APAC Next Generation Sequencing Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD4537

December 2024

84

About the Report

APAC Next Generation Sequencing (NGS) Market Overview

- The APAC Next Generation Sequencing (NGS) Market is currently witnessing significant growth, reaching a market size of USD 20 Bn, driven by advances in genomic research, rising prevalence of genetic disorders, and increasing adoption of personalized medicine. NGS technologies allow for rapid sequencing of DNA and RNA, making them essential for a range of applications including cancer diagnostics, drug discovery, and agriculture. The growing demand for high-throughput sequencing solutions in clinical and research settings has led to widespread adoption of NGS technologies across the region.

- Major markets such as China, Japan, and South Korea are leading the APAC NGS market due to their strong focus on healthcare innovation, government funding for genomic research, and the presence of advanced healthcare infrastructures. In China, for instance, the government has been actively promoting precision medicine initiatives, contributing to increased NGS adoption. Meanwhile, emerging markets like India and Southeast Asia are also experiencing growth in the NGS sector, as the awareness of genetic testing and its applications in healthcare continues to rise.

- Government policies and initiatives play a critical role in shaping the NGS landscape across the region. Chinas National Health Commission has implemented guidelines to expand the use of NGS in clinical settings, particularly for cancer diagnostics. Similarly, Japans Ministry of Health, Labour and Welfare (MHLW) has approved several NGS-based tests for genetic diseases, driving market growth in the country. These supportive policies, combined with the growing demand for precision medicine, are expected to propel the APAC NGS market forward in the coming years.

