APAC EV Charging Station Market Outlook to 2030

Region:Asia

Author(s):Mukul

Product Code:KROD6417

December 2024

97

About the Report

APAC EV Charging Station Market Overview

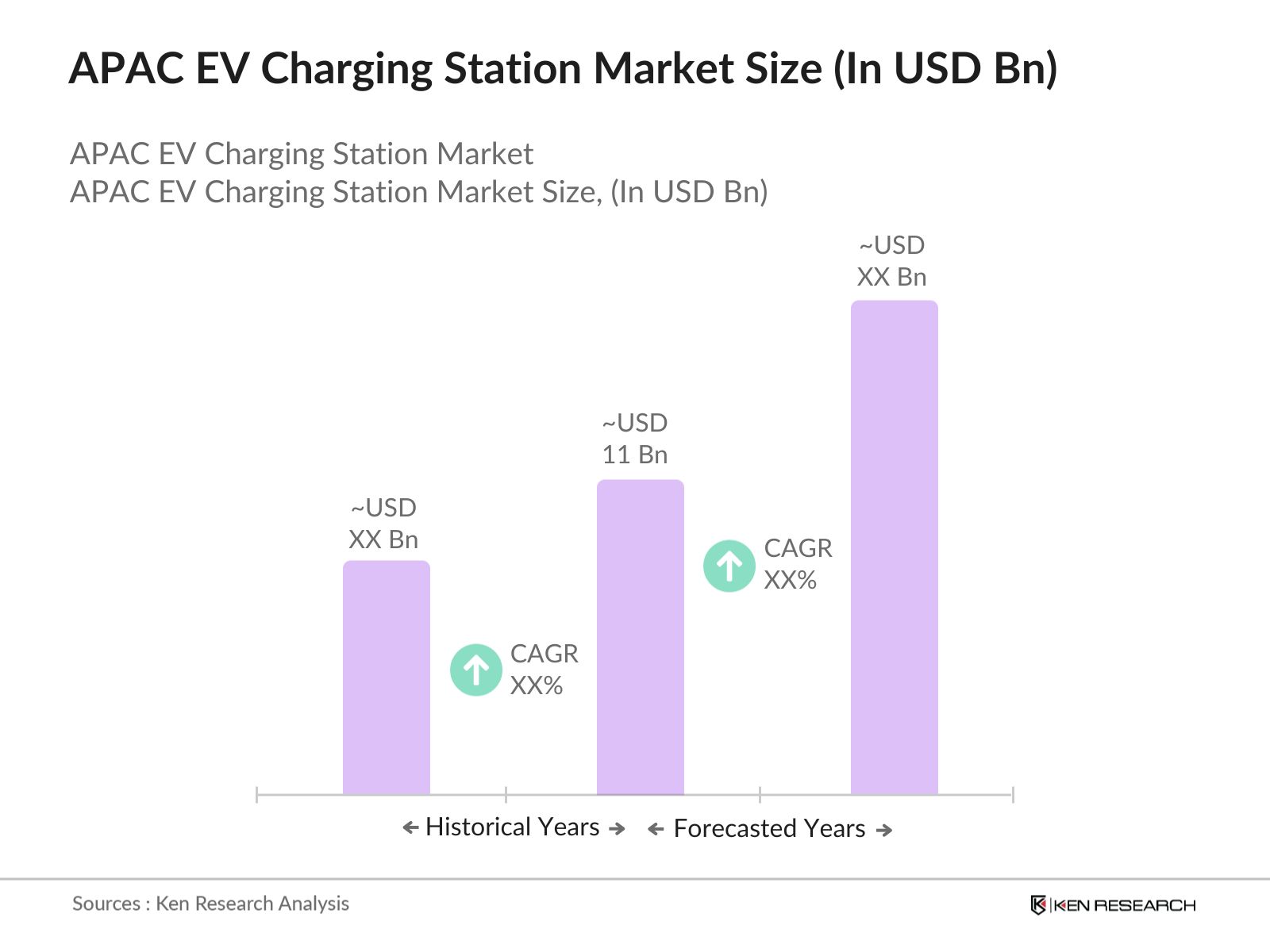

- The APAC electric vehicle (EV) charging station market is valued at USD 11 billion, driven primarily by the surging adoption of electric vehicles across key markets such as China, India, and Japan. The rapid increase in EV adoption, supported by government initiatives and rising environmental consciousness, has significantly boosted the demand for EV charging infrastructure. The market's expansion is further fueled by technological advancements in charging solutions, including wireless and fast-charging technologies. This growth is reinforced by initiatives aimed at reducing carbon emissions and the increasing demand for sustainable energy solutions.

