APAC Bedroom Market Outlook to 2030

Region:Asia

Author(s):Mukul

Product Code:KROD8278

October 2024

87

About the Report

APAC Bedroom Market Overview

- The APAC bedroom furniture market is valued at USD 26.50 billion, with growth largely driven by rapid urbanization, rising disposable incomes, and increased demand for modern, modular furniture. According to data from Statista and industry reports, consumers in the region are increasingly investing in high-quality bedroom furniture as homeownership rates rise. Moreover, the strong presence of e-commerce platforms has simplified the purchasing process, further driving demand for bedroom furniture across APAC countries.

- China and India are the dominant players in the APAC bedroom furniture market, primarily due to their large populations and rising middle-class consumers. Chinas dominance is attributed to its extensive manufacturing capabilities, making it a major exporter of furniture globally. Meanwhile, India is seeing a surge in demand for bedroom furniture due to an expanding urban middle class, increasing disposable incomes, and government initiatives supporting the housing sector. Other countries such as Japan and Australia also contribute significantly due to high demand for premium and modern bedroom furniture.

- Governments across APAC are tightening environmental regulations on the furniture industry to reduce deforestation and carbon emissions. For example, the Chinese government introduced stricter emission standards in 2023, requiring all furniture manufacturers to adopt low-emission production processes. This regulation is impacting the manufacturing processes and increasing compliance costs for bedroom furniture producers.