APAC Next Generation Sequencing (NGS) Market Segmentation

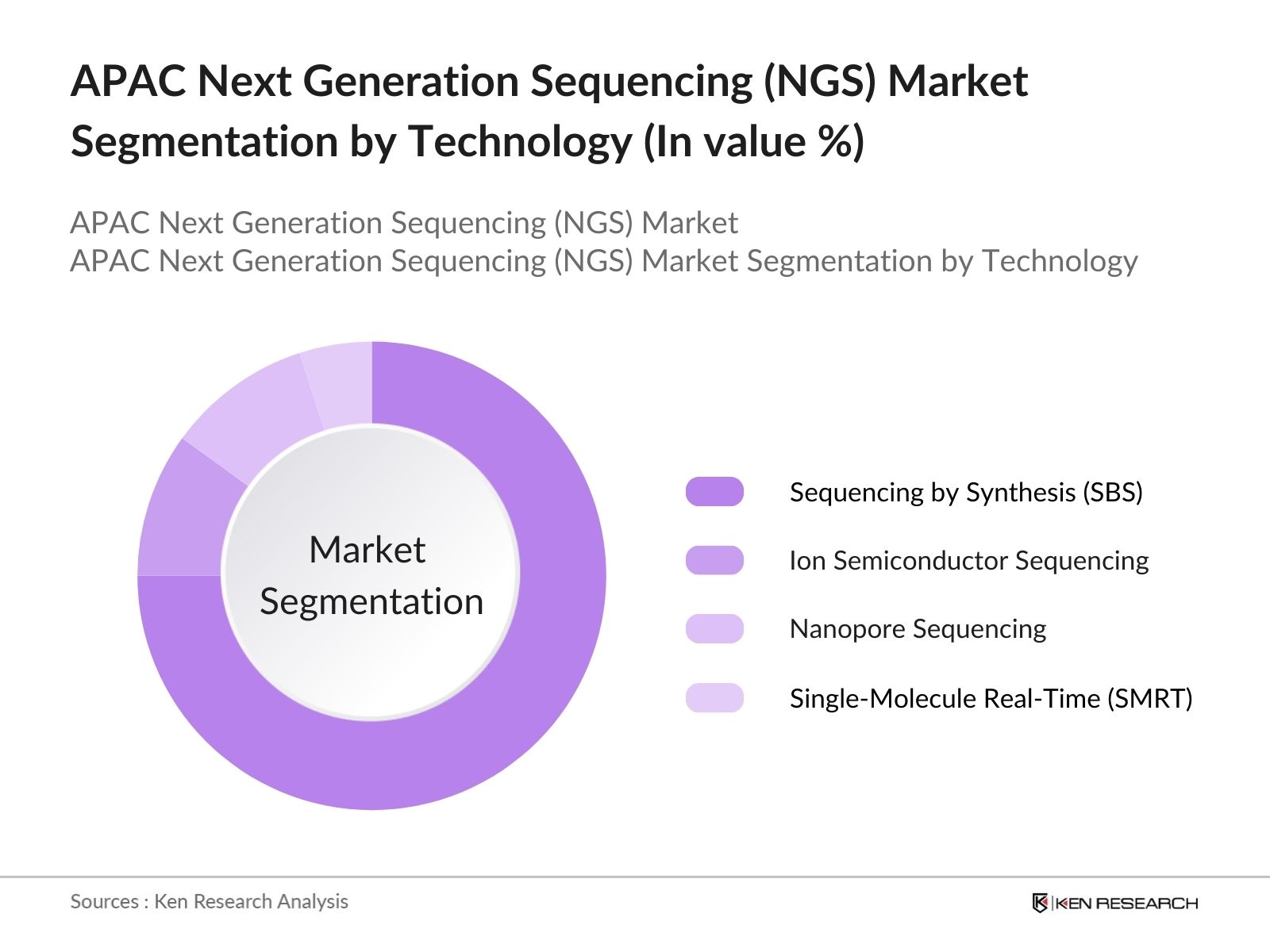

- By Technology: The market is segmented by technology into Sequencing by Synthesis (SBS), Ion Semiconductor Sequencing, Nanopore Sequencing, and Single-Molecule Real-Time (SMRT) Sequencing. Sequencing by Synthesis (SBS) is the dominant technology, with a market share of 57% in 2023. Its dominance is attributed to its widespread use in research and clinical applications, offering high accuracy and throughput. SBS platforms, such as Illuminas, are favored in academic research and hospitals for oncology diagnostics, which require large-scale sequencing and detailed genomic analysis.

