APAC Automotive Parts and Components Market Outlook to 2030

Region:Asia

Author(s):Shubham

Product Code:KROD6035

November 2024

90

About the Report

APAC Automotive Parts and Components Market Overview

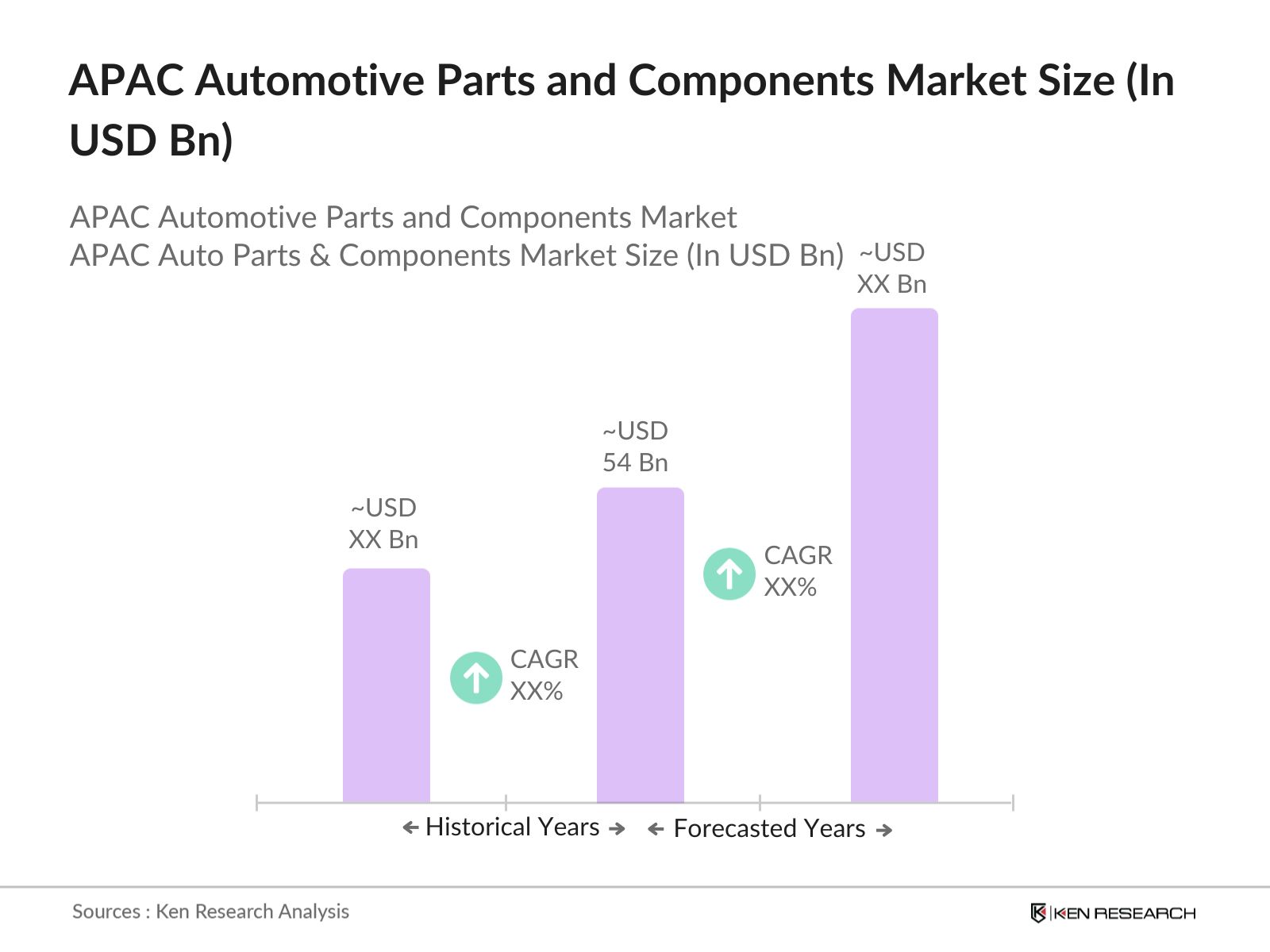

- The APAC Automotive Parts and Components market has been experiencing robust growth, reaching a market valuation of USD 54 billion, driven by the increasing demand for automotive components across passenger, commercial, and electric vehicles. This demand is largely fueled by the booming automotive manufacturing sector in the APAC region, with leading economies such as China, Japan, and South Korea contributing significantly. The market is also propelled by technological advancements in components, including engine parts, electric components, and hybrid solutions, meeting diverse applications across various vehicle types.

