Region:Asia

Author(s):Shubham

Product Code:KRAA8469

Pages:80

Published On:November 2025

By Type:The lip care products market is segmented into Lip Balm, Lip Scrub, Lip Gloss, Lipstick, Lip Treatment, Tinted Lip Balm, Lip Mask, Lip Oil, and Others. Each segment addresses distinct consumer needs, such as daily hydration (Lip Balm), exfoliation (Lip Scrub), shine and color (Lip Gloss, Lipstick), targeted repair (Lip Treatment), subtle tint (Tinted Lip Balm), intensive overnight care (Lip Mask), and nourishing oils (Lip Oil). The market is witnessing increased demand for products with natural ingredients, SPF protection, and multifunctional benefits.

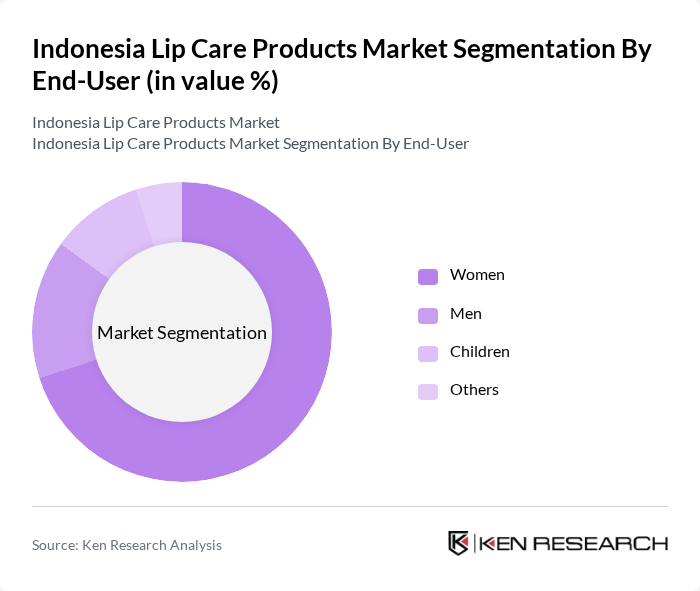

By End-User:The end-user segmentation includes Women, Men, Children, and Others. Women represent the largest consumer base, driven by a strong focus on beauty and personal grooming. Men and children are emerging segments, supported by increased awareness and product launches tailored to their unique needs, such as gender-neutral and sensitive skin formulations.

The Indonesia Lip Care Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Unilever Indonesia Tbk, PT. L’Oréal Indonesia, PT. Procter & Gamble Indonesia, PT. Oriflame Indonesia, PT. Natura Indonesia, PT. Revlon Indonesia, PT. Wardah Cosmetics, PT. Emina Cosmetics, PT. Sariayu Martha Tilaar, PT. Mustika Ratu Tbk, PT. Citra, PT. Bio-Oil Indonesia, PT. The Body Shop Indonesia, PT. Maybelline Indonesia, PT. NYX Professional Makeup Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian lip care products market appears promising, driven by evolving consumer preferences and technological advancements. As the trend towards multifunctional products continues, brands are likely to innovate by incorporating skincare benefits into lip care items. Additionally, the increasing focus on sustainability will push manufacturers to adopt eco-friendly practices, enhancing their appeal to environmentally conscious consumers. These trends suggest a dynamic market landscape that will adapt to meet the changing needs of Indonesian consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Lip Balm Lip Scrub Lip Gloss Lipstick Lip Treatment Tinted Lip Balm Lip Mask Lip Oil Others |

| By End-User | Women Men Children Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Others |

| By Ingredient Type | Natural Ingredients Synthetic Ingredients Organic Ingredients Others |

| By Packaging Type | Tubes Jars Sticks Others |

| By Price Range | Premium Mid-range Economy Others |

| By Region | Java Sumatra Bali Kalimantan Sulawesi Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Insights | 100 | Store Managers, Beauty Advisors |

| Consumer Preferences | 150 | Female Consumers aged 18-35 |

| Product Development Feedback | 80 | R&D Managers, Brand Managers |

| Market Trends Analysis | 60 | Market Analysts, Industry Experts |

| Distribution Channel Evaluation | 90 | Distributors, Wholesalers |

The Indonesia Lip Care Products Market is valued at approximately USD 3.4 billion, reflecting a significant growth driven by consumer awareness of personal grooming and the demand for multifunctional lip care products.