- China dominates the APAC EV charging station market, followed closely by Japan and South Korea. China's leadership is driven by its aggressive EV adoption policies, government subsidies, and a well-established EV manufacturing sector. Furthermore, cities like Beijing, Shanghai, and Shenzhen are at the forefront due to their substantial investment in EV infrastructure, including widespread public charging stations and smart charging solutions. Japan and South Korea follow suit, with significant advancements in technology and government-backed incentives for EV adoption.

- Governments across APAC are implementing national policies to accelerate EV infrastructure development. Chinas National Development and Reform Commission outlined plans in 2023 to install 20 million EV charging points by 2025, backed by substantial government funding. India has also developed a comprehensive EV policy, with targets to install 1 million public charging stations by 2025, particularly in urban centers. These policies ensure consistent development of infrastructure across the region, facilitating the rapid adoption of electric vehicles.

APAC EV Charging Station Market Segmentation

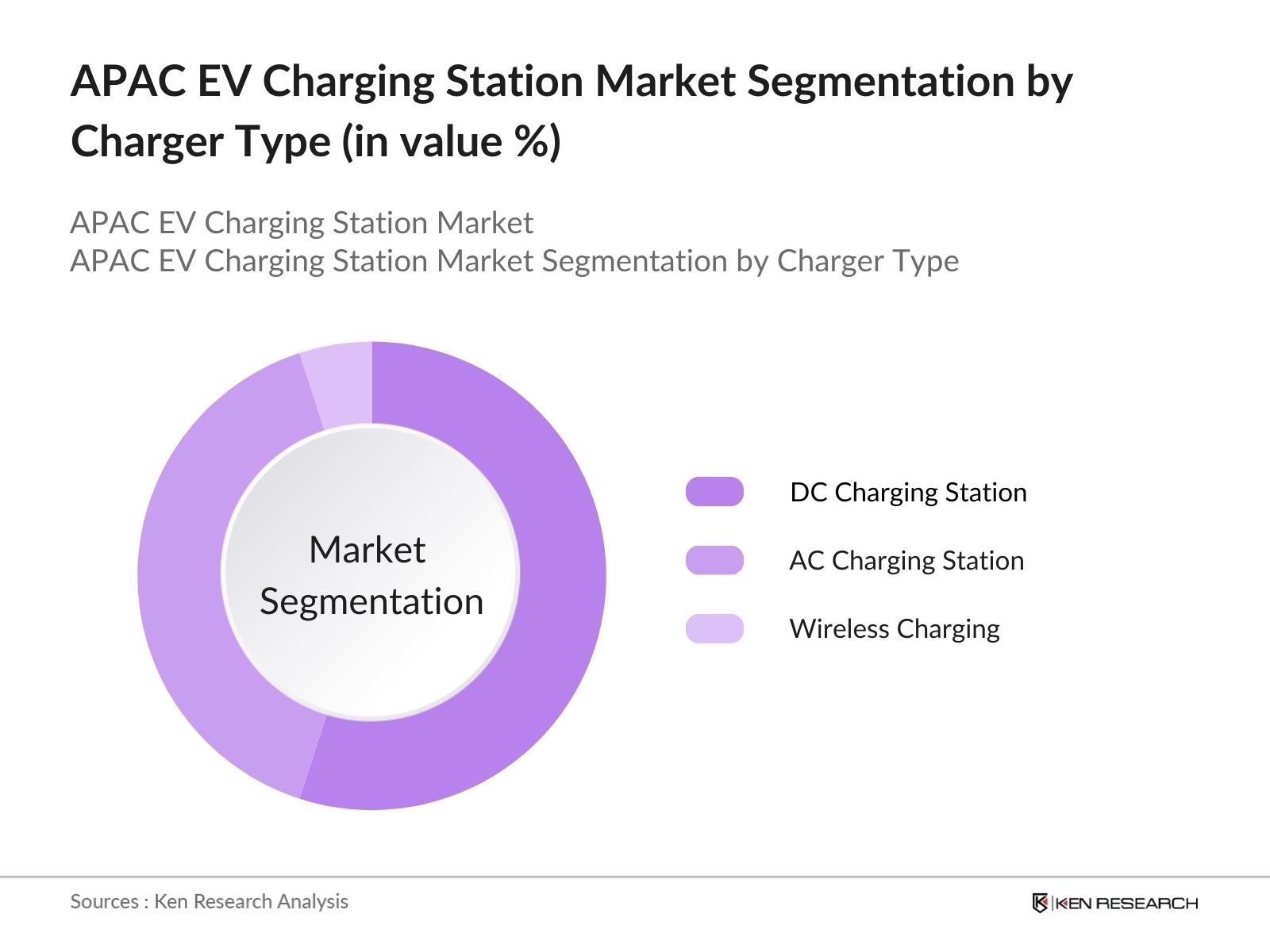

- By Charger Type: The APAC EV charging station market is segmented by charger type into AC charging stations, DC charging stations, and wireless charging. In 2023, DC charging stations hold the dominant market. This is attributed to their ability to provide rapid charging solutions, addressing the primary concern of range anxiety among EV users. The growing demand for fast, efficient charging infrastructure, particularly for long-distance travel, has bolstered the adoption of DC chargers, which offer quicker charge times compared to their AC counterparts.