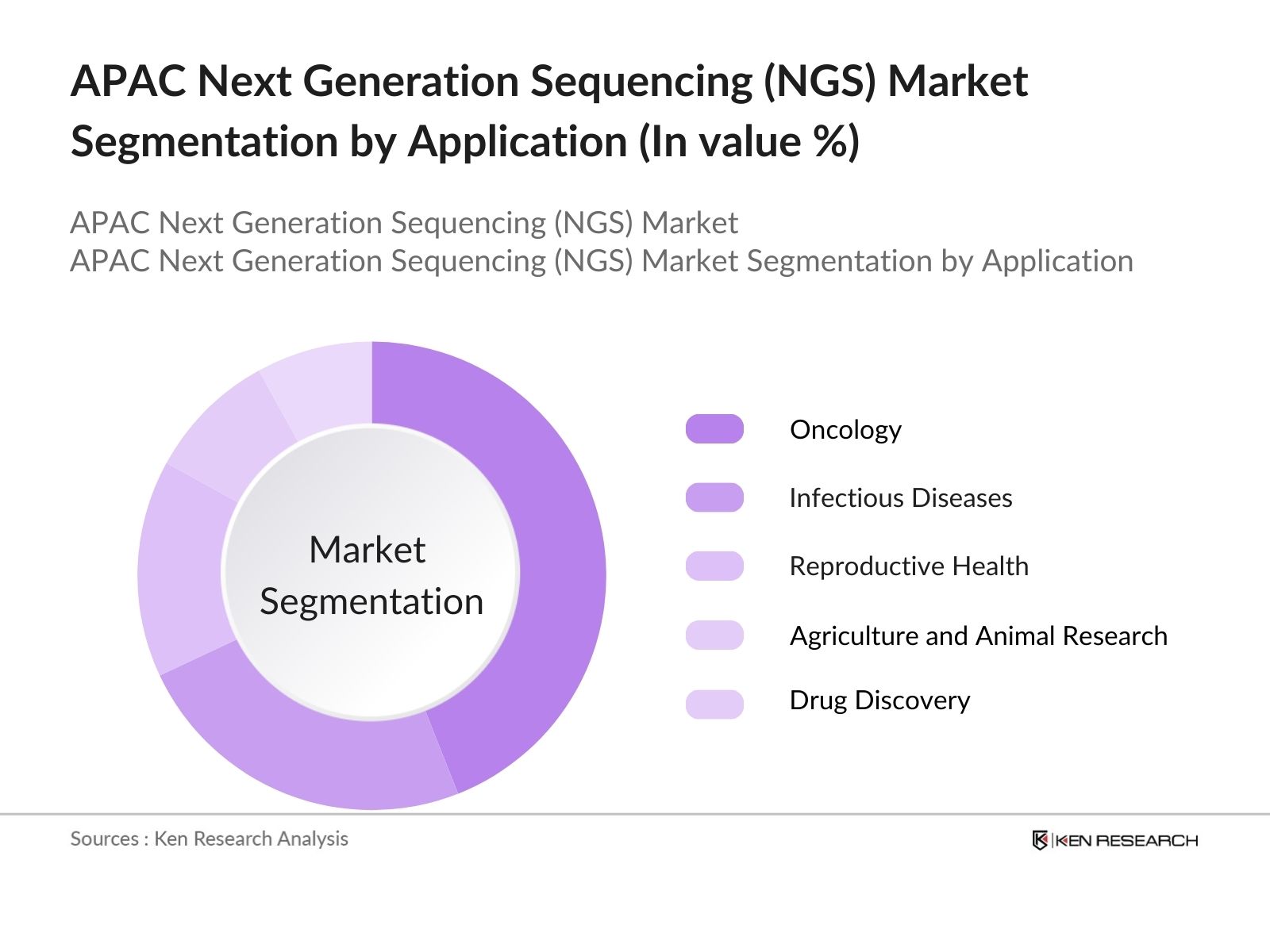

- By Application: The market is segmented by application into diagnostics, drug discovery, agriculture, infectious disease and others. Diagnostics represent the largest segment, as NGS is increasingly being used for cancer screening, genetic testing, and infectious disease diagnostics. The ability to sequence entire genomes at a relatively low cost has made NGS an indispensable tool in personalized medicine, particularly for identifying genetic mutations linked to diseases. In the field of drug discovery, NGS is being utilized to identify biomarkers and potential therapeutic targets, driving the market growth for pharmaceutical applications.

APAC Next Generation Sequencing (NGS) Market Competitive Landscape

The APAC NGS market is highly competitive, with both global and regional players investing in advanced sequencing technologies and expanding their product portfolios. Key players such as Illumina, Thermo Fisher Scientific, and BGI Genomics dominate the market with their cutting-edge sequencing platforms and consumables. These companies are also focusing on strategic partnerships, collaborations, and mergers to enhance their market presence and cater to the growing demand for NGS across the APAC region.

|

Company Name |

Establishment Year |

Headquarters |

Key NGS Focus |

Major NGS Platforms |

R&D Investment |

Strategic Collaborations |

Regional Presence |

Revenue in 2023 |

|

Illumina |

1998 |

San Diego, USA |

||||||

|

Thermo Fisher Scientific |

1956 |

Waltham, USA |

||||||

|

BGI Genomics |

1999 |

Shenzhen, China |

||||||

|

Oxford Nanopore Technologies |

2005 |

Oxford, UK |

||||||

|

Pacific Biosciences |

2004 |

California, USA |

APAC Next Generation Sequencing (NGS) Industry Analysis

Growth Drivers

- Technological Advancements in Sequencing Platforms: Technological advancements in sequencing platforms have been a key driver for the growth of the APAC NGS market. For example, next-generation sequencing (NGS) platforms in countries like China and Japan have been enhanced with more efficient sequencing techniques, reducing sequencing times and increasing data accuracy. The number of genome sequences available has risen dramatically, with over 350 human genomes sequenced globally as of 2023, a significant portion of which originates from APAC. Increased automation and integration of AI in sequencing have also reduced human errors, further driving adoption.

