APAC Alcoholic Ice Cream Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD6000

December 2024

84

About the Report

APAC Alcoholic Ice Cream Market Overview

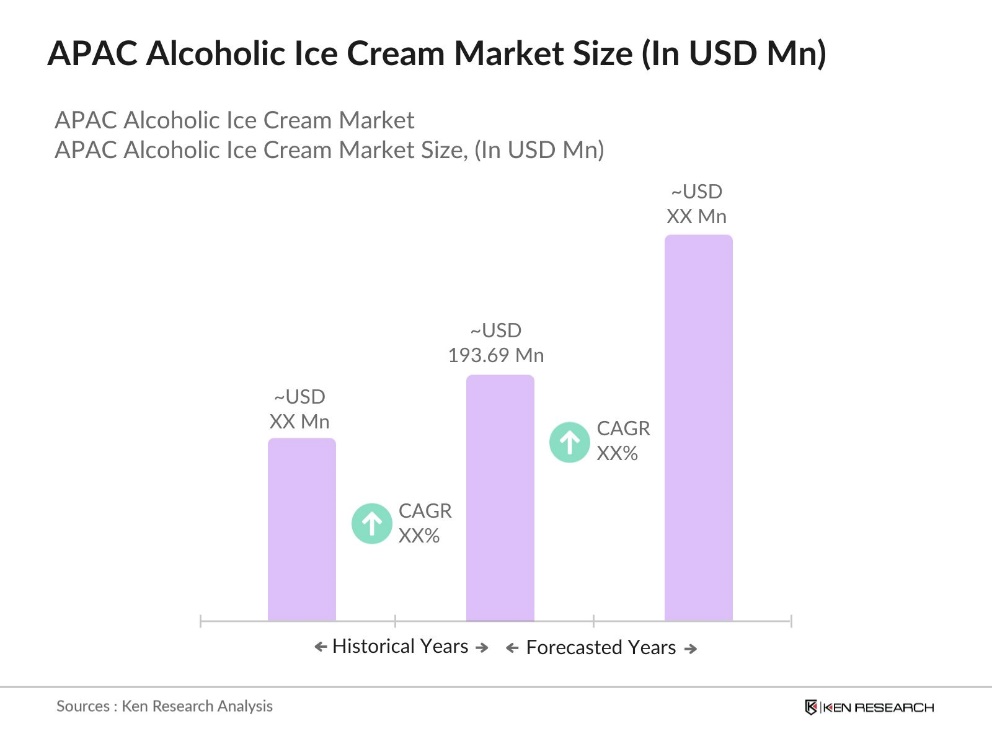

- The APAC Alcoholic Ice Cream Market is currently valued at USD 193.69 million, reflecting the region's growing appetite for novel dessert experiences. The market is driven by a combination of rising disposable incomes, urbanization, and a shift toward premium and indulgent food products. The fusion of alcohol and ice cream appeals to consumers seeking both flavor innovation and luxury, particularly in major metropolitan areas across the region.

- Dominant countries in the APAC alcoholic ice cream market include Japan, Australia, and South Korea. These countries are leading due to their mature dessert markets, strong consumer demand for premium products, and innovative approaches to incorporating alcohol into traditional ice cream. Cities like Tokyo, Sydney, and Seoul are witnessing a surge in boutique ice cream parlors, further bolstered by high tourism and hospitality sectors.

- Governments across the Asia-Pacific region impose strict regulations on the alcohol content in food products. In these regions, alcoholic ice creams typically contain between 0.5% to 8% ABV, but those with lower alcohol content (below 1%) are more widely accepted for sale in general retail settings. These restrictions pose a challenge for manufacturers, requiring careful formulation adjustments to comply with local laws while still maintaining the desired flavor profile.