- China, Japan, and South Korea are major players in the APAC Automotive Parts and Components market. Chinas massive automotive production capacity and strong domestic demand position it as a dominant force, while Japan excels in precision engineering and technological innovation, particularly in advanced components. South Korea, supported by established brands and extensive manufacturing infrastructure, focuses on high-quality component production, further strengthening the regions competitive edge in the global market.

- Supportive government policies and infrastructure investments across the APAC region encourage the production and adoption of advanced automotive components. China has emphasized technological upgrades in automotive manufacturing as part of its 2025 industrial policy. Similarly, Japans initiatives on eco-friendly vehicle components align with its carbon reduction goals, driving demand for electric and hybrid vehicle parts.

APAC Automotive Parts and Components Market Segmentation

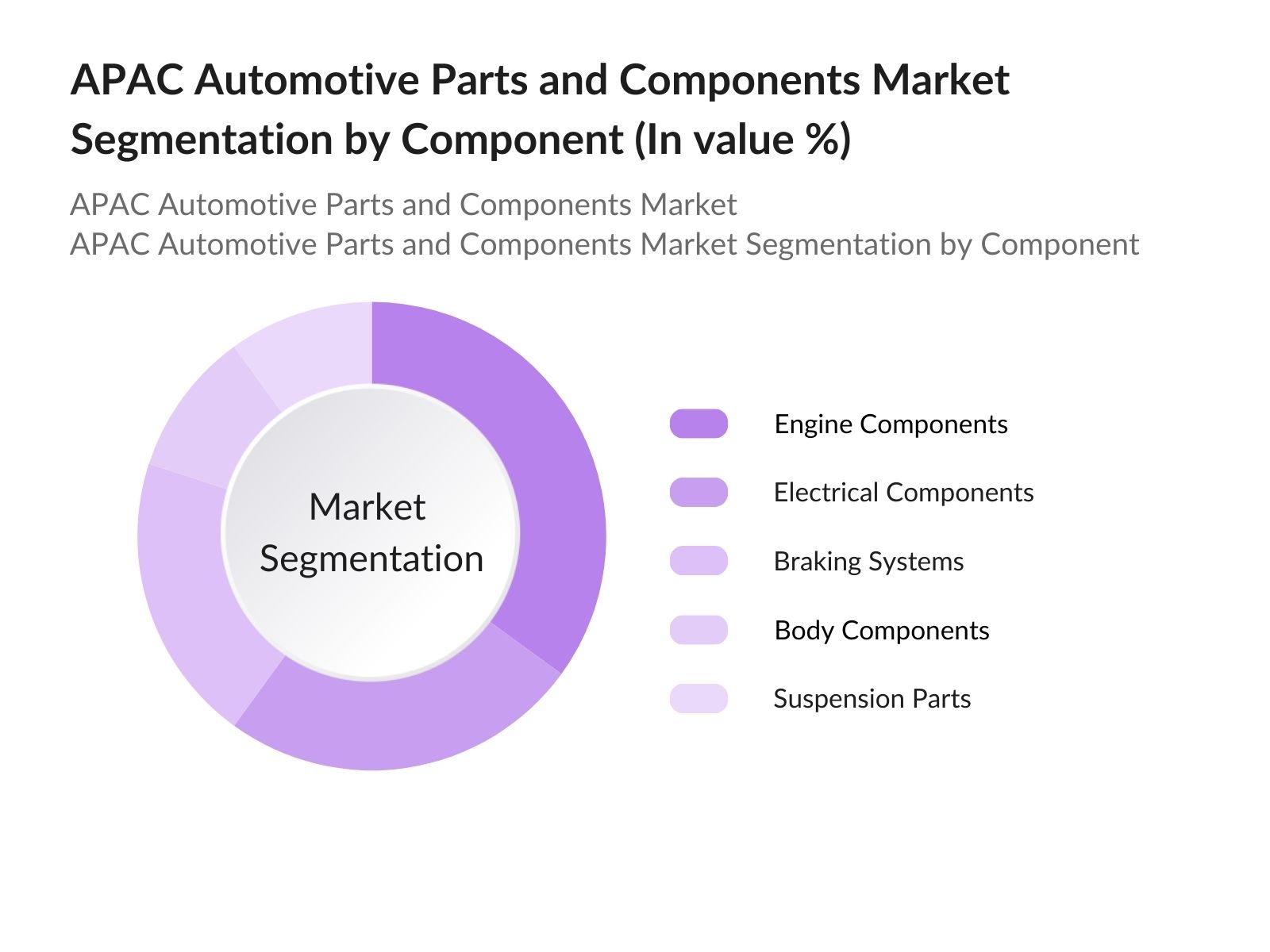

- By Component Type: The market is segmented by component type into engine components, electrical components, braking systems, body components, and suspension parts. Recently, engine components have secured a dominant market share within the component type segmentation, attributed to their critical role in both traditional and electric vehicles. These components are essential for vehicle performance, emissions control, and durability, making them indispensable in the automotive sector. Japan and South Korea have heavily invested in R&D for engine efficiency, supporting this segment's growth and reinforcing its dominance in the market.