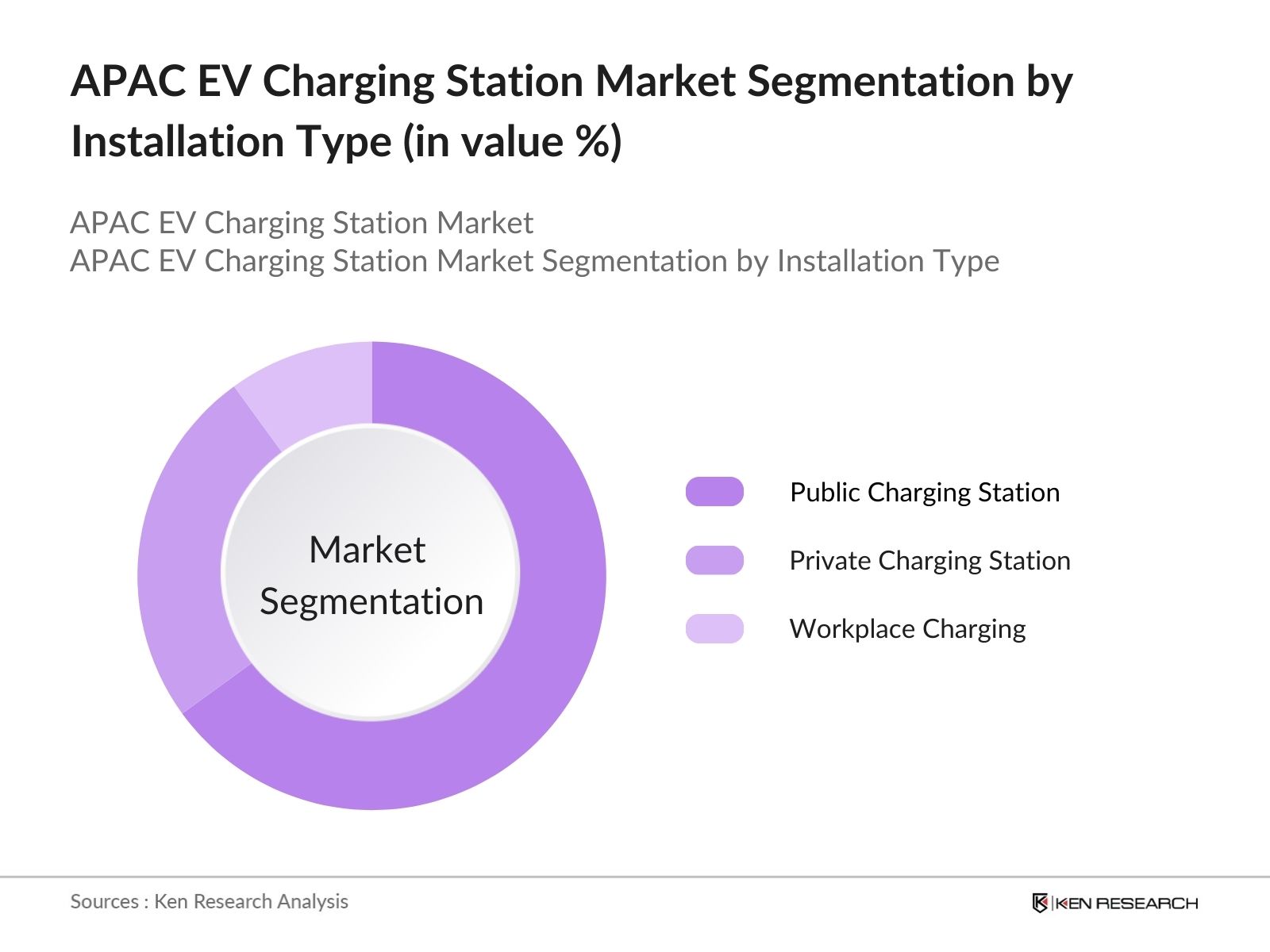

- By Installation Type: The market is further segmented by installation type into public charging stations, private charging stations, and workplace charging. Public charging stations dominate the market due to extensive government and private investments aimed at creating a widespread charging network for public use. Governments across APAC are encouraging the development of public charging stations through incentives and regulatory mandates, ensuring that charging infrastructure keeps pace with the growing EV adoption rate. The convenience of publicly accessible chargers has driven their widespread use across both urban and semi-urban areas.

APAC EV Charging Station Market Competitive Landscape

The APAC EV charging station market is characterized by the dominance of both global and regional players. Companies are actively focusing on technological innovation, strategic partnerships, and geographic expansion to maintain their market position. For instance, Teslas Supercharger network is expanding rapidly across major APAC markets, while local players like BYD and Delta Electronics are reinforcing their presence through collaborations with government entities and auto manufacturers.

|

Company |

Establishment Year |

Headquarters |

Charger Types |

Charging Speed (kW) |

Geographic Reach |

Strategic Partnerships |

R&D Investment (USD) |

Installed Charging Points |

|

Tesla |

2003 |

California, USA |

- | - | - | - | - | - |

|

BYD |

1995 |

Shenzhen, China |

- | - | - | - | - | - |

|

Delta Electronics |

1971 |

Taipei, Taiwan |

- | - | - | - | - | - |

|

Siemens AG |

1847 |

Munich, Germany |

- | - | - | - | - | - |

|

Tata Power |

1919 |

Mumbai, India |

APAC EV Charging Station Industry Analysis

Market Growth Drivers

- Government Policies (Subsidies, Incentives, Mandates): Government support across the APAC region has been pivotal in the expansion of EV charging infrastructure. In 2024, China continues to lead in implementing substantial subsidies and tax incentives, reducing the cost of EV adoption. For example, China allocated $2.5 billion for EV infrastructure development through various state subsidies, ensuring the deployment of nearly 1.8 million new charging stations by 2025. Similarly, India's Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme offers subsidies to both manufacturers and consumers, promoting a significant rise in EV adoption rates.

