APAC Online Grocery Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD9492

December 2024

90

About the Report

APAC Online Grocery Market Overview

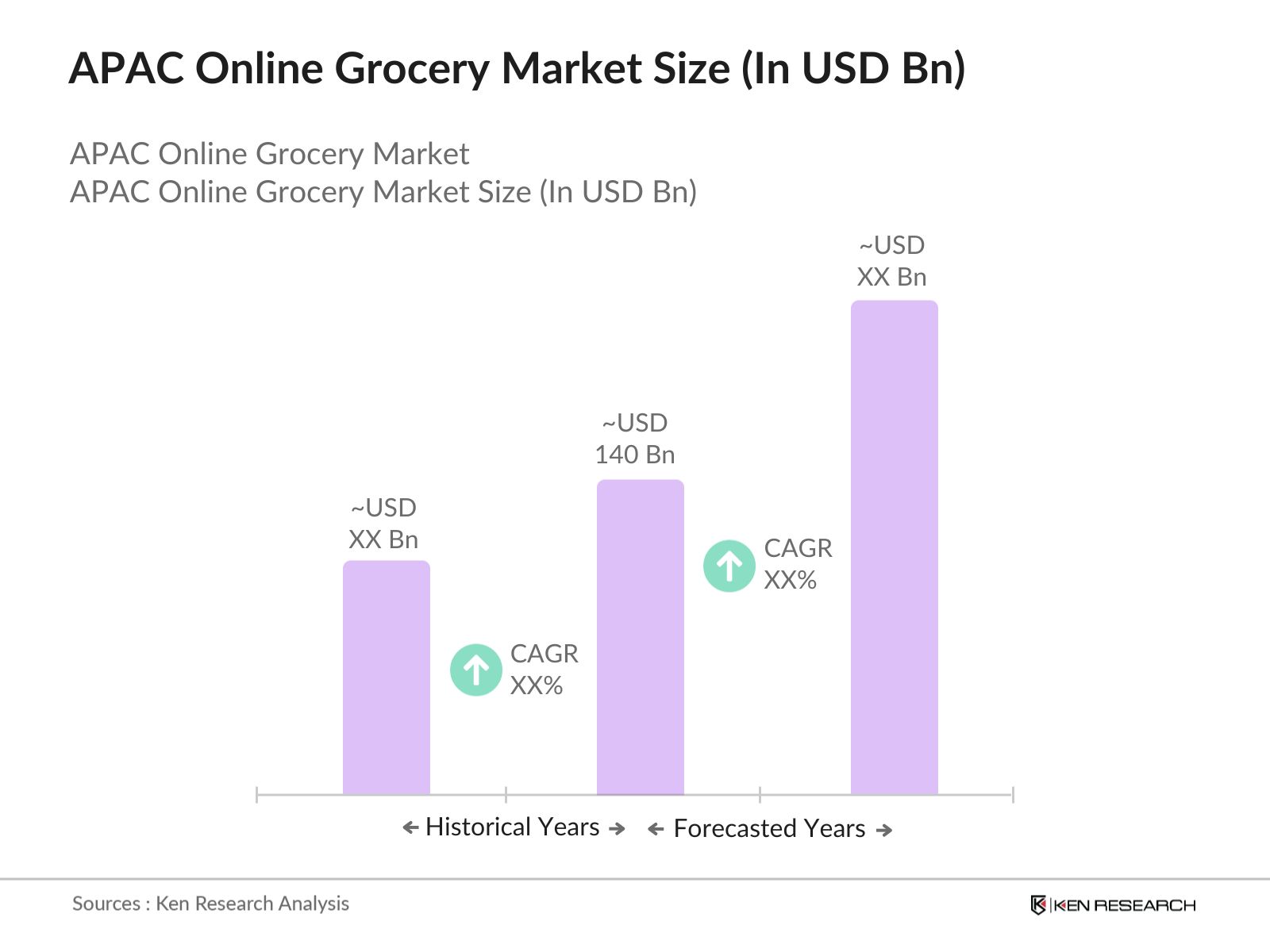

- The APAC online grocery market is valued at USD 140 billion, primarily driven by the increasing adoption of e-commerce platforms, changing consumer lifestyles, and enhanced logistics solutions. Factors such as urbanization, the rise of mobile shopping, and the growing demand for convenience in shopping are significantly contributing to market growth. Moreover, advancements in technology, including AI and machine learning, are improving the efficiency of delivery systems and personalization of the shopping experience, reinforcing APACs position as a leading market for online grocery shopping globally.

- Major demand centers for online grocery shopping in the APAC region include China, Japan, and India. China leads due to its vast population and advanced digital payment infrastructure, which makes online shopping accessible to a large consumer base. Japan follows, driven by high consumer expectations for quality and convenience, along with a tech-savvy demographic that readily embraces online purchasing. India is rapidly emerging as a key player, supported by a growing middle class, increasing smartphone penetration, and government initiatives to promote digital transactions, further stimulating market growth in the region.