APAC Alcoholic Ice Cream Market Segmentation

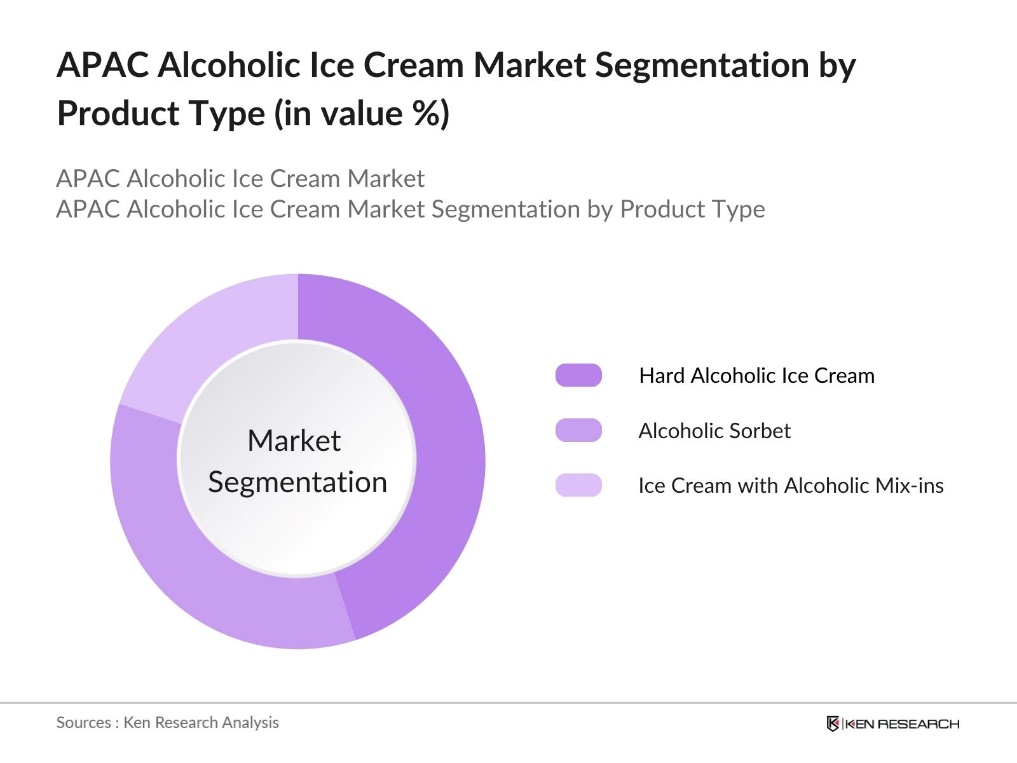

By Product Type: The APAC alcoholic ice cream market is segmented by product type into Hard Alcoholic Ice Cream, Alcoholic Sorbet, and Ice Cream with Alcoholic Mix-ins. Hard Alcoholic Ice Cream dominates the market within this segment. This sub-segment's dominance is attributed to the growing consumer preference for stronger alcoholic content in frozen desserts, combined with the rise of artisanal and gourmet ice cream brands focusing on high alcohol content. Hard alcoholic ice cream provides a unique fusion experience that attracts both dessert enthusiasts and alcohol connoisseurs.

