APAC Gluten-Free Products Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD6987

December 2024

93

About the Report

APAC Gluten-Free Products Market Overview

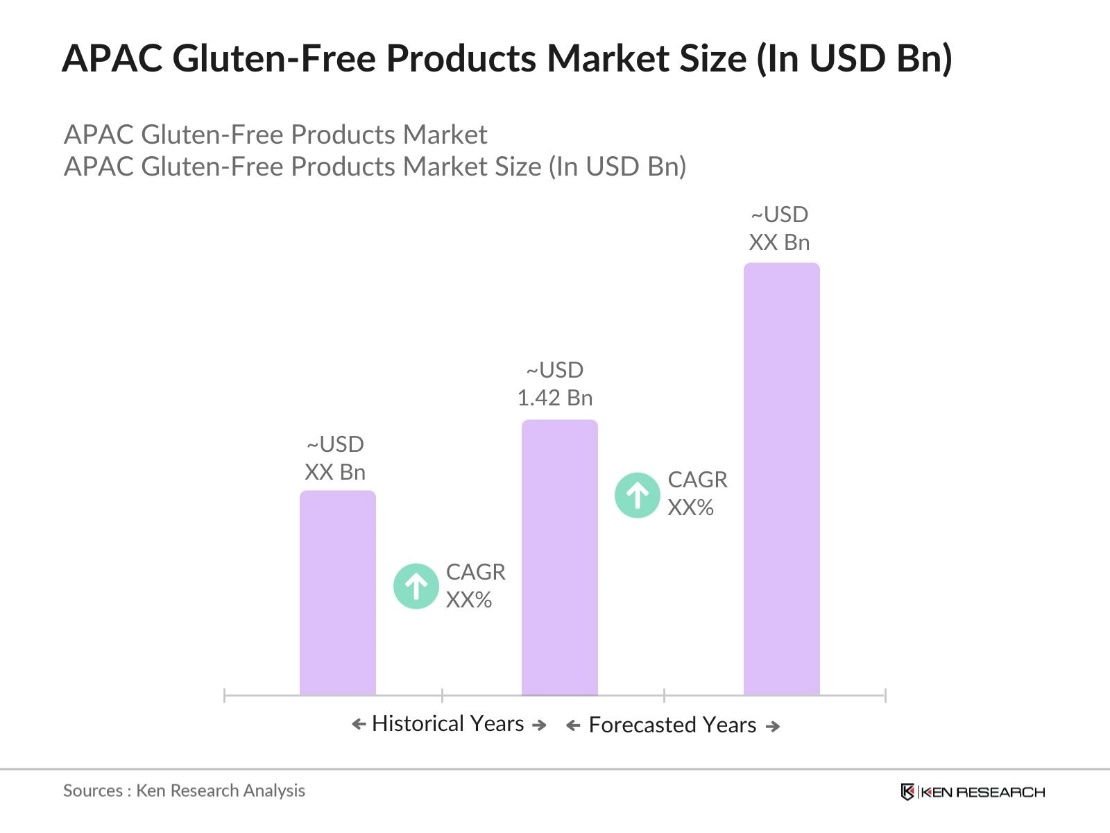

- The APAC Gluten-Free Products Market is valued at USD 1.42 billion, driven by increasing health consciousness and rising gluten intolerance rates across the region. This growth is supported by a shift towards healthier diets, influenced by consumer awareness and lifestyle changes. Expansion in retail channels, such as online stores and specialty shops, has facilitated the accessibility of gluten-free products, further driving market growth.

- Japan, China, and Australia are the dominant players in the APAC Gluten-Free Products Market due to their advanced retail infrastructure, strong consumer preference for healthy food alternatives, and proactive government initiatives encouraging dietary diversification. In Japan, gluten-free products align well with cultural trends of health-conscious living, while in Australia, a large percentage of the population opts for gluten-free products as part of their dietary regimen.

- APAC countries have strengthened allergen safety standards, with gluten among key regulated allergens. The Food Safety and Inspection Service (FSIS) in South Korea is set to expand its allergen verification sampling program starting August 1, 2024. This program aims to verify compliance with labeling regulations for ready-to-eat products that claim the absence of specific allergens, including gluten.