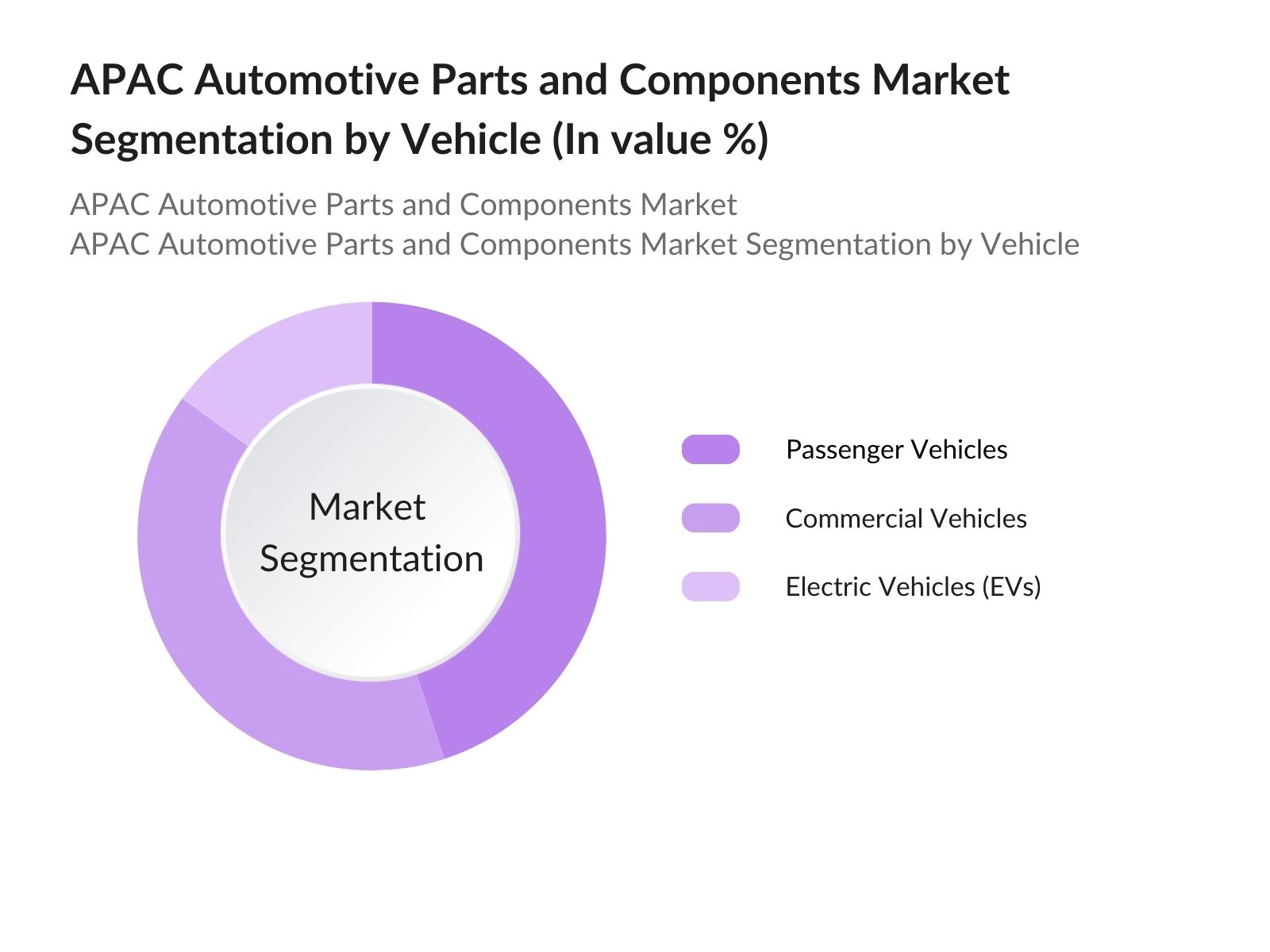

- By Vehicle Type: The market is further segmented by vehicle type into passenger vehicles, commercial vehicles, and electric vehicles. Electric vehicles (EVs) are leading within this segment, driven by the APAC regions strong focus on sustainable transportation and emission reduction. Governments in countries like China and Japan are providing incentives for EV adoption, and this growing demand drives the need for specialized EV components such as battery systems, electric motors, and inverters, making EVs a prominent segment in the market.

