Region:Asia

Author(s):Dev

Product Code:KRAD5111

Pages:90

Published On:December 2025

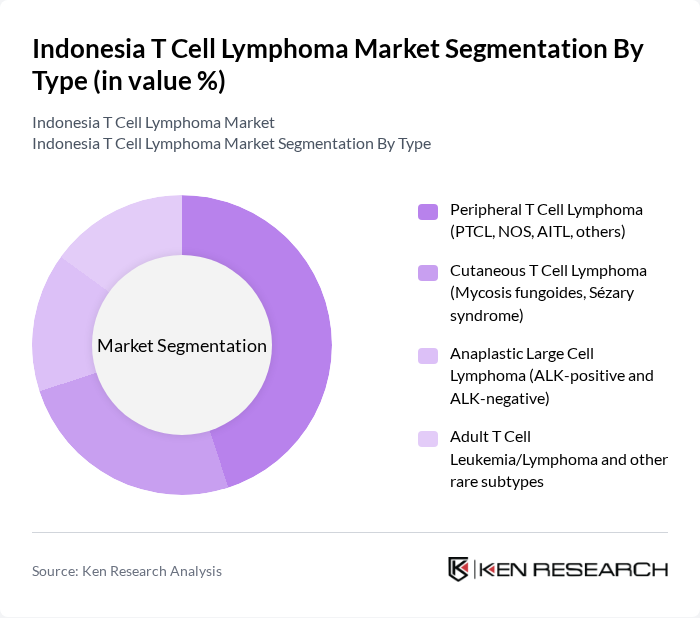

By Type:The T Cell Lymphoma market can be segmented into various types, including Peripheral T Cell Lymphoma (PTCL), Cutaneous T Cell Lymphoma, Anaplastic Large Cell Lymphoma, and Adult T Cell Leukemia/Lymphoma. Among these, Peripheral T Cell Lymphoma (PTCL) is the most prevalent subtype group in Asia and accounts for the largest share of T?cell lymphoma cases globally, driven by its diverse subtypes such as PTCL?NOS, angioimmunoblastic T?cell lymphoma, and anaplastic large cell lymphoma. The growing awareness of PTCL’s distinct biology, wider availability of immunohistochemistry panels, and evolving treatment strategies including CHOP?based regimens and consolidation with stem cell transplant where feasible have supported its dominance in the treated patient pool.

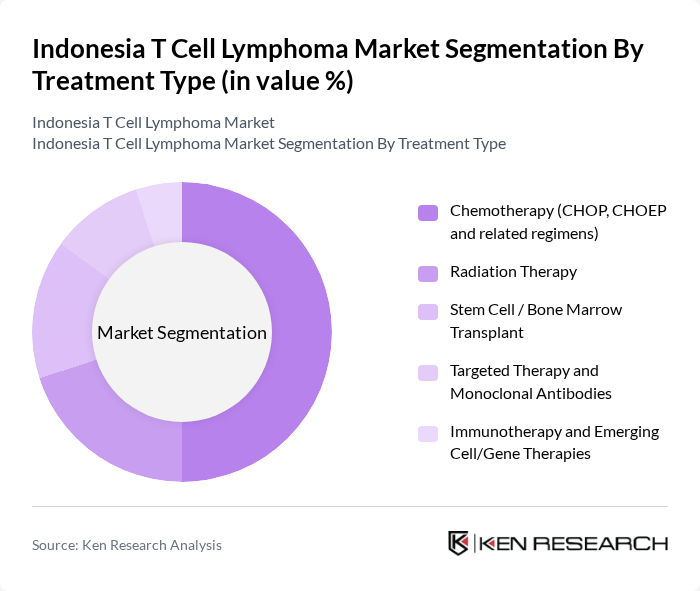

By Treatment Type:The treatment options for T Cell Lymphoma include Chemotherapy, Radiation Therapy, Stem Cell/Bone Marrow Transplant, Targeted Therapy, and Immunotherapy. Chemotherapy remains the leading treatment modality due to its established role as first?line therapy (for example, CHOP or CHOEP?like regimens) and its wide availability in public and private hospitals. The increasing adoption of targeted therapies and monoclonal antibodies, including agents developed for specific PTCL or cutaneous T?cell lymphoma indications in global markets, along with growing interest in immunotherapy and cell?based approaches, reflects a gradual shift towards more personalized medicine in the treatment landscape in Asia-Pacific.

The Indonesia T Cell Lymphoma Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Kalbe Farma Tbk, PT Kimia Farma Tbk, PT Indofarma Tbk, PT Merck Tbk (Merck KGaA), PT Novartis Indonesia, PT Roche Indonesia, PT Pfizer Indonesia, PT Sanofi Indonesia, PT AstraZeneca Indonesia, PT Takeda Indonesia, PT Johnson & Johnson Indonesia (Janssen), PT Bristol-Myers Squibb Indonesia, PT GlaxoSmithKline Indonesia Tbk, PT Otsuka Indonesia, PT Eisai Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the T Cell Lymphoma market in Indonesia appears promising, driven by ongoing advancements in treatment and increased healthcare investments. The government is expected to enhance healthcare infrastructure, facilitating better access to specialized services. Additionally, the growing trend towards personalized medicine and the integration of telemedicine will likely improve patient management and outcomes. These developments will create a more robust framework for addressing the challenges faced by T Cell Lymphoma patients in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Peripheral T Cell Lymphoma (PTCL, NOS, AITL, others) Cutaneous T Cell Lymphoma (Mycosis fungoides, Sézary syndrome) Anaplastic Large Cell Lymphoma (ALK-positive and ALK-negative) Adult T Cell Leukemia/Lymphoma and other rare subtypes |

| By Treatment Type | Chemotherapy (CHOP, CHOEP and related regimens) Radiation Therapy Stem Cell / Bone Marrow Transplant Targeted Therapy and Monoclonal Antibodies Immunotherapy and Emerging Cell/Gene Therapies |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Specialty Cancer Clinics and Day-care Centers Others |

| By Patient Demographics | Age Group (Pediatric, Adult, Geriatric) Gender (Male, Female) Urban vs Rural Patients Insurance Coverage Status (JKN/BPJS, Private, Self-pay) |

| By Geographic Region | Java (Jakarta, West Java, Central Java, East Java, Yogyakarta, Banten) Sumatra Kalimantan Sulawesi Bali & Nusa Tenggara, Papua and other regions |

| By Healthcare Provider Type | Public Tertiary Referral Hospitals (e.g., RSUP Dr. Cipto Mangunkusumo, Dharmais Cancer Hospital) Regional and District Public Hospitals Private Hospitals and Cancer Centers Academic / Teaching Hospitals and Research Institutes |

| By Research and Development Focus | Clinical Trials and Investigator-Initiated Studies Drug and Biologic Development (targeted and immunotherapies) Patient Registries and Real-World Evidence Programs Diagnostic and Biomarker Development |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncologists and Hematologists | 60 | Medical Doctors specializing in blood cancers |

| Healthcare Providers | 80 | Nurses and Administrators in oncology departments |

| Patient Advocacy Groups | 50 | Leaders and members of lymphoma support organizations |

| Pharmaceutical Representatives | 70 | Sales and Marketing professionals from oncology drug manufacturers |

| Health Insurance Providers | 60 | Policy Analysts and Claims Managers |

The Indonesia T Cell Lymphoma market is valued at approximately USD 11 million, reflecting a five-year historical analysis. This growth is attributed to increased awareness of hematological malignancies and improved access to diagnostics and treatment options.