APAC Electric Vehicle Supply Equipment (EVSE) Market Outlook to 2030

Region:Asia

Author(s):Shambhavi

Product Code:KROD4675

November 2024

92

About the Report

APAC Electric Vehicle Supply Equipment (EVSE) Market Overview

- The APAC Electric Vehicle Supply Equipment (EVSE) market is valued at USD 23 billion, driven by a surge in electric vehicle (EV) sales and governmental initiatives across key regions. Governments in countries like China, Japan, and India have introduced financial incentives for EV adoption and investments in EVSE infrastructure. Major cities like Shanghai and Tokyo have significantly expanded their charging networks, which has further contributed to the demand for EVSE. Urbanization and the push for reducing carbon emissions are fueling the market, supported by the rising EV sales.

- China, Japan, and South Korea dominate the APAC EVSE market due to robust government policies and investments in building extensive charging networks. China is a leader in EV adoption, backed by its massive government-driven infrastructure expansion. Japan's dominance comes from technological advancements in fast-charging solutions, while South Korea has invested heavily in wireless charging technologies, making these nations pioneers in the EVSE industry.

- Governments across the Asia-Pacific region have implemented strong policies to encourage the adoption of electric vehicles. For instance, Japans Green Growth Strategy is part of its commitment to reducing greenhouse gas emissions by 2030. It mandates that all new vehicles sold in Japan be either hybrid or electric by 2035. Similarly, China offers subsidies of up to 15,000 yuan per EV purchase, while Australias government is working to increase EV usage to 50% of new vehicle sales by 2030. These efforts are designed to reduce the environmental impact of transportation and promote energy security.

APAC Electric Vehicle Supply Equipment (EVSE) Market Segmentation

By Charging Type: The APAC Electric Vehicle Supply Equipment market is segmented by charging type into AC charging, DC fast charging, and wireless charging. Recently, DC fast charging has held a dominant market share in the APAC region, primarily due to its ability to rapidly charge EVs within a short period. The preference for fast charging stems from growing consumer demand for quick charging solutions in urban settings, especially in countries like China and Japan. With the expansion of fast-charging stations, particularly in metropolitan areas, this segment continues to lead.

By Application: The APAC EVSE market is segmented by application into residential, commercial, public, and fleet charging. Public charging stations dominate the market share due to the widespread demand for accessible charging infrastructure in high-density urban centers. Public chargers are installed by governments and private enterprises alike, especially in countries like China, which has the largest EV population in the world. The rapid urbanization and increasing commuter traffic further drive the expansion of public charging facilities.