APAC Gluten-Free Products Market Segmentation

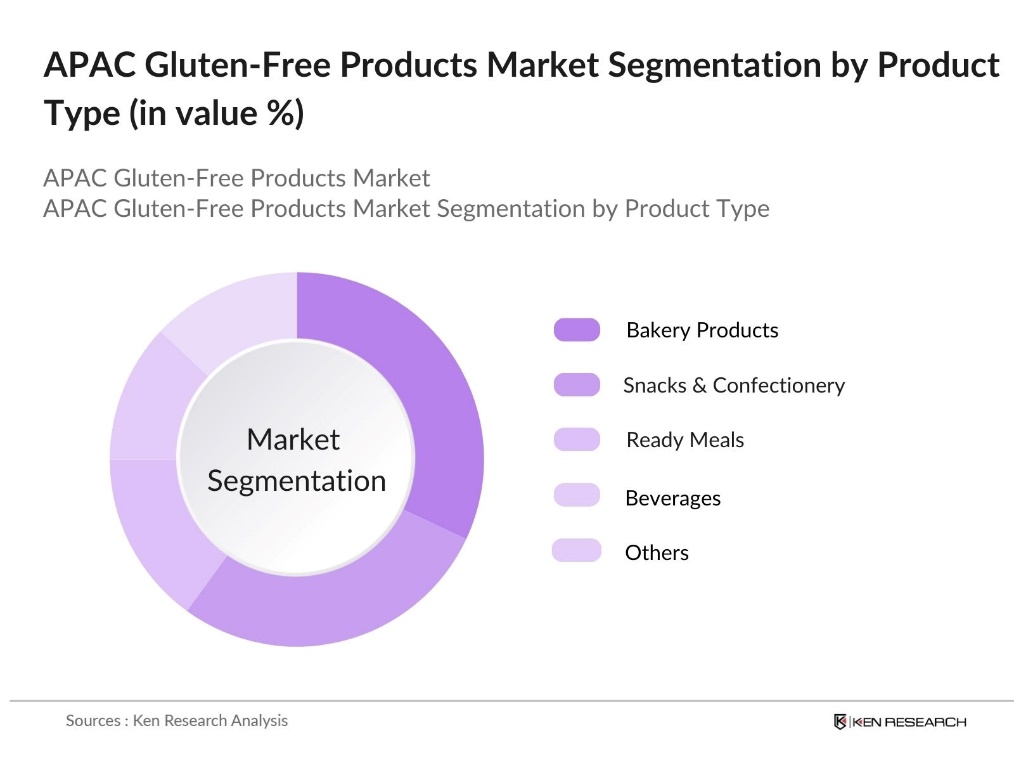

By Product Type: The market is segmented by product type into bakery products, snacks and confectionery, ready meals, beverages, and others. Bakery products currently dominate the product type segment due to their wide acceptance among consumers with gluten sensitivity, as well as those following healthier diets. The demand for gluten-free bakery items has surged due to enhanced taste and texture from new product formulations. These products align well with APACs urban demographic, which values convenient, on-the-go gluten-free options available in supermarkets and specialty stores.

