APAC Office Supplies Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD5804

December 2024

91

About the Report

APAC Office Supplies Market Overview

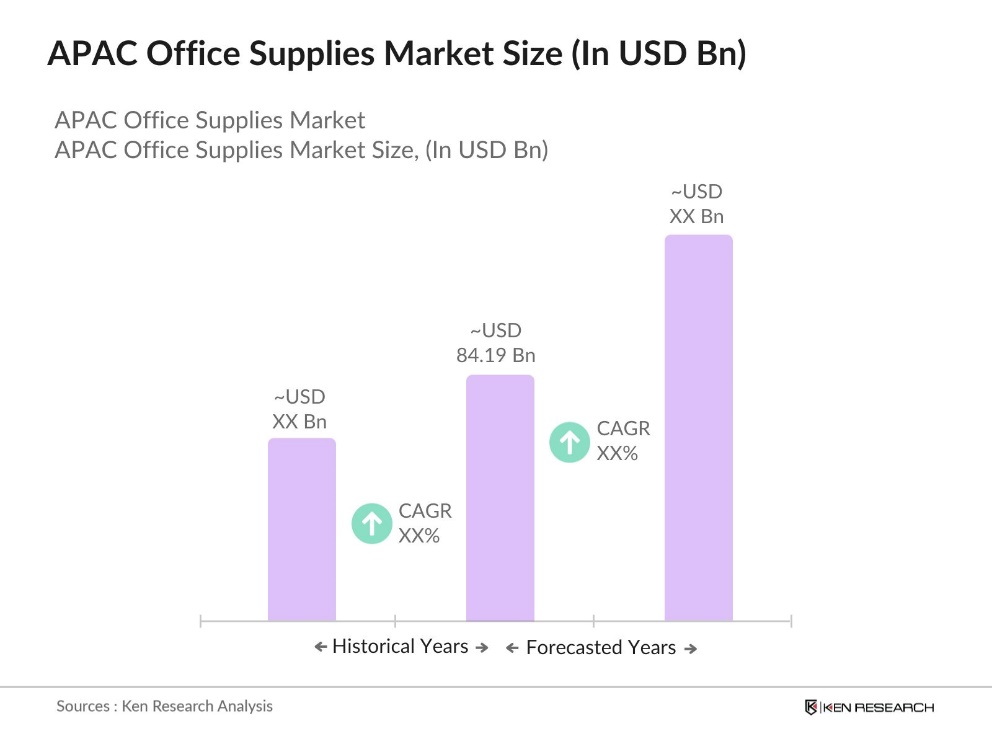

- The APAC Office Supplies Market is valued at USD 84.19 billion, based on a five-year historical analysis. The market is driven by various factors, including the rise in corporate activities, expanding educational institutions, and the growing adoption of eco-friendly office products. Increasing investments in smart office infrastructure and digital transformation across corporate offices have further contributed to this growth. The rapid expansion of e-commerce platforms also plays a critical role in making office supplies more accessible and affordable across the region.

- The dominant countries in the APAC office supplies market include China, India, and Japan. China's dominance is primarily due to its large manufacturing base and the availability of low-cost materials, while India has shown significant growth owing to its rising number of SMEs and corporate offices. Japan remains a leading market for high-quality and premium office supplies, driven by technological advancements and consumer preference for quality products.

- Governments across APAC have introduced strict environmental regulations, particularly focusing on reducing the use of plastic in office supplies. India's government has implemented initiatives to address the single-use plastic crisis, including a 2022 ban on 19 items and the Extended Producer Responsibility (EPR) policy promoting recycling. However, awareness campaigns diminished after August 2022, leading to a significant drop in complaintsfrom over 700 in September 2022 to fewer than 100 by March 2023, an 85% decline, reflecting weakened enforcement efforts post-ban.

