APAC Eyewear Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD5972

December 2024

86

About the Report

APAC Eyewear Market Overview

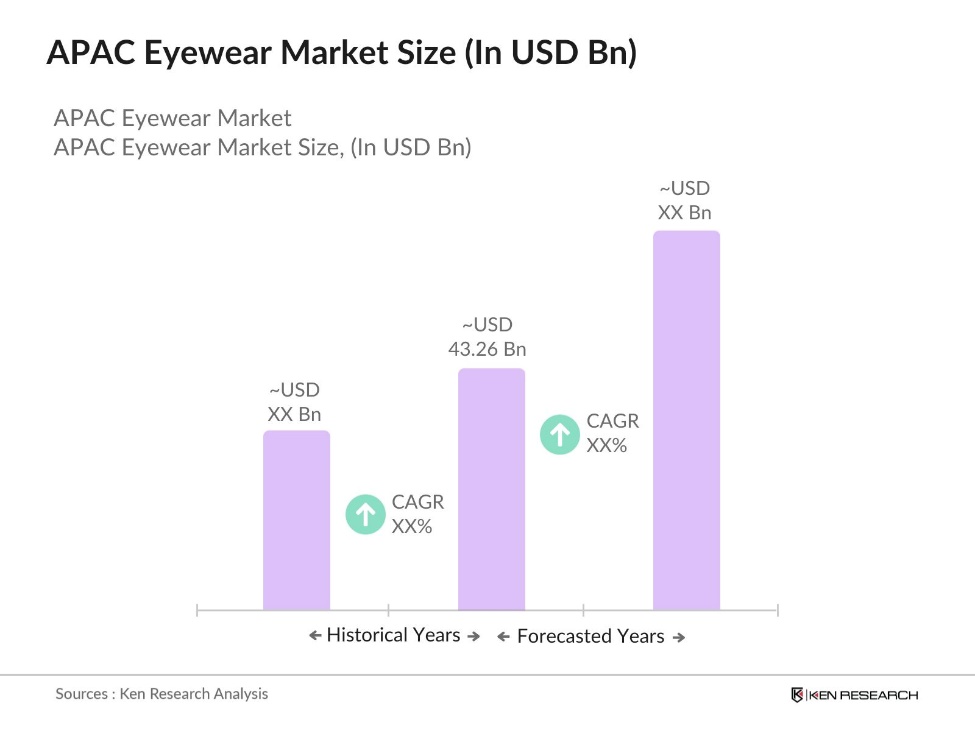

- The APAC Eyewear Market is valued at USD 43.26 billion, based on a five-year historical analysis. This market has been largely driven by a growing awareness of eye health due to increased screen time, technological advancements in eyewear, and rising fashion consciousness. The region's aging population and rising disposable incomes have further boosted demand for both prescription eyewear and premium products, particularly smart and luxury eyewear.

- China, India, and Japan dominate the APAC Eyewear market. Chinas dominance can be attributed to its vast consumer base, increased disposable income, and a strong manufacturing sector. India is rapidly growing due to its large population and increasing awareness of eye health, while Japans technologically advanced eyewear products, such as smart eyewear, have ensured its position as a leading market player.

- In 2024, Japan's simplified tariff system offers reduced or duty-free rates for products from developing countries. Imports under 200,000 (~$1,887) benefit from simplified classification, streamlining customs processes and cutting brokerage fees. This initiative supports businesses by making imports faster and more cost-effective. Additionally, Japan provides advance rulings on tariff classifications and has introduced measures to ensure transparency in customs operations, enhancing trade efficiency.

