APAC Interior Design Software Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD8659

December 2024

98

About the Report

APAC Interior Design Software Market Overview

- The APAC Interior Design Software Market is valued at USD 1 billion, based on a five-year historical analysis. This market is driven primarily by the surge in real estate development and the increasing demand for efficient design tools that enhance productivity and creativity. The availability of 3D modeling, rendering capabilities, and AR/VR integration in design software has further fueled adoption among designers, architects, and real estate developers.

- China, India, and Japan are the dominant players in the APAC Interior Design Software market. China's dominance is due to its expansive real estate sector and rapid urbanization, resulting in a high demand for residential and commercial design solutions. India's growing tech industry and focus on smart city projects drive the adoption of advanced software tools, while Japans inclination toward minimalistic and precise design standards propels the use of high-end design software.

- BIM standards are becoming increasingly important in APAC, driving the demand for certified software solutions. In 2023, the Building and Construction Authority (BCA) of Singapore mandated that all new public sector projects incorporate BIM standards. This regulation encourages the use of certified interior design software that integrates seamlessly with BIM workflows, ensuring compliance with national standards.

APAC Interior Design Software Market Segmentation

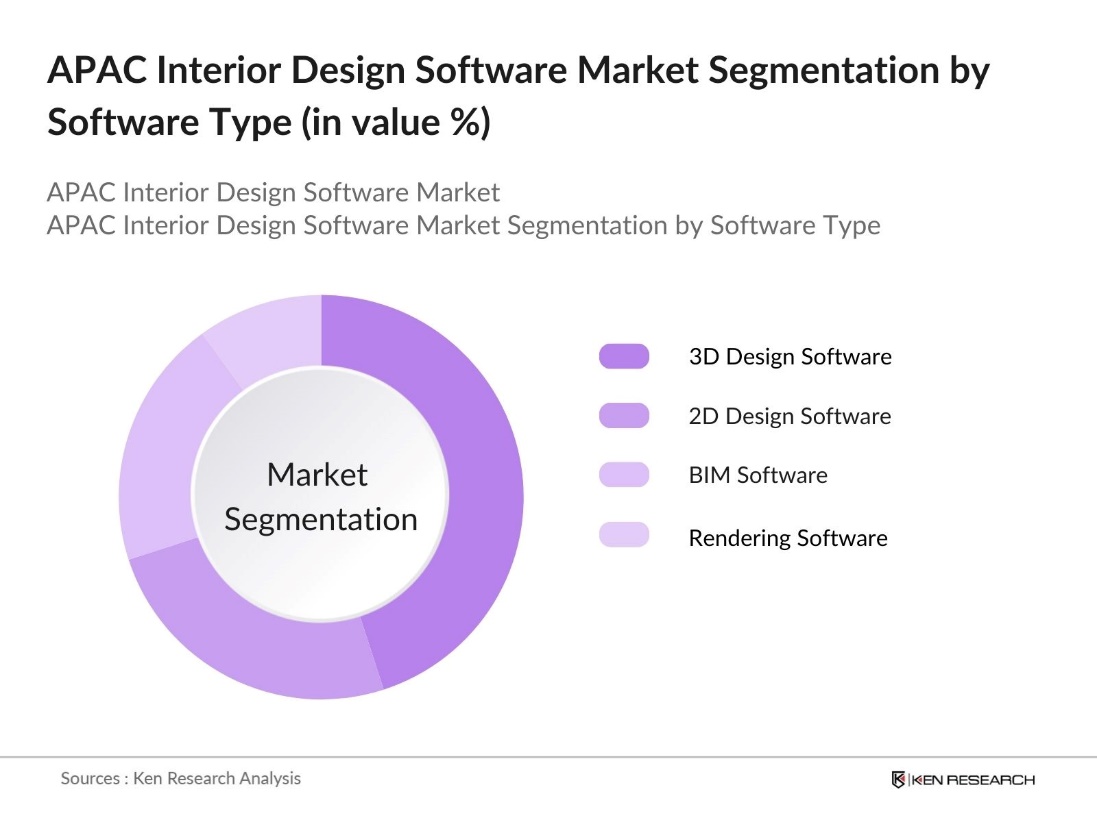

By Software Type: The APAC Interior Design Software market is segmented by software type into 3D Design Software, 2D Design Software, BIM Software, and Rendering Software. Recently, 3D Design Software has a dominant market share in the APAC region under this segmentation due to its advanced capabilities in creating realistic renderings and virtual walkthroughs. The preference for immersive design experiences makes 3D software a top choice for architects and interior designers who aim to provide a lifelike visualization of their projects. With the increasing adoption of AR and VR, 3D design tools continue to be a significant investment for design firms and individual designers alike.