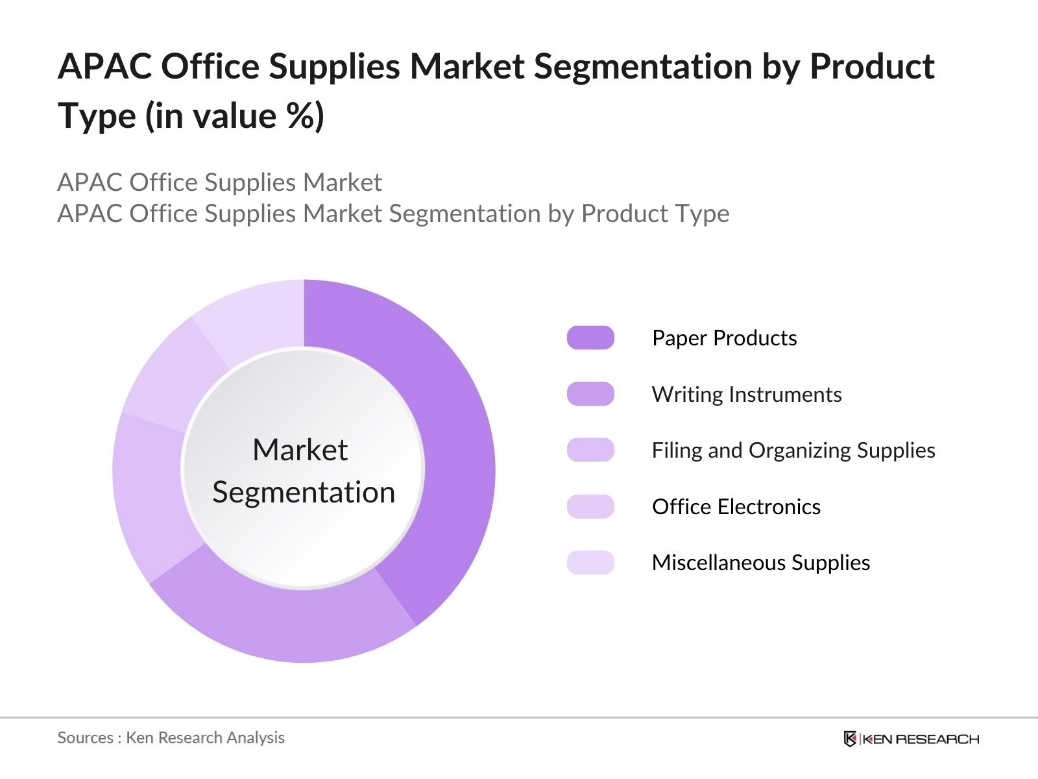

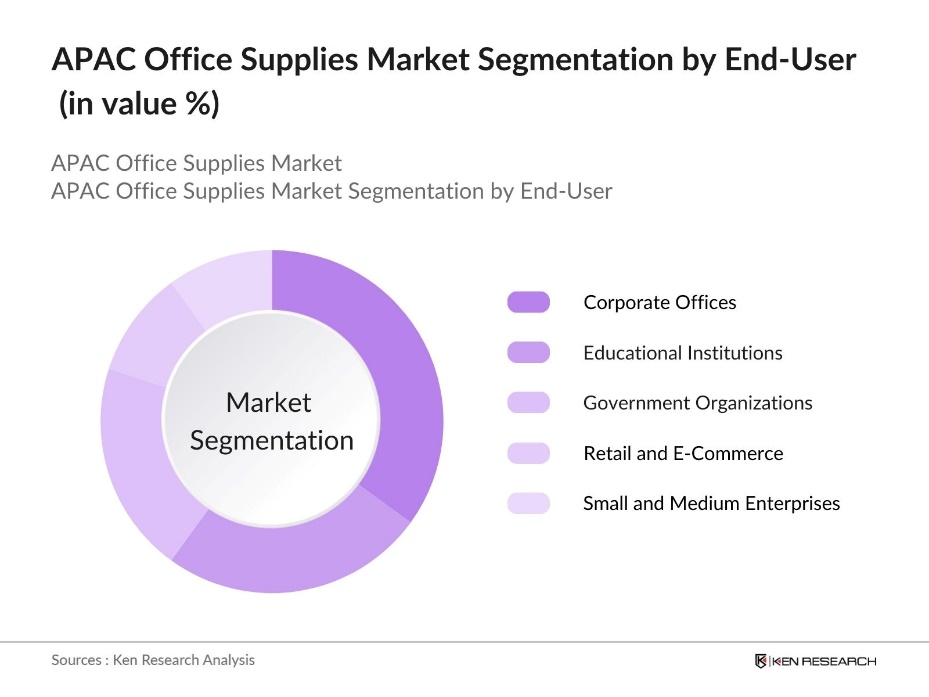

APAC Office Supplies Market Segmentation

By Product Type: The APAC office supplies market is segmented by product type into paper products, writing instruments, filing and organizing supplies, office electronics, and other miscellaneous supplies. The paper products have a dominant market share in the APAC region under the product type segmentation. This is primarily due to the continuous demand for notebooks, copy paper, and envelopes, particularly in the education sector and corporate offices. Despite the rise of digitalization, paper-based products remain essential for day-to-day operations in many businesses and institutions across APAC.

By End-User: The APAC office supplies market is segmented by end-user into corporate offices, educational institutions, government organizations, retail and e-commerce, and small and medium enterprises (SMEs). Corporate offices lead the end-user segmentation due to the high consumption of office supplies for daily operations and administrative tasks. As corporate businesses expand their footprints in emerging markets such as India and Southeast Asia, the demand for basic supplies like writing instruments, office furniture, and electronics continues to rise, further boosting the segment's growth.

APAC Office Supplies Market Competitive Landscape

The market is highly competitive, with a mix of international and regional players dominating the market. The competitive landscape highlights consolidation, where a few key players hold significant influence due to their strong product portfolios, distribution networks, and brand recognition.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD) |

Employee Count |

Product Portfolio |

R&D Spending |

Sustainability Efforts |

Innovation Index |

|

3M Company |

1902 |

St. Paul, USA |

||||||

|

Canon Inc. |

1937 |

Tokyo, Japan |

||||||

|

Fujitsu Limited |

1935 |

Tokyo, Japan |

||||||

|

Kokuyo Co. Ltd. |

1905 |

Osaka, Japan |

||||||

|

Zebra Pen Corporation |

1914 |

Tokyo, Japan |

APAC Office Supplies Industry Analysis

Growth Drivers