APAC Bedroom Market Segmentation

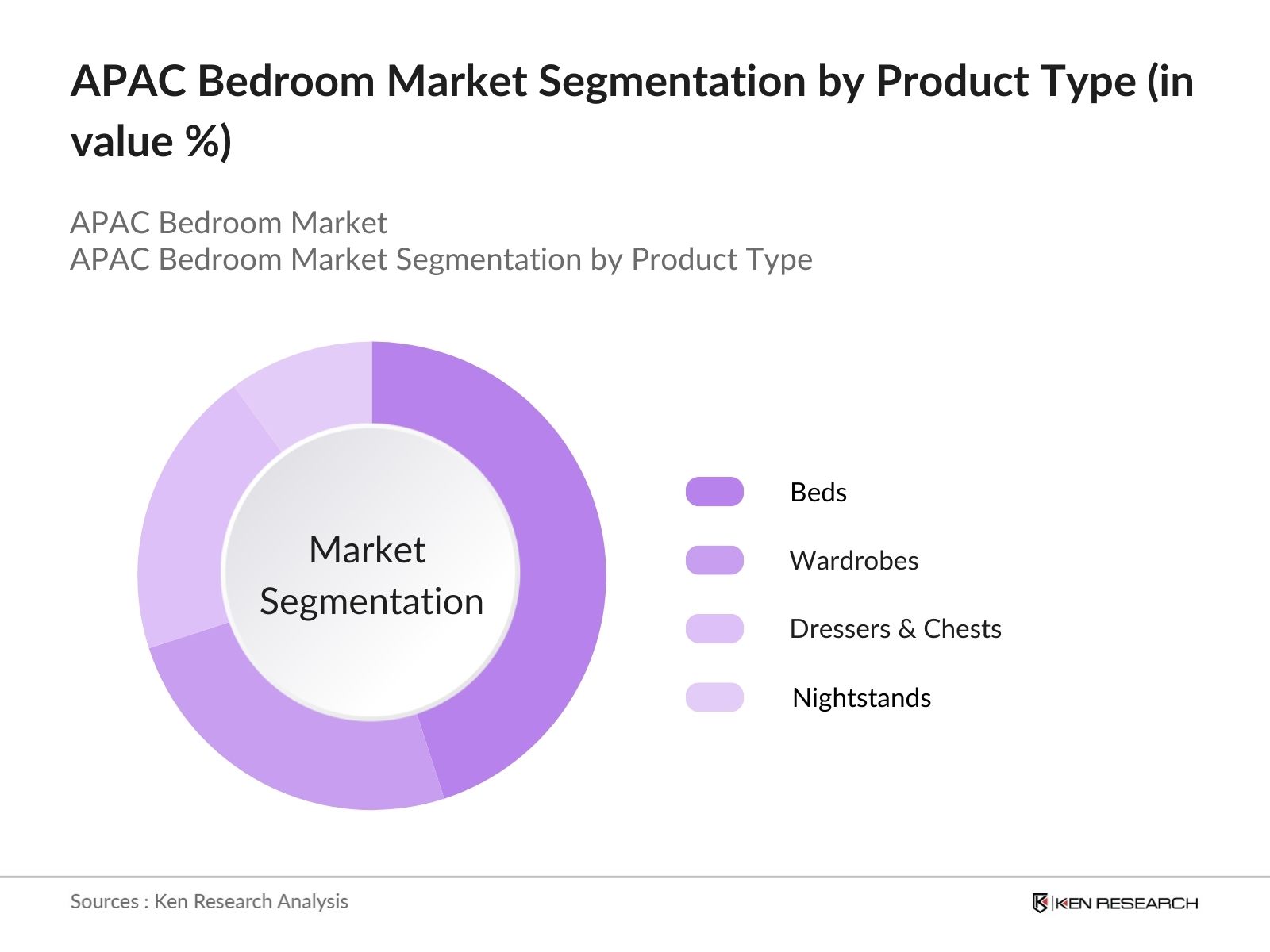

- By Product Type: The APAC bedroom furniture market is segmented by product type into beds, wardrobes, dressers & chests, and nightstands. Recently, beds hold a dominant market share in the APAC region under the product type segmentation, driven by the increasing demand for multi-functional and space-saving bed designs. Beds with integrated storage or convertible features are particularly popular among urban populations with limited space, making them an essential purchase for most households.

