APAC Frozen Fruits and Vegetables Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD10194

November 2024

83

About the Report

APAC Frozen Fruits and Vegetables Market Overview

- The APAC Frozen Fruits and Vegetables Market is valued at USD 1.5 billion, based on a five-year historical analysis. This growth is driven by increasing consumer demand for convenient, healthy options and the expansion of cold chain infrastructure. Additionally, awareness about the nutritional benefits retained by frozen fruits and vegetables has contributed to the market's growth, especially in urban areas where busy lifestyles drive demand for quick, nutritious options. This expansion is also supported by advanced freezing technologies and strategic partnerships with foodservice providers.

- China and Japan dominate this market within APAC due to robust distribution networks, large urban populations, and strong consumer acceptance of frozen foods. Chinas growth is further fueled by a rising middle class and expanding e-commerce platforms. In Japan, high demand for convenient and healthy food options aligns with an established culture of frozen food consumption, positioning these countries as leading forces within the market.

- Quality certifications like U.S. FDA and Indias FSSAI shape APAC frozen food imports, ensuring food safety and high standards. These certifications are vital for brands aiming to meet the preferences of health-conscious consumers in APAC regions, especially in Japan and South Korea, where rigorous quality control is prioritized to meet consumer expectations.

APAC Frozen Fruits and Vegetables Market Segmentation

By Product Type: The market is segmented by product type into frozen fruits, frozen vegetables, mixed varieties, and exotic fruits and vegetables. Frozen vegetables lead this segment, largely because of their widespread use in cooking and their longer shelf life, which resonates with cost-conscious consumers in APAC. Leading products like broccoli, peas, and carrots enjoy popularity in both residential and commercial settings, especially in countries like China and India, where culinary versatility makes these products indispensable.

By Distribution Channel: In APAC, the distribution channel segmentation comprises supermarkets & hypermarkets, online retailers, specialty stores, and the HoReCa (Hotels, Restaurants, and Catering) sector. Supermarkets and hypermarkets hold a dominant position in the distribution landscape due to their established infrastructure, broad product availability, and focus on in-store promotions, making it convenient for urban consumers. Additionally, these channels cater to a wide range of consumers, from families seeking variety to bulk purchasers.