APAC Automotive Parts and Components Market Competitive Landscape

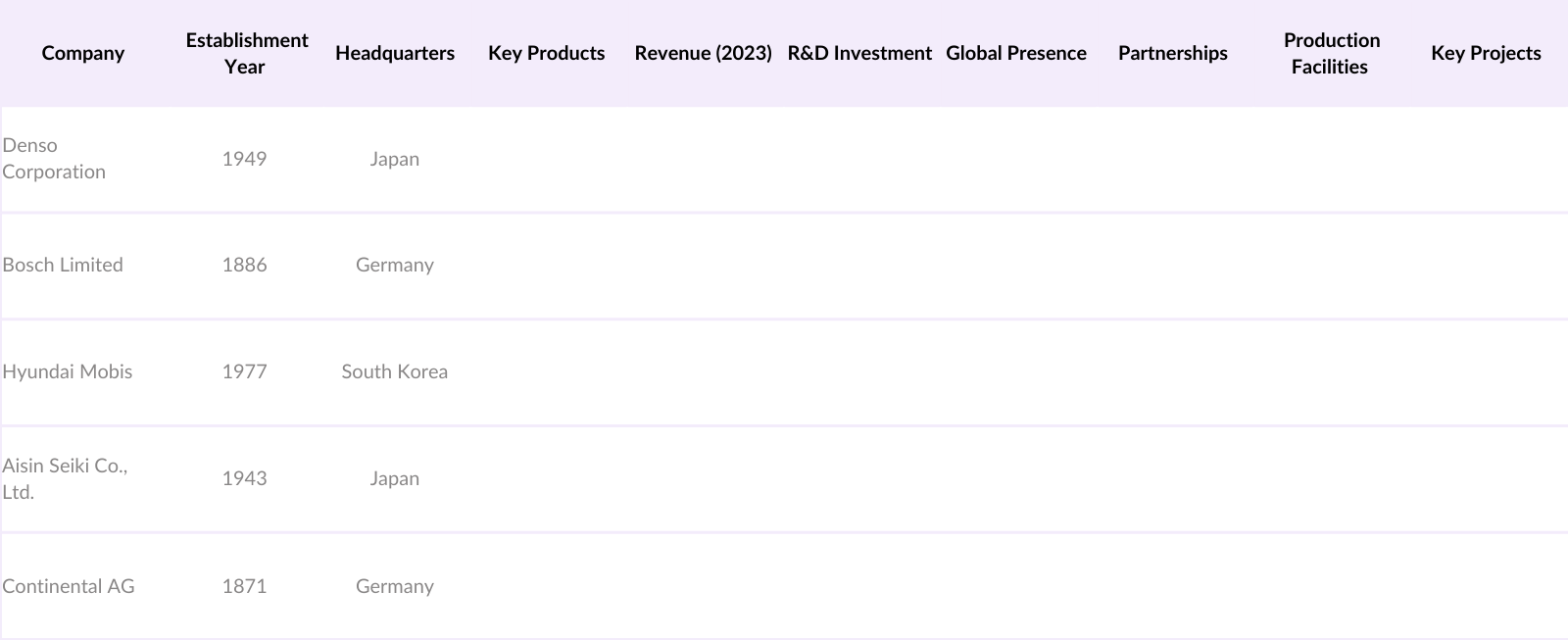

The APAC Automotive Parts and Components market is competitive, dominated by key international and regional players focusing on innovations in fuel efficiency, safety, and electric vehicle components. Leading companies such as Denso Corporation, Bosch Limited, Hyundai Mobis, and Aisin Seiki Co., Ltd. hold substantial market shares, supported by their extensive R&D investments and established partnerships with global and local manufacturers. This competition emphasizes the innovation-driven approach taken by key players to meet rising demands in both conventional and electric vehicle markets.

APAC Automotive Parts and Components Market Industry Analysis

Growth Drivers

- Economic and Industrial Expansion in Key APAC Countries: The APAC region is experiencing significant economic growth, with countries like China, Japan, and India leading in automotive industrial expansion. Japans GDP rose to USD 5.2 trillion in 2023, supporting substantial industrial activities, including automotive parts production, as noted by the World Bank. China, a crucial automotive hub, reported a manufacturing output increase of over 2 billion units of auto components in 2023, according to China's Ministry of Industry and Information Technology. Additionally, Indias export of auto components increased to USD 21 billion in 2024, highlighting the regions economic dynamism as a growth driver.

- Advancements in Automotive Technologies: Technological advancements in the automotive industry, such as the integration of AI for predictive maintenance and electric vehicle (EV) component innovation, are driving the APAC automotive parts market. In 2023, Japans investment in R&D for automotive technologies reached billions, as reported by Japans Ministry of Economy, Trade, and Industry. This includes advancements in battery technology and AI applications in vehicle assembly, which have spurred demand for specialized automotive parts. Chinas government aims to increase its EV component production capacity by an additional 36 million units annually by 2025, supporting this technological growth.

