APAC Amino Acid Market Outlook to 2030

Region:Asia

Author(s):Mukul

Product Code:KROD6613

October 2024

81

About the Report

APAC Amino Acid Market Overview

- The APAC amino acid market is valued at USD 12.5 billion, primarily driven by the expanding food and beverage industry, the growing use of amino acids in animal feed, and increasing consumer health awareness. The demand for plant-based amino acids is on the rise due to the growing vegan population in countries like China, Japan, and South Korea. Additionally, the integration of amino acids in dietary supplements and pharmaceuticals to address lifestyle-related diseases further fuels market expansion.

- Countries such as China, Japan, and South Korea dominate the market, owing to their advanced manufacturing capacities, large-scale production of amino acids, and strong focus on biotechnology. China, in particular, holds a significant position due to its robust industrial infrastructure and cost-effective production processes. These nations also benefit from well-established industries in pharmaceuticals, food & beverage, and animal feed, driving the high demand for amino acids.

- Governments across APAC have implemented stricter labeling requirements for amino acid-based products. In 2023, Australia introduced new labeling regulations requiring explicit details on amino acid content in nutraceutical products to enhance consumer transparency. Similarly, Japan mandates certification for the use of specific amino acids in food products, requiring companies to undergo rigorous testing to ensure compliance. These regulatory changes are aimed at increasing consumer trust in the safety and efficacy of amino acid-based supplements.

