APAC Cybersecurity Market Outlook to 2030

Region:Asia

Author(s):Shambhavi Awasthi

Product Code:KROD988

October 2024

98

About the Report

APAC Cybersecurity Market Overview

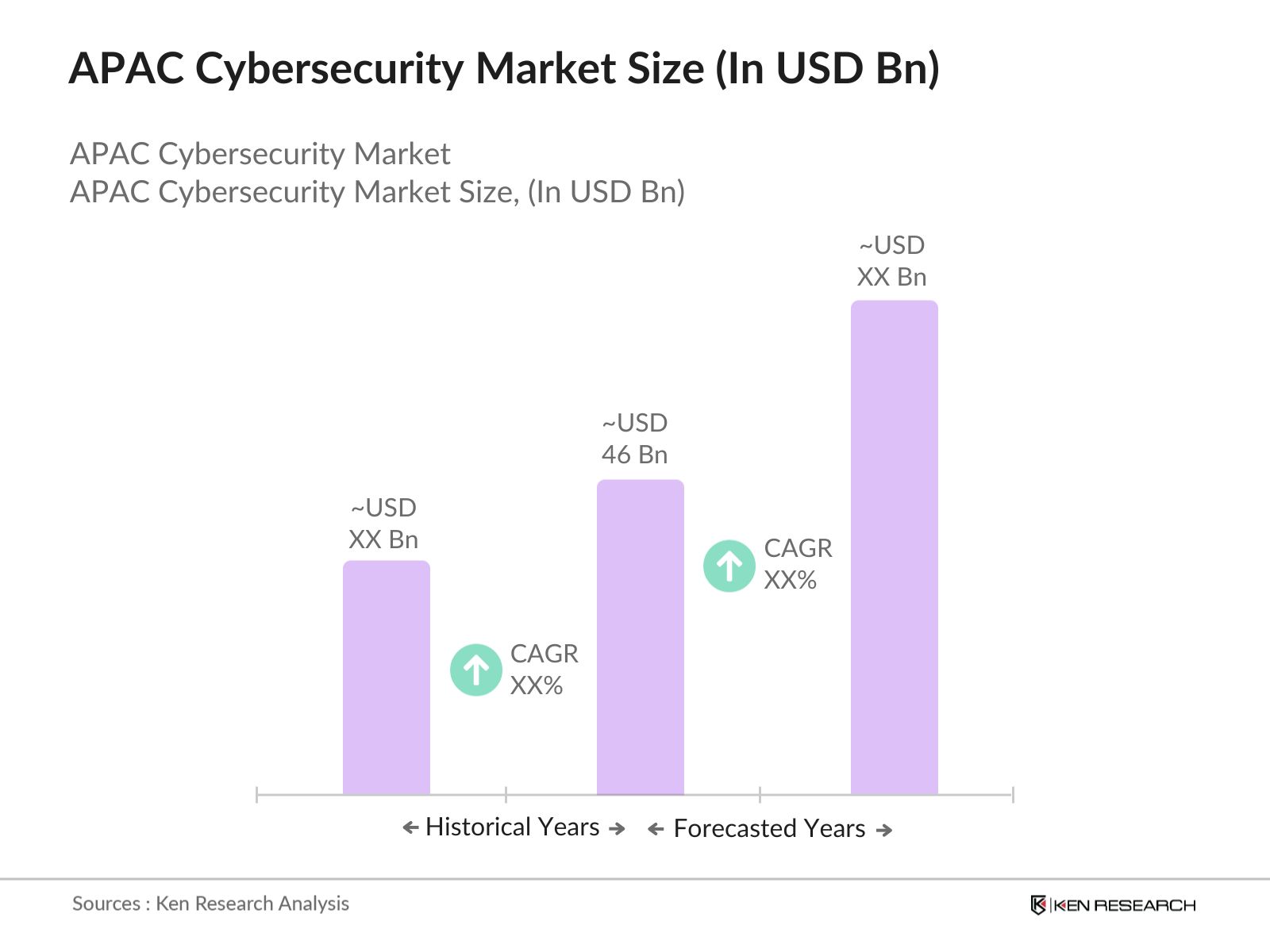

- The APAC cybersecurity market reached USD 46 billion in 2023. This growth is driven primarily by the increasing digitization of services across various industries, including financial services, healthcare, and government sectors. The rapid adoption of cloud computing and the Internet of Things (IoT) has expanded the attack surface, necessitating robust cybersecurity solutions. Additionally, the rise in cyber threats, including ransomware and phishing attacks, has accelerated the demand for advanced cybersecurity measures across the region.