- Rising Electric Vehicle Sales (EV Adoption Rate, Growth of EV Market): Electric vehicle sales in APAC have surged, with countries like China and South Korea leading the region in terms of adoption. As of 2023, China sold over 3 million electric vehicles, representing a substantial portion of global EV sales. South Korea saw an increase in EV registrations by 500,000 in 2023. Governments are aggressively promoting EV adoption through financial incentives, with Japan offering subsidies up to $4,000 for EV buyers. The rapid growth in EV sales is directly driving demand for a robust charging network across the region.

- Technological Advancements (Smart Charging, Wireless Charging): Technological innovations are transforming EV charging in APAC, with advancements such as smart charging and wireless charging being implemented. In 2023, Japan rolled out its first commercial wireless charging stations, allowing EVs to charge without being physically connected to the grid. Meanwhile, South Korea has begun implementing smart charging stations that adapt to grid demand, ensuring optimal charging during peak hours. These innovations are expected to drastically reduce charging times and increase overall system efficiency, catering to the growing EV fleet across the region.

Market Restraints

- Lack of Standardization in Charging Protocols: The lack of standardization in charging protocols across the APAC region presents significant operational challenges. China primarily uses the GB/T protocol, while Japan relies on CHAdeMO, and South Korea employs both CHAdeMO and CCS. This lack of harmonization complicates cross-border EV usage and limits the seamless integration of EVs across multiple markets within the region. As of 2024, industry experts in Japan and South Korea are working to develop unified standards, but widespread adoption remains years away.