- Increasing Adoption in Clinical Diagnostics: The use of NGS in clinical diagnostics, particularly in oncology and infectious diseases, is expanding in APAC. NGS is widely adopted for cancer diagnosis and monitoring, with China leading the region in the number of genomic tests performed annually. According to the National Health Commission of China, thousands of cancer patients underwent genomic testing in 2023. Additionally, NGS-based diagnostics played a crucial role during the COVID-19 pandemic in sequencing viral strains across countries like India and Singapore, where genomic surveillance programs have identified over 100,000 virus samples.

- Growing Adoption of Personalized Medicine: Personalized medicine is gaining traction in APAC, particularly in oncology, where NGS is being used to identify specific genetic mutations that guide treatment decisions. The increasing use of NGS in cancer diagnostics and treatment is a key growth driver, as it enables healthcare providers to offer targeted therapies based on a patients genetic profile. The expansion of personalized medicine programs in countries like Japan and South Korea is expected to boost the NGS market significantly.

Market Challenges

- High Cost of NGS Technologies: One of the major challenges facing the APAC NGS market is the high cost associated with NGS technologies. Although the cost of sequencing has decreased significantly over the past decade, the initial investment required for NGS platforms, reagents, and data analysis remains high. This is particularly challenging for smaller research institutions and healthcare providers in emerging markets, where financial constraints may limit the adoption of NGS technologies.

- Data Privacy and Security Concerns: The growing use of NGS in clinical settings has raised concerns about data privacy and security, particularly with regard to the handling of genetic information. As more patient data is generated through NGS technologies, there is an increasing need for robust data protection measures to safeguard sensitive information. The lack of clear regulations around genetic data privacy in some APAC countries could pose challenges to the widespread adoption of NGS technologies in healthcare.

APAC Next Generation Sequencing (NGS) Market Future Outlook

The APAC NGS market is expected to experience strong growth over the next five years, driven by advancements in genomic research, the rising prevalence of genetic diseases, and the growing adoption of precision medicine. The increasing use of NGS technologies in clinical diagnostics, particularly for cancer and rare diseases, will further propel market growth. As governments continue to invest in healthcare infrastructure and genomic research, the demand for NGS solutions is expected to rise across the region.

Future Market Opportunities

- Integration of NGS in Personalized Medicine and Precision Health: The integration of NGS in personalized medicine and precision health presents vast opportunities in APAC. Japan's precision health initiatives have already benefited thousands of patients, using NGS for tailored treatment plans in oncology. Similarly, South Korea has launched a national program aimed at integrating NGS into healthcare by 2025, which will make genomic testing a standard practice for cancer diagnosis and rare disease treatment. As the healthcare sector shifts towards personalized medicine, NGS is expected to play an integral role in improving treatment outcomes.

- Expansion of NGS Applications in Agricultural Genomics: NGS technologies are increasingly applied in agricultural genomics, contributing to advancements in crop breeding and livestock production in APAC. In 2023, China sequenced the genomes of over 1,000 rice varieties to enhance crop resilience to climate change. Similarly, in Australia, NGS has been used to identify genetic markers for disease resistance in livestock, with over 2 million cattle genotyped in 2023. This expansion of NGS into agriculture presents significant opportunities for improving food security in the region.