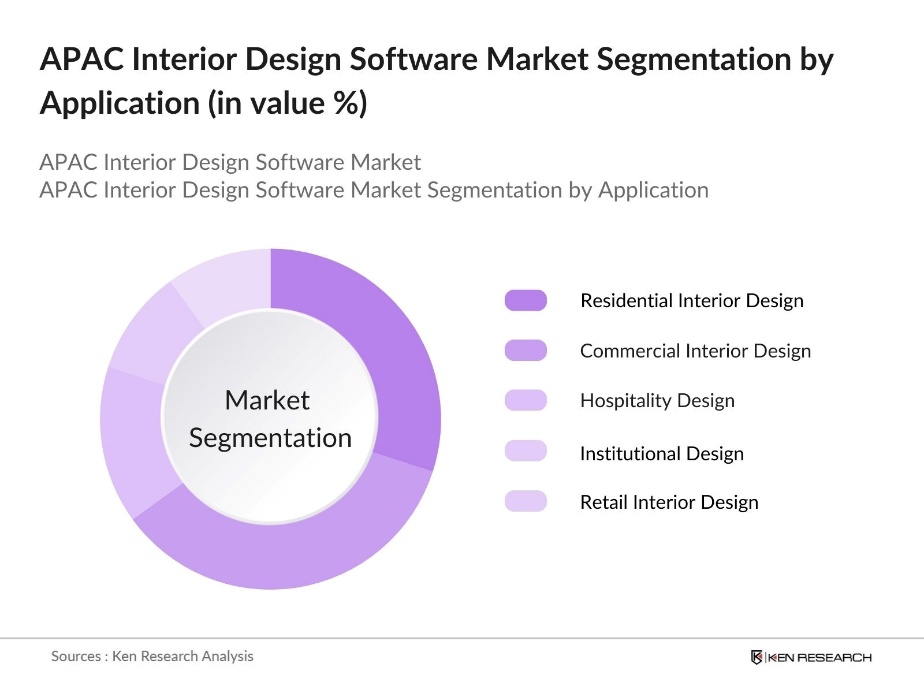

By Application: The APAC Interior Design Software market is segmented by application into Residential Interior Design, Commercial Interior Design, Hospitality Design, Institutional Design, and Retail Interior Design. The Commercial Interior Design holds a significant market share due to the rise in office spaces, co-working hubs, and retail outlets throughout the APAC region. As businesses prioritize creating attractive and functional work environments, they invest in sophisticated design software to ensure flexibility and precision in layout planning. Moreover, the rise of e-commerce has driven demand for well-designed retail interiors that offer immersive customer experiences, further fueling this segments growth.

APAC Interior Design Software Market Competitive Landscape

The market is characterized by the presence of both global giants and emerging regional players, leading to a diverse and competitive environment. The market is dominated by companies that offer comprehensive design solutions, user-friendly interfaces, and advanced rendering capabilities, which cater to a wide range of applications from residential to commercial projects. These firms continuously invest in R&D and strategic partnerships to maintain a competitive edge.

|

Company Name |

Year of Establishment |

Headquarters |

Product Portfolio |

User Base |

Regional Presence |

Market Strategy |

Revenue (USD) |

Key Partnership |

|

Autodesk Inc. |

1982 |

USA |

||||||

|

Trimble Inc. |

1978 |

USA |

||||||

|

Dassault Systmes SE |

1981 |

France |

||||||

|

SketchUp (Trimble) |

2000 |

USA |

||||||

|

Chief Architect Inc. |

1992 |

USA |

APAC Interior Design Software Industry Analysis

Growth Drivers

- Surge in Real Estate and Construction (Market Growth Rate, Market Adoption): The APAC region has witnessed a notable increase in real estate development of new residential space added in China alone in 2023. This growth is mirrored in other key markets like India, where urbanization has driven a demand for 8.5 million new homes in urban centers. The rise in construction activities directly influences the adoption of interior design software, as developers prioritize efficiency and precision in architectural planning. This surge contributes to a higher integration of digital design tools across residential and commercial projects.