- Increase in Remote Work (Impact of Work-from-Home Culture): The Asia-Pacific office supplies market has experienced a surge in demand driven by the increase in remote and hybrid work models across the region. Countries like Japan and South Korea have reported the ratio of employed remote workers in Japan decreased from 26.1% in FY2022 to 24.8% in FY2023. In the Tokyo Metropolitan area, about 40% of workers are engaged in hybrid work, which combines remote and in-office work, influencing the need for essential home office supplies such as ergonomic furniture, printing paper, and accessories.

- Corporate Expansion in Developing Economies: The expansion of multinational corporations in emerging APAC economies like Vietnam and Indonesia has propelled the demand for office supplies. In 2023, Vietnam recorded over 160,000 newly registered enterprises, creating a significant need for essential office products like stationery, IT peripherals, and office furniture. This corporate growth trend is expected to sustain the demand for office supplies across the region.

- Growing Demand for Sustainable Office Products: Growing demand for sustainable office products is reshaping the APAC market, with businesses increasingly opting for eco-friendly solutions like recycled paper, biodegradable pens, and sustainably sourced furniture. Certifications such as Singapores Green Label are driving this trend, promoting the use of renewable and recyclable materials. This shift reflects a broader commitment to reducing environmental impact, as companies prioritize sustainability in their procurement and operational processes.

Market Challenges

- Price Fluctuation of Raw Materials (Paper, Plastic, etc.): Volatility in raw material prices, especially for paper and plastic, is a major challenge for the APAC office supplies market. Fluctuations in costs, driven by factors like supply chain disruptions and changes in oil prices, affect the production of essential office materials. Manufacturers, particularly in regions like India and China, face increased production costs, which can impact profitability and force adjustments to pricing strategies for office supplies.

