Region:Asia

Author(s):Geetanshi

Product Code:KRAB3391

Pages:82

Published On:October 2025

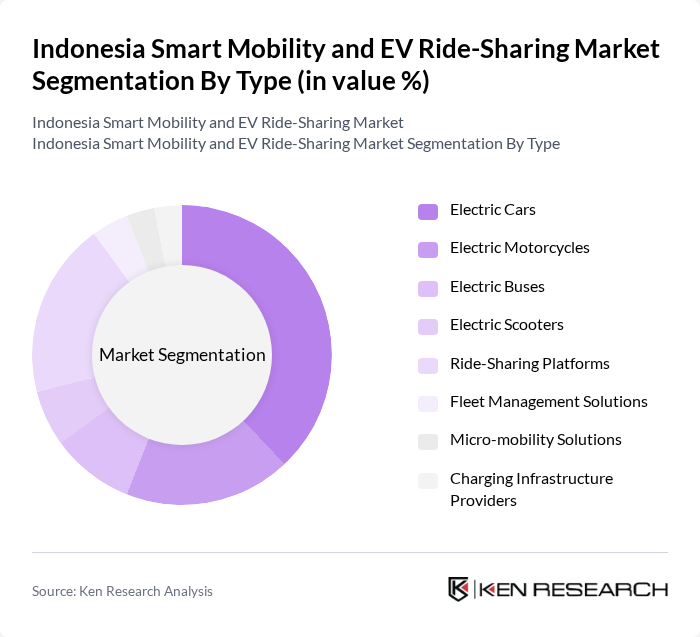

By Type:The market can be segmented into Electric Cars, Electric Motorcycles, Electric Buses, Electric Scooters, Ride-Sharing Platforms, Fleet Management Solutions, Micro-mobility Solutions, and Charging Infrastructure Providers. Among these, Electric Cars and Ride-Sharing Platforms are particularly prominent, reflecting their strong adoption in daily commuting and integration with digital mobility ecosystems. Electric Motorcycles are also gaining rapid traction, supported by government subsidies and their suitability for dense urban environments .

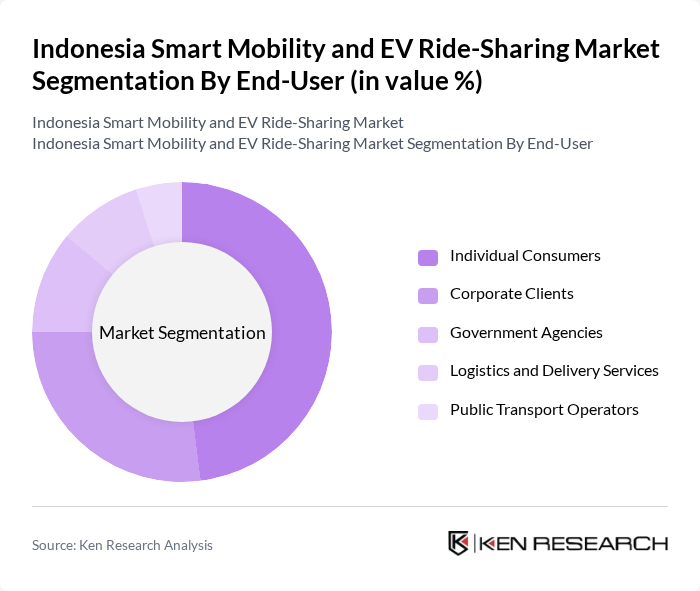

By End-User:The end-user segmentation includes Individual Consumers, Corporate Clients, Government Agencies, Logistics and Delivery Services, and Public Transport Operators. Individual Consumers and Corporate Clients are the dominant segments, reflecting the growing use of electric vehicles for personal mobility and business operations. Government Agencies and Logistics Services are also expanding their adoption, driven by sustainability mandates and operational efficiency goals .

The Indonesia Smart Mobility and EV Ride-Sharing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gojek, Grab, Bluebird Group, OVO, Aplikasi Layanan Transportasi (ALTA), Maxim, Anterin, Migo, Volt Indonesia, Electrum, Smoot Motor, GrabWheels, Vrent, SWAP Energi, and Oyika contribute to innovation, geographic expansion, and service delivery in this space .

The future of Indonesia's smart mobility and EV ride-sharing market appears promising, driven by increasing urbanization and government support. In future, the integration of advanced technologies such as AI and big data will enhance operational efficiency and user experience. Additionally, the rise of smart city initiatives will facilitate the development of sustainable transport solutions. As consumer preferences shift towards eco-friendly options, the market is poised for significant growth, with innovative mobility solutions becoming integral to urban transportation systems.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Cars Electric Motorcycles Electric Buses Electric Scooters Ride-Sharing Platforms Fleet Management Solutions Micro-mobility Solutions Charging Infrastructure Providers |

| By End-User | Individual Consumers Corporate Clients Government Agencies Logistics and Delivery Services Public Transport Operators |

| By Vehicle Ownership Model | Owned Vehicles Leased Vehicles Shared Vehicles |

| By Service Type | Ride-Hailing Services Carpooling Services Shuttle Services Subscription-Based Mobility |

| By Payment Model | Pay-Per-Ride Subscription-Based Corporate Contracts |

| By Charging Infrastructure | Public Charging Stations Private Charging Solutions Fast Charging Networks Battery Swapping Stations |

| By Policy Support | Government Subsidies Tax Incentives Grants for Infrastructure Development Local Content Requirements |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Ride-Sharing Users | 100 | Frequent riders, occasional users, and potential adopters |

| EV Fleet Operators | 60 | Fleet managers, operations managers, and logistics coordinators |

| Government Transportation Officials | 40 | Policy makers, urban planners, and regulatory authorities |

| Charging Infrastructure Providers | 50 | Business development managers, technical leads, and project managers |

| Consumer Advocacy Groups | 40 | Representatives from environmental and consumer rights organizations |

The Indonesia Smart Mobility and EV Ride-Sharing Market is valued at approximately USD 2.5 billion, driven by urbanization, government incentives for electric vehicles, and increasing consumer demand for sustainable transportation solutions.