- Increasing Demand for Customized Designs (Consumer Preferences, User Experience): In 2023, consumer demand for customized interior solutions surged in APAC, particularly in countries like India and China. This trend drives the adoption of interior design software, which offers advanced customization options for layouts and styles. The growing disposable income in APAC, for example, in China, urban households had a disposable income of approximately 51,821 CNY (around $7,200) in 2023.

- Rise in Remote Collaboration Tools (Integration Capabilities, Cloud Computing Trends): The APAC region has seen increased demand for remote collaboration tools, with many design firms adopting cloud-based platforms. These tools enable seamless sharing of project data, real-time feedback, and collaborative design sessions, supporting hybrid work models. The integration of interior design software with cloud computing enhances efficiency, allowing design professionals to collaborate across borders, making the design process more flexible and responsive to client needs.

Market Challenges

- High Software Subscription Costs (Pricing Trends, Affordability Concerns): High subscription costs for premium interior design software pose challenges for smaller design firms in the APAC region. These costs can make it difficult for startups and individual designers to access advanced tools, particularly in emerging markets. Despite the increasing demand for digital transformation in design, the financial burden can prevent smaller firms from adopting comprehensive software solutions, which in turn may impact their ability to compete effectively in the market.

- Data Security Concerns in Cloud Adoption (Cybersecurity Measures, Data Compliance): The rise in cloud-based interior design software usage in APAC has heightened concerns about data security. Ensuring compliance with local data protection regulations requires significant investment in cybersecurity measures. Companies need to implement robust protocols to protect sensitive data and comply with privacy laws, which can increase operational costs. These concerns can create challenges for both software providers and users, affecting the overall adoption rate of cloud-based solutions in the industry.

APAC Interior Design Software Market Future Outlook

The APAC Interior Design Software market is poised for significant growth over the next few years, driven by the rapid urbanization across key markets such as China and India. The push towards sustainable development and the demand for efficient space utilization in urban areas have increased the need for advanced design tools. Additionally, the rise of remote working trends and the increasing focus on enhancing home environments are expected to boost demand for residential design software.

Market Opportunities

- Growing Adoption of AR/VR in Design Visualization: The adoption of AR and VR technologies in interior design visualization is on the rise in the APAC region. These tools allow clients to experience design concepts in a virtual environment before actual construction begins, enhancing client satisfaction and minimizing the need for adjustments during the building phase. In markets where digital transformation is supported by government initiatives, the demand for AR/VR-enabled design software is expanding, offering new opportunities for software providers.

- Expansion into Emerging Markets: Emerging markets in Southeast Asia, such as Vietnam and the Philippines, offer growth opportunities for interior design software vendors. Rapid urbanization and increasing demand for new residential and commercial spaces drive the need for efficient digital design tools. Companies entering these markets can benefit from the rising focus on digitalization in construction, as governments encourage the use of modern design technologies to improve project efficiency and urban planning.Top of FormBottom of Form

Scope of the Report

|

Software Type |

3D Design Software 2D Design Software BIM Software Rendering Software |

|

Application |

Residential Interior Design Commercial Interior Design Hospitality Design Institutional Design Retail Interior Design |

|

Deployment Type |

Cloud-Based On-Premises |

|

End-User |

Interior Designers Architects Construction Firms Real Estate Developers Educational Institutions |

|

Region |

China India Japan South Korea Australia & New Zealand Southeast Asia |

Products

Key Target Audience

Facility Management Companies

Luxury Interior Design Firms

Furniture Manufacturers

Property Management Firms

Architectural Firms

Construction Companies

Government and Regulatory Bodies (National Building Code Authorities)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Autodesk Inc.

Trimble Inc.

Dassault Systmes SE

SketchUp (Trimble)

Chief Architect Inc.

Sweet Home 3D

Roomstyler

Cedreo

Floorplanner

SmartDraw LLC

Table of Contents

1. APAC Interior Design Software Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. APAC Interior Design Software Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. APAC Interior Design Software Market Analysis