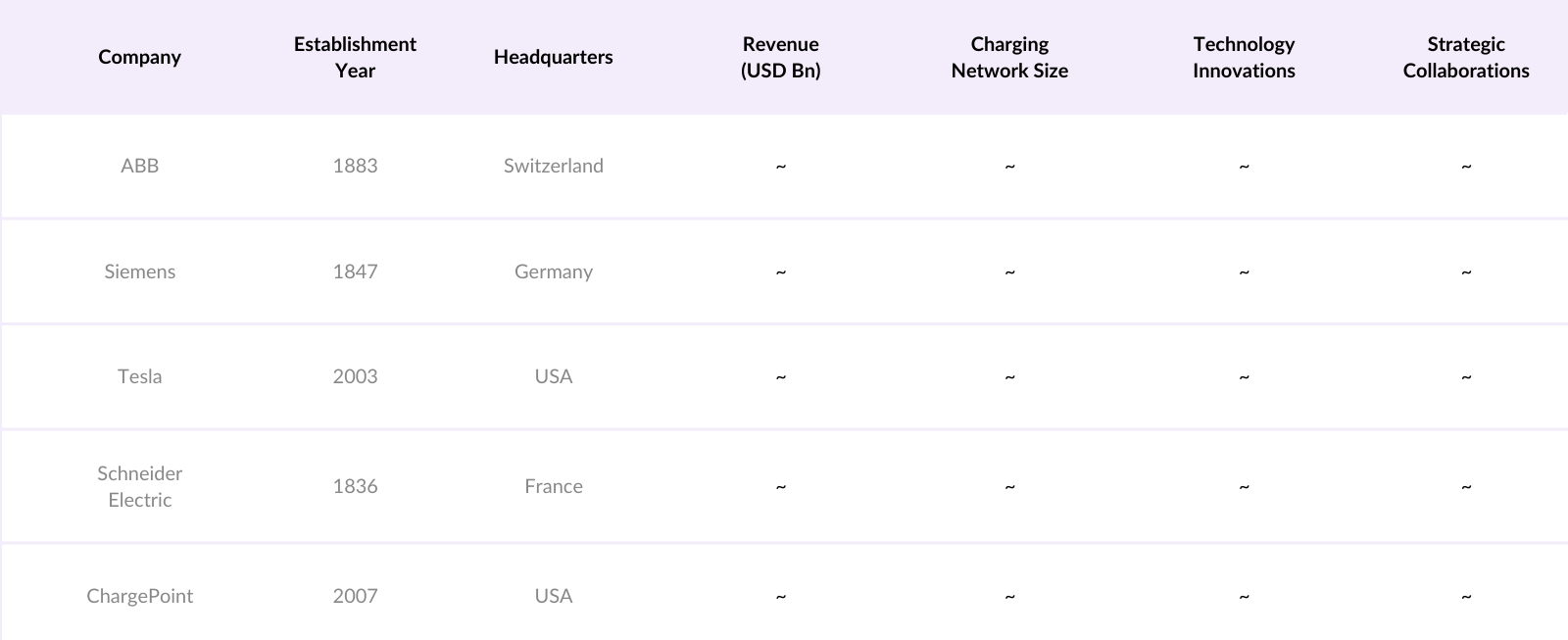

APAC Electric Vehicle Supply Equipment (EVSE) Market Competitive Landscape

The APAC Electric Vehicle Supply Equipment market is dominated by a few key players who have established strong regional and global operations. Local manufacturers, particularly in China, compete with international companies offering advanced technologies and extensive charging networks. The market's competitive landscape is shaped by Chinas dominance in infrastructure development: Chinese companies benefit from government incentives and vast domestic demand. Japan's focus on fast and wireless charging innovations strengthens its market position. Multinational collaborations are helping key players penetrate new markets across the APAC region.

APAC Electric Vehicle Supply Equipment (EVSE) Market Analysis

Growth Drivers

- Surge in Electric Vehicle Sales: Electric vehicle (EV) sales in the Asia-Pacific region have seen significant growth, driven by government incentives and consumer demand for cleaner energy. For example, China, a key player in the EV market, reported over 4 million EVs sold in 2023, making it a leading market globally. South Korea also reported increased adoption, with nearly 180,000 electric vehicles added to its fleet in 2023. This rise reflects strong government support and investments in EV infrastructure across the region. These sales are bolstered by incentives such as tax breaks, subsidies, and exemptions on registration fees.

- Investments in Charging Infrastructure: The Asia-Pacific region has seen a massive influx of investments in electric vehicle supply equipment (EVSE). China leads in EVSE installations, with over 2.2 million public and private charging stations established in 2023. India is targeting 100,000 public charging stations by 2024, backed by the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme. These infrastructure investments are vital to supporting EV growth, allowing for more efficient vehicle charging and reducing concerns about range anxiety among EV users.

- Increasing Urbanization and Smart City Initiatives: Urbanization is another key driver of EVSE adoption, with many APAC cities integrating smart technology to manage their growing populations. Cities such as Singapore and Tokyo are developing smart transportation grids where EVSE infrastructure plays a critical role. Singapore has committed to installing 60,000 EV charging points by 2030, and its Smart Nation initiative supports electric mobility solutions. These developments highlight how urban growth and smart city initiatives across Asia are fueling the demand for EV charging solutions.

Market Challenges

- High Installation and Maintenance Costs: One of the primary challenges in the APAC EVSE market is the high cost of installation and maintenance. Installing a fast-charging station can cost up to $50,000 per unit in countries like Japan and South Korea, significantly higher than slower alternatives. Maintenance costs can further burden operators, particularly in developing nations like Indonesia and Thailand, where such expenses represent a more considerable portion of income. This high cost often limits the rate at which charging stations are deployed, particularly in rural or underserved areas.

- Lack of Uniform Charging Standards: The lack of standardized charging systems across the region is another challenge for the APAC EVSE market. China, for example, uses the GB/T standard for charging, while Japan relies on CHAdeMO, and Europe has adopted CCS. This lack of standardization makes it difficult to create a seamless charging network across borders, complicating travel and trade within the region. While efforts are being made to align these systems, the differences still pose logistical and operational hurdles.

