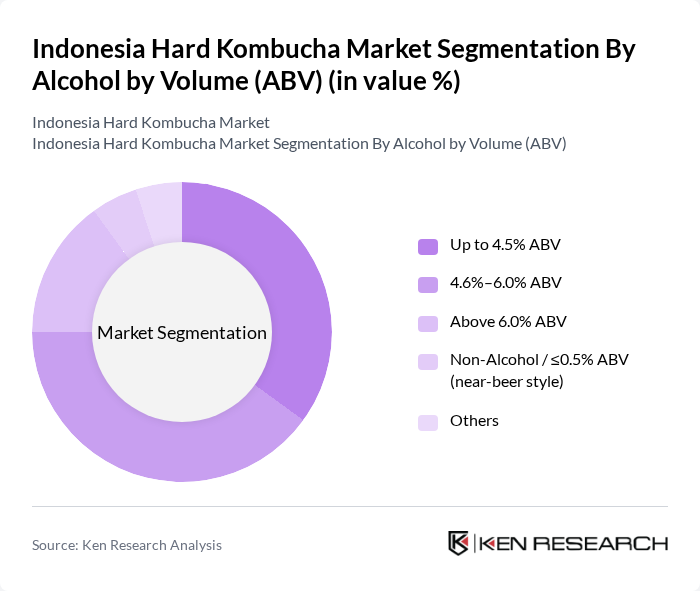

By Alcohol by Volume (ABV):The market is segmented based on the alcohol content in hard kombucha, which includes various categories that cater to different consumer preferences. The subsegments include Up to 4.5% ABV, 4.6%–6.0% ABV, Above 6.0% ABV, Non-Alcohol / ?0.5% ABV (near-beer style), and Others. The demand for lower ABV options is particularly strong among health-conscious consumers.

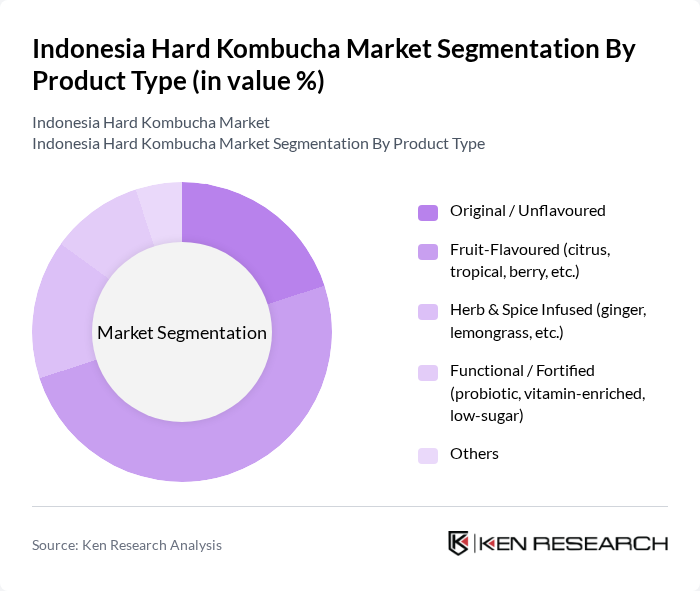

By Product Type:The product type segmentation includes Original / Unflavoured, Fruit-Flavoured (citrus, tropical, berry, etc.), Herb & Spice Infused (ginger, lemongrass, etc.), Functional / Fortified (probiotic, vitamin-enriched, low-sugar), and Others. The fruit-flavored segment is particularly popular among younger consumers looking for refreshing and unique taste experiences.

