Region:Asia

Author(s):Dev

Product Code:KRAD6327

Pages:91

Published On:December 2025

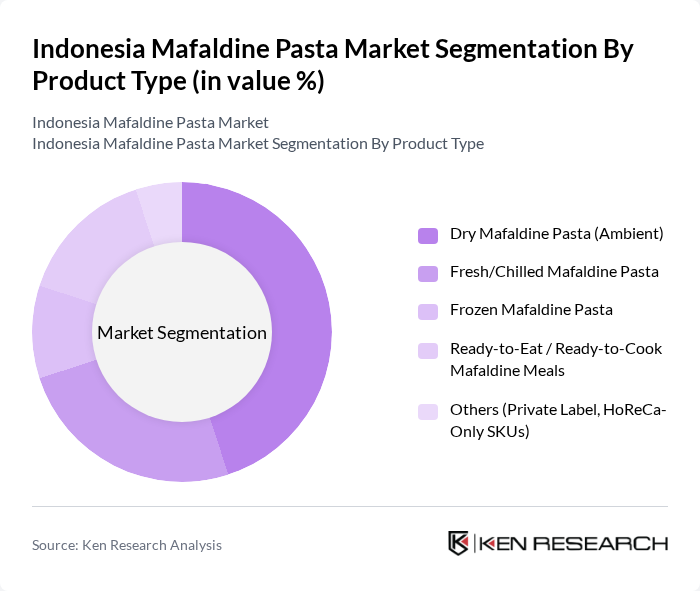

By Product Type:The product type segmentation of the Indonesia Mafaldine Pasta Market includes various forms of pasta that cater to different consumer preferences and usage occasions. The subsegments include Dry Mafaldine Pasta (Ambient), Fresh/Chilled Mafaldine Pasta, Frozen Mafaldine Pasta, Ready-to-Eat / Ready-to-Cook Mafaldine Meals, and Others (Private Label, HoReCa-Only SKUs). Among these, Dry Mafaldine Pasta is the most popular due to its long shelf life, ease of storage, and suitability for both home cooking and foodservice channels, in line with dried pasta’s dominance in the broader pasta market. Fresh and chilled options are gaining traction in modern retail and specialty stores as consumers seek perceived fresher and restaurant-style quality, while the ready-to-eat and ready-to-cook segment is expanding rapidly due to increasing demand for convenience foods, growth of single-person and young professional households, and the rise of online grocery and quick commerce platforms. The market is characterized by a growing trend towards premium and gourmet offerings, particularly in urban areas, with imported Italian brands and chef-inspired recipes increasingly featured in supermarkets and HoReCa menus.

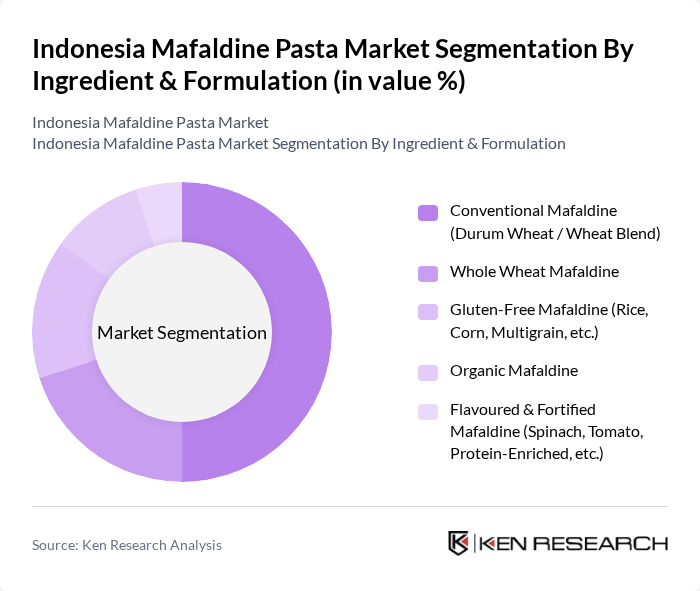

By Ingredient & Formulation:The ingredient and formulation segmentation of the Indonesia Mafaldine Pasta Market includes various types of pasta based on their ingredients and health attributes. The subsegments are Conventional Mafaldine (Durum Wheat / Wheat Blend), Whole Wheat Mafaldine, Gluten-Free Mafaldine (Rice, Corn, Multigrain, etc.), Organic Mafaldine, and Flavoured & Fortified Mafaldine (Spinach, Tomato, Protein-Enriched, etc.). Conventional Mafaldine remains the dominant choice due to its traditional appeal, competitive pricing, and widespread availability across modern trade and e-commerce channels. However, the demand for Whole Wheat and Gluten-Free options is on the rise as health-conscious consumers increasingly focus on higher-fibre, lower-GI, and allergen-sensitive diets, mirroring global pasta trends toward better-for-you products. Organic and fortified variants are also gaining popularity, particularly among affluent urban consumers who prioritize clean-label, premium ingredients, and added nutritional benefits such as vegetable-enriched or protein-enriched pasta.