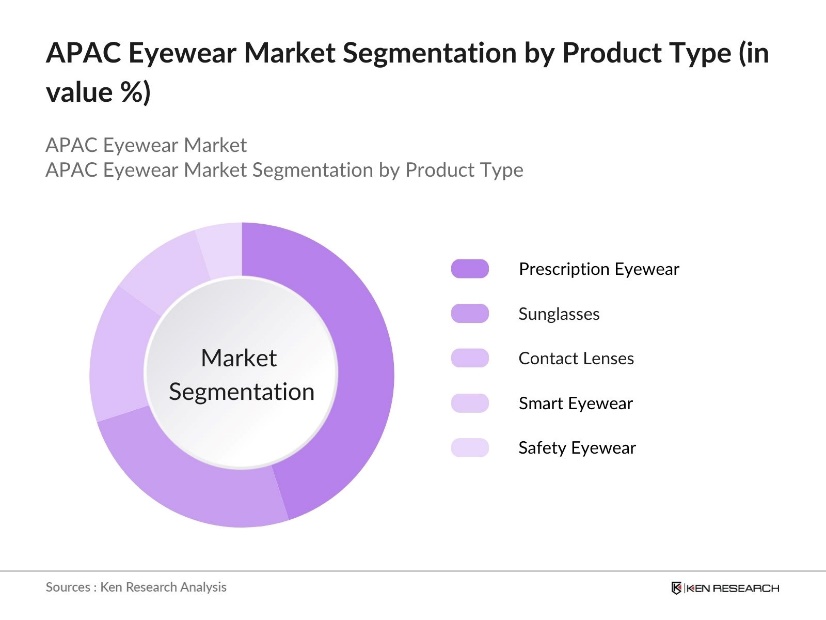

APAC Eyewear Market Segmentation

By Product Type: The APAC Eyewear market is segmented by product type into prescription eyewear, sunglasses, contact lenses, smart eyewear, and safety eyewear. Among these, prescription eyewear holds a dominant market share due to the growing number of people requiring vision correction across urban and rural populations. The increased screen time from digital devices has exacerbated eye strain and vision issues, making prescription glasses a necessity for many consumers. Additionally, there is a strong demand for customization and fashionable frames in this segment.

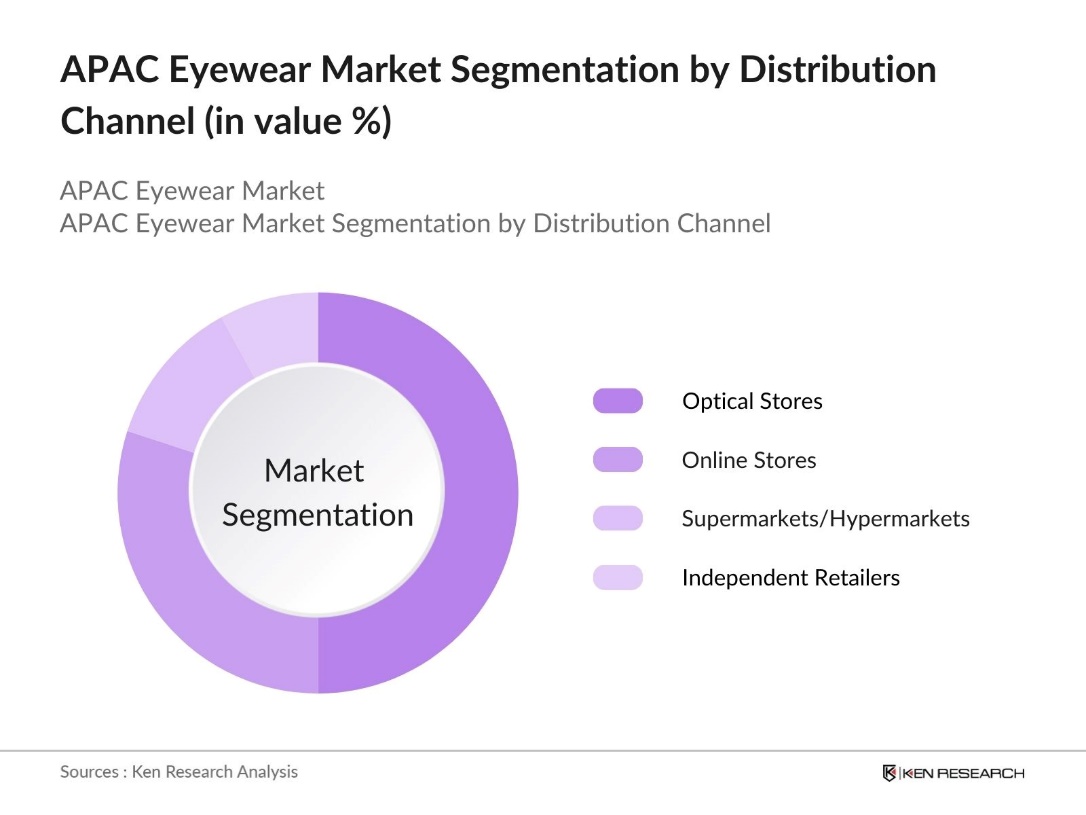

By Distribution Channel: The APAC Eyewear market is also segmented by distribution channels into optical stores, online stores, supermarkets/hypermarkets, and independent retailers. Optical stores remain the dominant distribution channel, holding the largest market share. This is due to the consumer preference for in-person eye tests and fitting services offered at these stores. However, online channels are witnessing rapid growth, especially with younger consumers and tech-savvy individuals, who prefer the convenience and vast array of choices available online.