- Limited Grid Capacity in Rural Areas: Rural regions across the APAC face severe grid capacity limitations, hindering the deployment of EV charging stations. In India, for instance, power outages in rural areas are frequent, with over 40% of rural districts reporting grid instability as of 2023. This creates operational challenges for deploying fast-charging infrastructure, which requires a stable and robust grid connection. In Indonesia, the limited reach of the national power grid in rural provinces further hampers the expansion of EV charging networks in these areas.

APAC EV Charging Station Market Future Outlook

Over the next five years, the APAC EV charging station market is expected to experience significant growth, driven by continuous government support, advancements in EV charging technology, and rising consumer demand for eco-friendly transportation solutions. The transition towards electrification in the automotive industry, supported by ambitious net-zero carbon goals, is likely to bolster the demand for efficient charging infrastructure across the region. Additionally, investments in fast-charging networks, particularly along highways and in urban areas, will play a pivotal role in expanding the market.

Market Opportunities

- Expansion in Untapped Markets (Rural and Semi-Urban Areas): Significant potential exists for expanding EV charging infrastructure into untapped rural and semi-urban markets across the APAC region. In 2023, India identified over 1,200 rural towns where demand for EV infrastructure is projected to rise due to increasing EV adoption. Similarly, China has announced plans to expand its EV charging network to over 5,000 rural towns by 2025. With rising income levels and government-backed initiatives in these regions, the expansion of charging infrastructure will unlock new growth avenues in previously underserved markets.

- Integration with Renewable Energy (Solar-Powered Charging Stations): The integration of renewable energy sources, particularly solar power, presents a significant opportunity for the EV charging station market. In 2023, Thailand installed over 2,000 solar-powered EV charging stations, reducing dependence on the national grid and contributing to the country's sustainability goals. In Australia, government-backed initiatives are promoting the use of solar energy for EV charging, with over 1,500 stations already equipped with solar panels. This integration aligns with regional sustainability targets and reduces the operational costs of EV charging stations.

Scope of the Report

|

Segment |

Sub-segments |

|

Charger Type |

AC Charging Station |

|

DC Charging Station |

|

|

Wireless Charging |

|

|

Connector Type |

CHAdeMO |

|

CCS |

|

|

GB/T |

|

|

Type 2 |

|

|

Installation Type |

Public Charging Station |

|

Private Charging Station |

|

|

Workplace Charging |

|

|

Charging Speed |

Slow Charging |

|

Fast Charging |

|

|

Ultra-Fast Charging |

|

|

Country |

China |

|

India |

|

|

Japan |

|

|

South Korea |

|

|

Australia |

Products

Key Target Audience

Electric Vehicle Manufacturers

Charging Station Operators

Utility Providers

Government and Regulatory Bodies (e.g., Ministry of Transport, Chinas National Development and Reform Commission)

Automotive OEMs

Infrastructure Development Firms

Investment and Venture Capitalist Firms

Renewable Energy Providers

Companies

Players Mentioned in the Report:

Tesla

BYD

Delta Electronics

Siemens AG

Tata Power

ABB Ltd.

Schneider Electric

EVBox Group

ChargePoint, Inc.

BP Pulse

Shell Recharge

Star Charge

Tritium DCFC Limited

Envision Digital

Hyundai Motor Company

Table of Contents

1. APAC EV Charging Station Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. APAC EV Charging Station Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. APAC EV Charging Station Market Analysis

3.1. Growth Drivers

3.1.1. Government Policies (Subsidies, Incentives, Mandates)

3.1.2. Rising Electric Vehicle Sales (EV Adoption Rate, Growth of EV Market)

3.1.3. Expansion of Charging Infrastructure (Public & Private Initiatives)

3.1.4. Technological Advancements (Smart Charging, Wireless Charging)

3.2. Market Challenges

3.2.1. High Installation Costs

3.2.2. Lack of Standardization in Charging Protocols

3.2.3. Limited Grid Capacity in Rural Areas

3.3. Opportunities

3.3.1. Expansion in Untapped Markets (Rural and Semi-Urban Areas)

3.3.2. Integration with Renewable Energy (Solar-Powered Charging Stations)

3.3.3. Partnerships and Collaborations with OEMs

3.4. Trends

3.4.1. Adoption of Fast Charging Solutions (High-Power Charging Stations)

3.4.2. Deployment of IoT-based Charging Solutions

3.4.3. Increasing Use of Ultra-Rapid Chargers (Ultra-High DC Charging Stations)

3.5. Government Regulation

3.5.1. National EV Infrastructure Policy

3.5.2. Zero Emission Vehicle Mandates

3.5.3. Public-Private Partnerships (EV Infrastructure Grants)

3.5.4. Tax Incentives for Charging Station Installation

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Utility Providers, EV Manufacturers, Charging Station Operators)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. APAC EV Charging Station Market Segmentation