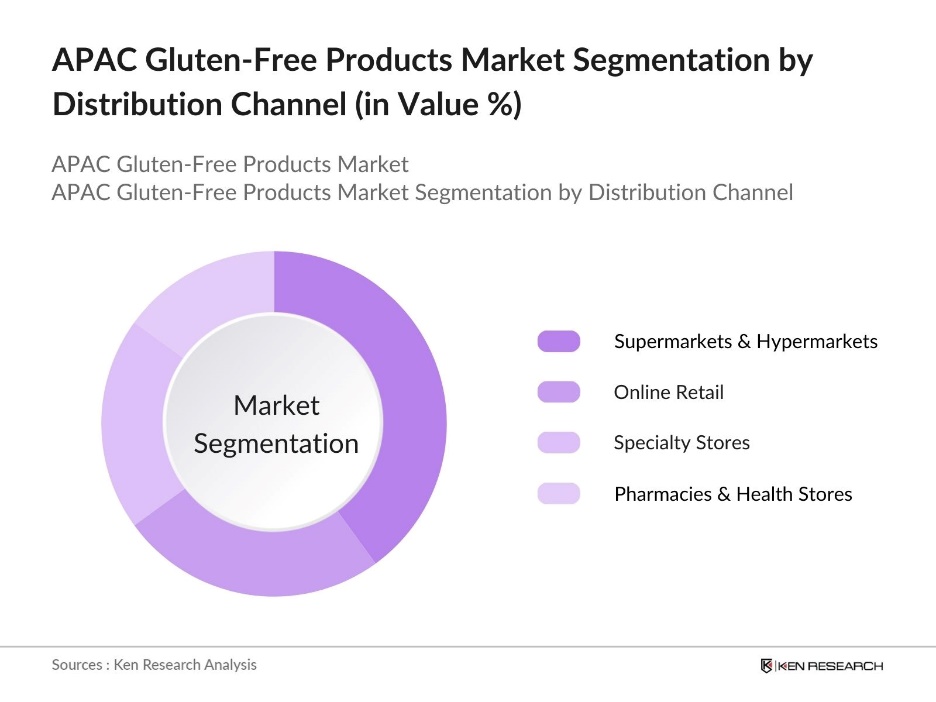

By Distribution Channel: The distribution channels in this market are segmented into supermarkets & hypermarkets, online retail, specialty stores, and pharmacies & health stores. Supermarkets and hypermarkets lead this segment as they provide the widest selection of gluten-free products, complemented by their ability to cater to a high volume of consumers. Many supermarkets have dedicated gluten-free sections, making it easier for consumers to access these products conveniently.

APAC Gluten-Free Products Market Competitive Landscape

The APAC Gluten-Free Products Market is dominated by both multinational corporations and regional players, all competing on product quality, variety, and pricing. Prominent companies have invested significantly in product innovation and strategic partnerships to gain a competitive edge. Global players such as Nestl and General Mills have leveraged strong brand recognition and extensive distribution networks to maintain market presence, while local companies focus on regionally inspired gluten-free products.

APAC Gluten-Free Products Industry Analysis

Growth Drivers

- Prevalence of Gluten Intolerance and Celiac Disease: Growing awareness of celiac disease and gluten sensitivity in the APAC region. For example, a study noted a seroprevalence of 1.2% among general populations in the Asia-Pacific region. Countries like India and China report an increase in gluten sensitivity diagnoses in urban areas, partially due to better access to medical diagnostics. Reports by public health authorities indicate rising diagnoses across APAC, making gluten-free products increasingly necessary.

- Rising Health Awareness and Lifestyle Changes: The APAC region has witnessed substantial growth in health awareness, with governments reporting increased expenditures on public health campaigns. For instance, in 2021, Passage Foods launched a new range of Passage to India curry pastes. These curry pastes are made using the perfect blend of authentic ingredients, and they're gluten-free and made with no artificial colors or flavors too. A 2023 study by the Japan Health Ministry highlights a marked increase in gluten-free demand, especially among urban populations, as lifestyle diseases linked to dietary habits rise across the region.

- Increasing Product Innovations in Gluten-Free Foods: The gluten-free food market in APAC is witnessing significant innovation, particularly in South Korea and Japan, where manufacturers are introducing unique rice-based products. Efforts to adapt local favorites like noodles and rice snacks to gluten-free versions are expanding options for consumers, especially in urban areas. This focus on culturally relevant, gluten-free offerings is driving growth and appealing to diverse consumer preferences across the region.

Market Challenges

- High Production Costs and Pricing Challenges: The production of gluten-free foods in APAC incurs higher costs due to the need for specialized ingredients and strict regulatory standards. Sourcing gluten-free ingredients locally is challenging, often necessitating imports that add to production expenses. These factors contribute to increased pricing, making gluten-free products less accessible for some consumers and adding pressure on manufacturers to balance cost and compliance.

- Limited Availability of Raw Materials: The scarcity of specific raw materials, such as certain grains and starches, limits gluten-free production capabilities in APAC. Countries face supply constraints and often depend on imported ingredients like millet and quinoa, which disrupts local production cycles. This reliance on imports can lead to supply chain inconsistencies, impacting the availability and pricing of gluten-free products in the region.

APAC Gluten-Free Products Market Future Outlook

Over the next five years, the APAC Gluten-Free Products Market is expected to expand, driven by an increase in dietary health awareness and product innovation. Rising urbanization and disposable income in key countries like China, Japan, and India will further boost demand. Additionally, the adoption of gluten-free products beyond those with gluten intolerance points towards an evolving consumer base seeking healthier lifestyles. Expansion in retail distribution, particularly online, will likely amplify market reach, offering opportunities for growth in untapped regions within the APAC.