APAC Eyewear Market Competitive Landscape

The market is dominated by both global and regional players. The competitive landscape includes key players such as Luxottica Group, Essilor International, and Johnson & Johnson Vision Care. These companies have established a strong presence due to their global reach, product innovations, and investments in branding and marketing. Additionally, the market is highly fragmented with many local and smaller players offering affordable eyewear solutions to meet the needs of various consumer segments.

|

Company |

Year Established |

Headquarters |

Product Range |

Revenue (USD Bn) |

Retail Footprint |

Digital Presence |

Sustainability Initiatives |

Brand Recognition |

|

Luxottica Group |

1961 |

Milan, Italy |

||||||

|

Essilor International |

1849 |

Charenton-le-Pont, France |

||||||

|

Johnson & Johnson Vision |

1886 |

New Brunswick, USA |

||||||

|

Hoya Corporation |

1941 |

Tokyo, Japan |

||||||

|

Safilo Group |

1934 |

Padua, Italy |

APAC Eyewear Industry Analysis

Growth Drivers

- Increased Consumer Awareness on Eye Health: Consumer awareness around eye health has risen significantly across the Asia-Pacific region, with countries such as Japan and South Korea witnessing substantial growth in demand for prescription eyewear. According to the World Health Organization (WHO), at least 2.2 billion people globally experience some form of vision impairment, with approximately 1 billion of these cases being preventable or yet to be addressed. currently suffer from vision impairment, making the need for corrective lenses a crucial market driver.

- Rising Fashion Consciousness: Fashion-driven eyewear has gained significant traction in APAC markets, especially in urban areas of countries like China, India, and South Korea. For instance, the collaboration between Jennie Kim from BLACKPINK and Gentle Monster, a South Korean luxury eyewear brand. This partnership has resulted in successful product lines like Jentle Home and Jentle Garden, which have attracted significant media attention and consumer interest globally.

- Increasing Usage of Digital Devices: The widespread use of digital devices in the Asia-Pacific region has led to increased demand for eyewear to combat eye strain. The surge in internet usage and the proliferation of smartphones have significantly contributed to the need for protective eyewear, particularly blue-light filtering glasses. As more people spend extended periods in front of screens, optical prescriptions for screen-related vision problems are on the rise. This trend is noticeable across both developed and developing markets in the region, where the digital shift is rapidly transforming consumer behavior towards eyewear products.

Market Challenges

- Counterfeit Eyewear Products: The widespread availability of counterfeit eyewear in APAC, especially in China and Southeast Asia, challenges the growth of legitimate brands. These knock-offs erode consumer trust and reduce sales of authentic products. Regulatory bodies are working to curb the spread of fake goods, but counterfeit products still make it difficult for consumers to differentiate between real and fake eyewear.

- High Cost of Branded Eyewear: The high cost of branded eyewear in developing APAC economies limits its accessibility. Many consumers, especially in rural areas, find premium eyewear unaffordable compared to local alternatives. This price gap discourages the adoption of high-end products, leading most buyers to opt for cheaper, non-branded options instead, especially in regions with lower disposable incomes.

APAC Eyewear Market Future Outlook

The APAC Eyewear market is expected to see significant growth over the next five years, driven by the increasing demand for both corrective and non-corrective eyewear. Factors such as the adoption of smart eyewear technologies, growing fashion consciousness, and the rise of disposable incomes are likely to accelerate market growth. The expansion of e-commerce and digital marketing channels will further provide new growth avenues, particularly among the younger population who are more inclined towards purchasing eyewear online.

Market Opportunities

- Expansion in Emerging Economies: Emerging economies in the APAC region, such as Vietnam and the Philippines, present significant opportunities for eyewear expansion. With growing urbanization and increasing disposable incomes, these markets are becoming more attractive for multinational eyewear brands. As consumer demand rises and local optical retail infrastructure improves, companies can penetrate these underserved markets, establishing a foothold and catering to the evolving needs of the population.

- Online Retail Expansion: The rapid growth of e-commerce in the APAC region has created new opportunities for eyewear sales. Online platforms offer consumers easy access to a wide variety of eyewear products, allowing brands to reach previously untapped markets. As online shopping continues to rise, eyewear companies are increasingly relying on digital retail channels to expand their customer base and provide convenient purchasing options.

Scope of the Report

|

By Product Type |

Prescription Eyewear Sunglasses Contact Lenses Smart Eyewear Safety Eyewear |

|

By End-User |

Men Women Unisex Children |

|

By Distribution Channel |

Optical Stores Online Stores Supermarkets/Hypermarkets Independent Retailers |

|

By Frame Material |

Metal Frames Plastic Frames Natural Material Frames |

|

By Region |

China India Japan South Korea Australia |

Products

Key Target Audience

Eyewear Manufacturers

Pharmaceutical Companies

Hospitality Industry

Optical Lens Coating Companies

E-Commerce Platforms

Government and Regulatory Bodies (such as China's State Administration for Market Regulation)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Luxottica Group

