Region:Asia

Author(s):Shubham

Product Code:KRAD6800

Pages:97

Published On:December 2025

By Type:The market is segmented into various types, including Application Development & Modernization Platforms, Application Maintenance & Support Services, Testing, Quality Assurance & Validation Services, Release, Deployment & DevOps Orchestration Solutions, and Application Portfolio & Governance Solutions. Among these, Application Development & Modernization Platforms are leading due to the increasing need for customized healthcare applications that cater to specific organizational needs, including EMR/HIS customization, integration with laboratory and imaging systems, and mobile patient apps. The demand for these platforms is driven by the rapid digital transformation in healthcare, where organizations seek to enhance operational efficiency, interoperability, cybersecurity, and patient engagement through cloud-based and API-driven architectures.

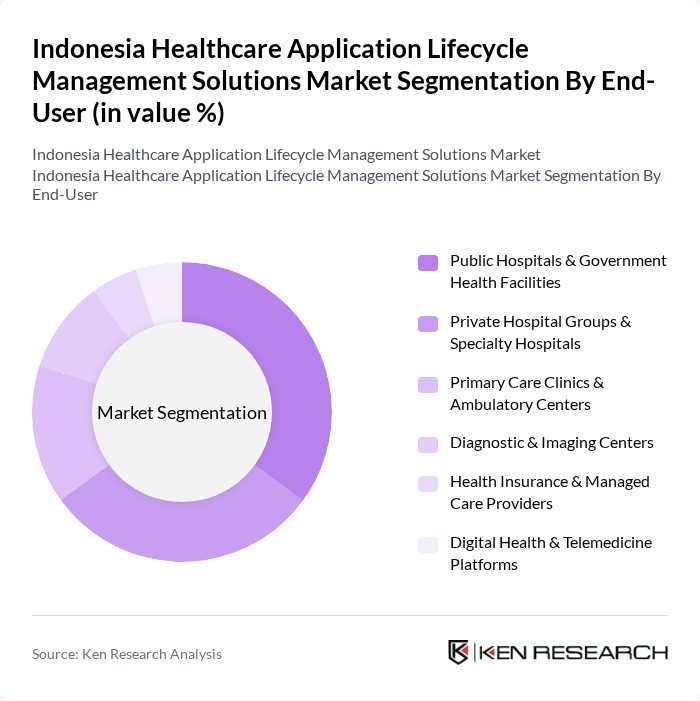

By End-User:The end-user segmentation includes Public Hospitals & Government Health Facilities, Private Hospital Groups & Specialty Hospitals, Primary Care Clinics & Ambulatory Centers, Diagnostic & Imaging Centers, Health Insurance & Managed Care Providers, and Digital Health & Telemedicine Platforms. The Public Hospitals & Government Health Facilities segment is currently the largest due to the significant investments made by the government in public hospitals, referral networks, and national health information systems under the Jaminan Kesehatan Nasional (JKN) program and Health System Transformation agenda. This segment is crucial for implementing nationwide health initiatives, including interoperable electronic medical records, reporting systems for disease surveillance, and integration with BPJS Kesehatan claims platforms, thereby improving access to and coordination of healthcare services across provinces.

The Indonesia Healthcare Application Lifecycle Management Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Telekomunikasi Indonesia (Persero) Tbk – Telkom Indonesia / Telkom Sigma (Healthcare IT), Halodoc (PT Media Dokter Investama), Alodokter (PT Sumo Teknologi Solusi), SehatQ (PT SehatQ Harsana Emedika), KlikDokter (PT Medika Komunika Teknologi), Aido Health (PT Aido Health Indonesia), Siloam Hospitals Group (PT Siloam International Hospitals Tbk), Mitra Keluarga (PT Mitra Keluarga Karyasehat Tbk), Hermina Hospitals (PT Medikaloka Hermina Tbk), ProSehat (PT ProSehat Digital Indonesia), Kimia Farma Diagnostika (PT Kimia Farma Diagnostika), Prodia (PT Prodia Widyahusada Tbk), Doctor Anywhere Indonesia (PT Doctor Anywhere Indonesia), Halodoc – BPJS Kesehatan Integration Partnerships, International Health IT & ALM Vendors Active in Indonesia Healthcare (e.g., Oracle Health, SAP, Microsoft Azure, AWS Healthcare Solutions) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's healthcare application lifecycle management solutions market appears promising, driven by ongoing digital transformation efforts and increasing healthcare investments. As the government continues to promote telehealth and digital health initiatives, the integration of advanced technologies like AI and machine learning will likely enhance service delivery. Additionally, the growing emphasis on patient-centric solutions will foster innovation, leading to improved healthcare outcomes and greater accessibility for the population.