Market Opportunities

- Expansion in Untapped Asian Markets: The growing middle-class population in APAC offers substantial opportunities for gluten-free products, especially in emerging markets like Thailand and Vietnam. As disposable incomes rise and urbanization accelerates, consumer demand for specialized diets, including gluten-free options, is increasing. This trend enables market players to introduce diverse gluten-free offerings in urban areas where dietary preferences are rapidly evolving.

- Adoption of E-commerce Channels: The rapid expansion of e-commerce in APAC has significantly boosted the accessibility of gluten-free products, making them available to a wider range of consumers. As more households turn to online platforms for groceries, gluten-free products have gained a strong presence in digital marketplaces. This shift provides gluten-free manufacturers with a scalable channel to reach diverse and geographically dispersed customer bases across the region.

Scope of the Report

|

By Product Type |

Bakery Products Snacks and Confectionery Ready Meals Beverages Others |

|

By Distribution Channel |

Supermarkets & Hypermarkets Online Retail Specialty Stores Pharmacies and Health Stores |

|

By Ingredient Type |

Rice-Based Corn-Based Millet-Based Quinoa-Based |

|

By Consumer Segment |

Health-Conscious Consumers Individuals with Celiac Disease Lactose-Intolerant Consumers Other Dietary Needs |

|

By Region |

East Asia South Asia Southeast Asia Australasia Other APAC Regions |

Products

Key Target Audience

Food and Beverage Manufacturers

E-commerce Platforms

Packaging and Labeling Industry

Raw Material Suppliers and Ingredient Manufacturers

Investors and venture capital Firms

Government and Regulatory Bodies (e.g., Food Safety and Standards Authority of India)

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Nestl

General Mills

The Kraft Heinz Company

Kelloggs

Dr. Schr AG

Amys Kitchen

Boulder Brands

Freedom Foods

PepsiCo

Glutino (Groupe Le Duff)

Table of Contents

1. APAC Gluten-Free Products Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Demand Drivers in the Gluten-Free Segment

1.4 Market Segmentation Overview

2. APAC Gluten-Free Products Market Size (in USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. APAC Gluten-Free Products Market Analysis