APAC Electric Vehicle Supply Equipment (EVSE) Market Future Outlook

Over the next few years, the APAC Electric Vehicle Supply Equipment market is expected to witness significant growth driven by continued government support, advances in EV charging technology, and increasing consumer demand for EVs. Urbanization, rising environmental concerns, and financial incentives for EV infrastructure development will play a crucial role in expanding the EVSE market across the region. As more countries in APAC commit to reducing carbon emissions, the demand for robust EV charging networks will grow exponentially, supported by advancements such as ultra-fast charging, vehicle-to-grid (V2G) systems, and renewable energy integration. The focus on expanding infrastructure in both developed and emerging markets is likely to accelerate the adoption of EVSE, providing immense opportunities for businesses operating in this space.

Market Opportunities

- Expanding Fast Charging Network: There is a growing opportunity for fast charging networks across the APAC region. By 2023, China had installed over 850,000 public fast-charging stations, and Japan is making significant investments to introduce ultra-fast chargers across the countrys highway network. The growth of fast chargers is crucial for reducing charging times, with stations capable of fully charging a vehicle in under 30 minutes. This expansion of fast-charging capabilities will further enhance EV adoption, particularly for long-distance travel.

- Collaborations with Automakers and Utility Providers: Strategic partnerships between automakers and utility providers are driving the development of EVSE infrastructure in the APAC region. In South Korea, Hyundai has collaborated with local utility companies to install over 1,000 new fast-charging stations across the country by 2024. Similarly, Japans automakers have partnered with energy providers to roll out wireless charging technologies. These collaborations leverage the expertise of both industries, accelerating the deployment of reliable, efficient EVSE infrastructure across APAC markets.

Scope of the Report

|

Segment |

Sub-segments |

|

By Charging Type |

AC Charging, DC Fast Charging, Wireless Charging |

|

By Application |

Residential, Commercial, Public Charging, Fleet Charging |

|

By Power Output |

Up to 11 kW, 12-50 kW, Above 50 kW |

|

By Connector Type |

CHAdeMO, CCS, Type 1, Type 2, GB/T |

|

By Region |

China, Japan, South Korea, India, Australia |

Products

Key Target Audience

Electric Vehicle Manufacturers

Government and Regulatory Bodies (e.g., Chinas Ministry of Industry and Information Technology, Japan's Ministry of Economy, Trade, and Industry)

EVSE Manufacturers and Installers

Utility Companies and Grid Operators

Real Estate Developers (commercial and residential)

Public Transportation Providers

Investor and Venture Capitalist Firms

Fleet Operators and Logistics Companies

Companies

Players mentioned in the report

ABB

Siemens

Tesla

Schneider Electric

ChargePoint

EVBox

Delta Electronics

NIO Power

Webasto

Enel X

Leviton

TGOOD

Efacec

BP Pulse

ClipperCreek

Table of Contents

1. APAC Electric Vehicle Supply Equipment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. APAC Electric Vehicle Supply Equipment Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. APAC Electric Vehicle Supply Equipment Market Analysis

3.1. Growth Drivers (Electric vehicle adoption rates, government incentives, EVSE infrastructure investments)

3.1.1. Surge in Electric Vehicle Sales

3.1.2. Government Policies Promoting Electrification

3.1.3. Investments in Charging Infrastructure

3.1.4. Increasing Urbanization and Smart City Initiatives

3.2. Market Challenges (High initial installation costs, grid infrastructure limitations, lack of standardization)

3.2.1. High Installation and Maintenance Costs

3.2.2. Lack of Uniform Charging Standards

3.2.3. Limited Charging Infrastructure in Rural Areas

3.2.4. Impact of Power Grid Reliability and Capacity

3.3. Opportunities (Growth in fast charging networks, cross-border EVSE partnerships, renewable energy integration)

3.3.1. Expanding Fast Charging Network

3.3.2. Collaborations with Automakers and Utility Providers

3.3.3. Integration of Renewable Energy into Charging Stations

3.3.4. Emerging Markets in Southeast Asia

3.4. Trends (Wireless charging systems, ultra-fast charging, V2G technology)

3.4.1. Adoption of Ultra-Fast Charging Technologies

3.4.2. Emergence of Wireless Charging Systems

3.4.3. Vehicle-to-Grid (V2G) Technology Implementation

3.4.4. Increasing Use of IoT in EVSE Management Systems

3.5. Government Regulation (EVSE installation guidelines, carbon reduction policies, EV incentives)

3.5.1. Subsidies for EVSE Infrastructure

3.5.2. Emission Reduction Policies

3.5.3. Mandatory EV Charging Station Installation in New Developments

3.5.4. Public-Private Partnerships for EVSE Expansion

3.6. SWOT Analysis (Market Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (OEMs, utility providers, technology providers, government bodies)