APAC Amino Acid Market Segmentation

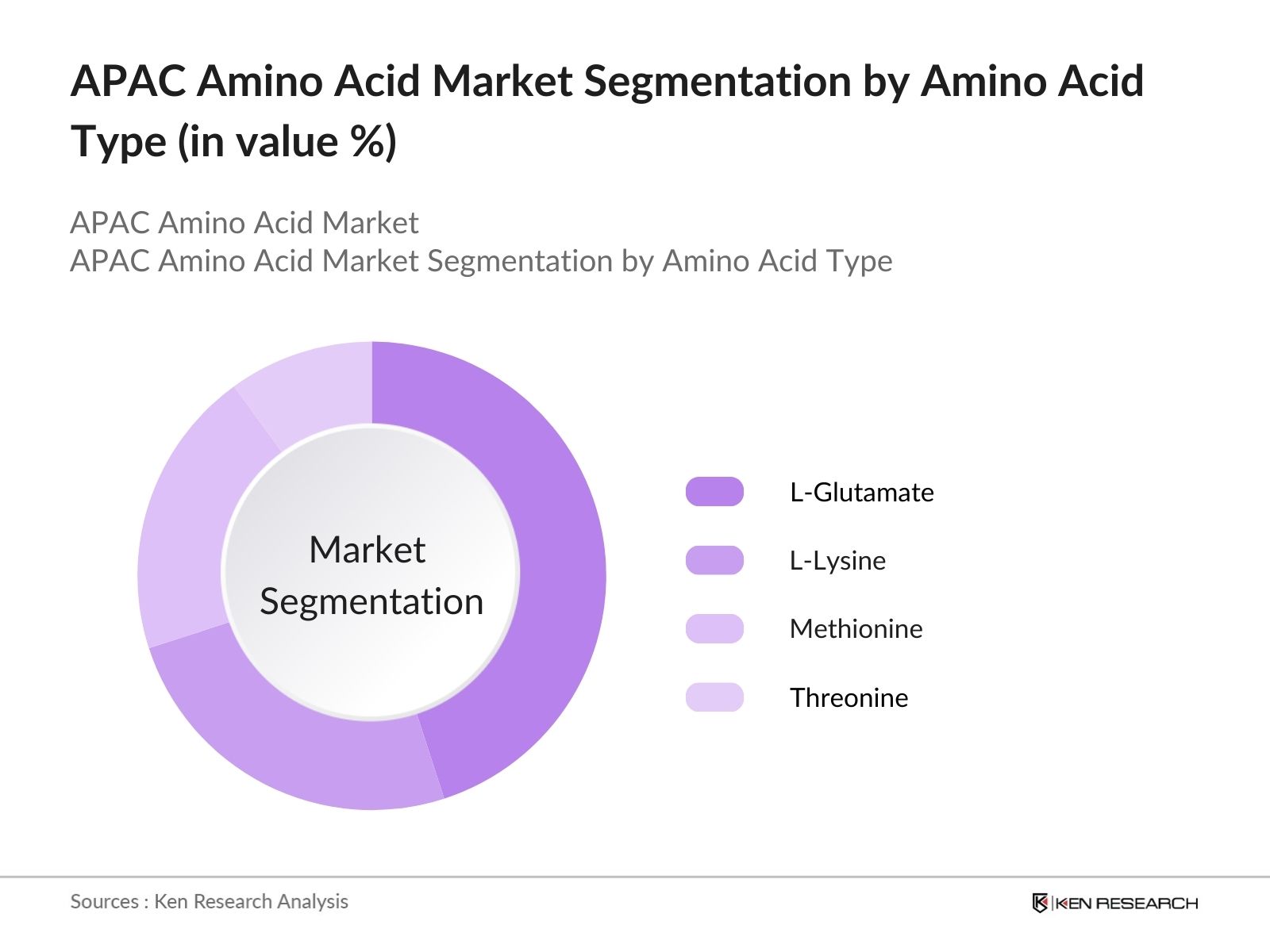

- By Amino Acid Type: The APAC amino acid market is segmented by type into L-Glutamate, L-Lysine, Methionine, Threonine, and Others. Among these, L-Glutamate holds the dominant share in 2023, accounting for 35% of the total market. This is attributed to its extensive application as a flavor enhancer in the food industry, especially in the Chinese and Japanese markets, where umami flavor is integral to culinary preferences. The increasing popularity of processed foods and fast food chains also boosts demand for L-Glutamate.