- Shift Toward Digitalization (Impact on Paper-based Products): The growing shift toward digitalization in corporate and educational environments is reducing demand for traditional paper-based office supplies. As more businesses and institutions adopt digital platforms, there is less need for paper products like printing paper and notebooks. This trend presents a challenge for traditional office supply manufacturers, who must adapt to the increasing preference for digital alternatives, such as electronic notepads and cloud-based solutions.

APAC Office Supplies Market Future Outlook

Over the next five years, the APAC office supplies market is expected to experience steady growth driven by several key factors. Continuous investments in smart office infrastructure, the growing trend of flexible working environments, and increasing government spending on education are likely to boost the demand for office supplies. The market is also expected to witness significant innovation, with more companies offering eco-friendly and sustainable office products.

Market Opportunities

- Expansion of SME Sector in Emerging Markets: The growth of small and medium enterprises (SMEs) in APAC is creating significant opportunities for the office supplies market. As the number of SMEs rises in emerging markets, the demand for essential office equipment, such as desks, chairs, and stationery, is increasing. These businesses require affordable, high-quality office solutions, presenting a lucrative opportunity for suppliers to meet the expanding needs of this sector.

- Adoption of Smart Office Solutions (Automation and IoT Products): The adoption of smart office solutions, including automation and IoT-based products, is a growing opportunity in the APAC region. As businesses increasingly integrate automation into their operations, there is a rising demand for advanced office equipment that enhances productivity and energy efficiency. This trend is driven by a focus on smart workplaces, creating growth opportunities for innovative office supply manufacturers.

Scope of the Report

|

Product Type |

Paper Products Writing Instruments Filing and Organizing Supplies Office Electronics Others |

|

End-User |

Corporate Offices Educational Institutions Government Organizations Retail and E-Commerce SMEs |

|

Distribution Channel |

Online (E-Commerce Platforms, Direct-to-Consumer) Offline (Retail Stores, Office Supply Chains) |

|

Material Type |

Paper-Based Products Plastic-Based Products Metal-Based Products Eco-friendly/Sustainable Materials |

|

Country |

China Japan India Australia Rest of APAC |

Products

Key Target Audience

E-commerce Platforms

Facility Management Companies

Office Supplies Manufacturers

Smart Office Technology Companies

Small and Medium Enterprises (SMEs)

Government and Regulatory Bodies (APAC Education Ministries, Environmental Agencies)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

3M Company

Canon Inc.

Fujitsu Limited

Ricoh Company Ltd.

Staedtler Mars GmbH & Co. KG

Faber-Castell

Avery Dennison Corporation

BIC Group

Kokuyo Co. Ltd.

Pelikan International Corporation

Table of Contents

1. APAC Office Supplies Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics

1.4. Market Segmentation Overview

2. APAC Office Supplies Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. APAC Office Supplies Market Analysis

3.1. Growth Drivers

3.1.1. Increase in Remote Work (Impact of Work-from-Home Culture)

3.1.2. Corporate Expansion in Developing Economies

3.1.3. Government Educational Spending (Public and Private Sector Support)

3.1.4. Growing Demand for Sustainable Office Products

3.1.5. Expansion in E-Commerce and Retail Networks

3.2. Market Challenges

3.2.1. Price Fluctuation of Raw Materials (Paper, Plastic, etc.)

3.2.2. Shift Toward Digitalization (Impact on Paper-based Products)

3.2.3. Intense Competition Among Local and International Brands

3.3. Opportunities

3.3.1. Expansion of SME Sector in Emerging Markets

3.3.2. Adoption of Smart Office Solutions (Automation and IoT Products)

3.3.3. Rise in Office Stationery Demand for Hybrid Work Models

3.4. Trends

3.4.1. Growing Preference for Eco-friendly Products (Sustainable Packaging, Recycled Paper)

3.4.2. Increasing Adoption of Customizable Office Supplies

3.4.3. Impact of Automation on Procurement Processes

3.5. Government Regulations

3.5.1. Environmental Regulations on Plastic Use (Single-Use Ban)

3.5.2. Workplace Safety Regulations Impacting Office Equipment

3.5.3. Import-Export Regulations for Stationery and Office Supplies

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. APAC Office Supplies Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Paper Products (Notebooks, Envelopes, Copy Paper)