- Major players in the APAC cybersecurity market include Palo Alto Networks, Cisco Systems, Check Point Software Technologies, Fortinet, and Trend Micro. These companies dominate the market through extensive product portfolios, strong R&D capabilities, and strategic partnerships. For instance, Palo Alto Networks has continued to expand its footprint in the region through acquisitions and partnerships, solidifying its position as a leader in network security and cloud security solutions.

- The Indian government launched the Cyber Suraksha Bharat initiative, aimed at enhancing the country's cybersecurity infrastructure. The Cyber Surakshit Bharat initiative was launched in 2018 by the Ministry of Electronics and Information Technology (MeitY) in cooperation with the National e-Governance Division (NeGD) and various industry partners in India. The initiative is part of India's broader effort to secure its digital ecosystem and protect against escalating cyber threats.

- Singapore and Tokyo dominate the APAC cybersecurity market due to their advanced digital infrastructure and proactive government policies. Singapore, as a global financial hub, has implemented stringent cybersecurity regulations, attracting significant investments from global cybersecurity firms. Tokyo, with its concentration of multinational corporations and high-tech industries, has seen substantial growth in demand for cybersecurity solutions, driven by the need to protect intellectual property and sensitive data.

APAC Cybersecurity Market Segmentation

By Security Type: The APAC cybersecurity market is segmented by security type into network security, endpoint security, and cloud security. In 2023, network security held the dominant market share in APAC, driven by the increasing complexity and frequency of cyberattacks targeting network infrastructure. The rise of remote work and the proliferation of IoT devices have necessitated the implementation of advanced network security measures, including firewalls, intrusion detection systems, and VPNs.

By Deployment Mode: The market is segmented by deployment mode into on-premise, cloud-based, and hybrid. In 2023, cloud-based cybersecurity solutions dominated the market, accounting for the largest share. This dominance is attributed to the rapid adoption of cloud computing across various industries in APAC, particularly in SMEs. Cloud-based solutions offer scalability, flexibility, and cost-effectiveness, making them ideal for businesses looking to secure their digital assets without significant capital expenditure.

By Region: The APAC cybersecurity market is segmented by region into China, South Korea, Japan, India, Australia, and rest of APAC. In 2023, China dominated the APAC cybersecurity market, driven by substantial investments exceeding USD 15 billion. This investment underscores China's commitment to enhancing its cybersecurity capabilities amid growing cyber threats. The government's focus on strengthening digital defences and advancing cybersecurity technologies has solidified China's leading position in the region's cybersecurity landscape.

APAC Cybersecurity Market Competitive Landscape

|

Company Name |

Year of Establishment |

Headquarters |

|

Palo Alto Networks |

2005 |

Santa Clara, USA |

|

Cisco Systems |

1984 |

San Jose, USA |

|

Check Point Software Technologies |

1993 |

Tel Aviv, Israel |

|

Fortinet |

2000 |

Sunnyvale, USA |

|

Trend Micro |

1988 |

Tokyo, Japan |

- Palo Alto Networks: In November 2022, Palo Alto Networks announced it had signed a definitive agreement to acquire Cider Security, a pioneer in application security (AppSec) and software supply chain security, for $195 million in cash, excluding the value of replacement equity awards, subject to adjustment. This acquisition strengthens Palo Alto's capabilities in securing software development environments, addressing the growing threat of supply chain attacks.

- Cisco Systems: In March 2024, Cisco Systems launched a new AI-powered cybersecurity platform called Cisco Secure X, designed to integrate security across networks, endpoints, and cloud environments. This platform has been particularly well-received in APAC, where the complexity of hybrid IT environments has driven demand for integrated security solutions. Ciscos continued innovation in AI and machine learning positions it strongly in the region.

APAC Cybersecurity Market Analysis

Growth Drivers

- Increased Regulatory Compliance Requirements: The APAC region has seen a significant increase in regulatory compliance requirements as governments recognise the growing threat of cybercrime. In 2024, the Indian government implemented the Personal Data Protection Bill, which mandates stringent data protection measures across industries, particularly in finance and healthcare. This legislation, coupled with similar initiatives in Singapore and Australia.

- Escalating Cybersecurity Threats in Critical Sectors: In 2024, the APAC region reported over 12,000 significant cyber incidents, targeting critical infrastructure sectors like energy, healthcare, and finance. The energy sector alone faced a 30% increase in cyberattacks compared to 2023, with multiple attacks on power grids in South Korea and Australia causing widespread disruptions. This surge in targeted attacks has led to increased investments in cybersecurity by both government and private players.