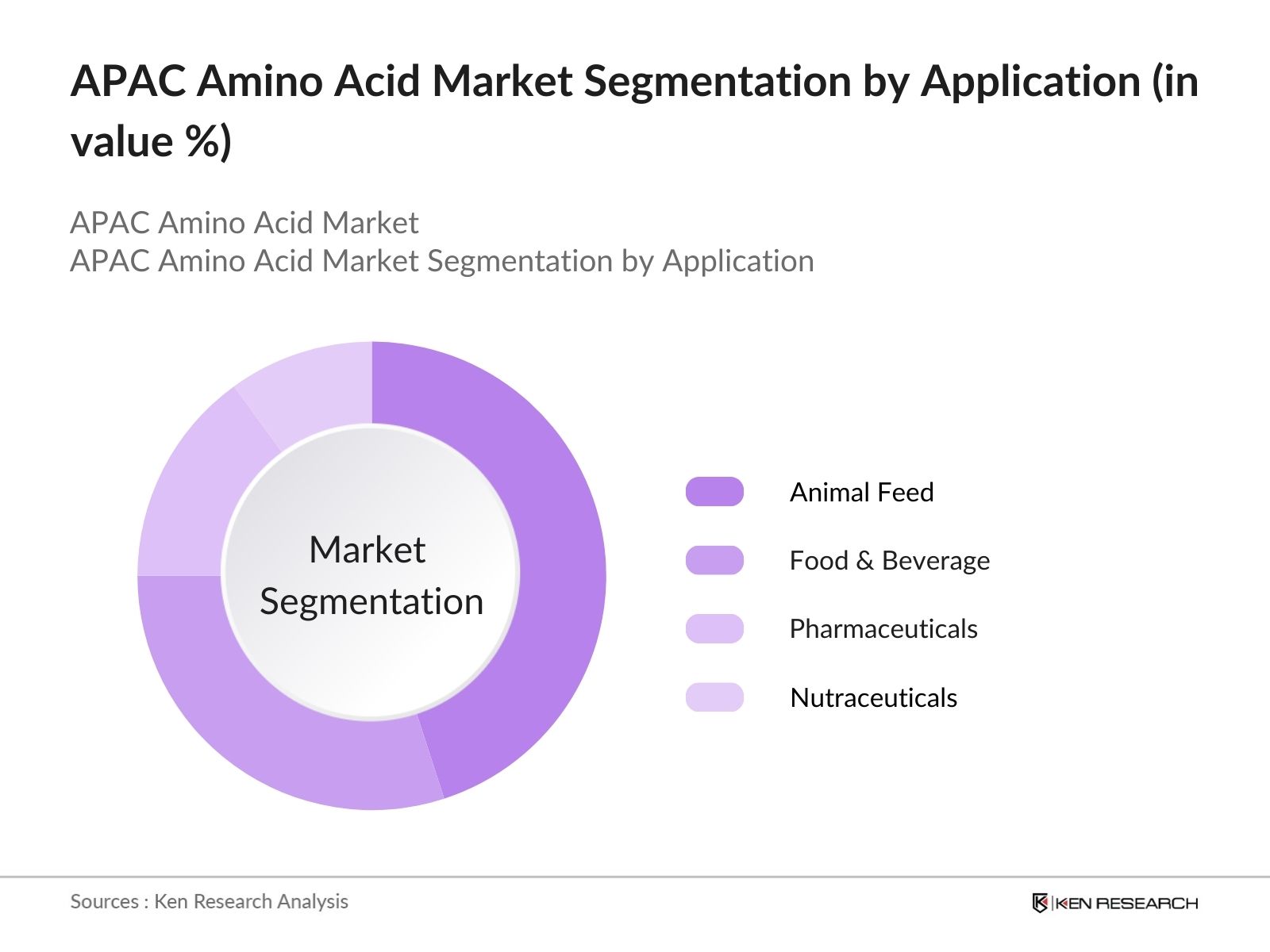

- By Application: The market is further segmented by application into Food & Beverage, Pharmaceuticals, Animal Feed, Cosmetics, and Nutraceuticals. The Animal Feed segment captures the largest market share at 40% in 2023. The dominance of this segment is driven by the rising need for protein-rich feed in the livestock and poultry industries across China, India, and Southeast Asia. Amino acids like L-Lysine and Methionine are essential for improving the protein quality in animal diets, supporting optimal growth and development in livestock, and increasing meat production efficiency.

APAC Amino Acid Market Competitive Landscape

The APAC amino acid market is characterized by the presence of a few dominant players with significant influence over production and innovation. Companies such as Ajinomoto Co., Inc., CJ CheilJedang, and Evonik Industries AG hold strong positions due to their established distribution networks, research and development efforts, and ability to meet growing demand in emerging markets like India and Vietnam. These firms are leveraging their advanced manufacturing technologies and expanding their product portfolios to maintain a competitive edge.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Bn) |

Product Portfolio |

R&D Investment (USD Mn) |

Global Presence |

Sustainability Initiatives |

|

Ajinomoto Co., Inc. |

1909 |

Tokyo, Japan |

||||||

|

CJ CheilJedang |

1953 |

Seoul, South Korea |

||||||

|

Evonik Industries AG |

2007 |

Essen, Germany |

||||||

|

Fufeng Group |

1999 |

Shandong, China |

||||||

|

Meihua Holdings Group |

2002 |

Langfang, China |

APAC Amino Acid Industry Analysis

Market Growth Drivers

- Increasing Health Awareness: In 2024, the growing focus on healthy lifestyles across APAC has driven increased consumption of amino acids due to their benefits in muscle recovery, immune support, and metabolic regulation. In Japan alone, 35% of the population actively purchases health supplements, reflecting heightened health consciousness, according to national statistics. Moreover, Chinas urbanization rate of over 65% fuels demand for health and wellness products, particularly among younger, health-conscious consumers. These trends highlight a shift towards preventive healthcare, supporting amino acid consumption growth across the region.

- Expanding Food & Beverage Industry: In 2024, APACs food and beverage sector has seen robust growth, driven by increased consumer spending on protein-rich products. For instance, Indias food service industry has grown steadily, with food consumption reaching 450 million metric tons in 2023, significantly boosting the demand for amino acids used as flavor enhancers and nutritional additives. The shift toward functional foods, fortified with amino acids, further aligns with the evolving dietary patterns across key APAC markets such as China and Southeast Asia.

- Growing Demand for Animal Feed Supplements: APACs livestock production is on the rise, with animal feed consumption expected to remain high in 2024. In China, the worlds largest producer of pork and poultry, feed production reached 230 million metric tons in 2023, driving demand for lysine and methionineessential amino acids for animal growth. India and Vietnam have also seen significant increases in livestock feed demand, driven by rising meat consumption. The sectors growth continues to be supported by regional agricultural policies aimed at enhancing productivity.

Market Restraints

- Fluctuating Raw Material Prices: Amino acid production heavily depends on feedstock like corn and soybeans, the prices of which are subject to volatility. For instance, due to adverse weather conditions and supply chain disruptions, the global price of corn rose to $275 per metric ton in 2023, according to government sources, impacting the cost structure of amino acid production. This volatility, compounded by transportation bottlenecks, particularly affects producers across Southeast Asia, where feedstock imports constitute a significant cost factor.