4.1.2. Writing Instruments (Pens, Pencils, Markers)

4.1.3. Filing and Organizing Supplies (Folders, Binders)

4.1.4. Office Electronics (Printers, Shredders, Scanners)

4.1.5. Others (Staplers, Clips, Adhesives)

4.2. By End-User (In Value %)

4.2.1. Corporate Offices

4.2.2. Educational Institutions

4.2.3. Government Organizations

4.2.4. Retail and E-Commerce

4.2.5. Small and Medium Enterprises (SMEs)

4.3. By Distribution Channel (In Value %)

4.3.1. Online (E-Commerce Platforms, Direct-to-Consumer)

4.3.2. Offline (Retail Stores, Office Supply Chains)

4.4. By Material Type (In Value %)

4.4.1. Paper-Based Products

4.4.2. Plastic-Based Products

4.4.3. Metal-Based Products

4.4.4. Eco-friendly/Sustainable Materials

4.5. By Country (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. Australia

4.5.5. Rest of APAC

5. APAC Office Supplies Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. 3M Company

5.1.2. Canon Inc.

5.1.3. HP Inc.

5.1.4. Fujitsu Limited

5.1.5. Ricoh Company Ltd.

5.1.6. Staedtler Mars GmbH & Co. KG

5.1.7. Faber-Castell

5.1.8. Avery Dennison Corporation

5.1.9. BIC Group

5.1.10. Office Depot Asia

5.1.11. Kokuyo Co. Ltd.

5.1.12. Pelikan International Corporation

5.1.13. ACCO Brands Asia

5.1.14. Shachihata Inc.

5.1.15. Zebra Pen Corporation

5.2. Cross Comparison Parameters (Revenue, Employee Strength, Headquarters, Manufacturing Capacity, Innovation Index, Product Portfolio, R&D Spending, Sustainability Efforts)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. APAC Office Supplies Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes (ISO, Environmental Certifications, Industry Compliance)

7. APAC Office Supplies Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. APAC Office Supplies Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By End-User (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Material Type (In Value %)

8.5. By Country (In Value %)

9. APAC Office Supplies Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the initial phase, an ecosystem map was constructed to include all major stakeholders within the APAC office supplies market. Extensive desk research was undertaken, utilizing proprietary and secondary databases to gather comprehensive information on office supplies trends and market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data was compiled for the APAC office supplies market, assessing product consumption rates, distribution networks, and revenue generation. Key factors such as material cost and consumer demand were analyzed to ensure reliability in market penetration analysis.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated using computer-assisted telephone interviews (CATI) with industry experts representing office supplies manufacturers and distributors. These consultations provided valuable insights into product performance and emerging trends, further refining the market data.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing all research findings, conducting direct interviews with office supply manufacturers to acquire detailed insights into product categories, sales volumes, and emerging innovations. This step confirmed the accuracy of our bottom-up analysis, ensuring a comprehensive report.

Frequently Asked Questions

01 How big is the APAC Office Supplies Market?

The APAC Office Supplies Market is valued at USD 84.19 billion, driven by expanding corporate offices, educational institutions, and the rise in demand for sustainable office products.

02. What are the challenges in the APAC Office Supplies Market?

Challenges in the APAC Office Supplies Market include fluctuations in raw material prices, the growing impact of digitalization on paper-based products, and intense competition among local and international brands.

03. Who are the major players in the APAC Office Supplies Market?

Key players in APAC Office Supplies Market include 3M Company, Canon Inc., Kokuyo Co. Ltd., Ricoh Company Ltd., and Zebra Pen Corporation, each dominating the market with their strong product offerings and distribution networks.

04. What are the growth drivers of the APAC Office Supplies Market?

Growth drivers in APAC Office Supplies Market include the rise of smart office infrastructure, increasing government spending on education, the expansion of SMEs, and the growing trend of eco-friendly office supplies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.