- Proliferation of IoT Devices: The APAC region saw a sharp increase in the number of Internet of Things (IoT) devices. This rapid proliferation has expanded the attack surface, necessitating advanced cybersecurity measures. Countries like Japan and South Korea have been at the forefront of IoT adoption, particularly in smart cities and industrial automation. By 2024, it is anticipated that over50 billion connected IoT deviceswill be deployed globally, with a significant portion in the APAC region.

Challenges

- Shortage of Skilled Cybersecurity Professionals: Despite the growing demand for cybersecurity solutions, the APAC region faces a critical shortage of skilled cybersecurity professionals. In 2024, the gap between demand and supply was estimated at over 2 million professionals, with countries like India and China experiencing the most significant shortages. This talent gap poses a considerable challenge to organizations seeking to implement comprehensive cybersecurity measures, as they struggle to find qualified personnel to manage and maintain security infrastructures.

- High Costs of Advanced Cybersecurity Solutions: The cost of implementing advanced cybersecurity solutions remains a significant challenge for many organizations in the APAC region, particularly SMEs. In 2024, the average cost of deploying a comprehensive cybersecurity framework, including AI-driven threat detection and response systems, was approximately USD 2 million for mid-sized companies. This high cost is a deterrent for many businesses, leading to underinvestment in cybersecurity, which can result in vulnerabilities and breaches.

Government Initiatives

- Singapore's Cybersecurity Act Amendments (2024): In 2024, Singapore amended its Cybersecurity Act to include stricter regulations for critical information infrastructure (CII) owners. The amendments mandate CII owners to conduct regular cybersecurity audits and submit incident reports to the Cyber Security Agency of Singapore. The government also allocated SGD 500 million to support the implementation of these measures, highlighting Singapore's commitment to strengthening its cybersecurity framework in response to the increasing threat landscape.

- Australia's National Cybersecurity Strategy (2024): Australia's National Cybersecurity Strategy 2023, launched by the Department of Home Affairs, introduced new guidelines for securing critical infrastructure and supply chains. With a funding allocation of AUD 1.2 billion, the strategy emphasizes collaboration between the government and private sector to improve cyber resilience. Key initiatives include the establishment of a Cybersecurity Coordination Centre and incentives for businesses to adopt advanced cybersecurity technologies.

APAC Cybersecurity Market Future Outlook

The APAC cybersecurity market is poised for robust growth through 2028, driven by increasing digital transformation, rising cyber threats, and substantial government investments in cybersecurity infrastructure. The adoption of AI and machine learning in threat detection, along with expanding cloud security solutions, will further accelerate market development, making APAC a critical region in the global cybersecurity landscape.

Future Trends

- Increased Integration of AI and Machine Learning in Cybersecurity Solutions: By 2028, the APAC cybersecurity market is expected to witness widespread integration of AI and machine learning technologies in cybersecurity solutions. These technologies will be used to enhance threat detection, automate incident response, and predict potential vulnerabilities. Countries like Japan and South Korea are expected to lead the adoption of AI-driven cybersecurity tools, with governments and enterprises alike investing heavily in these technologies to stay ahead of evolving cyber threats.

- Growth in Cybersecurity Spending by SMEs: The next five years will see a significant increase in cybersecurity spending by small and medium-sized enterprises (SMEs) across the APAC region. With the rise in cyber threats targeting SMEs, governments in countries like Australia and Singapore are expected to introduce incentives and subsidies to encourage SMEs to invest in cybersecurity. By 2028, SMEs are projected to account for a substantial portion of the overall cybersecurity market, as they increasingly recognize the importance of protecting their digital assets.

Scope of the Report

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Telecommunications Companies

Large Enterprises (Fortune 500 companies)

Small and Medium Enterprises (SMEs)

IT and Software Development Firms

Healthcare Organizations

Critical Infrastructure Operators

Cybersecurity Service Providers

E-commerce and Retail Companies

Defense and Aerospace Companies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., CERT-In, JPCERT/CC)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Palo Alto Networks

Cisco Systems

Check Point Software Technologies

Fortinet

Trend Micro

IBM Corporation

Symantec Corporation

FireEye, Inc.

McAfee Corp.

Kaspersky Lab

Sophos Group plc

Microsoft Corporation

RSA Security LLC

Rapid7, Inc.

Proofpoint, Inc.

