APAC Education Technology (EdTech) Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD6168

December 2024

92

About the Report

APAC Education Technology (EdTech) Market Overview

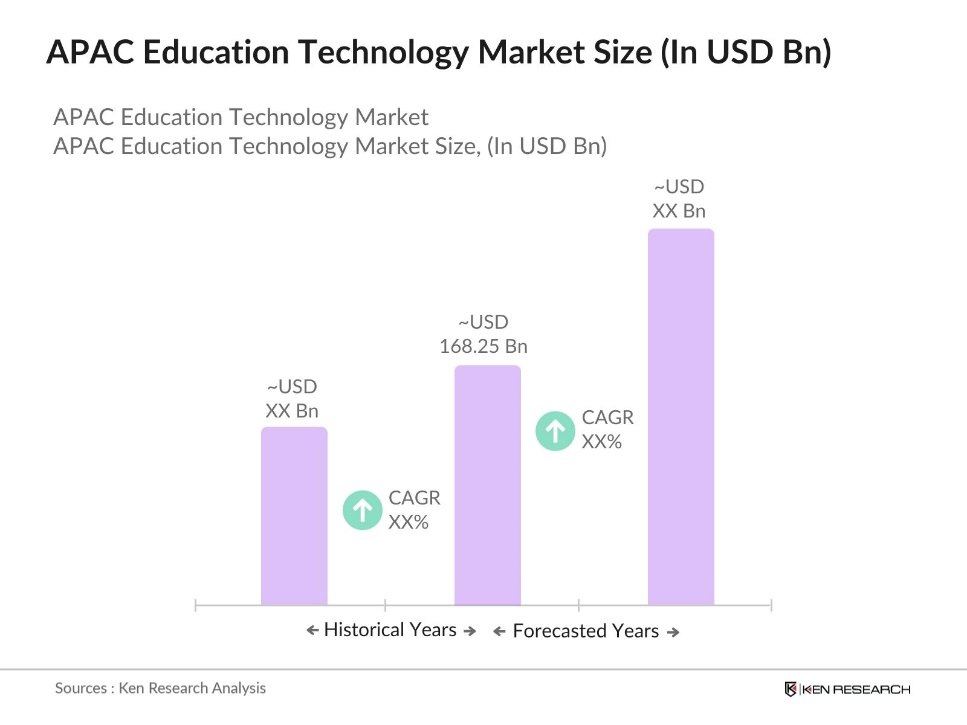

- The APAC EdTech Market is currently valued at USD 168.25 billion, based on a five-year historical analysis. This market is primarily driven by the increasing digitalization of education systems across major countries like China, India, and Japan. Governments in these regions are actively investing in smart classrooms and internet connectivity, while the growing adoption of AI-powered educational platforms further propels market expansion. The COVID-19 pandemic accelerated the transition to online learning, further bolstering the demand for digital education solutions in the region.

- Key dominant countries in the APAC EdTech market include China, India, and South Korea. These countries dominate due to their large student populations, increased government focus on e-learning infrastructure, and the rising penetration of smartphones and internet access. For instance, China's government-led initiatives to incorporate AI and big data in the education system have positioned it as a leader in the EdTech space. Similarly, Indias growing tech-savvy younger population has driven the adoption of mobile-based learning platforms.

- In 2024, governments across APAC have allocated significant funding to support EdTech startups. For instance, Singapores government has earmarked over SGD 500 million (approximately $370 million) to foster innovation in the EdTech sector through grants and tax incentives. Similar initiatives in countries like Japan and Australia are providing vital financial support to early-stage startups, enabling them to scale their operations and develop cutting-edge solutions.

