Indonesia Pediatric Oral Care Market Overview

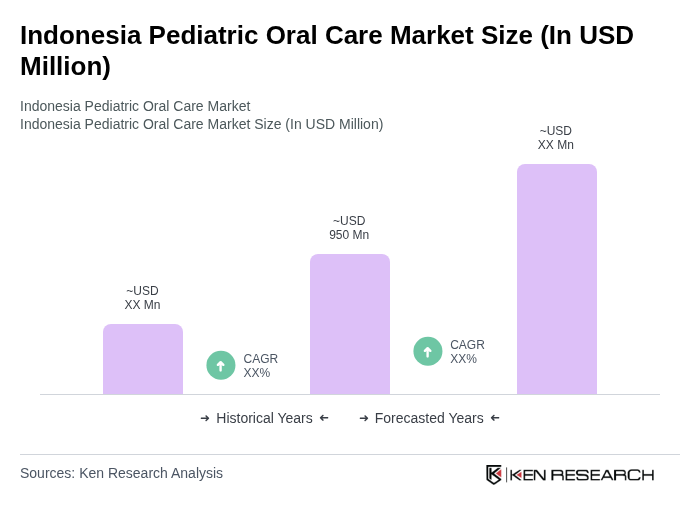

- The Indonesia Pediatric Oral Care Market is valued at USD 950 million, based on a five-year historical analysis. This valuation aligns with the broader Indonesia oral care market size and the proportion typically attributed to pediatric segments in Asia-Pacific markets. Growth is primarily driven by increasing awareness of dental hygiene among parents, rising disposable incomes, and the expanding availability of specialized oral care products for children. The market is further supported by innovations such as flavored toothpaste, eco-friendly packaging, and the integration of natural ingredients, reflecting a growing emphasis on preventive dental care.

- Key cities such as Jakarta, Surabaya, and Bandung dominate the market due to their high population density and advanced urban infrastructure. These urban centers have a higher concentration of pediatric dental clinics and retail outlets, facilitating easier access to a wide variety of oral care products. The presence of both international brands and local manufacturers in these cities contributes to the market's growth and product diversity.

- The Indonesian government has implemented regulations to promote oral health among children, including mandatory dental check-ups in schools. The operational framework for these initiatives is outlined in the “Peraturan Menteri Kesehatan Republik Indonesia Nomor 89 Tahun 2015 tentang Upaya Kesehatan Gigi dan Mulut” (Regulation of the Minister of Health of the Republic of Indonesia Number 89 of 2015 concerning Dental and Oral Health Efforts), issued by the Ministry of Health. This regulation mandates regular dental health programs in schools, including routine check-ups, oral health education, and preventive care, aiming to reduce the prevalence of dental caries and improve overall oral hygiene among children.

Indonesia Pediatric Oral Care Market Segmentation

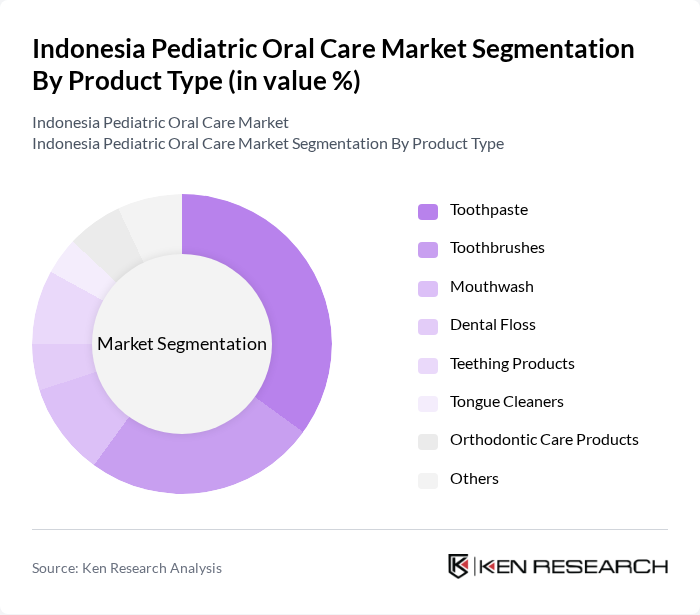

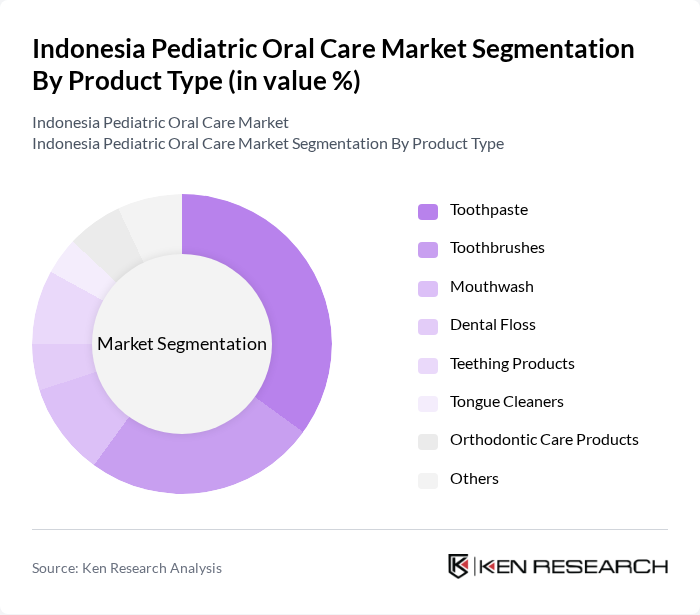

By Product Type:The product type segmentation includes toothpaste, toothbrushes, mouthwash, dental floss, teething products, tongue cleaners, orthodontic care products, and others. Toothpaste is the leading sub-segment, driven by its essential role in daily oral hygiene and the increasing availability of flavored and specialized options for children. Toothbrushes also hold a significant share, with innovations in ergonomic design and soft bristle materials tailored for pediatric use. Mouthwash and dental floss are gaining traction as parents seek comprehensive oral care solutions for their children, while teething products and tongue cleaners address specific age-related needs.