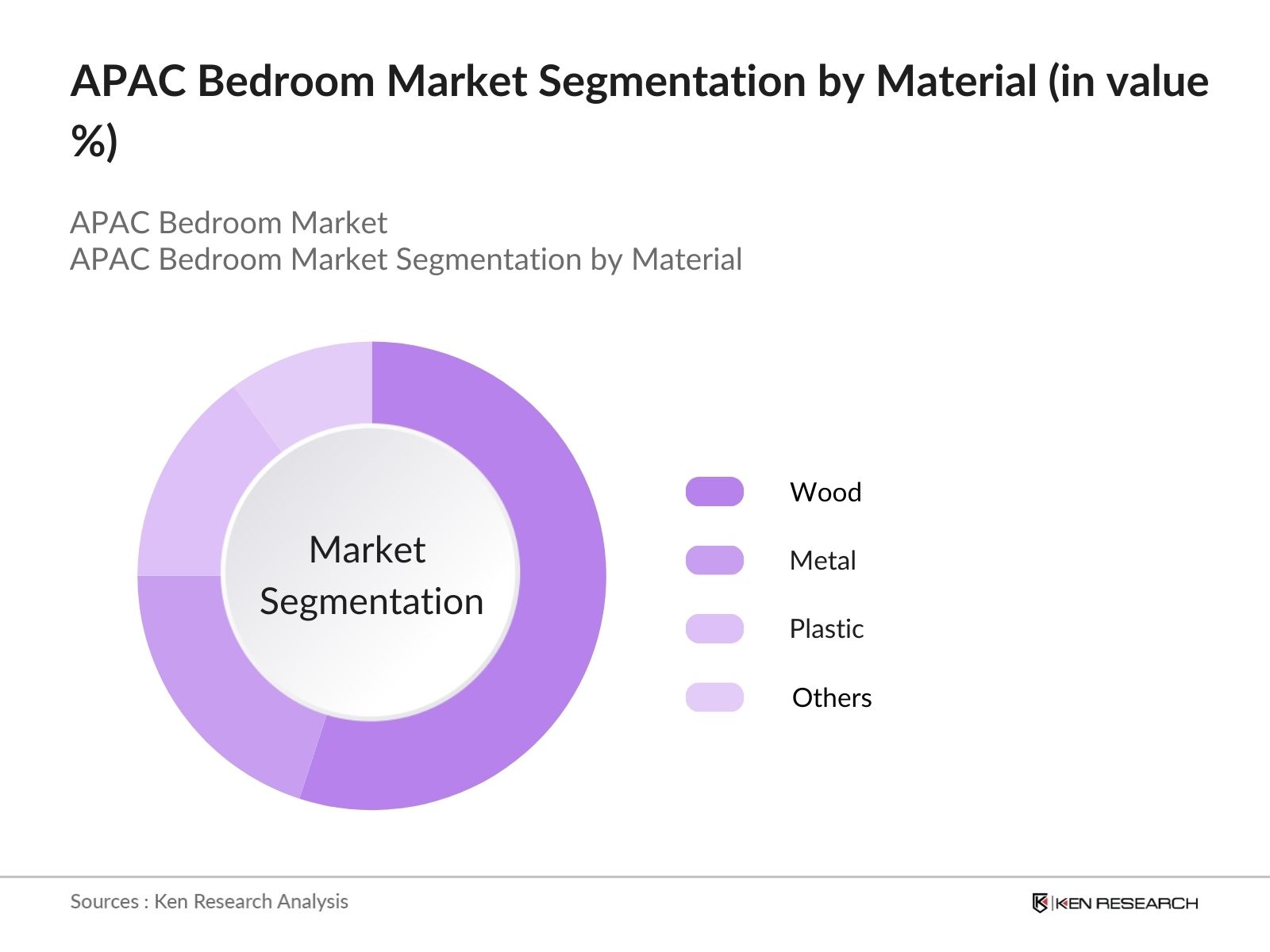

- By Material: The APAC bedroom furniture market is segmented by material into wood, metal, plastic, and others. Wooden furniture has a dominant market share within this segmentation due to the regions longstanding preference for wood-based furniture, which is valued for its durability and aesthetic appeal. Wooden furniture continues to be in high demand, particularly in countries like China, India, and Japan, where traditional wood designs are integrated with modern elements.

APAC Bedroom Market Competitive Landscape

The APAC bedroom furniture market is dominated by a mix of local and international players, reflecting the regions diverse consumer preferences and manufacturing capabilities. Key players focus on providing innovative, space-efficient designs and cater to both luxury and affordable segments. Brands like IKEA, which lead in modular and ready-to-assemble furniture, have expanded significantly in Asia, capitalizing on the growing demand for convenience and affordability.

|

Company Name |

Establishment Year |

Headquarters |

Key Products |

Market Strategy |

Revenue (2023) |

Number of Stores |

Sustainability Initiatives |

Global Reach |

|

IKEA Group |

1943 |

Netherlands |

||||||

|

Ashley Furniture |

1945 |

USA |

||||||

|

Godrej Interio |

1897 |

India |

||||||

|

Stanley Furniture |

1924 |

USA |

||||||

|

HNI Corporation |

1944 |

USA |

APAC Bedroom Industry Analysis

Growth Drivers

- Urbanization: Urbanization in APAC is rapidly increasing, with the United Nations noting that more than 2.3 billion people live in urban areas as of 2024, leading to a rise in demand for bedroom furniture. The movement of people to urban centers drives housing development, increasing the need for modern bedroom furniture. Countries like China and India are witnessing accelerated urbanization rates, with over 62% of Chinas population now residing in cities. Urban households' demand for bedroom furniture aligns with the growing housing market.

- Disposable Income: The World Bank data shows that the Gross National Income (GNI) per capita in countries like China and Indonesia has steadily increased, reaching $12,550 and $4,580 in 2024, respectively. As disposable incomes rise across APAC, consumer spending on durable goods, including bedroom furniture, is growing. This trend is especially notable in China, Indonesia, and Vietnam, where rising middle-class wealth is shifting consumer preferences towards high-quality, durable bedroom furniture.