APAC Education Technology (EdTech) Market Segmentation

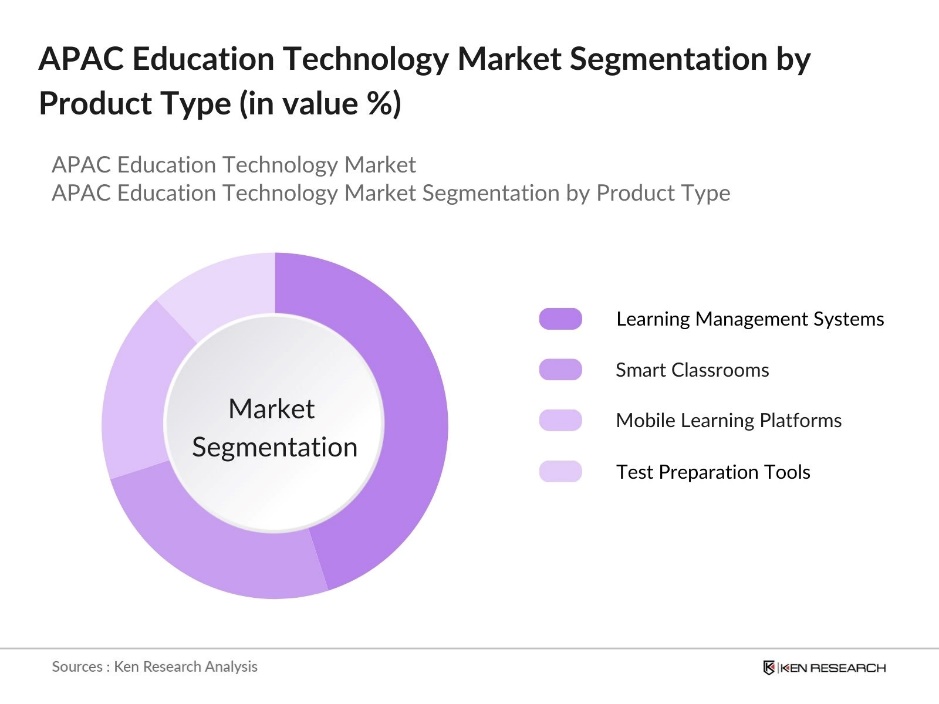

By Product Type: The APAC EdTech market is segmented by product type into Learning Management Systems (LMS), Smart Classrooms, Mobile Learning Platforms, and Test Preparation Tools. Learning Management Systems (LMS) have a dominant market share in this segmentation due to their widespread use in both academic and corporate sectors. Educational institutions in the region have increasingly adopted LMS platforms for curriculum management, assignment submissions, and performance tracking. In addition, corporates are using LMS tools for employee training, which enhances market share.

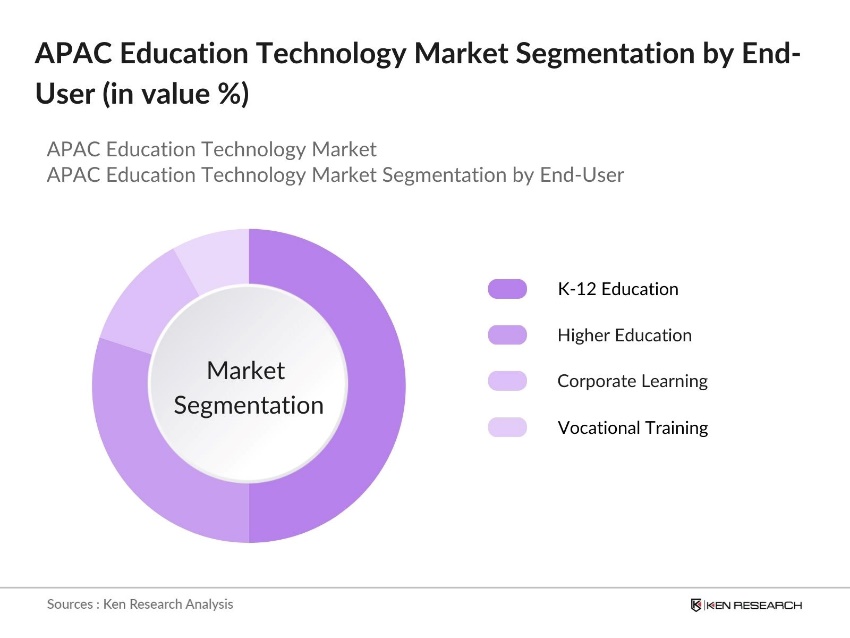

By End-User: The APAC EdTech market is further segmented by end-user into K-12 Education, Higher Education, Corporate Learning, and Vocational Training. K-12 Education dominates this segment due to the rapid adoption of digital learning tools in schools across countries like India, China, and Japan. Government programs, such as Indias Digital India initiative and Chinas AI-based education policy, have played significant roles in integrating technology into K-12 education, making it the leading sub-segment.

APAC Education Technology (EdTech) Market Competitive Landscape

The market is characterized by consolidation, where global leaders like Coursera and Pearson coexist with local champions such as BYJUs in India. These companies are continuously innovating through partnerships with educational institutions, content providers, and technology firms, creating a diversified and competitive landscape. Companies like BYJUs have built their dominance through mobile learning solutions, while Coursera benefits from its extensive library of courses and certifications.

|

Company |

Establishment Year |

Headquarters |

Revenue (2023) |

Platform Reach |

Active Users |

Global Presence |

Key Products |

Innovation Index |

|

Coursera |

2012 |

USA |

||||||

|

BYJU's |

2011 |

India |

||||||

|

Pearson |

1844 |

UK |

||||||

|

Unacademy |

2015 |

India |

||||||

|

Knewton |

2008 |

USA |

APAC Education Technology (EdTech) Industry Analysis

Growth Drivers

- Increased Internet Penetration: Internet access has significantly grown across the Asia-Pacific (APAC) region, with more than 2.6 billion people connected to the internet in 2022. Major economies like China and India have added millions of new internet users annually. Improved internet infrastructure, especially in Southeast Asian countries, supports a growing number of educational institutions moving online, expanding accessibility to EdTech solutions across rural and urban areas.