Scope of the Report

|

By Technology |

Sequencing by Synthesis (SBS) Ion Semiconductor Sequencing Nanopore Sequencing Single-Molecule Real-Time (SMRT) Sequencing |

|

By Application |

Oncology Infectious Diseases Reproductive Health Agriculture and Animal Research Drug Discovery and Development |

|

By End-User |

Academic and Research Institutions Hospitals and Clinics Pharmaceutical and Biotechnology Companies Contract Research Organizations (CROs) Other End-Users |

|

By Workflow |

Pre-Sequencing Sequencing Data Analysis Post-Sequencing |

|

By Country |

China Japan South Korea India Rest of the APAC |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (China National Health Commission, Japan Ministry of Health, Labour and Welfare)

Biotechnology Companies

Pharmaceutical Manufacturers

Healthcare Providers (Hospitals and Clinics)

Academic and Research Institutions

Contract Research Organizations (CROs)

Agricultural Genomics Firms

Banks and Financial Institutions

Companies

Major Players Mentioned in the Report

Illumina Inc.

Thermo Fisher Scientific

BGI Genomics

Oxford Nanopore Technologies

Pacific Biosciences of California

Roche Sequencing Solutions

Agilent Technologies

Qiagen N.V.

PerkinElmer Inc.

Genewiz

Macrogen

Takara Bio

Bio-Rad Laboratories

Beckman Coulter

GenScript Biotech

Table of Contents

1. APAC Next Generation Sequencing (NGS) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. APAC Next Generation Sequencing (NGS) Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. APAC Next Generation Sequencing (NGS) Market Analysis

3.1. Growth Drivers

Technological Advancements in Sequencing Platforms

Increasing Adoption in Clinical Diagnostics (Oncology, Infectious Diseases)

Expanding Use of NGS in Drug Development and Research

Rising Government Support and Funding for Genomic Research

3.2. Market Challenges

High Cost of NGS Instruments and Consumables

Complex Data Interpretation and Bioinformatics Challenges

Limited Access in Emerging Markets

Data Privacy and Security Concerns (Handling Genetic Data)

3.3. Opportunities

Integration of NGS in Personalized Medicine and Precision Health

Expansion of NGS Applications in Agricultural Genomics

Collaborations Between Academic Institutions and Pharmaceutical Companies

Increasing Availability of Cloud-Based NGS Solutions

3.4. Trends

Shift Towards Third-Generation Sequencing (Long-Read Technologies)

Growth in Direct-to-Consumer Genetic Testing

Miniaturization and Portability of NGS Devices

Rising Demand for NGS in Clinical Trials and Drug Development

3.5. Government Regulation

National Genomics Programs and Initiatives (China, Japan, South Korea)

Regulatory Guidelines for NGS in Diagnostics and Clinical Use

Standardization of NGS Testing Protocols

Cross-Border Collaboration in Genomic Data Sharing

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Healthcare Providers, Research Institutions, Biotech Firms)

3.8. Porters Five Forces

Supplier Power (NGS Instrument Manufacturers, Reagent Providers)

Buyer Power (Pharmaceutical Companies, Academic Research Institutes)

Threat of New Entrants (Emerging NGS Startups)

Threat of Substitutes (Alternative Genomic Technologies)

Competitive Rivalry (Key Market Players)

3.9. Competition Ecosystem

4. APAC Next Generation Sequencing (NGS) Market Segmentation

4.1. By Technology (In Value %)

Sequencing by Synthesis (SBS)

Ion Semiconductor Sequencing

Nanopore Sequencing

Single-Molecule Real-Time (SMRT) Sequencing

4.2. By Application (In Value %)

Oncology

Infectious Diseases

Reproductive Health (Non-Invasive Prenatal Testing, Carrier Screening)

Agriculture and Animal Research

Drug Discovery and Development

4.3. By End-User (In Value %)

Academic and Research Institutions

Hospitals and Clinics

Pharmaceutical and Biotechnology Companies

Contract Research Organizations (CROs)

Other End-Users (Agriculture, Consumer Genomics)

4.4. By Workflow (In Value %)

Pre-Sequencing (Sample Preparation, Library Preparation)

Sequencing (NGS Platforms, Reagents)