3.1 Growth Drivers

3.1.1 Rising Health Awareness and Lifestyle Changes

3.1.2 Prevalence of Gluten Intolerance and Celiac Disease

3.1.3 Government Initiatives for Healthy Eating

3.1.4 Increasing Product Innovations in Gluten-Free Foods

3.2 Market Challenges

3.2.1 High Production Costs and Pricing Challenges

3.2.2 Limited Availability of Raw Materials

3.2.3 Consumer Misperceptions of Gluten-Free Products

3.3 Opportunities

3.3.1 Expansion in Untapped Asian Markets

3.3.2 Adoption of E-commerce Channels

3.3.3 Collaboration with Local Suppliers for Regional Flavors

3.4 Trends

3.4.1 Growing Demand for Clean Label Products

3.4.2 Rise in Plant-Based and Organic Gluten-Free Offerings

3.4.3 Innovations in Functional Gluten-Free Snacks

3.5 Regulatory Environment

3.5.1 Gluten-Free Labeling Standards

3.5.2 Certification Requirements for Gluten-Free Products

3.5.3 Safety Standards and Allergen Regulations

3.6 Consumer Insights (Demographic Preferences)

3.7 Competitive Ecosystem (Brand Strategies)

3.8 Porters Five Forces (Market Dynamics)

3.9 Cross-Comparison Parameters (Taste, Texture, Price, Variety)

4. APAC Gluten-Free Products Market Segmentation

4.1 By Product Type (in Value %)

4.1.1 Bakery Products

4.1.2 Snacks and Confectionery

4.1.3 Ready Meals

4.1.4 Beverages

4.1.5 Others

4.2 By Distribution Channel (in Value %)

4.2.1 Supermarkets & Hypermarkets

4.2.2 Online Retail

4.2.3 Specialty Stores

4.2.4 Pharmacies and Health Stores

4.3 By Ingredient Type (in Value %)

4.3.1 Rice-Based

4.3.2 Corn-Based

4.3.3 Millet-Based

4.3.4 Quinoa-Based

4.4 By Consumer Segment (in Value %)

4.4.1 Health-Conscious Consumers

4.4.2 Individuals with Celiac Disease

4.4.3 Lactose-Intolerant Consumers

4.4.4 Other Dietary Needs

4.5 By Region (in Value %)

4.5.1 East Asia

4.5.2 South Asia

4.5.3 Southeast Asia

4.5.4 Australasia

4.5.5 Other APAC Regions

5. APAC Gluten-Free Products Market Competitive Analysis

5.1 Profiles of Key Competitors

5.1.1 Nestl

5.1.2 General Mills

5.1.3 The Kraft Heinz Company

5.1.4 Kelloggs

5.1.5 Conagra Brands

5.1.6 Amys Kitchen

5.1.7 Boulder Brands

5.1.8 Dr. Schr AG

5.1.9 Barilla Group

5.1.10 Freedom Foods

5.1.11 PepsiCo

5.1.12 Bobs Red Mill

5.1.13 Glutino (Groupe Le Duff)

5.1.14 Enjoy Life Foods

5.1.15 Jovial Foods

5.2 Cross-Comparison Parameters (Product Range, Market Presence, Pricing Strategy, Distribution Network, Brand Recognition, Innovation, Customer Reach, Ingredient Sourcing)

5.3 Market Share Analysis

5.4 Strategic Initiatives by Key Players

5.5 Mergers and Acquisitions

5.6 Investment and Funding Analysis

5.7 Partnerships and Collaborations

5.8 Product Development and Innovation

5.9 Consumer Feedback and Brand Loyalty

6. APAC Gluten-Free Products Market Regulatory Framework

6.1 Gluten-Free Certification Process

6.2 Labeling and Compliance Standards

6.3 Quality and Safety Requirements

6.4 Import-Export Regulations for Gluten-Free Products

7. APAC Gluten-Free Products Future Market Segmentation

7.1 By Product Type (in Value %)

7.2 By Distribution Channel (in Value %)

7.3 By Ingredient Type (in Value %)

7.4 By Consumer Segment (in Value %)

7.5 By Region (in Value %)

8. APAC Gluten-Free Products Market Analysts Recommendations

8.1 Consumer Demographic Analysis

8.2 Customer Experience Enhancement

8.3 Product Diversification Strategies

8.4 White Space Opportunities in the Market

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step entails creating a comprehensive framework to map all primary stakeholders within the APAC Gluten-Free Products Market. Extensive desk research, including secondary and proprietary databases, is utilized to gather in-depth data about industry players, consumer segments, and other critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data related to the markets penetration and consumer preferences are compiled and assessed. The assessment focuses on consumption ratios, the distribution channel prevalence, and the resultant impact on market revenue to ensure accurate analysis of segment trends.

Step 3: Hypothesis Validation and Expert Consultation

Using insights from initial research, market hypotheses are formulated and subsequently validated via computer-assisted telephone interviews (CATIs) with leading industry experts. These discussions provide operational and financial insights that are essential for refining and verifying market data.

Step 4: Research Synthesis and Final Output

The final phase involves collaboration with gluten-free product manufacturers and retailers to gather specific insights on sales performance, consumer preferences, and key factors influencing the market. This step verifies data derived from the bottom-up approach and ensures a holistic, validated view of the APAC Gluten-Free Products Market.

Frequently Asked Questions

01. How big is the APAC Gluten-Free Products Market?

The APAC Gluten-Free Products Market is valued at USD 1.42 billion, driven primarily by health-conscious consumers, rising awareness of gluten intolerance, and expanding product accessibility across major cities.

02. What challenges does the APAC Gluten-Free Products Market face?

The APAC Gluten-Free Products Market faces challenges such as high production costs, limited availability of gluten-free ingredients, and consumer misperceptions about the need for gluten-free products, impacting broader market adoption.

03. Which companies dominate the APAC Gluten-Free Products Market?

Leading companies in the APAC Gluten-Free Products Market include Nestl, General Mills, The Kraft Heinz Company, and Dr. Schr AG, driven by strong distribution networks and extensive product portfolios.

04. What are the key growth drivers of the APAC Gluten-Free Products Market?

Growth in this APAC Gluten-Free Products Market is propelled by factors like the rise in health consciousness, increasing cases of gluten intolerance, and the availability of gluten-free products in retail chains and online platforms across APAC.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.