- Adoption of Digital Learning Tools: Across APAC, the adoption of digital learning tools that the students gaining access to various forms of online learning platforms. The rise in mobile device usage, especially in India, Indonesia, and Vietnam, plays a key role in this transformation. Governments in the APAC region are actively promoting digital education through investments in infrastructure and training. For example, India's PM e-VIDYA initiative aims to unify efforts related to digital education and provide free e-learning resources.

- Rise in Demand for STEM Education: Demand for STEM (Science, Technology, Engineering, Mathematics) education is rising in the APAC region as countries like South Korea, Singapore, and Japan prioritize technological innovation and competitiveness. This emphasis is driven by employers seeking candidates with strong STEM skills across various sectors. As a result, EdTech platforms focused on STEM education are growing, equipping students with essential skills for the future job market.

Market Challenges

- Digital Divide: The digital divide in the APAC region, especially in rural and low-income areas, limits access to EdTech solutions. Many regions lack reliable internet and digital infrastructure, preventing students from accessing the same educational resources as those in urban areas. This disparity in access hinders the equitable spread of digital learning tools, particularly in countries with lower digital literacy and underdeveloped infrastructure.

- Limited Access to Quality Digital Content: A challenge in the APAC EdTech market is the lack of localized, high-quality digital content. Many countries face difficulties aligning digital resources with national curricula or offering content in native languages. This gap, especially in non-English speaking regions, limits the effectiveness of digital learning platforms, necessitating more region-specific content to meet diverse educational needs.

APAC Education Technology (EdTech) Market Future Outlook

Over the next few years, the APAC EdTech market is expected to show significant growth, driven by ongoing investments in digital infrastructure, increasing internet penetration, and the growing popularity of mobile learning solutions. The integration of artificial intelligence, machine learning, and virtual reality into education platforms will be a key growth driver, providing enhanced personalized learning experiences.

Market Opportunities

- Emerging Markets with Low Digital Penetration: Emerging markets in the APAC region, such as Laos, Cambodia, and Papua New Guinea, offer significant potential for EdTech expansion due to their lower digital penetration. These regions present opportunities for EdTech providers to introduce scalable and affordable solutions, bridging the educational gap. Increased investments in digital infrastructure and foreign support further enhance the growth prospects for educational technology in these underserved markets.

- Advancements in AI-Powered Learning Platforms: AI-powered learning platforms are gaining momentum across APAC, transforming traditional education methods. Countries like Japan, China, and South Korea are leading the way by leveraging AI to personalize learning experiences, automate tasks, and provide real-time student performance insights. These advancements allow institutions to offer more customized and effective learning solutions, reshaping the regions educational landscape.

Scope of the Report

|

Product Type |

Learning Management Systems (LMS) Smart Classrooms Mobile Learning Platforms Test Preparation Tools |

|

End-User |

K-12 Education Higher Education Corporate Learning Vocational Training |

|

Technology |

AI-Powered Learning Systems Blockchain in Education Virtual Learning Environment Cloud-Based Learning Solutions |

|

Mode of Learning |

Blended Learning Synchronous Online Learning Asynchronous Learning Personalized Learning |

|

Region |

East West South North |

Products

Key Target Audience

Educational Data Analytics Companies

Mobile Device Manufacturers (For Education Purposes)

Education-based Social Media Platforms

EdTech Hardware Manufacturers

Investors and venture capital Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Ministry of Education, Digital Literacy Councils)

Companies

Players Mentioned in the Report

Coursera

BYJUs

Pearson

Unacademy

Knewton

Blackboard

Chegg

Google for Education

Khan Academy

Alibaba DingTalk

Table of Contents

1. APAC EdTech Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Based on E-Learning Penetration, Digital Literacy Rates)