APAC Frozen Fruits and Vegetables Market Competitive Landscape

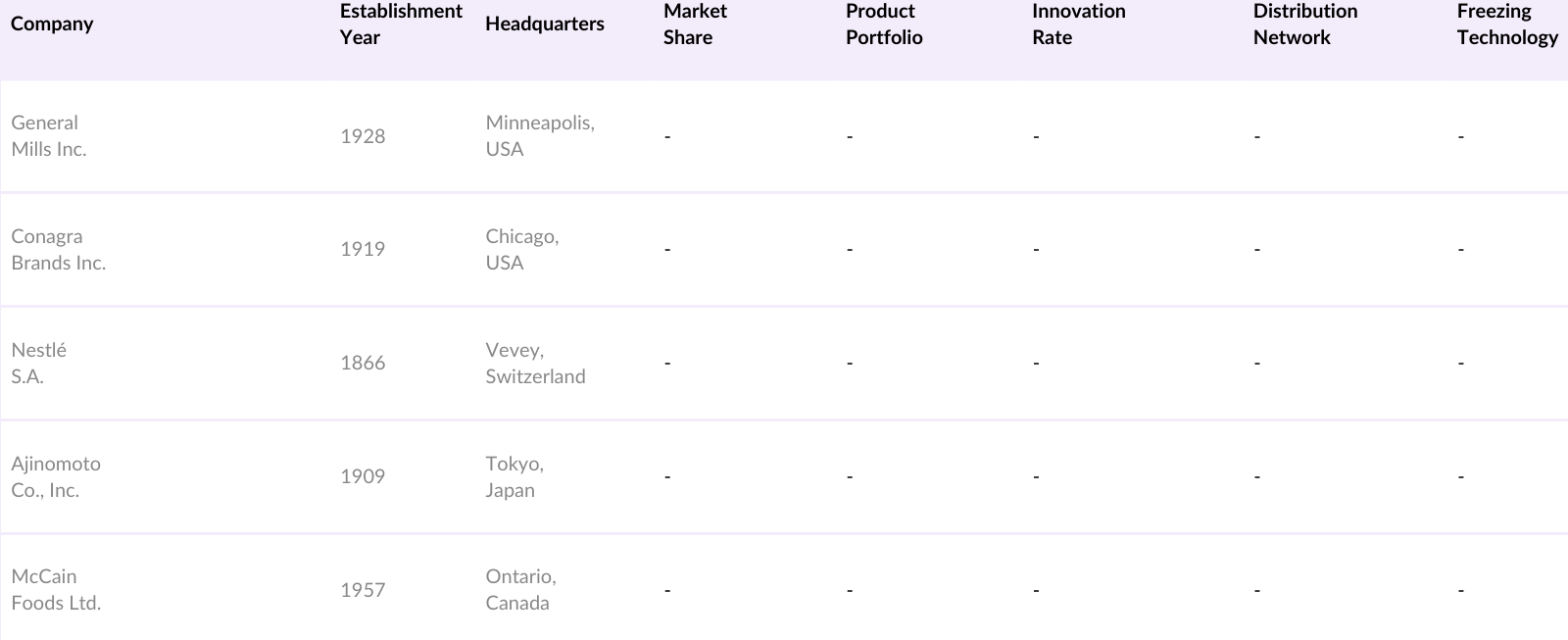

The APAC Frozen Fruits and Vegetables market is led by a few prominent players, including major global and regional companies. The competitive landscape is shaped by significant investments in R&D, adoption of eco-friendly packaging, and technological advancements in freezing processes. This market's consolidation reflects the influence and market power of these companies, who are setting trends in product innovation and sustainability initiatives.

APAC Frozen Fruits and Vegetables Industry Analysis

Growth Drivers

- Increasing Consumer Preference for Convenience Foods: The shift towards convenience foods in the APAC region has led to a significant rise in frozen food consumption. Japan, for example, consumes approximately 14 million metric tons of fresh vegetables, with an increasing proportion of these items now processed and frozen to cater to consumers with busy lifestyles. The preference for frozen fruits is also growing, especially in urban areas where consumers value the extended shelf life and ease of use that frozen options provide. Rising income levels and urbanization further drive this trend, as evidenced by the 70% of Hong Kong's fruit imports re-exported to China, showing demand for high-quality frozen options in metropolitan hubs like Hong Kong and Singapore.

- Expansion of Cold Chain Logistics Infrastructure: Investment in cold chain logistics is expanding across APAC, with countries like the Philippines and Thailand seeing significant enhancements to support frozen goods. The Philippines, for example, increased its imports of processed vegetables by 40% in the first half of 2023, signaling a parallel growth in cold storage capacity as the GDP rose by 5% in the same period. This infrastructure supports consistent supply chains for frozen produce, addressing regional demands for high-quality, preserved fruits and vegetables. Government incentives for cold chain advancements further amplify growth in this sector.

- Rise in Health-Conscious Population (Functional Benefits): With a growing awareness of health benefits, APAC consumers are increasingly opting for frozen fruits and vegetables due to their retention of essential nutrients post-freezing. Japan's consumer base, for instance, shows a preference for high-nutrition vegetables like broccoli and carrots, which have remained popular in frozen form due to convenience and health benefits. The health-focused demographic, particularly in urban regions of South Korea and Singapore, prefers fruits such as berries and leafy greens, fueling demand for nutrient-preserving frozen options.

Market Challenges

- High Energy Costs (Cold Storage and Transportation): Cold storage and transportation remain costly in APAC, impacting the profitability of frozen goods. Japan, for example, incurs high energy expenses for maintaining large-scale cold chain facilities, which raises operational costs across the industry. High refrigeration costs are particularly challenging in developing nations with less access to affordable energy sources, limiting the markets accessibility to rural areas.