The Indonesia Mafaldine Pasta Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Indofood Sukses Makmur Tbk (Indofood) – La Fonte, PT Pronas (Mayora Group) – San Remo (Licensing / Distribution), PT Sukanda Djaya (Diamond Cold Storage) – Barilla, De Cecco & Other Imported Pasta Brands, PT Sinar Mas Agro Resources and Technology Tbk (SMART) – Private Label & Foodservice Pasta Solutions, PT Hero Supermarket Tbk – Private Label Mafaldine & Pasta Ranges, PT Lion Super Indo – Private Label Mafaldine & Italian Pasta Lines, PT Trans Retail Indonesia (Carrefour / Transmart) – Imported & Private Label Mafaldine Portfolios, PT Supra Boga Lestari Tbk (Ranch Market, Farmers Market) – Premium & Gourmet Mafaldine Importers, PT Kem Chicks Indonesia – Specialty & Gourmet Imported Mafaldine Brands, PT Mitra Pangan Indonesia – HoReCa Pasta Distributor & Foodservice Specialist, PT Sukanda Djaya Foodservice Division – Distribution to Hotels, Restaurants & Catering, PT Indoguna Utama – Premium HoReCa Importer (Italian Mafaldine & Specialty Pasta), PT Mugi Rajawali Internusa – Distributor of European Pasta & Mafaldine in Indonesia, De Cecco di Filippo Fara San Martino S.p.A. – Export & Brand Presence in Indonesia, Barilla G. e R. Fratelli S.p.A. – Export & Brand Presence in Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia Mafaldine pasta market appears promising, driven by evolving consumer preferences and a growing food service sector. As disposable incomes rise, consumers are likely to seek premium and diverse culinary experiences, including Italian cuisine. Additionally, the increasing popularity of online food delivery services is expected to facilitate access to Mafaldine pasta, enhancing its visibility and availability. The market is poised for growth, with opportunities for innovation and collaboration with local chefs to create unique offerings.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Dry Mafaldine Pasta (Ambient) Fresh/Chilled Mafaldine Pasta Frozen Mafaldine Pasta Ready-to-Eat / Ready-to-Cook Mafaldine Meals Others (Private Label, HoReCa-Only SKUs) |

| By Ingredient & Formulation | Conventional Mafaldine (Durum Wheat / Wheat Blend) Whole Wheat Mafaldine Gluten-Free Mafaldine (Rice, Corn, Multigrain, etc.) Organic Mafaldine Flavoured & Fortified Mafaldine (Spinach, Tomato, Protein-Enriched, etc.) |

| By End-User | Household / Retail Consumers HoReCa – Restaurants & Cafés Hotels & Resorts Catering & Institutional Foodservice Industrial / Food Processing Companies (Ready Meals, Meal Kits) |

| By Distribution Channel | Modern Grocery Retail (Supermarkets / Hypermarkets) Convenience Stores & Minimarkets (e.g., Alfamart, Indomaret) Specialty & Gourmet Stores (Imported & Premium) HoReCa Distributors / Foodservice Wholesalers Online Channels (E-commerce & Quick-Commerce) |

| By Packaging Type | Flexible Plastic Bags / Pouches Paperboard Boxes / Cartons Rigid Plastic Trays & Cups Bulk / Foodservice Packaging (Sacks, Catering Packs) Sustainable & Eco-Friendly Packaging Formats |

| By Price Tier | Economy (Mass-Market & Private Label) Mid-Range (Mainstream Branded) Premium (Imported & Gourmet) Super-Premium / Artisanal |

| By Region | Greater Jakarta (Jabodetabek) Rest of Java (West, Central, East Java, DI Yogyakarta) Sumatra Bali & Nusa Tenggara Kalimantan, Sulawesi & Eastern Indonesia |

| By Consumer Demographics | Age Group (18–24, 25–34, 35–49, 50+) Income Level (Mass, Aspirational Middle, Affluent) Lifestyle Segment (Health-Conscious, Gourmet/Experimenters, Convenience Seekers, Family-Oriented) Consumption Occasion (Everyday Meals, Weekend Dining, Special Occasions, Out-of-Home) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 120 | Store Managers, Retail Buyers |

| Consumer Preferences | 140 | Household Decision Makers, Food Enthusiasts |

| Food Service Sector | 100 | Restaurant Owners, Chefs |

| Distribution Channel Analysis | 80 | Logistics Managers, Supply Chain Coordinators |

| Market Trend Analysis | 110 | Food Industry Analysts, Market Researchers |

The Indonesia Mafaldine Pasta Market is valued at approximately USD 140 million, reflecting a significant segment of the broader pasta and noodles category in Indonesia, which totals around USD 2.7 billion.