APAC Linux Operating System Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD3899

December 2024

94

About the Report

APAC Linux Operating System Market Overview

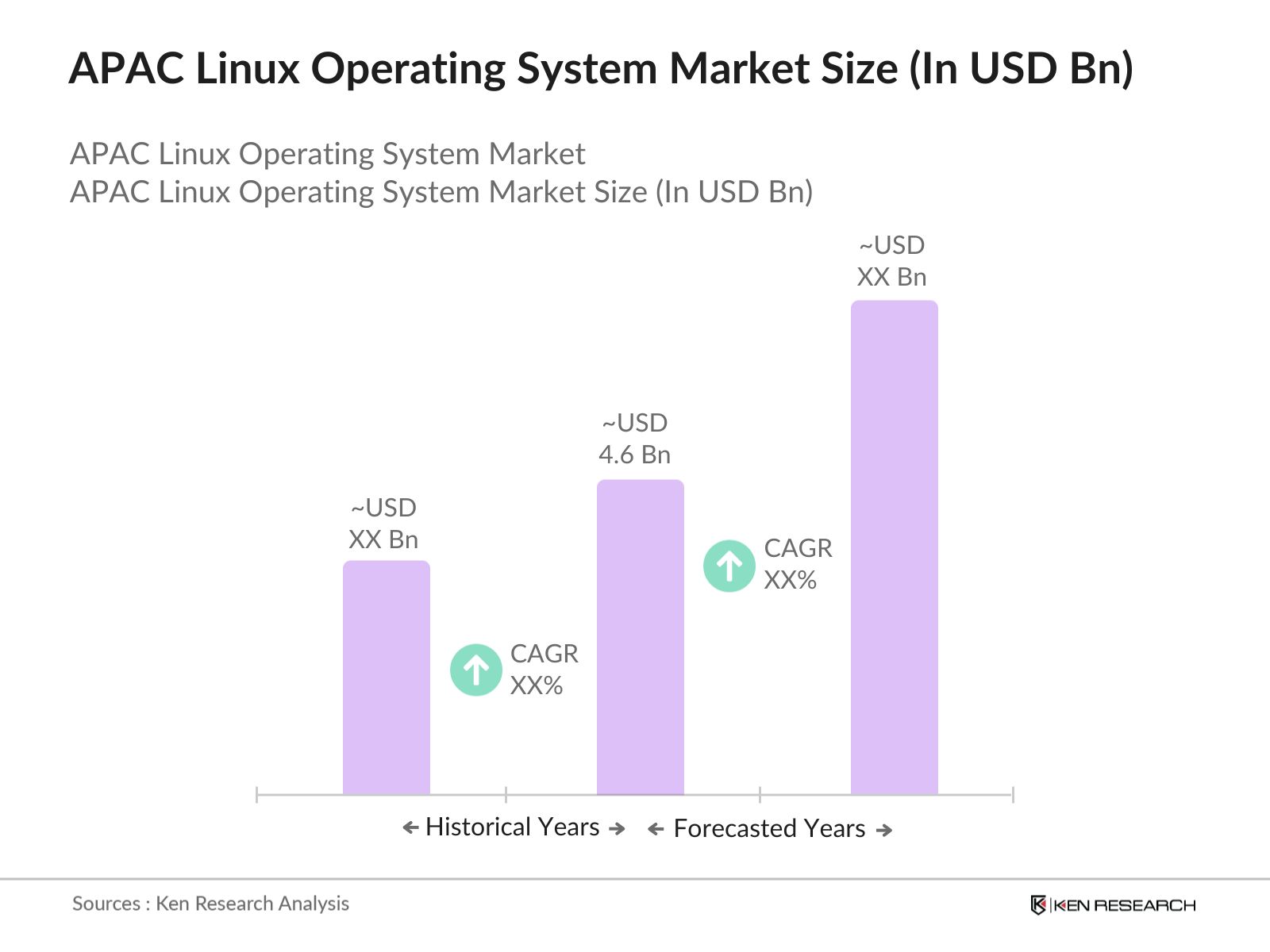

- The APAC Linux operating system market is witnessing substantial growth, valued at USD 4.6 billion, based on a five-year historical analysis. This market is driven by the increasing adoption of open-source platforms across various industries, including IT, telecommunications, and government sectors in key countries like China, Japan, South Korea, and India. The rise of cloud computing, along with the growing popularity of containerization technologies such as Kubernetes, has further accelerated the demand for Linux-based operating systems in the region.