- Changing Lifestyle: The shift towards nuclear family units, especially in countries like Japan and South Korea, has significantly impacted furniture preferences. With 75% of families in these countries living in smaller spaces, consumers are prioritizing compact and modular bedroom furniture to optimize space. This trend reflects the changing lifestyle driven by urbanization and demographic changes in the region, creating demand for multifunctional, compact bedroom sets

Market Restraints

- Raw Material Shortages: Several countries in the APAC region have experienced significant shortages in raw materials such as wood and steel, affecting bedroom furniture production. For instance, Vietnam, a major exporter of wooden furniture, reported a 12% decline in wood imports due to global supply chain disruptions and environmental regulations in 2024. This scarcity has impacted the production cycle and delivery timelines for bedroom furniture manufacturers across the region.

- Fluctuating Transportation Costs: According to the IMF, the average global freight cost rose by 8% in 2023 due to fluctuating fuel prices and logistical bottlenecks, affecting furniture exports from China, Vietnam, and Malaysia. With transportation accounting for up to 30% of the total cost for bedroom furniture exports, manufacturers are increasingly under pressure to absorb these expenses or pass them on to consumers, creating pricing instability.

APAC Bedroom Market Future Outlook

The APAC bedroom furniture market is expected to witness significant growth in the coming years, fueled by urbanization, rising disposable incomes, and an increased focus on interior home design. The growing trend of modular and multifunctional furniture, driven by shrinking living spaces, will continue to propel market demand. Additionally, the growing adoption of sustainable furniture materials and eco-friendly designs will influence purchasing decisions. Countries like China and India will remain dominant players, while Southeast Asian markets such as Vietnam and Indonesia are expected to emerge as key growth areas due to their booming real estate sectors and young populations.

Market Opportunities

- Rising Demand for Modular Furniture: As urban living spaces shrink, the demand for modular bedroom furniture has surged across APAC. In Japan and South Korea, where the average home size is under 75 square meters, consumers are increasingly opting for space-saving modular bedroom sets. This trend has resulted in higher sales for domestic manufacturers, who are catering to space-constrained urban consumers by offering flexible, customizable furniture solutions.

- Sustainability Trends: Environmental awareness is shaping consumer choices, leading to increased demand for eco-friendly bedroom furniture. In 2024, 30% of furniture consumers in Australia and New Zealand indicated a preference for sustainably sourced wood and recyclable materials. This shift towards sustainability has encouraged APAC manufacturers to adopt green practices, such as using FSC-certified wood and reducing carbon footprints in production.

Scope of the Report

|

By Product Type |

Beds Wardrobes Dressers & Chests Nightstands |

|

By Material |

Wood Metal Plastic Others |

|

By Distribution |

Offline Stores Online Stores |

|

By End-User |

Residential Commercial |

|

By Region |

China India Japan Southeast Asia Australia |

Products

Key Target Audience

Bedroom furniture manufacturers

Interior design firms

E-commerce retailers (Amazon, Alibaba)

Investors and venture capitalist firms

Real estate developers

Government and regulatory bodies (Ministry of Commerce, APAC Furniture Export Councils)

Furniture importers and distributors

Architects and design consultants

Companies

Players Mentioned in the Report:

IKEA Group

Ashley Furniture Industries

Godrej Interio

Stanley Furniture

HNI Corporation

Steelcase Inc.

Durham Furniture

Hooker Furniture Corporation

Williams-Sonoma, Inc.

Leggett & Platt, Incorporated

Sauder Woodworking Co.

Restoration Hardware

Kimball International, Inc.

La-Z-Boy Inc.

Inter IKEA Systems B.V.