Data Analysis (Bioinformatics Solutions, Cloud-Based Analysis Tools)

Post-Sequencing (Interpretation, Reporting)

4.5. By Region (In Value %)

China

Japan

South Korea

India

Southeast Asia (Indonesia, Malaysia, Thailand, Vietnam)

5. APAC Next Generation Sequencing (NGS) Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Illumina Inc.

5.1.2. Thermo Fisher Scientific

5.1.3. BGI Genomics

5.1.4. Oxford Nanopore Technologies

5.1.5. Pacific Biosciences of California

5.1.6. Roche Sequencing Solutions

5.1.7. Agilent Technologies

5.1.8. Qiagen N.V.

5.1.9. PerkinElmer

5.1.10. Genewiz

5.1.11. Macrogen

5.1.12. Takara Bio

5.1.13. Bio-Rad Laboratories

5.1.14. Beckman Coulter

5.1.15. GenScript Biotech

5.2. Cross Comparison Parameters

Inception Year

Revenue

Employee Size

Headquarters

Core NGS Focus Areas (Platforms, Reagents, Bioinformatics Solutions)

Strategic Collaborations

Market Presence (Global vs. Regional)

Key Technologies (Short-Read vs. Long-Read Sequencing)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. APAC Next Generation Sequencing (NGS) Market Regulatory Framework

6.1. Compliance with Regional Genomic Data Protection Laws

6.2. National Healthcare Regulations for NGS Diagnostic Tests

6.3. Certification and Approval Processes for NGS Platforms

6.4. Guidelines for Clinical Implementation of NGS in Healthcare

7. APAC Next Generation Sequencing (NGS) Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. APAC Next Generation Sequencing (NGS) Future Market Segmentation

8.1. By Technology

8.2. By Application

8.3. By End-User

8.4. By Workflow

8.5. By Region

9. APAC Next Generation Sequencing (NGS) Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase involves mapping the ecosystem of the APAC NGS market, identifying all major stakeholders, including technology providers, healthcare institutions, and end-users. Comprehensive desk research was conducted, leveraging proprietary databases to define the key market variables and their impact on growth.

Step 2: Market Analysis and Construction

In this step, historical market data was analyzed to assess the penetration of NGS technologies across various applications. The focus was on segmenting the market based on end-user types, while revenue generation and service quality metrics were compiled for accurate forecasting.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses regarding market growth drivers and challenges were validated through consultations with industry experts via CATIs. This process helped refine the insights on how NGS technologies are being deployed across different sectors in the APAC region.

Step 4: Research Synthesis and Final Output

The final phase synthesized the data collected from multiple sources, including NGS manufacturers, healthcare institutions, and genomic researchers. This comprehensive analysis ensured a detailed and accurate report on the APAC NGS market, based on both primary and secondary research inputs.

Frequently Asked Questions

01. How big is the APAC Next Generation Sequencing (NGS) Market?

The APAC Next Generation Sequencing (NGS) market is valued at USD 20 billion, driven by widespread adoption in clinical diagnostics, oncology, and agricultural research across leading countries like China, Japan, and South Korea.

02. What are the challenges in the APAC NGS Market?

Key challenges in the APAC Next Generation Sequencing (NGS) market include the high cost of NGS platforms and consumables, data privacy concerns related to genetic information, and limited access to advanced NGS technologies in emerging markets.

03. Who are the major players in the APAC NGS Market?

The APAC Next Generation Sequencing (NGS) market is dominated by Illumina, Thermo Fisher Scientific, BGI Genomics, Oxford Nanopore Technologies, and Pacific Biosciences. These companies lead through their advanced sequencing technologies and strong regional presence.

04. What are the growth drivers of the APAC NGS Market?

The APAC Next Generation Sequencing (NGS) market is primarily driven by advancements in genomic research, increasing prevalence of genetic diseases, and rising adoption of personalized medicine in APAC. Government initiatives and healthcare infrastructure improvements are also significant growth factors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.