- Regulatory Restrictions on Synthetic Amino Acids: Stringent regulations on the use of synthetic amino acids have posed challenges for market players. In 2023, several countries in the APAC region, including Japan and South Korea, introduced tighter controls on synthetic amino acids in food products due to safety concerns. These regulations have increased compliance costs for manufacturers, particularly impacting small and medium-sized enterprises (SMEs) involved in production. Moreover, Indias ban on specific synthetic compounds in animal feed has forced suppliers to reformulate their products to meet local guidelines.

APAC Amino Acid Market Future Outlook

The APAC amino acid market is set to witness substantial growth over the next five years, driven by increasing health consciousness, rising demand for plant-based proteins, and innovations in biotechnology. The food & beverage and animal feed industries are expected to continue dominating the demand for amino acids, particularly in the expanding markets of Southeast Asia and India. Moreover, technological advancements in amino acid production, such as precision fermentation, are anticipated to enhance product quality and reduce costs, further propelling market growth.

Market Opportunities

- Rising Demand for Plant-Based Amino Acids: As the trend toward plant-based diets grows, especially in countries like Australia and India, there has been increased demand for plant-derived amino acids. In 2024, Australia reported that 10% of its population identifies as vegetarian, driving demand for amino acid supplements derived from soy, peas, and other plant sources. In response, manufacturers have shifted their focus to plant-based amino acid production, especially to cater to the growing vegan and vegetarian population across the APAC region.

- Growth in Sports Nutrition Market: The sports nutrition market across APAC has seen robust growth, with a surge in demand for amino acids such as BCAAs (Branched-Chain Amino Acids) and glutamine, key components of sports supplements. In 2023, Japan reported a 15% increase in sports supplement sales due to rising fitness awareness. Similarly, India has witnessed an increasing number of gym memberships, with over 10 million active members in 2023, further driving demand for amino acids that enhance athletic performance and recovery.

Scope of the Report

|

By Amino Acid Type |

L-Glutamate, L-Lysine, Methionine, Threonine, Others |

|

By Application |

Food & Beverage, Pharmaceuticals, Animal Feed, Cosmetics, Nutraceuticals |

|

By Source |

Plant-based Amino Acids, Animal-based Amino Acids, Synthetic Amino Acids |

|

By End-Use |

Food Processing Companies, Pharmaceutical Manufacturers, Nutraceuticals Companies, Animal Feed Producers |

|

By Distribution Channel |

Direct Sales, Distribu |

Products

Key Target Audience

Food & Beverage Manufacturers

Pharmaceutical Companies

Animal Feed Producers

Nutraceutical Companies

Cosmetics Manufacturers

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., China Food and Drug Administration, Indias Food Safety and Standards Authority)

R&D Institutes specializing in Biotechnology

Companies

Players Mentioned in the Report:

Ajinomoto Co., Inc.

CJ CheilJedang

Evonik Industries AG

Fufeng Group

Meihua Holdings Group

Daesang Corporation

Royal DSM N.V.

Novus International, Inc.

Kyowa Hakko Bio Co., Ltd.

Global Bio-Chem Technology Group Company Limited

Sumitomo Chemical

Merck KGaA

Yokkaichi Chemical

Prinova Group

ADM (Archer Daniels Midland)

Table of Contents

1. APAC Amino Acid Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (By Amino Acid Type, By Application, By Source, By End-Use, By Distribution Channel)

1.3. Market Growth Rate (Annual Growth Rate, CAGR, Growth Comparison by Region)

1.4. Market Segmentation Overview

2. APAC Amino Acid Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. APAC Amino Acid Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Health Awareness

3.1.2. Expanding Food & Beverage Industry

3.1.3. Growing Demand for Animal Feed Supplements

3.1.4. Technological Advancements in Fermentation & Synthesis

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices

3.2.2. Regulatory Restrictions on Synthetic Amino Acids

3.2.3. Stringent Environmental Regulations

3.3. Opportunities

3.3.1. Rising Demand for Plant-Based Amino Acids

3.3.2. Growth in Sports Nutrition Market

3.3.3. Expansion into Emerging Economies

3.4. Trends

3.4.1. Increased Use of Amino Acids in Nutraceuticals

3.4.2. Adoption of Precision Nutrition in Animal Feed

3.4.3. Innovations in Amino Acid Blends and Supplements

3.5. Government Regulation

3.5.1. Labeling and Certification Requirements

3.5.2. Regulations on Synthetic and Fermented Amino Acids

3.5.3. Environmental Impact Standards

3.5.4. Government Incentives for Bio-based Amino Acid Production

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. APAC Amino Acid Market Segmentation