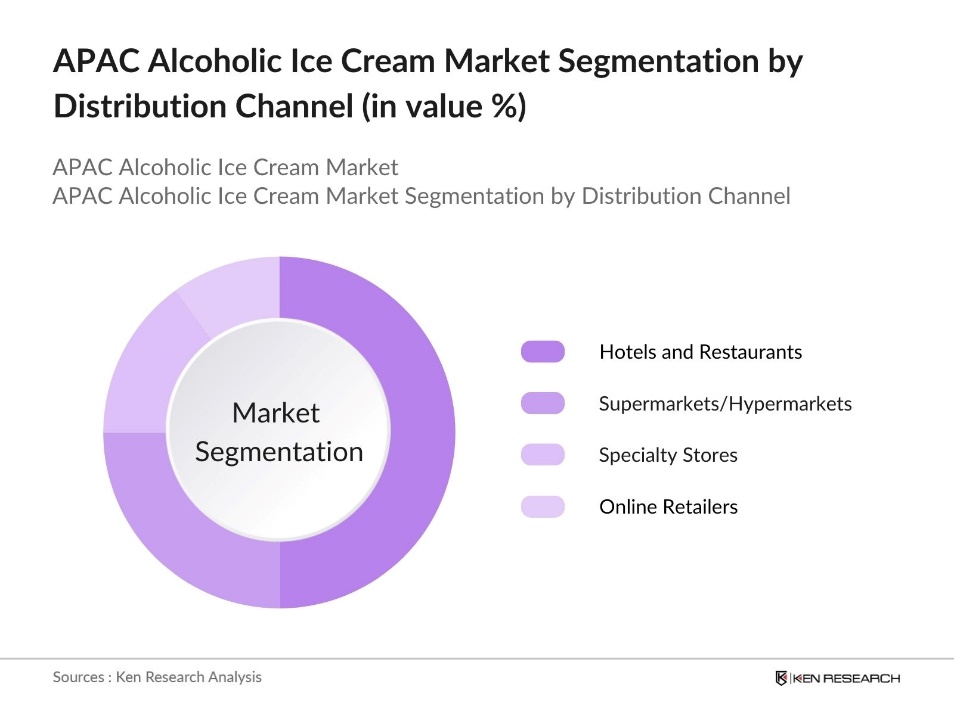

By Distribution Channel: The APAC alcoholic ice cream market is segmented by distribution channels into Supermarkets/Hypermarkets, Online Retailers, Specialty Stores, and Hotels and Restaurants. Hotels and Restaurants dominate this segment due to the trend of premiumization within the hospitality industry. Many luxury hotels and fine dining restaurants are increasingly offering alcoholic ice cream as part of their dessert menus, catering to consumers looking for a complete dining experience. This channel is also driven by the growing tourism industry in APAC, with international visitors seeking unique local flavors.

APAC Alcoholic Ice Cream Market Competitive Landscape

The APAC alcoholic ice cream market is highly competitive, with key players ranging from established global ice cream brands to emerging regional artisans. The competitive landscape is characterized by product innovation, with a focus on unique flavor combinations, alcohol content, and premium ingredients. The market is driven by the consolidation of large brands such as Haagen-Dazs and Ben & Jerrys, which have significant global presence and well-established distribution networks.

|

Company Name |

Year of Establishment |

Headquarters |

Production Capacity |

Distribution Network |

Key Products |

Alcohol Content Range |

Partnerships |

|

Haagen-Dazs |

1960 |

USA |

|||||

|

Tipsy Scoop |

2014 |

USA |

|||||

|

Ben & Jerry's |

1978 |

USA |

|||||

|

BuzzBar Ice Cream |

2012 |

USA |

|||||

|

ArcticBuzz |

2015 |

USA |

APAC Alcoholic Ice Cream Industry Analysis

Growth Drivers

- Increasing Preference for Unique Flavors: Consumers in the Asia-Pacific region, particularly millennials, are showing a growing preference for unique and exotic flavors, both in desserts and alcoholic products. For instance, a survey indicated that 55% of consumers globally consider traditional flavors influential in their food choices, underscoring a trend towards fusion cuisine that blends different cultural elements. This shift in consumer preference is driving innovation in the alcoholic ice cream segment, where companies are exploring ways to infuse locally popular spirits into traditional ice cream flavors.

- Growth in Tourism and Hospitality Industry: According to the Pacific Asia Travel Association (PATA), international visitor arrivals (IVAs) in the Asia-Pacific region were projected to exceed 516 million by the end of 2023. The hospitality industry, especially in countries like Thailand and Indonesia, is embracing alcoholic ice cream as part of its dessert offerings to cater to foreign tourists looking for unique experiences. As tourism continues to rebound post-pandemic, demand for premium, novelty desserts in hotels and resorts is expected to support the alcoholic ice cream market, particularly in tourist-heavy destinations.

- Expansion of Premium Dessert Offerings: The growing middle class and affluent consumers in markets like Singapore and Hong Kong are driving the expansion of premium dessert offerings. With an increasing demand for gourmet and artisanal brands, alcoholic ice cream is emerging as a luxurious and indulgent option within this trend. These regions are seeing a rise in the number of high-end dessert parlors that cater to consumers seeking unique and innovative frozen desserts.

Market Challenges

- Regulatory Barriers on Alcohol-Based Products: Regulations on alcohol-infused food products are stringent in many Asia-Pacific countries, particularly in nations like India and Indonesia, where alcohol consumption is heavily restricted. Strict controls on alcohol content in food create challenges for manufacturers, requiring adjustments to formulations and complicating market entry. These regulatory hurdles add significant complexity to the production and distribution of alcoholic ice cream in the region.

- High Production Costs and Cold Storage Needs: Producing alcoholic ice cream requires specialized processes due to its alcohol content, leading to higher production costs. Additionally, maintaining consistent cold chain logistics is crucial, particularly in developing Asia-Pacific markets where infrastructure can be unreliable. These factors increase overall expenses, making the production and distribution of alcoholic ice cream a costly endeavor.