- Rising Investments in Auto Component Manufacturing: Rising investments in auto component manufacturing across APAC nations are fueling the industrys expansion. In 2023, South Korea allocated substantial amount for automotive parts manufacturing, with a focus on lightweight materials and energy-efficient technologies. The Indian governments Production-Linked Incentive (PLI) scheme in 2024 facilitated USD 8.2 billion in investment into the auto components sector, encouraging the establishment of advanced manufacturing facilities. These substantial investments are bolstering APACs position as a key player in the global automotive parts industry.

Market Challenges

- Logistics and Distribution Complexities: The APAC automotive parts market faces logistical challenges due to the need for efficient transportation solutions amid complex international trade routes. Disruptions in logistics have caused delays in auto parts shipments across major APAC trade routes. Countries like China and India experience challenges in maintaining timely distribution, which results in potential revenue losses for automotive parts manufacturers. Efficient logistics and distribution systems remain critical to sustaining market competitiveness, as the industry navigates both demand pressures and infrastructural complexities.

- High Cost of Compliance with Environmental Regulations: The APAC region enforces stringent environmental regulations, which increase compliance costs for automotive parts manufacturers. Japan, for example, has implemented laws that mandate companies to significantly reduce emissions. Compliance expenditures within the auto parts sector are substantial, and failure to meet these standards can result in penalties. In India, recent emission standards have imposed stricter guidelines, creating financial challenges for manufacturers working to meet both national and international environmental regulations.

APAC Automotive Parts and Components Market Future Outlook

The APAC Automotive Parts and Components market is expected to experience considerable growth over the next five years, fueled by increasing demand for EVs, government policies supporting the automotive sector, and continuous advancements in automotive technologies. As major APAC countries prioritize sustainable transportation solutions and low-emission vehicles, the market will likely see a rise in demand for high-efficiency components.

