Region:Asia

Author(s):Geetanshi

Product Code:KRAB3344

Pages:84

Published On:October 2025

By Type:The market is segmented into various types of loans, including personal loans, business loans, micro loans, invoice financing, education loans, agriculture loans, home improvement loans, vehicle loans, debt consolidation loans, and others. Each type serves different consumer needs and preferences, contributing to the overall growth of the market.

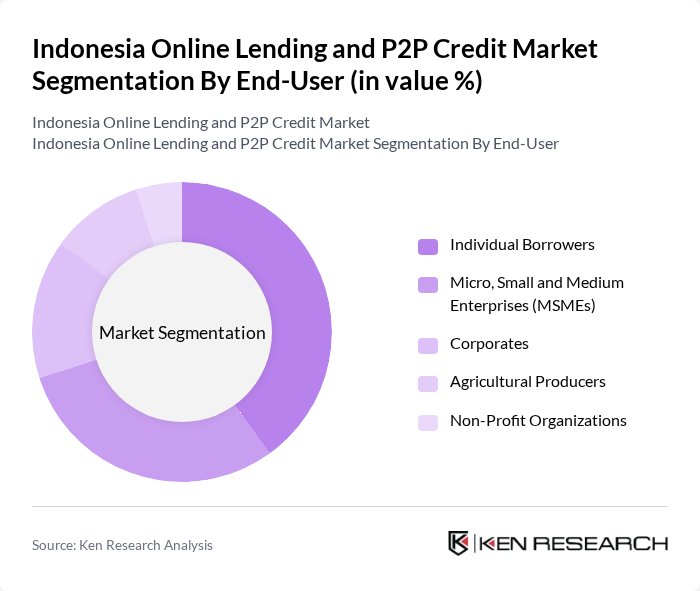

By End-User:The end-user segmentation includes individual borrowers, micro, small and medium enterprises (MSMEs), corporates, agricultural producers, and non-profit organizations. Each segment has unique borrowing needs and preferences, influencing the types of loans they seek.

The Indonesia Online Lending and P2P Credit Market is characterized by a dynamic mix of regional and international players. Leading participants such as Modalku (Funding Societies), Kredit Pintar, Akulaku, Investree, Amartha, KoinWorks, Danamas, AdaKami, UangTeman, Julo, Cicil, PinjamDuit, Alami Sharia, Kredivo, Asetku contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's online lending and P2P credit market appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy improves, more individuals will engage with online lending platforms. Additionally, the integration of AI in credit scoring will enhance risk assessment, allowing lenders to offer tailored products. The anticipated growth of e-commerce will further fuel demand for accessible credit solutions, positioning the market for significant expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Micro Loans Invoice Financing Education Loans Agriculture Loans Home Improvement Loans Vehicle Loans Debt Consolidation Loans Others |

| By End-User | Individual Borrowers Micro, Small and Medium Enterprises (MSMEs) Corporates Agricultural Producers Non-Profit Organizations |

| By Loan Amount | Micro Loans (IDR <10 million) Small Loans (IDR 10–50 million) Medium Loans (IDR 50–250 million) Large Loans (IDR >250 million) |

| By Loan Duration | Short-Term Loans (up to 12 months) Medium-Term Loans (1–3 years) Long-Term Loans (over 3 years) |

| By Interest Rate Type | Fixed Interest Rate Variable Interest Rate |

| By Distribution Channel | Online Platforms Mobile Applications Direct Lending |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| P2P Lending Users | 120 | Individual Borrowers, Small Business Owners |

| Fintech Executives | 40 | CEOs, Product Managers, Compliance Officers |

| Regulatory Bodies | 40 | Policy Makers, Financial Regulators |

| Financial Analysts | 60 | Market Researchers, Investment Analysts |

| Industry Experts | 50 | Consultants, Academic Researchers |

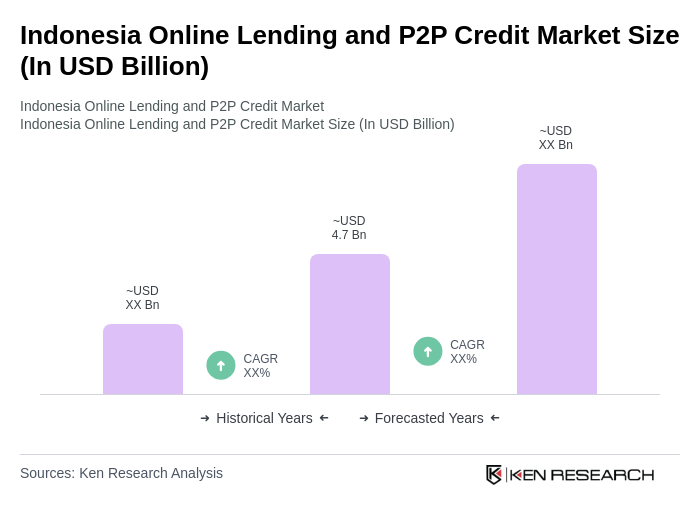

The Indonesia Online Lending and P2P Credit Market is valued at approximately USD 4.7 billion, driven by the increasing adoption of digital financial services and a growing unbanked population, particularly among younger demographics who prefer online platforms for their financial needs.