- Seasonal Variability and Supply Chain Disruptions: The APAC frozen foods sector faces seasonal and logistical constraints, particularly with labor shortages and climatic events impacting the supply chain. In the Philippines, logistical disruptions, such as typhoons, have historically affected vegetable production and supply, posing challenges for maintaining steady frozen food supplies. Cold chain infrastructure advancements aim to mitigate these impacts but are uneven across the region

APAC Frozen Fruits and Vegetables Market Future Outlook

The APAC Frozen Fruits and Vegetables Market is projected to see considerable growth, spurred by rising health consciousness, technological advancements in freezing methods, and expanded cold chain logistics. The trend towards plant-based diets and demand for organic frozen produce are expected to further bolster the market. As governments in APAC countries implement policies supporting food preservation technologies, and with the continuous rise of urbanization and disposable incomes, this market is primed for steady expansion.

Market Opportunities

- Growing Demand for Organic and Non-GMO Frozen Products: A shift towards organic and non-GMO frozen products is observed in APAC markets, with Japan importing over 46,000 metric tons of non-GMO vegetables in 2023, largely due to increasing consumer awareness of health and environmental impacts. Organic frozen fruits, such as berries and cherries, are also in demand across urbanized APAC areas, signaling a trend towards healthier, environmentally conscious choices.

- Innovations in Freezing Technologies (IQF, Cryogenic Freezing): Innovative freezing technologies such as Individual Quick Freezing (IQF) are enhancing product quality and shelf life, fostering growth in high-demand regions like South Korea and Hong Kong. These methods preserve the texture and nutritional content of fruits and vegetables better than traditional methods, catering to APACs health-conscious market. Advanced freezing technology investments are expected to improve production efficiency.

Scope of the Report

|

Product Type |

Frozen Fruits Frozen Vegetables Mixed Varieties Exotic Fruits and Vegetables |

|

Distribution Channel |

Supermarkets & Hypermarkets Online Retailers Specialty Stores HoReCa |

|

End-User Industry |

Residential Consumers Foodservice Industry Food Processing Industry |

|

Freezing Technique |

Blast Freezing Individual Quick Freezing (IQF) Cryogenic Freezing |

|

Country |

China Japan South Korea Australia India |

Products

Key Target Audience

Frozen food manufacturers

Supermarket and hypermarket chains

Online retail platforms

Cold chain logistics companies

Packaging solution providers (Eco-Friendly Packaging Innovators)

Investments and venture capitalist firms

Government and regulatory bodies (Food Safety and Standards Authority of India, China Food and Drug Administration)

Restaurants and HoReCa operators

Companies

Players Mentioned in the Report

General Mills Inc.

Conagra Brands Inc.

Nestl S.A.

Ajinomoto Co., Inc.

McCain Foods Ltd.

The Kraft Heinz Company

Dole Food Company Inc.

Unilever PLC

Greenyard NV

Bonduelle S.A.

Table of Contents

1. APAC Frozen Fruits and Vegetables Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. APAC Frozen Fruits and Vegetables Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. APAC Frozen Fruits and Vegetables Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Consumer Preference for Convenience Foods

3.1.2. Expansion of Cold Chain Logistics Infrastructure

3.1.3. Rise in Health-Conscious Population (Functional Benefits)

3.1.4. Increase in Disposable Income Levels

3.2. Market Challenges

3.2.1. High Energy Costs (Cold Storage and Transportation)

3.2.2. Seasonal Variability and Supply Chain Disruptions

3.2.3. Limited Penetration in Rural Areas

3.3. Opportunities

3.3.1. Growing Demand for Organic and Non-GMO Frozen Products

3.3.2. Innovations in Freezing Technologies (IQF, Cryogenic Freezing)

3.3.3. Strategic Partnerships with E-commerce Platforms

3.4. Trends

3.4.1. Adoption of Eco-Friendly Packaging Solutions

3.4.2. Growth in Private Label Offerings

3.4.3. Rising Popularity of Plant-Based Diets

3.5. Regulatory Framework

3.5.1. Import/Export Standards and Tariffs

3.5.2. Quality Standards and Certifications (FDA, FSSAI)

3.5.3. Labeling Requirements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. APAC Frozen Fruits and Vegetables Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Frozen Fruits