Future Market Opportunities

- Growth of EV Components Market: The EV components market in APAC is expanding, driven by increased EV adoption. China, the worlds largest EV market, produced 9 million EVs in 2023, necessitating a robust supply chain for components like batteries and sensors. South Korea aims to boost EV component production capacity by 1 million units per year to support its domestic and export needs, as per the Ministry of Trade, Industry, and Energy. This growth opens substantial opportunities for local parts manufacturers in APAC.

- Rising Demand for Aftermarket Products: The demand for automotive aftermarket products, such as replacement parts, accessories, and upgrades, is rising in APAC. In 2023, Japans aftermarket auto parts industry generated an estimated USD 45 billion in revenue, a figure that reflects high consumer demand for vehicle enhancements. Indias Ministry of Heavy Industries indicates that aftermarket product sales increased remarkably in 2023, further solidifying opportunities for parts manufacturers across APAC.

Scope of the Report

|

By Component Type |

Engine Components Electrical Components Suspension and Braking Components Body Components Interior Components |

|

By Vehicle Type |

Passenger Vehicles Commercial Vehicles Electric Vehicles |

|

By Distribution Channel |

OEMs Aftermarket |

|

By Technology Type |

Conventional Technology Advanced Electronics Hybrid/Electric Vehicle Components |

|

By Region |

China Japan India South Korea Rest of the APAC |

Products

Key Target Audience

Automotive Manufacturers and OEMs

Suppliers and Component Manufacturers

Government and Regulatory Bodies (e.g., Japan Automotive Standards Internationalization Center)

Investors and Venture Capitalist Firms

Banks and Financial Institutions

R&D Institutions in the Automotive Industry

EV and Hybrid Vehicle Manufacturers

Transportation and Logistics Companies

Companies

Players Mentioned in the Report

Denso Corporation

Bosch Limited

Hyundai Mobis

Aisin Seiki Co., Ltd.

Continental AG

Magna International Inc.

Yazaki Corporation

Faurecia SA

Valeo SA

Toyota Boshoku Corporation

ZF Friedrichshafen AG

Panasonic Automotive Systems

Sumitomo Electric Industries, Ltd.

Mitsubishi Electric Corporation

Lear Corporation

Table of Contents

1. APAC Automotive Parts and Components Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Industry Ecosystem and Stakeholders

1.4. Market Segmentation Overview

2. APAC Automotive Parts and Components Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. APAC Automotive Parts and Components Market Analysis

3.1. Growth Drivers [Economic Growth, Industrialization, Technological Advancements]

3.1.1. Economic and Industrial Expansion in Key APAC Countries

3.1.2. Advancements in Automotive Technologies

3.1.3. Rising Investments in Auto Component Manufacturing

3.1.4. Growth in Vehicle Production and Sales

3.2. Market Challenges [Supply Chain Vulnerabilities, Regulatory Compliance, Volatile Raw Material Prices]

3.2.1. Logistics and Distribution Complexities

3.2.2. High Cost of Compliance with Environmental Regulations

3.2.3. Dependency on Key Raw Materials

3.3. Opportunities [Electrification, Aftermarket Expansion, Digitalization in Manufacturing]

3.3.1. Growth of EV Components Market

3.3.2. Rising Demand for Aftermarket Products

3.3.3. Adoption of Advanced Digital Manufacturing Processes

3.4. Trends [Automation, Lightweight Materials, Focus on Sustainability]

3.4.1. Increased Adoption of Robotics in Manufacturing

3.4.2. Shift Towards Lightweight Composite Materials

3.4.3. Growing Focus on Eco-Friendly Components and Processes

3.5. Government Regulations [Emission Norms, Safety Standards, Localization Policies]

3.5.1. Adoption of Stringent Emission Standards

3.5.2. Implementation of Vehicle Safety Protocols

3.5.3. Localization and Manufacturing Incentives

3.6. SWOT Analysis

3.7. Porters Five Forces [Supplier Power, Buyer Power, Competitive Rivalry, Threat of Substitution, Threat of New Entrants]