Table of Contents

1. APAC Cybersecurity Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. APAC Cybersecurity Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. APAC Cybersecurity Market Analysis

3.1. Growth Drivers

3.1.1. Increased Regulatory Compliance Requirements

3.1.2. Escalating Cybersecurity Threats in Critical Sectors

3.1.3. Proliferation of IoT Devices

3.2. Challenges

3.2.1. Shortage of Skilled Cybersecurity Professionals

3.2.2. High Costs of Advanced Cybersecurity Solutions

3.2.3. Complex and Fragmented Regulatory Environment

3.3. Opportunities

3.3.1. Expansion into Emerging Markets

3.3.2. Increasing Demand for Cloud-Based Security Solutions

3.3.3. Integration of AI and ML in Cybersecurity

3.4. Trends

3.4.1. Rise in Ransomware Attacks

3.4.2. Growth of Zero Trust Architecture

3.4.3. Expansion of Managed Security Services

3.5. Government Initiatives

3.5.1. Indias Cyber Suraksha Bharat Initiative (2023)

3.5.2. Singapores Cybersecurity Act Amendments (2024)

3.5.3. Australias National Cybersecurity Strategy (2024)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competitive Ecosystem

4. APAC Cybersecurity Market Segmentation, 2023

4.1. By Security Type (in Value %)

4.1.1. Network Security

4.1.2. Endpoint Security

4.1.3. Cloud Security

4.2. By Deployment Mode (in Value %)

4.2.1. On-Premise

4.2.2. Cloud-Based

4.2.3. Hybrid

4.3. By Industry Vertical (in Value %)

4.3.1. Financial Services

4.3.2. Healthcare

4.3.3. Government & Defense

4.4. By Region (in Value %)

4.4.1. China

4.4.2. South Korea

4.4.3. Japan

4.4.4. India

4.4.5. Australia

4.4.6. Rest of APAC

5. APAC Cybersecurity Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Palo Alto Networks

5.1.2. Cisco Systems

5.1.3. Check Point Software Technologies

5.1.4. Fortinet

5.1.5. Trend Micro

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. APAC Cybersecurity Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. APAC Cybersecurity Market Regulatory Framework

7.1. Data Protection and Privacy Laws

7.2. Compliance Requirements

7.3. Cybersecurity Certification Processes

8. APAC Cybersecurity Market Future Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. APAC Cybersecurity Market Future Segmentation, 2028

9.1. By Security Type (in Value %)

9.2. By Deployment Mode (in Value %)

9.3. By Industry Vertical (in Value %)

9.4. By Region (in Value %)

10. APAC Cybersecurity Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables:

An ecosystem was created for all major entities within the APAC Cybersecurity Market, referencing a combination of secondary and proprietary databases to conduct comprehensive desk research. This involved gathering industry-level information, identifying market trends, and understanding the competitive landscape to ensure a holistic analysis.

Step 2: Market Building:

Statistics on the APAC Cybersecurity Market were collated over the years, analyzing market penetration across various segments and evaluating the performance of key market players. This included reviewing subscriber data, content production investments, and regional market shares to accurately compute the market size and growth trajectory.

Step 3: Validating and Finalizing:

Market hypotheses were validated through Computer Assisted Telephone Interviews (CATIs) with industry experts and stakeholders from leading companies in the Permanent Magnet market. These interviews were crucial for refining market forecasts and obtaining insights directly from industry representatives.

Step 4: Research Output:

Multiple key players in Cybersecurity were engaged to understand product segment dynamics, customer needs, sales patterns, and market challenges. A bottom-up approach was used to validate the data, ensuring that the final statistics and insights accurately reflect market conditions and support strategic decision-making.

Frequently Asked Questions

1. How big is the APAC cybersecurity market?

The APAC cybersecurity market was valued at USD 49.1 billion in 2023, driven by the increasing digitization across sectors, rising cyber threats, and government initiatives aimed at bolstering cybersecurity infrastructure.

2. What are the challenges in the APAC cybersecurity market?

Challenges in the APAC cybersecurity market include a shortage of skilled cybersecurity professionals, the high cost of implementing advanced security solutions, and a fragmented regulatory environment across different countries in the region.

3. Who are the major players in the APAC cybersecurity market?

Key players in the APAC cybersecurity market include Palo Alto Networks, Cisco Systems, Check Point Software Technologies, Fortinet, and Trend Micro. These companies lead the market due to their advanced security solutions, strong regional presence, and strategic partnerships.

4. What are the growth drivers of the APAC cybersecurity market?

The APAC cybersecurity market is driven by increasing regulatory compliance requirements, the rising frequency of cyberattacks on critical infrastructure, and the rapid adoption of IoT devices, which have expanded the attack surface.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.