- China is a dominant player in the APAC Linux operating system market, driven by the governments push for technological self-reliance and its initiatives to reduce dependency on foreign software. In Japan, Linux adoption is fueled by the country's mature IT infrastructure and growing interest in cloud-native applications. South Korea and India are also witnessing rapid growth, with strong demand for Linux in the education sector, public sector digital transformation, and enterprise applications.

- Governments across APAC are increasingly favoring Linux as part of their digital infrastructure strategies, particularly in sectors requiring high security and customization. China's Ministry of Industry and Information Technology has introduced a policy encouraging the use of open-source operating systems in critical infrastructure. Similarly, India is advancing Linux adoption under its Digital India initiative, aiming to enhance government services' reach and efficiency by leveraging Linux-based solutions.

APAC Linux Operating System Market Segmentation

- By Deployment Type: The market is segmented by deployment type into on-premises and cloud-based systems. This segment remains significant due to its strong presence in sectors such as government, defense, and banking, where data privacy and control are paramount. Large-scale enterprises prefer on-premises Linux systems for managing their critical data infrastructure. On-premises solutions also cater to organizations with specific regulatory or security requirements, offering better control over their IT environments.

- By End-User: The market is further segmented by industry into IT and Telecommunications, BFSI (Banking, Financial Services, and Insurance), Government, and Others. The IT and telecommunications sector dominates the Linux operating system market in APAC. The open-source nature of Linux makes it highly favored for software development, hosting services, and managing telecommunications infrastructure. As businesses continue to adopt DevOps practices, the flexibility and scalability of Linux play a crucial role in driving the adoption of cloud-native applications and software-defined networking technologies.

APAC Linux Operating System Market Competitive Landscape

The APAC Linux operating system market is highly competitive, with global and regional players striving to capture market share. Key companies include Red Hat (IBM), Canonical Ltd., SUSE, and Oracle Corporation. These companies are focused on developing advanced features, expanding their open-source ecosystems, and entering strategic partnerships with cloud service providers and government organizations to strengthen their market position.

|

Company Name |

Establishment Year |

Headquarters |

Key Offerings |

Revenue (2023) |

Linux Distribution |

Cloud Partnerships |

Open-Source Contributions |

Key Clients |

|

Red Hat (IBM) |

1993 |

Raleigh, USA |

||||||

|

Canonical Ltd. |

2004 |

London, UK |

||||||

|

SUSE |

1992 |

Nuremberg, Germany |

||||||

|

Oracle Corporation |

1977 |

Austin, USA |

||||||

|

Huawei Technologies |

1987 |

Shenzhen, China |

APAC Linux Operating System Industry Analysis

Growth Drivers

- Cloud Computing and Virtualization Expansion: The rapid growth of cloud computing across the APAC region is directly contributing to the increased adoption of Linux systems. According to World Bank data, the APAC region saw significant growth in IT infrastructure investments, with cloud computing growing 16% annually due to the digitalization of economies like India, Japan, and Australia. Virtualization platforms, particularly in China, have benefited from Linux's flexibility and open-source capabilities, which support a wide range of cloud services and scalable computing environments. In 2023, cloud-related IT spending reached $150 billion in the region.

- Digital Transformation in Key Sectors: With ongoing digital transformation, sectors like IT, telecommunications, and the public sector are increasingly adopting Linux systems for their flexibility, security, and open-source nature. The International Telecommunication Union (ITU) estimated that by 2023, more than half of APAC's telecommunications companies utilized Linux-based systems for their back end and core operations, resulting in savings of up millions annually in infrastructure costs. The IT sectors demand for scalable, secure, and cost-effective systems has led to a surge in Linux-based solutions across APAC nations.

- Increased Adoption of Containerization Technologies: Containerization technologies like Kubernetes and Docker, both of which predominantly run on Linux, are expanding across APAC. Reports indicate that in 2023, more than half of containerized workloads in the region ran on Linux, driven by its compatibility with these technologies. As cloud-native applications gain traction, large companies in China and India have adopted Kubernetes and Docker for streamlining software deployment. Additionally, Docker reported that over 40 million container instances were running on Linux in 2022 within APAC, further accelerating the OS's growth.

Market Challenges

- High Adoption Costs for On-Premises Solutions: While Linux is often cost-effective in cloud and open-source environments, implementing it on-premises comes with high initial costs. Businesses in APAC face expenses related to hardware, specialized Linux software support, and training, which can be a financial barrier, particularly for smaller enterprises. These upfront costs deter many organizations from fully adopting Linux on-premises, as they prefer to allocate resources elsewhere.