APAC Alcoholic Ice Cream Market Future Outlook

Over the next five years, the APAC alcoholic ice cream market is expected to show robust growth due to the increasing demand for luxury desserts and the rising popularity of alcohol-infused products. Additionally, advancements in food processing technologies, coupled with innovative marketing strategies, will help cater to the growing millennial and Gen Z populations that favor experiential and indulgent products.

Market Opportunities

- Introduction of Alcohol-Free Variants: The growing demand for alcohol-free or low-alcohol alternatives offers a significant opportunity for alcoholic ice cream manufacturers in the Asia-Pacific region. By introducing alcohol-free variants, companies can reach a wider audience, including consumers who enjoy the flavor of alcohol but prefer not to consume it. This approach allows brands to cater to non-drinking populations in markets where alcohol is restricted, such as Malaysia and Indonesia.

- Increasing Demand in Luxury Food Markets: The rise in demand for luxury food experiences in the Asia-Pacific region presents a valuable opportunity for alcoholic ice cream brands. As consumers in countries like Japan and Singapore increasingly seek out premium and gourmet foods, alcoholic ice cream can position itself as a high-end dessert option. By targeting upscale restaurants and specialty food stores, these products can tap into the growing luxury food market in metropolitan areas.

Scope of the Report

|

By Product Type |

Hard Alcoholic Ice Cream Alcoholic Sorbet Ice Cream with Alcoholic Mix-ins |

|

By Alcohol Content |

Low Alcohol (0.5% - 1.5%) Medium Alcohol (1.5% - 4%) High Alcohol (>4%) |

|

By Distribution Channel |

Supermarkets/Hypermarkets Online Retailers Specialty Stores Hotels and Restaurants |

|

By Packaging Type |

Cups Tubs Cones |

|

By Region |

East Asia Southeast Asia South Asia Oceania |

Products

Key Target Audience

Alcoholic Ice Cream Manufacturers

Alcohol Beverage Companies

Event Catering Companies

Hospitality Industry Players (Hotels & Restaurants)

Government and Regulatory Bodies (APAC Food Safety Authorities)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Haagen-Dazs

Tipsy Scoop

Ben & Jerry's

BuzzBar Ice Cream

ArcticBuzz

Mercer's Dairy

Sloshed Scoop

Frozen Pints

Jeni's Splendid Ice Creams

Poppaball

Table of Contents

1. APAC Alcoholic Ice Cream Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics

1.4. Market Segmentation Overview

2. APAC Alcoholic Ice Cream Market Size (in USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. APAC Alcoholic Ice Cream Market Analysis

3.1. Growth Drivers (e.g., Consumer Lifestyle Changes, Millennial Preference, Premiumization, Alcoholic Beverages Integration)

3.1.1. Rising Alcoholic Consumption Trends

3.1.2. Increasing Preference for Unique Flavors

3.1.3. Expansion of Premium Dessert Offerings

3.1.4. Growth in Tourism and Hospitality Industry

3.2. Market Challenges (e.g., Regulation on Alcohol Content, Logistics, Cold Chain Distribution)

3.2.1. Regulatory Barriers on Alcohol-Based Products

3.2.2. High Production Costs and Cold Storage Needs

3.2.3. Limited Awareness in Emerging Markets

3.3. Opportunities (e.g., Innovation in Flavors, Niche Targeting, Eco-Friendly Packaging)

3.3.1. Introduction of Alcohol-Free Variants

3.3.2. Increasing Demand in Luxury Food Markets

3.3.3. Rising Popularity in Asia's Metropolitan Areas

3.4. Trends (e.g., Vegan Ice Cream Variants, Organic Alcohol Integration, Sustainability Focus)

3.4.1. Fusion of Organic Alcoholic Ingredients

3.4.2. Alcoholic Ice Cream in Pop-up Stores and Events

3.4.3. Growth of Plant-Based Alcoholic Ice Cream

3.5. Government Regulations (e.g., Alcohol Licensing, FDA Approvals, Packaging Regulations)

3.5.1. Alcohol Content Restrictions

3.5.2. Labelling Requirements for Alcoholic Products

3.5.3. Import and Export Guidelines for Frozen Desserts

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. APAC Alcoholic Ice Cream Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. Hard Alcoholic Ice Cream