1.4. Market Segmentation Overview

2. APAC EdTech Market Size (In USD Bn)

2.1. Historical Market Size (Revenue from EdTech Platforms, Smart Classrooms)

2.2. Year-On-Year Growth Analysis (Key Regional Developments, Investment Trends)

2.3. Key Market Developments and Milestones (EdTech Policy Changes, Government Initiatives)

3. APAC EdTech Market Analysis

3.1. Growth Drivers

3.1.1. Increased Internet Penetration

3.1.2. Adoption of Digital Learning Tools

3.1.3. Government Investments in Education Infrastructure

3.1.4. Rise in Demand for STEM Education

3.2. Market Challenges

3.2.1. Digital Divide

3.2.2. Limited Access to Quality Digital Content

3.2.3. High Initial Setup Costs

3.3. Opportunities

3.3.1. Emerging Markets with Low Digital Penetration

3.3.2. Advancements in AI-Powered Learning Platforms

3.3.3. Partnerships with Traditional Educational Institutions

3.4. Trends

3.4.1. Adoption of Gamified Learning

3.4.2. Mobile-First Learning Solutions

3.4.3. Increased Use of Augmented Reality (AR) and Virtual Reality (VR) in Classrooms

3.5. Government Regulation

3.5.1. Policies Promoting Online Education

3.5.2. Digital Literacy Programs

3.5.3. Grants and Funding for EdTech Startups

3.5.4. Regulations for EdTech Certifications and Standards

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stake Ecosystem (Key Stakeholders: Platform Providers, Content Creators, Educators)

3.8. Porters Five Forces Analysis (Forces Impacting Profitability: Buyer Power, Supplier Power, etc.)

3.9. Competition Ecosystem (Key Competitors, Market Strategies)

4. APAC EdTech Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Learning Management Systems (LMS)

4.1.2. Smart Classrooms

4.1.3. Mobile Learning Platforms

4.1.4. Test Preparation Tools

4.2. By End-User (In Value %)

4.2.1. K-12 Education

4.2.2. Higher Education

4.2.3. Corporate Learning

4.2.4. Vocational Training

4.3. By Technology (In Value %)

4.3.1. AI-Powered Learning Systems

4.3.2. Blockchain in Education

4.3.3. Virtual Learning Environment (VLE)

4.3.4. Cloud-Based Learning Solutions

4.4. By Mode of Learning (In Value %)

4.4.1. Blended Learning

4.4.2. Synchronous Online Learning

4.4.3. Asynchronous Learning

4.4.4. Personalized Learning

4.5. By Region (In Value %)

4.5.1. East

4.5.2. West

4.5.3. South Asia

4.5.4. North

5. APAC EdTech Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Coursera

5.1.2. BYJU'S

5.1.3. Pearson

5.1.4. Edmodo

5.1.5. Udemy

5.1.6. Unacademy

5.1.7. Google for Education

5.1.8. Knewton

5.1.9. Blackboard

5.1.10. Chegg

5.1.11. Class Technologies Inc.

5.1.12. Khan Academy

5.1.13. Alibaba DingTalk

5.1.14. Zenius

5.1.15. Extramarks

5.2. Cross Comparison Parameters (No. of Employees, Revenue, Platform Reach, Active Users, Growth Rate, Global Presence, Content Offering, Innovation Index)

5.3. Market Share Analysis (Platform Share, User Base by Region)

5.4. Strategic Initiatives (Partnerships, New Product Launches)

5.5. Mergers and Acquisitions (Significant Transactions in the Market)

5.6. Investment Analysis (Private Investments, Public Funding)

5.7. Venture Capital Funding (Key Startups Funded)

5.8. Government Grants (Funding for Digital Education and Startups)

5.9. Private Equity Investments (Major Investors and EdTech Firms)

6. APAC EdTech Market Regulatory Framework

6.1. EdTech Policy Standards (National and Regional Guidelines)

6.2. Compliance Requirements for EdTech Platforms

6.3. Certification Processes for EdTech Tools

7. APAC EdTech Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. APAC EdTech Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By End-User (In Value %)

8.3. By Technology (In Value %)

8.4. By Mode of Learning (In Value %)

8.5. By Region (In Value %)

9. APAC EdTech Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the APAC EdTech market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the APAC EdTech market. This includes assessing market penetration, the ratio of educational institutions to service providers, and revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple EdTech providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the APAC EdTech market.

Frequently Asked Questions

01. How big is the APAC EdTech Market?

The APAC EdTech Market is valued at USD 168.25 billion, driven by government investments, increasing digitalization, and the rising demand for mobile-based learning solutions.

02. What are the challenges in the APAC EdTech Market?

Key challenges in APAC EdTech Market include the digital divide across rural and urban regions, limited access to high-quality content, and the high initial setup costs for digital learning infrastructure in certain regions.

03. Who are the major players in the APAC EdTech Market?

Major players in APAC EdTech Market include Coursera, BYJUs, Pearson, Unacademy, and Knewton. These companies dominate the market through extensive digital learning offerings, strategic partnerships, and wide geographical reach.

04. What are the growth drivers of the APAC EdTech Market?

The APAC EdTech Market growth is driven by increased internet penetration, advancements in AI-powered learning, government support for digital literacy programs, and the rising demand for personalized learning experiences.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.