Region:Asia

Author(s):Shubham

Product Code:KRAC4300

Pages:100

Published On:October 2025

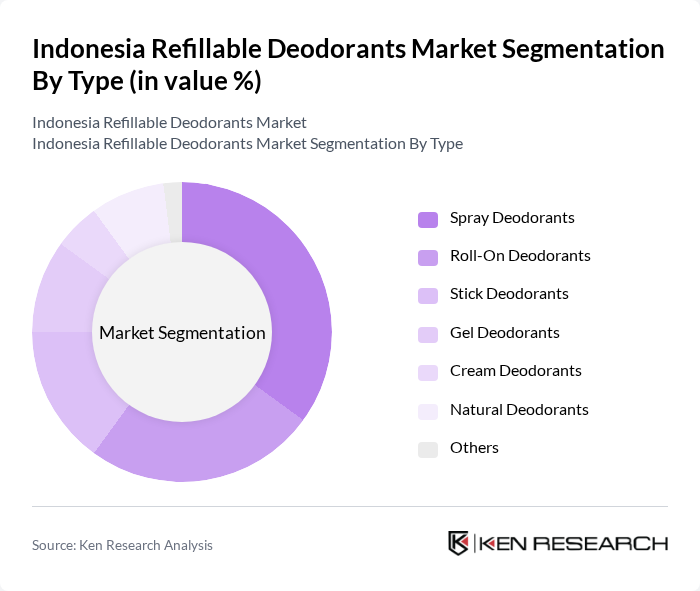

By Type:The market is segmented into various types of refillable deodorants, including Spray Deodorants, Roll-On Deodorants, Stick Deodorants, Gel Deodorants, Cream Deodorants, Natural Deodorants, and Others. Spray Deodorants are currently leading the market due to their convenience and ease of use, appealing to a broad consumer base. The trend towards natural and organic products is also gaining traction, with Natural Deodorants witnessing increased demand as consumers become more health-conscious and environmentally aware.

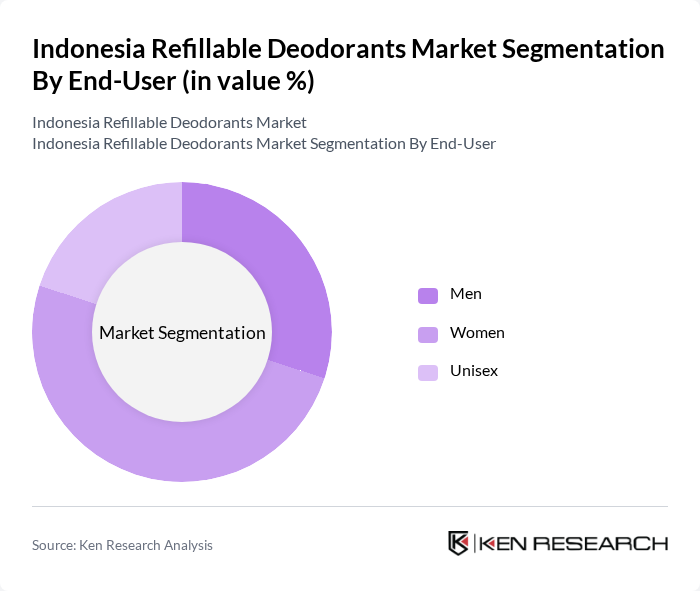

By End-User:The market is segmented by end-user demographics into Men, Women, and Unisex. Women represent the largest segment, driven by a higher demand for personal care products and a growing trend towards sustainable beauty. Men’s grooming products are also on the rise, with an increasing number of male consumers seeking eco-friendly options. Unisex products are gaining popularity as they cater to a broader audience, appealing to consumers who prefer gender-neutral branding.

The Indonesia Refillable Deodorants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unilever Indonesia, Procter & Gamble Indonesia, Natura &Co, L'Oréal Indonesia, Henkel Indonesia, The Body Shop Indonesia, Scentio Indonesia, Sensatia Botanicals, Green People Indonesia, Eco Warrior Indonesia, Biore Indonesia, Dove Indonesia, Secret Indonesia, Nivea Indonesia, Avoskin contribute to innovation, geographic expansion, and service delivery in this space.

The future of the refillable deodorants market in Indonesia appears promising, driven by increasing consumer demand for sustainable products and supportive government policies. As awareness grows, brands that effectively communicate the environmental benefits of refillable options are likely to gain traction. Additionally, the rise of e-commerce platforms will facilitate access to these products, enabling consumers to make more sustainable choices conveniently. Innovations in packaging and product formulation will further enhance market appeal, positioning refillable deodorants as a viable alternative in personal care.

| Segment | Sub-Segments |

|---|---|

| By Type | Spray Deodorants Roll-On Deodorants Stick Deodorants Gel Deodorants Cream Deodorants Natural Deodorants Others |

| By End-User | Men Women Unisex |

| By Sales Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Convenience Stores Others |

| By Packaging Type | Refillable Bottles Bulk Refill Stations Eco-friendly Packaging |

| By Price Range | Budget Mid-range Premium |

| By Brand Loyalty | Established Brands Emerging Brands Private Labels |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Income Level (Low, Middle, High) Urban vs Rural |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Refillable Deodorants | 120 | Eco-conscious Consumers, Personal Care Users |

| Retail Insights on Refillable Product Sales | 60 | Store Managers, Category Buyers |

| Brand Perception and Marketing Strategies | 50 | Marketing Managers, Brand Strategists |

| Distribution Channels for Refillable Deodorants | 40 | Supply Chain Managers, Logistics Coordinators |

| Consumer Feedback on Product Features | 45 | Product Development Teams, Consumer Insights Analysts |

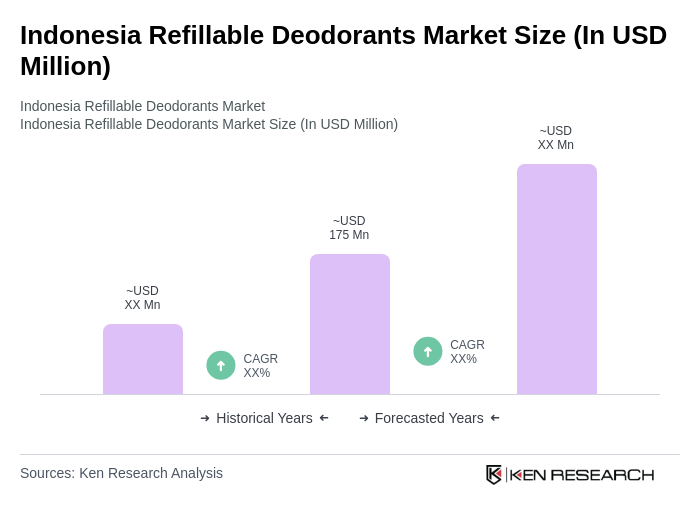

The Indonesia Refillable Deodorants Market is valued at approximately USD 175 million, reflecting a growing trend towards sustainable and eco-friendly personal care products among consumers in the region.