Region:Asia

Author(s):Rebecca

Product Code:KRAC3171

Pages:96

Published On:October 2025

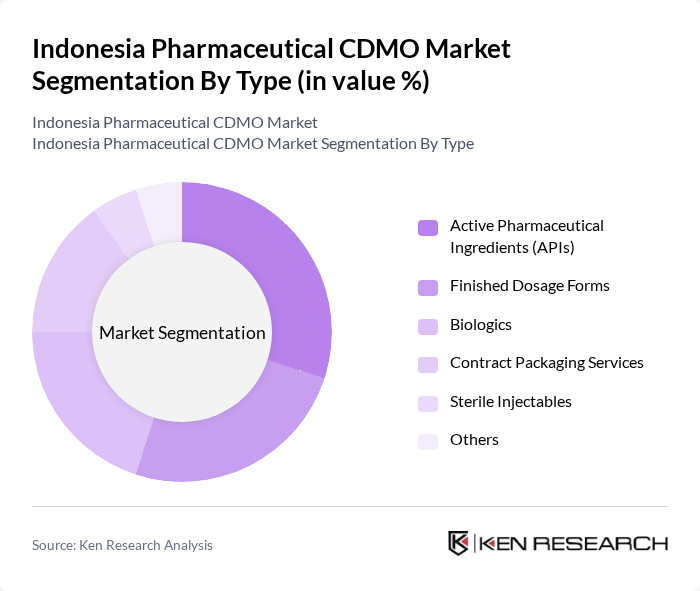

By Type:The market can be segmented into various types, including Active Pharmaceutical Ingredients (APIs), Finished Dosage Forms, Biologics, Contract Packaging Services, Sterile Injectables, and Others. Each segment plays a crucial role in market dynamics:

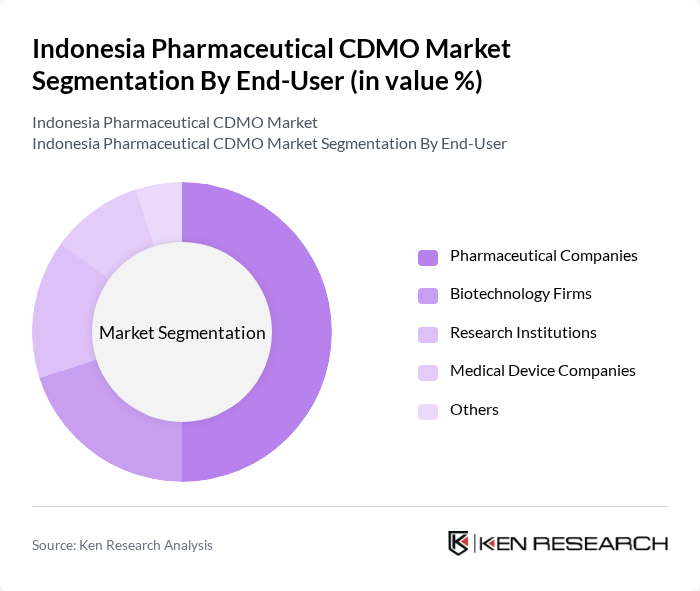

By End-User:The end-user segmentation includes Pharmaceutical Companies, Biotechnology Firms, Research Institutions, Medical Device Companies, and Others. Each end-user group has distinct requirements:

The Indonesia Pharmaceutical CDMO Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Kalbe Farma Tbk, PT Kimia Farma Tbk, PT Indofarma Tbk, PT Dexa Medica, PT Sanbe Farma, PT Merck Tbk, PT Novell Pharmaceutical Laboratories, PT Soho Global Health, PT Harsen Laboratories, PT Bio Farma (Persero), PT Indofarma Global Medika, PT Anugerah Pharmindo Lestari, PT Mersifarma Tirmaku Mercusana, PT Darya-Varia Laboratoria Tbk, PT Sido Muncul Tbk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian pharmaceutical CDMO market appears promising, driven by increasing investments in healthcare infrastructure and a growing emphasis on local manufacturing. As the government continues to support initiatives aimed at enhancing production capabilities, local CDMOs are expected to expand their service offerings. Additionally, the integration of digital technologies and AI in drug development will likely streamline processes, improve efficiency, and foster innovation, positioning Indonesia as a competitive player in the global pharmaceutical landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Active Pharmaceutical Ingredients (APIs) Finished Dosage Forms Biologics Contract Packaging Services Sterile Injectables Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Research Institutions Medical Device Companies Others |

| By Application | Oncology Cardiovascular Infectious Diseases Metabolic Disorders Others |

| By Distribution Channel | Direct Sales Online Platforms Distributors Retail Sales Others |

| By Regulatory Compliance Level | GMP Compliant Non-GMP Compliant Others |

| By Product Lifecycle Stage | Development Stage Commercial Stage Others |

| By Market Maturity | Emerging Market Established Market Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical CDMO Services | 100 | Operations Managers, Business Development Executives |

| Regulatory Compliance Insights | 60 | Regulatory Affairs Specialists, Quality Assurance Managers |

| Market Entry Strategies | 40 | Strategic Planners, Market Analysts |

| Client Satisfaction and Feedback | 80 | Pharmaceutical Company Executives, Procurement Officers |

| Trends in Outsourcing | 50 | Supply Chain Managers, R&D Directors |

The Indonesia Pharmaceutical CDMO Market is valued at approximately USD 10 billion, driven by the increasing demand for contract manufacturing services, particularly in generic drugs and biologics, as well as the focus on cost-effective manufacturing solutions.