3.8. Industry Ecosystem Analysis

3.9. Competition Ecosystem

4. APAC Automotive Parts and Components Market Segmentation

4.1. By Component Type (In Value %)

4.1.1. Engine Components

4.1.2. Electrical Components

4.1.3. Suspension and Braking Components

4.1.4. Body Components

4.1.5. Interior Components

4.2. By Vehicle Type (In Value %)

4.2.1. Passenger Vehicles

4.2.2. Commercial Vehicles

4.2.3. Electric Vehicles

4.3. By Distribution Channel (In Value %)

4.3.1. OEMs

4.3.2. Aftermarket

4.4. By Technology Type (In Value %)

4.4.1. Conventional Technology

4.4.2. Advanced Electronics

4.4.3. Hybrid/Electric Vehicle Components

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. South Korea

4.5.5. ASEAN Countries

5. APAC Automotive Parts and Components Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Denso Corporation

5.1.2. Bosch Limited

5.1.3. Hyundai Mobis

5.1.4. Aisin Seiki Co., Ltd.

5.1.5. Continental AG

5.1.6. Magna International Inc.

5.1.7. Yazaki Corporation

5.1.8. Faurecia SA

5.1.9. Valeo SA

5.1.10. Toyota Boshoku Corporation

5.1.11. ZF Friedrichshafen AG

5.1.12. Panasonic Automotive Systems

5.1.13. Sumitomo Electric Industries, Ltd.

5.1.14. Mitsubishi Electric Corporation

5.1.15. Lear Corporation

5.2. Cross Comparison Parameters [Revenue, Market Share, Product Portfolio, Innovation Index, Manufacturing Facilities, Regional Presence, Strategic Partnerships, Workforce Size]

5.3. Market Share Analysis

5.4. Strategic Initiatives and Partnerships

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Research and Development Focus

5.8. Product Launches and Innovations

6. APAC Automotive Parts and Components Market Regulatory Framework

6.1. Emission Control Standards

6.2. Automotive Safety Regulations

6.3. Import and Export Regulations

6.4. Industry Certification Standards

7. APAC Automotive Parts and Components Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Influencing Future Growth

8. APAC Automotive Parts and Components Future Market Segmentation

8.1. By Component Type (In Value %)

8.2. By Vehicle Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Technology Type (In Value %)

8.5. By Region (In Value %)

9. APAC Automotive Parts and Components Market Analysts Recommendations

9.1. Market Expansion Strategies

9.2. Risk Mitigation Strategies

9.3. White Space Opportunities

9.4. Regional Investment Prospects

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research process initiates with identifying critical factors impacting the APAC Automotive Parts and Components market. Comprehensive desk research is conducted using industry databases and proprietary sources, mapping stakeholder influence on market trends.

Step 2: Market Analysis and Construction

Historical data on market performance, production volume, and component adoption is analyzed to assess growth trends. This data-driven analysis aids in segmenting the market by component type and vehicle category.

Step 3: Hypothesis Validation and Expert Consultation

Through expert interviews and consultations, market assumptions are validated. These insights from industry experts provide further clarity on market trends, opportunities, and challenges.

Step 4: Research Synthesis and Final Output

The final phase consolidates data from various sources, offering a comprehensive overview of the market. A synthesis of findings ensures a validated analysis, grounded in robust methodology.

Frequently Asked Questions

How big is the APAC Automotive Parts and Components Market?

The APAC Automotive Parts and Components market was valued at USD 54 billion, with growth driven by demand for automotive and EV components across the region.

What are the primary growth drivers in the APAC Automotive Parts and Components Market?

Key growth drivers in the APAC Automotive Parts and Components market include increasing EV demand, government incentives, and technological advancements in automotive components.

Who are the major players in the APAC Automotive Parts and Components Market?

Major companies in the APAC Automotive Parts and Components market include Denso Corporation, Bosch Limited, Hyundai Mobis, Aisin Seiki Co., Ltd., and Continental AG, known for their R&D and partnerships with OEMs.

What challenges does the APAC Automotive Parts and Components Market face?

Challenges in the APAC Automotive Parts and Components market include high production costs for advanced components and supply chain constraints impacting raw material availability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.