- Shortage of Skilled Open-Source IT Professionals: The APAC region is experiencing a skills gap in managing Linux-based systems. Many IT employers report difficulties in finding Linux-certified professionals, slowing down adoption in key sectors like banking, healthcare, and government. This shortage also drives up hiring costs, making it more challenging for businesses to adopt and support Linux environments effectively. However, there is a noticeable skills gap in the APAC region, particularly in emerging markets where the IT workforce is still catching up with open-source technologies. This presents a barrier to broader Linux adoption.

APAC Linux Operating System Market Future Outlook

The APAC Linux operating system market is expected to grow steadily over the next five years, driven by advancements in cloud computing, the expansion of open-source ecosystems, and strong government support for digital transformation. Key sectors such as IT, telecommunications, and government will continue to spearhead demand for Linux-based solutions. Additionally, the integration of Linux in edge computing, IoT devices, and AI-driven platforms presents significant growth opportunities for market players.

Future Market Opportunities

- Expansion into Emerging Markets: Linux adoption is gaining momentum in emerging APAC markets such as Vietnam, Indonesia, and Thailand. In 2023, Vietnam's Ministry of Information and Communications reported a substantial increase in government IT spending, with a significant focus on open-source software adoption. Indonesia and Thailand followed similar trajectories, as their public and private sectors sought cost-effective solutions for digitalization. In Indonesia alone, government agencies allocated anoteworthy amount in IT upgrades with an emphasis on Linux-based systems. These emerging markets represent a substantial opportunity for Linux vendors.

- Growth in Edge Computing and IoT Systems: The rise of edge computing and the Internet of Things (IoT) presents a major growth opportunity for Linux in APAC. Linux is the preferred OS for IoT devices due to its lightweight nature and customizability. By 2023, the APAC IoT market exceeded $300 billion, with more than devices running on Linux-based systems, according to the Asia IoT Business Platform. The expansion of IoT applications in smart cities and industrial automation in countries like South Korea and Japan will likely drive further adoption of Linux.

Scope of the Report

|

Deployment Type |

On-Premises Cloud-Based |

|

End-User Industry |

IT & Telecommunications BFSI Government Education Healthcare |

|

Distribution Channel |

Direct Sales Distributors System Integrators |

|

Application |

Enterprise Servers Cloud Infrastructure Edge Computing IoT |

|

Region |

China Japan South Korea Rest of APAC |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Chinas Ministry of Industry and Information Technology, Indias Ministry of Electronics and Information Technology)

IT & Telecommunications Companies

Cloud Service Providers

Defense and Intelligence Agencies

Large Enterprises in BFSI Sector

Public Sector Organizations

Banks and Financial Institutes

Cybersecurity Companies

Banks and Financial Institutions

Companies

Major Players Mentioned in the Report

Red Hat (IBM)

Canonical Ltd.

SUSE

Oracle Corporation

Huawei Technologies

Alibaba Cloud

Tencent Cloud

Amazon Web Services (AWS)

Google Cloud Platform

Microsoft Azure

VMware

Inspur Group

Tata Consultancy Services

NEC Corporation

Wipro

Table of Contents

1. APAC Linux Operating System Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Cloud Adoption, Containerization, Digital Transformation, Government Initiatives)

1.4. Market Segmentation Overview

2. APAC Linux Operating System Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Increased IT Expenditure, Open Source Adoption Rates)