4.1.2. Alcoholic Sorbet

4.1.3. Ice Cream with Alcoholic Mix-ins

4.2. By Alcohol Content (in Value %)

4.2.1. Low Alcohol (0.5% - 1.5%)

4.2.2. Medium Alcohol (1.5% - 4%)

4.2.3. High Alcohol (>4%)

4.3. By Distribution Channel (in Value %)

4.3.1. Supermarkets/Hypermarkets

4.3.2. Online Retailers

4.3.3. Specialty Stores

4.3.4. Hotels and Restaurants

4.4. By Packaging Type (in Value %)

4.4.1. Cups

4.4.2. Tubs

4.4.3. Cones

4.5. By Region (in Value %)

4.5.1. East Asia

4.5.2. Southeast Asia

4.5.3. South Asia

4.5.4. Oceania

5. APAC Alcoholic Ice Cream Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Haagen-Dazs

5.1.2. Tipsy Scoop

5.1.3. Ben & Jerry's

5.1.4. BuzzBar Ice Cream

5.1.5. Frozen Pints

5.1.6. Sloshed Scoop

5.1.7. Jeni's Splendid Ice Creams

5.1.8. Poppaball

5.1.9. ArcticBuzz

5.1.10. Winks Ice Cream

5.1.11. Mercer's Dairy

5.1.12. Lickalix

5.1.13. Fruta Pop

5.1.14. The Ice Co.

5.1.15. Gelato Fiasco

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Production Capacity, Distribution Network, Partnerships, Product Variations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. APAC Alcoholic Ice Cream Market Regulatory Framework

6.1. Food Safety Standards

6.2. Compliance Requirements

6.3. Licensing and Certification Processes

7. APAC Alcoholic Ice Cream Future Market Size (in USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. APAC Alcoholic Ice Cream Future Market Segmentation

8.1. By Product Type (in Value %)

8.2. By Alcohol Content (in Value %)

8.3. By Distribution Channel (in Value %)

8.4. By Packaging Type (in Value %)

8.5. By Region (in Value %)

9. APAC Alcoholic Ice Cream Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the APAC alcoholic ice cream market ecosystem, focusing on major stakeholders, including manufacturers, distributors, and retailers. Desk research and proprietary databases were utilized to gather industry-level information, identifying critical variables affecting market dynamics.

Step 2: Market Analysis and Construction

Historical data on market penetration, product types, and distribution channels were analyzed to understand revenue trends and service availability. Key metrics such as product demand across different regions and consumer purchasing patterns were evaluated.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through consultations with industry experts and key players, using CATI (computer-assisted telephone interviews). These discussions provided insights into production processes, pricing strategies, and regional variations in demand.

Step 4: Research Synthesis and Final Output

In the final phase, manufacturers and distributors were contacted directly to obtain detailed information on production capacity, sales performance, and consumer preferences, thereby verifying the bottom-up market estimates.

Frequently Asked Questions

01. How big is the APAC Alcoholic Ice Cream Market?

The APAC Alcoholic Ice Cream Market is valued at USD 193.69 million, driven by increasing consumer interest in indulgent, alcohol-infused desserts and expanding distribution channels through hospitality and retail sectors.

02. What are the challenges in the APAC Alcoholic Ice Cream Market?

Challenges in APAC Alcoholic Ice Cream Market include strict regulations on alcohol content in food products, high production costs due to cold chain requirements, and the limited awareness of alcoholic ice cream in certain emerging markets within APAC.

03. Who are the major players in the APAC Alcoholic Ice Cream Market?

Key players in the APAC Alcoholic Ice Cream Market include Haagen-Dazs, Tipsy Scoop, Ben & Jerry's, BuzzBar Ice Cream, and ArcticBuzz. These companies lead the market with innovative flavor combinations, strong distribution networks, and premium product offerings.

04. What are the growth drivers of the APAC Alcoholic Ice Cream Market?

The APAC Alcoholic Ice Cream Market growth drivers include the increasing popularity of premium and experiential desserts, rising disposable incomes, and the growing millennial and Gen Z demand for alcohol-infused products. Expansion in the tourism and hospitality industries also boosts market demand.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.