4.1. By Charger Type (In Value %) 4.1.1. AC Charging Station

4.1.2. DC Charging Station

4.1.3. Wireless Charging

4.2. By Connector Type (In Value %) 4.2.1. CHAdeMO

4.2.2. CCS

4.2.3. GB/T

4.2.4. Type 2

4.3. By Installation Type (In Value %) 4.3.1. Public Charging Station

4.3.2. Private Charging Station

4.3.3. Workplace Charging

4.4. By Charging Speed (In Value %) 4.4.1. Slow Charging

4.4.2. Fast Charging

4.4.3. Ultra-Fast Charging

4.5. By Country (In Value %) 4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Australia

5. APAC EV Charging Station Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ABB Ltd.

5.1.2. Tesla, Inc.

5.1.3. Schneider Electric

5.1.4. Siemens AG

5.1.5. ChargePoint, Inc.

5.1.6. BYD Company Ltd.

5.1.7. Delta Electronics, Inc.

5.1.8. EVBox Group

5.1.9. BP Pulse

5.1.10. Shell Recharge

5.1.11. Tata Power

5.1.12. NIO Power

5.1.13. Star Charge

5.1.14. Envision Digital

5.1.15. Tritium DCFC Limited

5.2. Cross Comparison Parameters

No. of Employees

Headquarters

Inception Year

Revenue

Market Share (Global/Regional)

Charging Stations Installed

Product Portfolio (Charger Types, Connector Compatibility)

Strategic Partnerships (OEMs, Governments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. APAC EV Charging Station Market Regulatory Framework

6.1. EV Infrastructure Standards (Charging Protocols, Safety Regulations)

6.2. Compliance Requirements (Country-Specific EV Charging Standards)

6.3. Certification Processes (ISO Standards, Local Certifications)

7. APAC EV Charging Station Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. APAC EV Charging Station Future Market Segmentation

8.1. By Charger Type (In Value %)

8.2. By Connector Type (In Value %)

8.3. By Installation Type (In Value %)

8.4. By Charging Speed (In Value %)

8.5. By Country (In Value %)

9. APAC EV Charging Station Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping out the ecosystem of the APAC EV Charging Station Market. This includes identifying key stakeholders such as EV manufacturers, utility providers, and charging station operators. A combination of desk research and proprietary databases is employed to extract critical data on market size, segmentation, and technological advancements.

Step 2: Market Analysis and Construction

We analyze historical data, focusing on market penetration of EVs and the number of installed charging points. This includes an evaluation of key geographic regions, assessing the market share by charger type, and installation type. Revenue data and growth trends are further evaluated to ensure reliable forecasting.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are generated based on preliminary research and are validated through consultations with industry experts from key companies. Interviews with stakeholders help refine the analysis, ensuring accuracy in the data and projections.

Step 4: Research Synthesis and Final Output

In this phase, the final report is synthesized, incorporating feedback from stakeholders. The data is reviewed and cross-checked with both top-down and bottom-up approaches to ensure that the report delivers a comprehensive and accurate overview of the APAC EV Charging Station Market.

Frequently Asked Questions

1. How big is the APAC EV Charging Station Market?

The APAC EV Charging Station Market is valued at USD 11 billion, driven by increasing electric vehicle sales, government subsidies, and the expansion of charging infrastructure across the region.

2. What are the challenges in the APAC EV Charging Station Market?

Challenges include high initial installation costs, lack of standardization in charging protocols, and limited grid capacity, especially in rural regions. Overcoming these challenges will be crucial for sustained growth.

3. Who are the major players in the APAC EV Charging Station Market?

Key players include Tesla, BYD, Delta Electronics, Siemens AG, and Tata Power, among others. These companies dominate the market due to their technological innovations, extensive charging networks, and strong government partnerships.

4. What are the growth drivers of the APAC EV Charging Station Market?

The growth is driven by rising electric vehicle adoption, government policies promoting EV infrastructure, and technological advancements in charging solutions such as fast and wireless charging technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.