Essilor International

Johnson & Johnson Vision Care

Safilo Group

Hoya Corporation

CooperVision

Fielmann AG

Carl Zeiss Vision

Shanghai Conant Optics

Warby Parker

Table of Contents

1. APAC Eyewear Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. APAC Eyewear Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. APAC Eyewear Market Analysis

3.1. Growth Drivers

3.1.1. Increased Consumer Awareness on Eye Health (Market-specific parameter)

3.1.2. Rising Fashion Consciousness (Market-specific parameter)

3.1.3. Increasing Usage of Digital Devices (Market-specific parameter)

3.1.4. Growing Aging Population (Market-specific parameter)

3.2. Market Challenges

3.2.1. Counterfeit Eyewear Products (Market-specific parameter)

3.2.2. High Cost of Branded Eyewear (Market-specific parameter)

3.2.3. Fluctuations in Raw Material Prices (Market-specific parameter)

3.3. Opportunities

3.3.1. Expansion in Emerging Economies (Market-specific parameter)

3.3.2. Online Retail Expansion (Market-specific parameter)

3.3.3. Adoption of Smart Eyewear (Market-specific parameter)

3.4. Trends

3.4.1. Sustainability and Eco-friendly Eyewear (Market-specific parameter)

3.4.2. Customization of Eyewear (Market-specific parameter)

3.4.3. Luxury Eyewear as a Status Symbol (Market-specific parameter)

3.5. Government Regulations

3.5.1. Optical Product Standards

3.5.2. Regulations on Counterfeit Products

3.5.3. Trade Policies and Import/Export Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Market-specific parameter: Manufacturers, Retailers, Distributors)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. APAC Eyewear Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Prescription Eyewear

4.1.2. Sunglasses

4.1.3. Contact Lenses

4.1.4. Smart Eyewear

4.1.5. Safety Eyewear

4.2. By End-User (In Value %)

4.2.1. Men

4.2.2. Women

4.2.3. Unisex

4.2.4. Children

4.3. By Distribution Channel (In Value %)

4.3.1. Optical Stores

4.3.2. Online Stores

4.3.3. Supermarkets/Hypermarkets

4.3.4. Independent Retailers

4.4. By Frame Material (In Value %)

4.4.1. Metal Frames

4.4.2. Plastic Frames

4.4.3. Natural Material Frames

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Australia

5. APAC Eyewear Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Luxottica Group

5.1.2. Essilor International

5.1.3. Johnson & Johnson Vision Care

5.1.4. Safilo Group

5.1.5. CooperVision

5.1.6. Hoya Corporation

5.1.7. De Rigo Vision

5.1.8. Bausch & Lomb

5.1.9. Fielmann AG

5.1.10. GrandVision

5.1.11. Marcolin Group

5.1.12. Carl Zeiss Vision

5.1.13. Shanghai Conant Optics

5.1.14. Warby Parker

5.1.15. Maui Jim

5.2. Cross Comparison Parameters (Product Range, Retail Footprint, Pricing Strategy, Brand Recognition, Market Share, Digital Presence, Sustainability Initiatives, M&A Activity)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. APAC Eyewear Market Regulatory Framework

6.1. Product Safety Standards

6.2. Consumer Protection Regulations

6.3. Import and Export Regulations

6.4. Environmental Regulations

7. APAC Eyewear Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. APAC Eyewear Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By End-User (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Frame Material (In Value %)

8.5. By Region (In Value %)

9. APAC Eyewear Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the APAC Eyewear Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the APAC Eyewear Market. This includes assessing market penetration, the ratio of eyewear retailers to manufacturers, and revenue generation. Furthermore, an evaluation of consumer trends will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple eyewear manufacturers and retailers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the APAC Eyewear market.

Frequently Asked Questions

01 How big is the APAC Eyewear Market?

The APAC Eyewear Market is valued at USD 43.26 billion, based on a five-year historical analysis. This market has been driven by growing consumer demand for vision correction solutions, increasing fashion consciousness, and advancements in smart eyewear technologies.

02 What are the challenges in the APAC Eyewear Market?

Key challenges in the APAC Eyewear Market include the prevalence of counterfeit products, fluctuating raw material prices, and the high cost of branded eyewear. Additionally, rising competition from local manufacturers has created pressure on pricing.

03 Who are the major players in the APAC Eyewear Market?

Major players in the APAC Eyewear Market include Luxottica Group, Essilor International, Johnson & Johnson Vision Care, Safilo Group, and Hoya Corporation. These companies dominate due to their global presence, product innovation, and strong distribution networks.

04 What are the growth drivers of the APAC Eyewear Market?

The APAC Eyewear Market is propelled by factors such as increasing screen time leading to eye strain, growing awareness of eye health, and the rising popularity of eyewear as a fashion accessory. The adoption of smart eyewear and expansion of online retail channels are also boosting market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.