Region:Asia

Author(s):Dev

Product Code:KRAD7801

Pages:93

Published On:December 2025

By Type:The market is segmented into various types of plano sunglasses, including polarized, non-polarized, fashion & lifestyle, sports & performance, luxury & designer, kids, and others. Among these, polarized plano sunglasses are gaining traction due to their superior glare reduction and eye protection features, making them popular among outdoor enthusiasts. Non-polarized options cater to a broader audience seeking affordable and stylish eyewear. The fashion & lifestyle segment is also significant, driven by trends in personal style and brand influence.

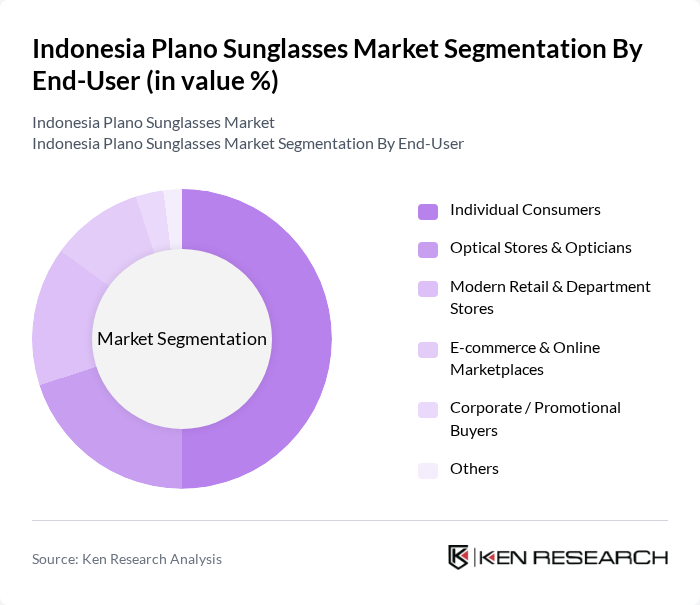

By End-User:The end-user segmentation includes individual consumers, optical stores & opticians, modern retail & department stores, e-commerce & online marketplaces, corporate/promotional buyers, and others. Individual consumers represent the largest segment, driven by the growing trend of personal eyewear choices and the increasing awareness of eye health. E-commerce has also seen significant growth, providing convenience and a wider selection for consumers.

The Indonesia Plano Sunglasses Market is characterized by a dynamic mix of regional and international players. Leading participants such as EssilorLuxottica (Ray-Ban, Oakley, Vogue Eyewear, Persol, Oliver Peoples), Safilo Group (Carrera, Polaroid Eyewear, Smith Optics), Kering Eyewear (Gucci, Saint Laurent, Balenciaga), Luxottica Indonesia (Local Subsidiary Operations), PT Optik Melawai Prima, Optik Seis (PT Mitra Seis Abadi), MAP Active Adiperkasa (Plan B, Oakley & Sports Sunglasses Retail), PT Kanmo Retailindo (Retail partner for global fashion & lifestyle brands), PT Erajaya Swasembada Tbk (Erajaya Active Lifestyle & Urban Republic), PT Lenskart Optik Indonesia (Lenskart), PT Matahari Department Store Tbk, PT Ramayana Lestari Sentosa Tbk, PT Trans Retail Indonesia (Transmart & Metro Dept. Store), PT Mitra Adiperkasa Tbk (MAP Fashion & Lifestyle Banners), PT Indonesia Optic (Local Independent Optical Chain) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia plano sunglasses market appears promising, driven by evolving consumer preferences and technological advancements. As health-conscious behaviors rise, consumers are increasingly seeking sunglasses that offer UV protection and polarized lenses. Additionally, the integration of augmented reality in online shopping experiences is expected to enhance consumer engagement, allowing for virtual try-ons. These trends indicate a shift towards more personalized and health-oriented products, positioning the market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Polarized Plano Sunglasses Non-Polarized Plano Sunglasses Fashion & Lifestyle Plano Sunglasses Sports & Performance Plano Sunglasses Luxury & Designer Plano Sunglasses Kids Plano Sunglasses Others |

| By End-User | Individual Consumers Optical Stores & Opticians Modern Retail & Department Stores E-commerce & Online Marketplaces Corporate / Promotional Buyers Others |

| By Gender | Male Female Unisex |

| By Age Group | Children Teenagers Adults Seniors |

| By Distribution Channel | Optical Stores & Optical Chains Specialty Sunglass Stores Modern Trade (Hypermarkets, Department Stores) Online Channels (Marketplaces, Brand E-stores) Traditional Trade & Informal Retail Others |

| By Material | Plastic & Acetate Frames Metal Frames Mixed / Combination Frames Sustainable / Bio-based Materials Others |

| By Price Range | Mass / Value (Below IDR 250,000) Mid-Range (IDR 250,000 – 1,000,000) Premium (IDR 1,000,000 – 3,000,000) Luxury (Above IDR 3,000,000) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Eyewear Outlets | 120 | Store Managers, Sales Associates |

| Online Sunglasses Retailers | 80 | E-commerce Managers, Digital Marketing Specialists |

| Consumer Focus Groups | 60 | Fashion Enthusiasts, Regular Sunglasses Buyers |

| Industry Experts and Analysts | 40 | Market Analysts, Fashion Industry Consultants |

| Fashion Influencers and Stylists | 30 | Social Media Influencers, Fashion Bloggers |

The Indonesia Plano Sunglasses Market is valued at approximately USD 22 million, reflecting a growing demand driven by increased consumer awareness of eye protection, fashion trends, and the popularity of outdoor activities.