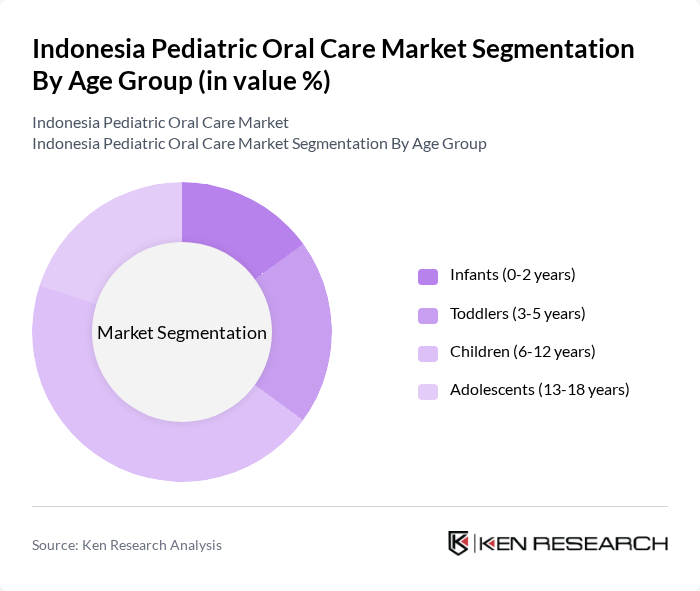

By Age Group:The age group segmentation includes infants (0-2 years), toddlers (3-5 years), children (6-12 years), and adolescents (13-18 years). The children (6-12 years) segment dominates the market, supported by increased dental health education in schools and the availability of products designed for this age group. Parents are increasingly purchasing products that address the unique dental needs of their children, driving demand for specialized oral care solutions.

Indonesia Pediatric Oral Care Market Competitive Landscape

The Indonesia Pediatric Oral Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unilever Indonesia, Procter & Gamble Indonesia, Colgate-Palmolive Indonesia, Johnson & Johnson Indonesia, Danone Indonesia, Nestlé Indonesia, Oriflame Indonesia, L'Oréal Indonesia, Reckitt Benckiser Indonesia, GSK Indonesia, Amway Indonesia, Herbalife Indonesia, Sido Muncul, Kalbe Farma, Kimia Farma, PT. Surya Dermatology Indonesia, PT. Surya Meditama Indonesia, PT. Surya Dental Indonesia, PT. Surya Dental Care Indonesia, and PT. Surya Dental Clinic Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

Indonesia Pediatric Oral Care Market Industry Analysis

Growth Drivers

- Increasing Awareness of Oral Hygiene Among Parents:The Indonesian government has reported a 30% increase in parental awareness regarding children's oral hygiene over the past five years. This shift is largely attributed to educational campaigns and community health initiatives. As a result, more parents are investing in pediatric oral care products, leading to a significant rise in demand. The World Health Organization (WHO) emphasizes that improved awareness correlates with better health outcomes, further driving market growth.

- Rising Prevalence of Dental Issues in Children:Recent studies indicate that approximately 60% of Indonesian children experience dental caries by age 12. This alarming statistic has prompted parents to seek preventive care and treatment options. The Ministry of Health reported that dental issues are among the top five health concerns for children, leading to increased spending on pediatric dental products and services. This growing prevalence is a critical driver for the pediatric oral care market.

- Growth in Disposable Income of Families:According to the World Bank, Indonesia's GDP per capita is estimated at approximately USD 4,580 in current terms. As families have more financial resources, they are more likely to prioritize health and wellness, including oral care for their children. This trend is expected to boost sales of premium pediatric oral care products, as parents are willing to invest in higher-quality options for their children's dental health.

Market Challenges

- Limited Access to Dental Care in Rural Areas:Approximately 43% of Indonesia's population resides in rural areas, where access to dental care is severely limited. The Indonesian Dental Association reports that only 30% of rural children receive regular dental check-ups. This lack of access hinders the overall growth of the pediatric oral care market, as many families cannot obtain necessary products or services, leading to untreated dental issues among children.

- High Cost of Pediatric Dental Products:The average cost of pediatric dental products in Indonesia has risen by 15% over the last three years, making them less affordable for many families. Economic disparities mean that lower-income households often prioritize basic needs over dental care. This challenge is compounded by the fact that many families are unaware of the importance of investing in quality dental products, which can lead to long-term health issues for children.

Indonesia Pediatric Oral Care Market Future Outlook

The future of the pediatric oral care market in Indonesia appears promising, driven by increasing health awareness and government initiatives. As disposable incomes rise, families are likely to invest more in preventive dental care. Additionally, the expansion of tele-dentistry services and digital marketing strategies will enhance accessibility and education. These trends indicate a shift towards a more proactive approach to children's oral health, fostering a healthier future generation and potentially increasing market growth.

Market Opportunities

- Introduction of Innovative Pediatric Oral Care Products:The demand for innovative products, such as fluoride-free toothpaste and eco-friendly toothbrushes, is on the rise. Companies that invest in research and development can capture a significant market share by addressing parents' preferences for safe and effective oral care solutions for their children.

- Partnerships with Schools for Dental Health Programs:Collaborating with educational institutions to implement dental health programs can significantly enhance awareness and accessibility. Such initiatives can lead to increased product adoption among families, as schools serve as trusted sources of information and resources for children's health.