Region:Asia

Author(s):Geetanshi

Product Code:KRAD4125

Pages:100

Published On:December 2025

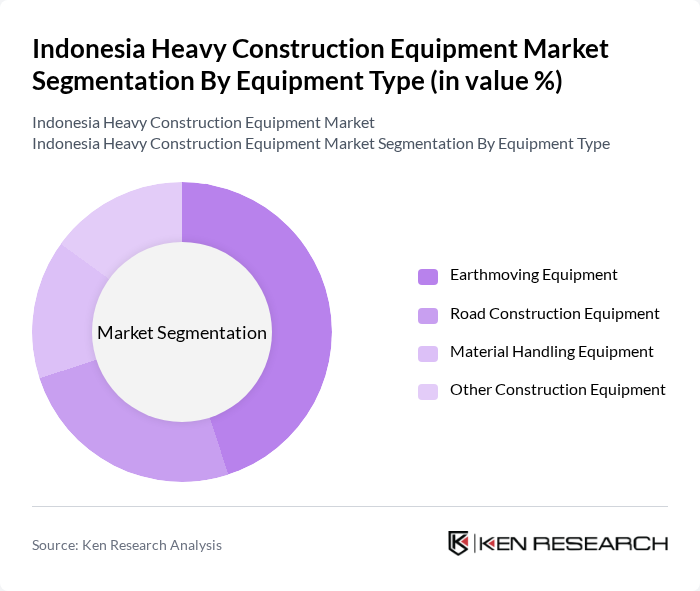

By Equipment Type:The equipment type segmentation includes various categories essential for construction activities. The dominant sub-segment is Earthmoving Equipment, which encompasses excavators, backhoe loaders, and bulldozers. These machines are crucial for site preparation and material handling, making them highly sought after in construction projects. The demand for excavators, particularly, has surged due to their versatility and efficiency in various applications.

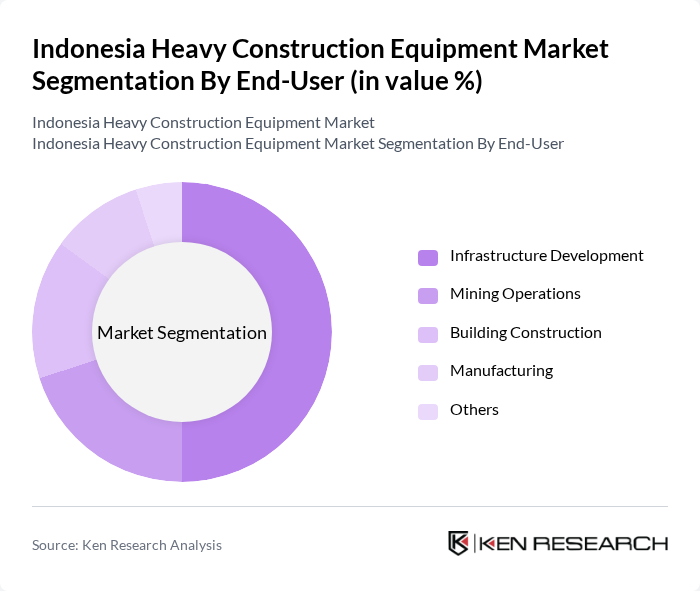

By End-User:The end-user segmentation highlights the various sectors utilizing heavy construction equipment. The Infrastructure Development segment leads the market, driven by government investments in public works and transportation projects. This segment's growth is fueled by the need for improved infrastructure to support economic growth and urbanization, making it a key driver for equipment demand.

The Indonesia Heavy Construction Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Komatsu Indonesia, Caterpillar Indonesia, Hitachi Construction Machinery Indonesia, Volvo Construction Equipment Indonesia, SANY Indonesia, Doosan Infracore Indonesia, JCB Indonesia, Liebherr Indonesia, Hyundai Construction Equipment Indonesia, XCMG Indonesia, United Tractors, PT Hexindo Adiperkasa, Intraco Penta, Traktor Nusantara, Yanmar Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the heavy construction equipment market in Indonesia appears promising, driven by ongoing infrastructure projects and urbanization trends. As the government continues to prioritize public works, the demand for advanced machinery is expected to rise. Additionally, the integration of smart technologies and eco-friendly equipment will likely shape the market landscape, enhancing operational efficiency and sustainability. The focus on safety and compliance will also drive innovation, ensuring that the industry adapts to evolving regulatory requirements and market needs.

| Segment | Sub-Segments |

|---|---|

| By Equipment Type | Earthmoving Equipment Excavators (20-ton, 4.5-ton, and other classes) Backhoe Loaders Wheeled Loaders Motor Graders Bulldozers Articulated Haulers Road Construction Equipment Road Rollers Asphalt Pavers Material Handling Equipment Cranes Forklifts Telescopic Handlers Aerial Platforms Other Construction Equipment Concrete Pump Trucks Dump Trucks and Tippers Batching Plants |

| By End-User | Infrastructure Development Mining Operations Building Construction Manufacturing Others |

| By Application | Toll Road Construction Building Construction Earthworks and Excavation Mining Operations Port and Airport Development Demolition Others |

| By Fuel Type | Diesel Electric Hydrogen Fuel Cell Hybrid Others |

| By Distribution Channel | Direct Sales Authorized Dealers/Distributors Online Sales Equipment Rental Services Others |

| By Region | Java Sumatra Kalimantan Sulawesi Papua and Maluku |

| By Market Structure | Organized Sector Unorganized Sector |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Project Managers | 100 | Project Managers, Site Supervisors |

| Heavy Equipment Rental Companies | 80 | Rental Managers, Business Development Executives |

| Manufacturers of Heavy Equipment | 70 | Sales Directors, Product Managers |

| Government Infrastructure Planners | 60 | Urban Planners, Policy Makers |

| Construction Equipment Operators | 90 | Operators, Maintenance Technicians |

The Indonesia Heavy Construction Equipment Market is valued at approximately USD 3.5 billion, driven by increasing infrastructure development, urbanization, and government initiatives aimed at expanding transportation networks and public services.