3.8. Porters Five Forces (Buyer power, supplier power, competition intensity, new entrants, substitutes)

3.9. Competition Ecosystem (Market competitiveness, consolidation trends, new entrants)

4. APAC Electric Vehicle Supply Equipment Market Segmentation

4.1. By Charging Type (In Value %)

4.1.1. AC Charging

4.1.2. DC Fast Charging

4.1.3. Wireless Charging

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Public Charging

4.2.4. Fleet Charging

4.3. By Power Output (In Value %)

4.3.1. Up to 11 kW

4.3.2. 12-50 kW

4.3.3. Above 50 kW

4.4. By Connector Type (In Value %)

4.4.1. CHAdeMO

4.4.2. CCS

4.4.3. Type 1

4.4.4. Type 2

4.4.5. GB/T

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. India

4.5.5. Australia

5. APAC Electric Vehicle Supply Equipment Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ABB

5.1.2. Siemens

5.1.3. Tesla

5.1.4. Schneider Electric

5.1.5. ChargePoint

5.1.6. BP Pulse

5.1.7. EVBox

5.1.8. Webasto

5.1.9. Delta Electronics

5.1.10. NIO Power

5.1.11. ClipperCreek

5.1.12. Enel X

5.1.13. Leviton

5.1.14. TGOOD

5.1.15. Efacec

5.2. Cross Comparison Parameters (Revenue, Market Presence, Technology Innovations, Charging Network Size, Strategic Collaborations, Sustainability Initiatives, Regional Coverage, Customer Base)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Expansions, Innovations)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Public and private investments, market funding)

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. APAC Electric Vehicle Supply Equipment Market Regulatory Framework

6.1. EV Charging Standards

6.2. Compliance Requirements

6.3. Certification Processes (Regional certifications, technical standards compliance)

7. APAC Electric Vehicle Supply Equipment Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (EV sales growth, government incentives, renewable integration)

8. APAC Electric Vehicle Supply Equipment Future Market Segmentation

8.1. By Charging Type (In Value %)

8.2. By Application (In Value %)

8.3. By Power Output (In Value %)

8.4. By Connector Type (In Value %)

8.5. By Region (In Value %)

9. APAC Electric Vehicle Supply Equipment Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Residential vs. commercial demand, fleet operations, urban vs. rural)

9.3. Marketing Initiatives (Targeted marketing, digital campaigns, partnership-driven strategies)

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem of the APAC EVSE market, identifying key stakeholders such as electric vehicle manufacturers, charging infrastructure developers, and government bodies. This step is supported by extensive desk research using industry reports, government databases, and proprietary research tools.

Step 2: Market Analysis and Construction

In this phase, historical data on the APAC EVSE market is compiled and analyzed to assess market growth. Factors such as the penetration of electric vehicles, the number of charging stations, and the revenue generated from EVSE installations are examined to determine market trends and dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with industry experts, including professionals from leading EV manufacturers and EVSE providers. These discussions provide insight into market operations and challenges, ensuring the accuracy of our analysis.

Step 4: Research Synthesis and Final Output

This step involves synthesizing data collected from primary and secondary sources to produce a comprehensive report. Our final output is reviewed for accuracy and completeness, ensuring it provides actionable insights into the APAC EVSE market.

Frequently Asked Questions

-

How big is the APAC Electric Vehicle Supply Equipment market?

The APAC Electric Vehicle Supply Equipment market is valued at USD 14.5 billion, driven by increasing electric vehicle adoption and significant investments in charging infrastructure by governments across key countries in the region. -

What are the challenges in the APAC EVSE Market?

Challenges include high initial installation costs, a lack of standardization across charging technologies, and limited charging infrastructure in rural areas. Grid capacity issues also pose barriers to expanding charging networks. -

Who are the major players in the APAC EVSE Market?

Key players include ABB, Siemens, Tesla, Schneider Electric, and ChargePoint. These companies dominate the market due to their technological innovations, strategic partnerships, and strong presence across the region. -

What are the growth drivers of the APAC EVSE Market?

The market is propelled by rising electric vehicle sales, government incentives promoting EV adoption, and investments in EVSE infrastructure across key urban centers. Additionally, technological advancements in fast and wireless charging are boosting market growth. -

What trends are influencing the APAC EVSE Market?

Trends include the growing adoption of ultra-fast charging, vehicle-to-grid (V2G) technology, and wireless charging solutions. Governments and private entities are also focusing on integrating renewable energy sources with EV charging stations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.