4.1.2. Frozen Vegetables

4.1.3. Mixed Varieties

4.1.4. Exotic Fruits and Vegetables

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets & Hypermarkets

4.2.2. Online Retailers

4.2.3. Specialty Stores

4.2.4. HoReCa (Hotels, Restaurants, and Catering)

4.3. By End-User Industry (In Value %)

4.3.1. Residential Consumers

4.3.2. Foodservice Industry

4.3.3. Food Processing Industry

4.4. By Freezing Technique (In Value %)

4.4.1. Blast Freezing

4.4.2. Individual Quick Freezing (IQF)

4.4.3. Cryogenic Freezing

4.5. By Country (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. Australia

4.5.5. India

5. APAC Frozen Fruits and Vegetables Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. General Mills Inc.

5.1.2. Conagra Brands Inc.

5.1.3. Nestl S.A.

5.1.4. The Kraft Heinz Company

5.1.5. Unilever PLC

5.1.6. Ajinomoto Co. Inc.

5.1.7. Bonduelle S.A.

5.1.8. Greenyard NV

5.1.9. Dole Food Company Inc.

5.1.10. Pinnacle Foods Inc.

5.1.11. Lamb Weston Holdings Inc.

5.1.12. J.R. Simplot Company

5.1.13. McCain Foods Ltd.

5.1.14. SunOpta Inc.

5.1.15. Ardo NV

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, Innovation Rate, Distribution Reach, Market Share, Freezing Technology, R&D Investments, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. APAC Frozen Fruits and Vegetables Market Regulatory Framework

6.1. Food Safety Standards (HACCP, ISO)

6.2. Import Tariffs and Trade Restrictions

6.3. Certification Processes (Organic, Non-GMO Certifications)

7. APAC Frozen Fruits and Vegetables Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. APAC Frozen Fruits and Vegetables Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Freezing Technique (In Value %)

8.5. By Country (In Value %)

9. APAC Frozen Fruits and Vegetables Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In this step, we create a comprehensive map of all major stakeholders in the APAC Frozen Fruits and Vegetables Market. Through secondary research and proprietary databases, we compile and verify industry-level information, pinpointing the most influential variables shaping the market.

Step 2: Market Analysis and Construction

This phase involves analyzing historical data related to the APAC market, such as consumption patterns, distribution ratios, and revenue figures. Furthermore, quality assessments are undertaken to validate revenue accuracy and assess the market's reliability metrics.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and tested through CATI interviews with industry experts and leaders across key companies, providing critical insights into operational trends, product performance, and emerging technologies. This step enables a well-rounded understanding of the markets dynamics.

Step 4: Research Synthesis and Final Output

Direct engagement with market participants, including manufacturers and distributors, is conducted to gather detailed insights. This approach serves to verify data obtained through bottom-up analysis, ensuring the report delivers a holistic and validated outlook of the APAC Frozen Fruits and Vegetables Market.

Frequently Asked Questions

01. How big is the APAC Frozen Fruits and Vegetables Market?

The APAC Frozen Fruits and Vegetables Market is valued at USD 1.5 billion, based on a five-year historical analysis. This growth is driven by increasing consumer demand for convenient, healthy options and the expansion of cold chain infrastructure.

02. What are the growth drivers in the APAC Frozen Fruits and Vegetables Market?

Key drivers include growing health awareness, urbanization, technological advancements in freezing techniques, and increased access to frozen food in rural and suburban regions.

03. Who are the major players in the APAC Frozen Fruits and Vegetables Market?

Leading players include General Mills Inc., Nestl S.A., Ajinomoto Co., Inc., McCain Foods Ltd., and Bonduelle S.A., each known for their innovative products, strong distribution networks, and commitment to sustainable practices.

04. What challenges are faced by the APAC Frozen Fruits and Vegetables Market?

Challenges include high costs associated with energy and logistics, limited rural access, and concerns over the environmental impact of packaging materials.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.