Table of Contents

1. APAC Bedroom Furniture Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. APAC Bedroom Furniture Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. APAC Bedroom Furniture Market Analysis

3.1. Growth Drivers (Urbanization, Disposable Income, Changing Lifestyle, E-Commerce Adoption)

3.2. Market Challenges (Raw Material Shortages, Fluctuating Transportation Costs, Trade Barriers, Supply Chain Disruptions)

3.3. Opportunities (Rising Demand for Modular Furniture, Sustainability Trends, Growth in Online Retail, Technological Integration)

3.4. Trends (Customizable Furniture, Smart Home Integration, Minimalist Designs, Use of Sustainable Materials)

3.5. Government Regulations (Environmental Compliance, Labor Regulations, Trade Agreements, Import Tariffs)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. APAC Bedroom Furniture Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Beds

4.1.2. Wardrobes

4.1.3. Dressers & Chests of Drawers

4.1.4. Nightstands

4.2. By Material (In Value %)

4.2.1. Wood

4.2.2. Metal

4.2.3. Plastic

4.2.4. Others

4.3. By Distribution Channel (In Value %)

4.3.1. Offline Stores

4.3.2. Online Stores

4.4. By End-User (In Value %)

4.4.1. Residential

4.4.2. Commercial (Hospitality, Corporate, etc.)

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Southeast Asia

4.5.5. Australia

5. APAC Bedroom Furniture Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. IKEA Group

5.1.2. Ashley Furniture Industries

5.1.3. Inter IKEA Systems B.V.

5.1.4. Godrej Interio

5.1.5. Williams-Sonoma, Inc.

5.1.6. Stanley Furniture Company, Inc.

5.1.7. HNI Corporation

5.1.8. Steelcase Inc.

5.1.9. Durham Furniture

5.1.10. Hooker Furniture Corporation

5.1.11. Restoration Hardware

5.1.12. Kimball International, Inc.

5.1.13. Heritage Home Group

5.1.14. Sauder Woodworking Co.

5.1.15. Leggett & Platt, Incorporated

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Revenue, Product Categories, Global Reach)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. APAC Bedroom Furniture Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. APAC Bedroom Furniture Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. APAC Bedroom Furniture Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Material (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. APAC Bedroom Furniture Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This stage involves mapping the APAC bedroom furniture market ecosystem, identifying key stakeholders, and determining influential market variables. In-depth desk research combined with secondary and proprietary databases helps pinpoint crucial market drivers, challenges, and opportunities.

Step 2: Market Analysis and Construction

During this phase, historical market data is analyzed, focusing on product segment penetration, the retail landscape, and revenue generation patterns. Key performance indicators are derived to assess the competitive landscape and future trends.

Step 3: Hypothesis Validation and Expert Consultation

Initial market assumptions are refined through consultations with industry experts using computer-assisted telephone interviews (CATI). Insights from manufacturers and retailers help validate the analysis and fill in data gaps.

Step 4: Research Synthesis and Final Output

A final synthesis of market data is conducted, involving direct interactions with top manufacturers to gain a deeper understanding of product innovations, market preferences, and upcoming trends. The output is thoroughly validated to ensure accuracy and reliability.

Frequently Asked Questions

01. How big is the APAC Bedroom Furniture Market?

The APAC bedroom furniture market is valued at USD 26.50 billion. This growth is attributed to urbanization, increased consumer spending on home interiors, and the availability of diverse furniture options through e-commerce platforms.

02. What are the challenges in the APAC Bedroom Furniture Market?

The key challenges include rising raw material costs, supply chain disruptions, and high competition from both local and global players. Fluctuating transportation costs also pose significant challenges to manufacturers.

03. Who are the major players in the APAC Bedroom Furniture Market?

Key players include IKEA Group, Ashley Furniture, Godrej Interio, Stanley Furniture, and HNI Corporation. These companies lead the market due to their strong manufacturing capabilities, innovative designs, and extensive distribution networks.

04. What are the growth drivers of the APAC Bedroom Furniture Market?

The market is driven by rapid urbanization, rising disposable incomes, and increased demand for modern, space-efficient furniture. Additionally, growing consumer interest in eco-friendly and sustainable furniture options contributes to market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.