2.3. Key Market Developments and Milestones (Linux in Cloud Infrastructure, Government Regulations)

3. APAC Linux Operating System Market Analysis

3.1. Growth Drivers

3.1.1. Cloud Computing and Virtualization Expansion

3.1.2. Government Push for Open-Source Systems

3.1.3. Digital Transformation in Key Sectors (IT, Telecommunications, Public Sector)

3.1.4. Increased Adoption of Containerization Technologies (Kubernetes, Docker)

3.2. Market Challenges

3.2.1. High Adoption Costs for On-Premises Solutions

3.2.2. Shortage of Skilled Open-Source IT Professionals

3.2.3. Competition from Proprietary Systems

3.3. Opportunities

3.3.1. Expansion into Emerging Markets (Vietnam, Indonesia, Thailand)

3.3.2. Growth in Edge Computing and IoT Systems

3.3.3. Partnerships with Cloud Service Providers

3.4. Trends

3.4.1. Rise in Hybrid Cloud Deployments

3.4.2. Adoption of AI/ML Workloads on Linux

3.4.3. Increasing Customization for Cybersecurity

3.5. Government Regulation

3.5.1. Open Source Mandates (China, India)

3.5.2. Data Privacy and Security Standards

3.5.3. Linux Certifications and Compliance Requirements

3.6. Stake Ecosystem

3.7. Porters Five Forces (Supplier Power, Buyer Power, Threat of Substitutes)

3.8. SWOT Analysis

3.9. Competition Ecosystem

4. APAC Linux Operating System Market Segmentation

4.1. By Deployment Type (In Value %)

4.1.1. On-Premises

4.1.2. Cloud-Based

4.2. By End-User Industry (In Value %)

4.2.1. IT & Telecommunications

4.2.2. BFSI (Banking, Financial Services, Insurance)

4.2.3. Government

4.2.4. Education

4.2.5. Healthcare

4.3. By Distribution Channel (In Value %)

4.3.1. Direct Sales

4.3.2. Distributors and System Integrators

4.4. By Application (In Value %)

4.4.1. Enterprise Servers

4.4.2. Cloud Infrastructure

4.4.3. Edge Computing and IoT

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. Southeast Asia

4.5.5. Australia & New Zealand

5. APAC Linux Operating System Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Red Hat (IBM)

5.1.2. Canonical Ltd.

5.1.3. SUSE

5.1.4. Oracle Corporation

5.1.5. Huawei Technologies Co., Ltd.

5.1.6. Inspur Group

5.1.7. Alibaba Cloud

5.1.8. Tencent Cloud

5.1.9. Amazon Web Services (AWS)

5.1.10. Google Cloud Platform

5.1.11. Microsoft Azure (Linux Compatibility)

5.1.12. VMware

5.1.13. Wipro

5.1.14. Tata Consultancy Services

5.1.15. NEC Corporation

5.2. Cross Comparison Parameters (Headquarters, Key Offerings, Client Base, Open Source Contributions, Cloud Partnerships, Linux Distribution Support, Market Presence, Key Regions)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. APAC Linux Operating System Market Regulatory Framework

6.1. Open-Source Licensing (GPL, MIT, Apache)

6.2. Data Localization Requirements (China, India)

6.3. Certification Processes for Linux Distributions

7. APAC Linux Operating System Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Cloud Expansion, Digital Economy, AI/ML Adoption)

8. APAC Linux Operating System Future Market Segmentation

8.1. By Deployment Type (In Value %)

8.2. By End-User Industry (In Value %)

8.3. By Application (In Value %)

8.4. By Region (In Value %)

8.5. By Distribution Channel (In Value %)

9. APAC Linux Operating System Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (SMEs, Large Enterprises, Government Agencies)

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

Contact US

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the stakeholders in the APAC Linux Operating System Market. Extensive desk research is conducted using secondary and proprietary databases to identify and define the critical variables impacting the market, such as cloud adoption and open-source software usage across key industries.

Step 2: Market Analysis and Construction

In this phase, historical data related to Linux operating system deployments is analyzed. This includes assessing the penetration of Linux in cloud infrastructure and enterprise environments. Market trends, revenue generation, and demand for open-source platforms are evaluated to provide reliable revenue estimates for the sector.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, expert consultations are conducted through interviews with key industry participants, including cloud service providers, IT companies, and public sector representatives. These insights are vital for refining market data and ensuring accuracy in the reports projections.

Step 4: Research Synthesis and Final Output

The final stage involves integrating data from various sources to provide a comprehensive view of the APAC Linux Operating System Market. This synthesis includes the verification of findings through bottom-up approaches and direct engagement with market participants, resulting in a reliable and data-backed analysis.

Frequently Asked Questions

01 How big is the APAC Linux Operating System Market?

The APAC Linux Operating System Market was valued at USD 4.6 billion, driven by increasing cloud adoption, government initiatives, and the rise of containerization technologies across industries.

02 What are the challenges in the APAC Linux Operating System Market?

Challenges in the APAC Linux Operating System Market include high competition from proprietary systems, a shortage of skilled Linux professionals, and high adoption costs for on-premises solutions, especially in emerging markets.

03 Who are the major players in the APAC Linux Operating System Market?

Key players in the APAC Linux Operating System Market include Red Hat (IBM), Canonical Ltd., SUSE, Oracle Corporation, and Huawei Technologies, each dominating due to their strong product portfolios and partnerships with cloud service providers.

04 What are the growth drivers of the APAC Linux Operating System Market?

APAC Linux Operating System Market growth is propelled by the expansion of cloud computing, increased adoption of open-source platforms, and the need for scalable IT infrastructure solutions across telecommunications, government, and BFSI sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.