| Segment | Sub-Segments |

|---|---|

| By Type | Application Development & Modernization Platforms Application Maintenance & Support Services Testing, Quality Assurance & Validation Services Release, Deployment & DevOps Orchestration Solutions Application Portfolio & Governance Solutions |

| By End-User | Public Hospitals & Government Health Facilities Private Hospital Groups & Specialty Hospitals Primary Care Clinics & Ambulatory Centers Diagnostic & Imaging Centers Health Insurance & Managed Care Providers Digital Health & Telemedicine Platforms |

| By Deployment Model | On-Premises Public Cloud Private Cloud Hybrid Cloud |

| By Application Workload | Clinical Information Systems (EHR, EMR, LIS, RIS) Patient Engagement & Care Management Applications Hospital Information & Revenue Cycle Management Systems Telehealth, Remote Monitoring & mHealth Applications Healthcare Analytics, AI & Decision Support Applications |

| By Region | Java (Including Jakarta, West Java, Central Java, East Java, Banten, DI Yogyakarta) Sumatra Bali & Nusa Tenggara Kalimantan Sulawesi, Maluku & Papua |

| By Healthcare Organization Size | Large Health Systems (?500 beds or multi-hospital networks) Medium Hospitals (100–499 beds) Small Hospitals & Clinics (<100 beds) |

| By Service Model | Managed Application Lifecycle Services Professional & Integration Services Consulting, Compliance & Training Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital IT Management | 100 | IT Directors, Chief Information Officers |

| Healthcare Application Development | 80 | Software Developers, Product Managers |

| Telemedicine Solutions | 70 | Telehealth Coordinators, Healthcare Innovators |

| Healthcare Compliance and Regulation | 60 | Compliance Officers, Legal Advisors |

| Healthcare Data Management | 90 | Data Analysts, IT Security Managers |

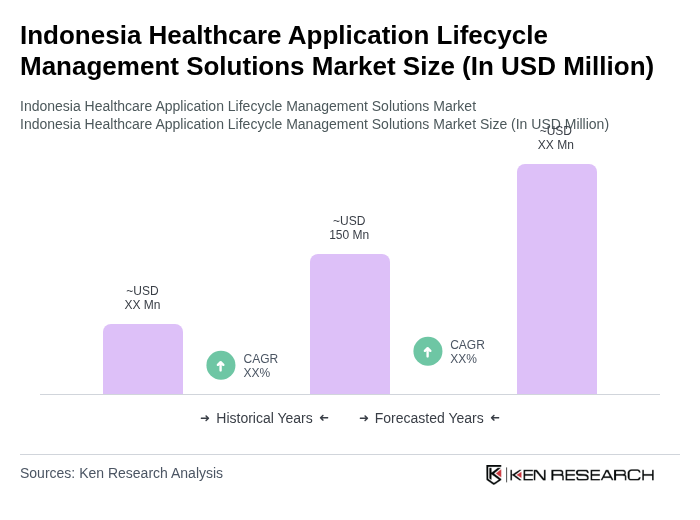

The Indonesia Healthcare Application Lifecycle Management Solutions Market is valued at approximately USD 150 million, reflecting its growth driven by the adoption of digital health technologies and government initiatives aimed at enhancing healthcare infrastructure and services.