4.1. By Amino Acid Type (In Value %)

4.1.1. L-Glutamate

4.1.2. L-Lysine

4.1.3. Methionine

4.1.4. Threonine

4.1.5. Others

4.2. By Application (In Value %)

4.2.1. Food & Beverage

4.2.2. Pharmaceuticals

4.2.3. Animal Feed

4.2.4. Cosmetics

4.2.5. Nutraceuticals

4.3. By Source (In Value %)

4.3.1. Plant-based Amino Acids

4.3.2. Animal-based Amino Acids

4.3.3. Synthetic Amino Acids

4.4. By End-Use (In Value %)

4.4.1. Food Processing Companies

4.4.2. Pharmaceutical Manufacturers

4.4.3. Nutraceuticals Companies

4.4.4. Animal Feed Producers

4.5. By Distribution Channel (In Value %)

4.5.1. Direct Sales

4.5.2. Distributors

4.5.3. E-commerce

4.5.4. Specialty Stores

5. APAC Amino Acid Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Ajinomoto Co., Inc.

5.1.2. CJ CheilJedang

5.1.3. Evonik Industries AG

5.1.4. ADM (Archer Daniels Midland)

5.1.5. Global Bio-Chem Technology Group Company Limited

5.1.6. Daesang Corporation

5.1.7. Fufeng Group

5.1.8. Meihua Holdings Group Co., Ltd.

5.1.9. Novus International, Inc.

5.1.10. Royal DSM N.V.

5.1.11. Sumitomo Chemical

5.1.12. Merck KGaA

5.1.13. Kyowa Hakko Bio Co., Ltd.

5.1.14. Yokkaichi Chemical

5.1.15. Prinova Group

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, R&D Spend, Key Products, Sustainability Initiatives, Regional Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. APAC Amino Acid Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. APAC Amino Acid Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. APAC Amino Acid Future Market Segmentation

8.1. By Amino Acid Type (In Value %)

8.2. By Application (In Value %)

8.3. By Source (In Value %)

8.4. By End-Use (In Value %)

8.5. By Distribution Channel (In Value %)

9. APAC Amino Acid Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we constructed a market ecosystem map, identifying all major stakeholders within the APAC Amino Acid Market. This involved comprehensive desk research, utilizing both secondary databases and proprietary data to understand market dynamics, product types, and applications.

Step 2: Market Analysis and Construction

This phase involved analyzing historical market data, such as sales volumes, production capacities, and revenue growth, specific to the APAC region. Key variables like amino acid demand in various applications (e.g., animal feed, pharmaceuticals) were critically evaluated to assess their influence on market growth.

Step 3: Hypothesis Validation and Expert Consultation

We developed hypotheses regarding market trends, growth drivers, and challenges. These were validated through in-depth interviews with industry experts, leveraging computer-assisted telephone interviews (CATIs) to gain operational and financial insights from key market players.

Step 4: Research Synthesis and Final Output

This phase included synthesizing the research findings into a final output. Industry-specific insights from amino acid producers and market leaders were used to validate our bottom-up market analysis, ensuring the accuracy and reliability of the forecasted data.

Frequently Asked Questions

01. How big is the APAC Amino Acid Market?

The APAC amino acid market is valued at USD 12.5 billion, driven by growing demand in the food, animal feed, and nutraceutical sectors, particularly in China, Japan, and Southeast Asia.

02. What are the challenges in the APAC Amino Acid Market?

Challenges include fluctuating raw material costs, regulatory restrictions on synthetic amino acids, and environmental concerns related to amino acid production processes.

03. Who are the major players in the APAC Amino Acid Market?

Key players include Ajinomoto Co., Inc., CJ CheilJedang, Evonik Industries AG, Fufeng Group, and Meihua Holdings Group. These companies dominate due to their strong production capacities and extensive distribution networks.

04. What are the growth drivers of the APAC Amino Acid Market?

The market is driven by the expanding food and beverage sector, growing use of amino acids in animal feed, and increasing health consciousness among consumers, particularly in China and Japan.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.