The Indonesia Hard Kombucha Market is characterized by a dynamic mix of regional and international players. Leading participants such as Island Brewing (Bali, Indonesia), Kura Kura Beer Co. (Bali, Indonesia), Stark Craft Beer (Bali, Indonesia), Belkraf Kombucha (Jakarta, Indonesia), Javara Kombucha (Jakarta, Indonesia), Better Booch (United States – imported/premium niche), Remedy Drinks / Remedy Kombucha (Australia – regional supplier to Indonesia), Booch Town (Singapore – regional craft supplier), Wild Kombucha Co. (Singapore – ASEAN focused), KSON Kombucha (Indonesia), Mugi Brewing Co. (Indonesia), Island Life Beverage Co. (Indonesia), Local HORECA Private Labels (hotel and bar house brands), Contract Manufacturers / White-Label Brewers in Java & Bali, Online-Only Kombucha Startups (D2C brands on Indonesian marketplaces) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hard kombucha market in Indonesia appears promising, driven by evolving consumer preferences and increasing health awareness. As the market matures, brands are likely to innovate with diverse flavors and health-focused formulations. Additionally, the rise of e-commerce will facilitate broader distribution, allowing consumers easier access to hard kombucha. Collaborations with local breweries may also enhance product offerings, while educational campaigns can boost consumer awareness, ultimately fostering a more robust market environment.

| Segment | Sub-Segments |

|---|---|

| By Alcohol by Volume (ABV) | Up to 4.5% ABV %–6.0% ABV Above 6.0% ABV Non-Alcohol / ?0.5% ABV (near-beer style) Others |

| By Product Type | Original / Unflavoured Fruit-Flavoured (citrus, tropical, berry, etc.) Herb & Spice Infused (ginger, lemongrass, etc.) Functional / Fortified (probiotic, vitamin-enriched, low-sugar) Others |

| By Packaging Type | Glass Bottles Aluminum Cans Kegs & Draft Systems PET & Other Packaging Others |

| By Distribution Channel | On-Trade (bars, pubs, clubs, restaurants) Off-Trade – Modern Retail (supermarkets/hypermarkets, convenience stores) Off-Trade – Specialty & Health Stores E-commerce & Direct-to-Consumer Others |

| By Region | Greater Jakarta (Jabodetabek) Java (excluding Greater Jakarta) Bali & Nusa Tenggara Sumatra Kalimantan, Sulawesi & Other Regions |

| By Consumer Demographics | Age Group (21–24, 25–34, 35–44, 45+) Gender Income Level (Mass, Upper-Mass, Affluent) Lifestyle Segment (health-conscious, experimental/craft seekers, social drinkers) Others |

| By Occasion | At-home Consumption Social Gatherings & Parties Restaurants, Cafés & Bars Events, Festivals & Tourism (Bali, resort-led) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Hard Kombucha | 150 | Health-conscious Consumers, Beverage Enthusiasts |

| Retail Distribution Insights | 100 | Retail Managers, Beverage Buyers |

| Production Insights from Breweries | 80 | Production Managers, Quality Control Officers |

| Market Trends and Regulatory Impact | 70 | Industry Analysts, Regulatory Affairs Specialists |

| Consumer Awareness and Brand Perception | 120 | Marketing Professionals, Brand Managers |

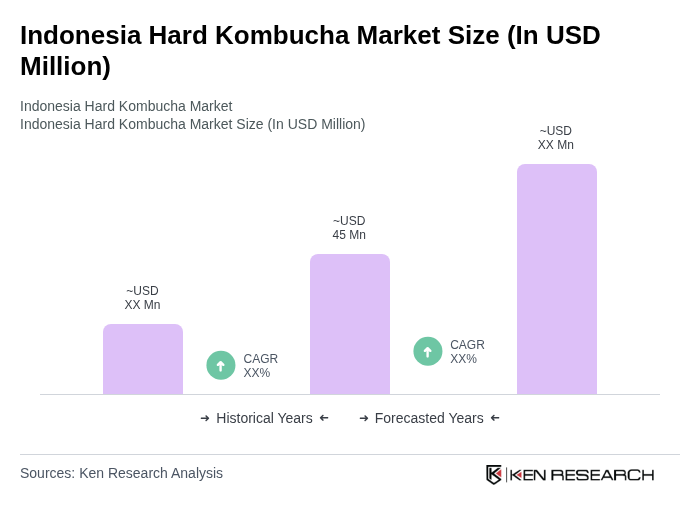

The Indonesia Hard Kombucha Market is valued at approximately USD 45 million, reflecting a growing consumer preference for healthier alcoholic beverages and innovative flavors, particularly among millennials and Gen Z.