3.1. Growth Drivers

3.1.1. Surge in Real Estate and Construction (Market Growth Rate, Market Adoption)

3.1.2. Technological Advancements in 3D Modeling (Software Efficiency, Design Flexibility)

3.1.3. Increasing Demand for Customized Designs (Consumer Preferences, User Experience)

3.1.4. Rise in Remote Collaboration Tools (Integration Capabilities, Cloud Computing Trends)

3.2. Market Challenges

3.2.1. High Software Subscription Costs (Pricing Trends, Affordability Concerns)

3.2.2. Data Security Concerns in Cloud Adoption (Cybersecurity Measures, Data Compliance)

3.2.3. Compatibility Issues with Different Operating Systems (Software Interoperability)

3.3. Opportunities

3.3.1. Growing Adoption of AR/VR in Design Visualization (Augmented Reality, Virtual Reality)

3.3.2. Expansion into Emerging Markets (New Market Entry, Regional Penetration)

3.3.3. Strategic Partnerships with Real Estate Firms (B2B Collaborations, Distribution Channels)

3.4. Trends

3.4.1. AI-Driven Design Recommendations (Artificial Intelligence, Predictive Analysis)

3.4.2. Shift Towards Sustainable Design Solutions (Eco-Friendly Design, Energy-Efficient Software)

3.4.3. Subscription-Based Software Models (Software as a Service, Pricing Flexibility)

3.5. Government Regulation

3.5.1. Data Privacy Regulations (GDPR, Local Compliance)

3.5.2. Standards for Building Information Modeling (BIM Certification)

3.5.3. Software Licensing Regulations (Intellectual Property, Software Patents)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. APAC Interior Design Software Market Segmentation

4.1. By Software Type (In Value %)

4.1.1. 3D Design Software

4.1.2. 2D Design Software

4.1.3. BIM Software

4.1.4. Rendering Software

4.2. By Application (In Value %)

4.2.1. Residential Interior Design

4.2.2. Commercial Interior Design

4.2.3. Hospitality Design

4.2.4. Institutional Design

4.2.5. Retail Interior Design

4.3. By Deployment Type (In Value %)

4.3.1. Cloud-Based

4.3.2. On-Premises

4.4. By End-User (In Value %)

4.4.1. Interior Designers

4.4.2. Architects

4.4.3. Construction Firms

4.4.4. Real Estate Developers

4.4.5. Educational Institutions

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Australia & New Zealand

4.5.6. Southeast Asia

5. APAC Interior Design Software Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Autodesk Inc.

5.1.2. Trimble Inc.

5.1.3. Dassault Systmes SE

5.1.4. Chief Architect Inc.

5.1.5. SketchUp (Trimble)

5.1.6. Roomstyler

5.1.7. Sweet Home 3D

5.1.8. SmartDraw LLC

5.1.9. Cedreo

5.1.10. Floorplanner

5.1.11. Vectorworks, Inc.

5.1.12. TurboCAD (IMSI Design)

5.1.13. Coohom

5.1.14. Infurnia Technologies Pvt. Ltd.

5.1.15. Planner 5D

5.2. Cross Comparison Parameters (Software Feature Set, Customer Support, Pricing Models, Market Presence, User Interface, Integration Capabilities, User Ratings, Mobile Accessibility)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Expansions, Product Launches)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Venture Capital, Private Equity)

5.7. Funding Rounds

5.8. Government Subsidies and Grants

5.9. New Product Development

6. APAC Interior Design Software Market Regulatory Framework

6.1. Data Storage and Transfer Policies

6.2. Industry Standards for Software Design (ISO Certifications, Local Standards)

6.3. Legal Requirements for Software Use in Interior Design

7. APAC Interior Design Software Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. APAC Interior Design Software Future Market Segmentation

8.1. By Software Type (In Value %)

8.2. By Application (In Value %)

8.3. By Deployment Type (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. APAC Interior Design Software Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Market Entry Strategies

9.4. White Space Opportunity Analysis

9.5. Product Differentiation Strategies

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the APAC Interior Design Software Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the APAC Interior Design Software Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of software efficiency statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple design software developers to acquire detailed insights into product segments, user trends, and sales performance. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the APAC Interior Design Software market.

Frequently Asked Questions

01. How big is the APAC Interior Design Software Market?

The APAC Interior Design Software Market is valued at USD 1 billion, based on a five-year historical analysis, and is driven by growing real estate development and the demand for advanced design tools.

02. What are the challenges in the APAC Interior Design Software Market?

Challenges in APAC Interior Design Software Market include high subscription costs for software, data security concerns in cloud adoption, and compatibility issues with different operating systems.

03. Who are the major players in the APAC Interior Design Software Market?

Key players in APAC Interior Design Software Market include Autodesk Inc., Trimble Inc., Dassault Systmes SE, Chief Architect Inc., and SketchUp, which dominate due to their advanced software capabilities and strong market presence.

04. What are the growth drivers of the APAC Interior Design Software Market?

The APAC Interior Design Software Market growth drivers include the rise in real estate and construction activities, demand for customized design solutions, and technological advancements in 3D modeling and AR/VR integration.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.