- The U.S. e-commerce industry is regulated by comprehensive policies, such as the E-commerce Act, enforcing consumer rights and business standards. These regulations, managed by the Federal Trade Commission, ensure fair competition and safeguard consumer interests, allowing a transparent and trustworthy online marketplace. Compliance with these standards has required online grocery businesses to adjust practices, ensuring ethical operations across the industry.

APAC Online Grocery Market Segmentation

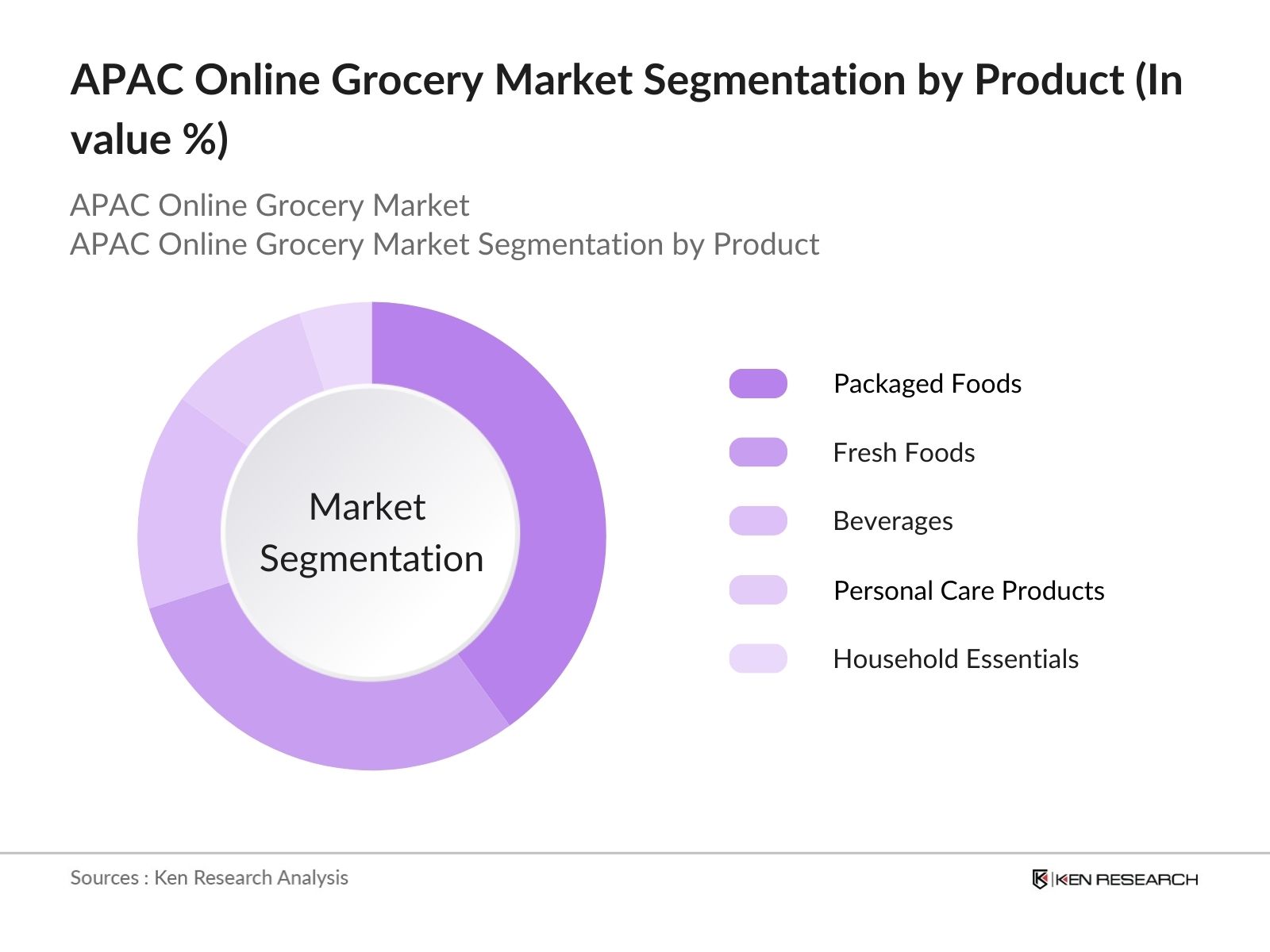

- By Product Type: The market is segmented by product type into packaged foods, fresh foods, beverages, personal care products, and household essentials. Recently, the packaged foods segment has emerged as the dominant sub-segment within this segmentation. Its dominance is attributed to the convenience of purchasing long-lasting products that require less immediate consumption, such as canned goods, snacks, and ready-to-eat meals. The continuous growth in urban populations and the rising demand for quick meal solutions have further solidified the popularity of packaged foods in the online grocery landscape.

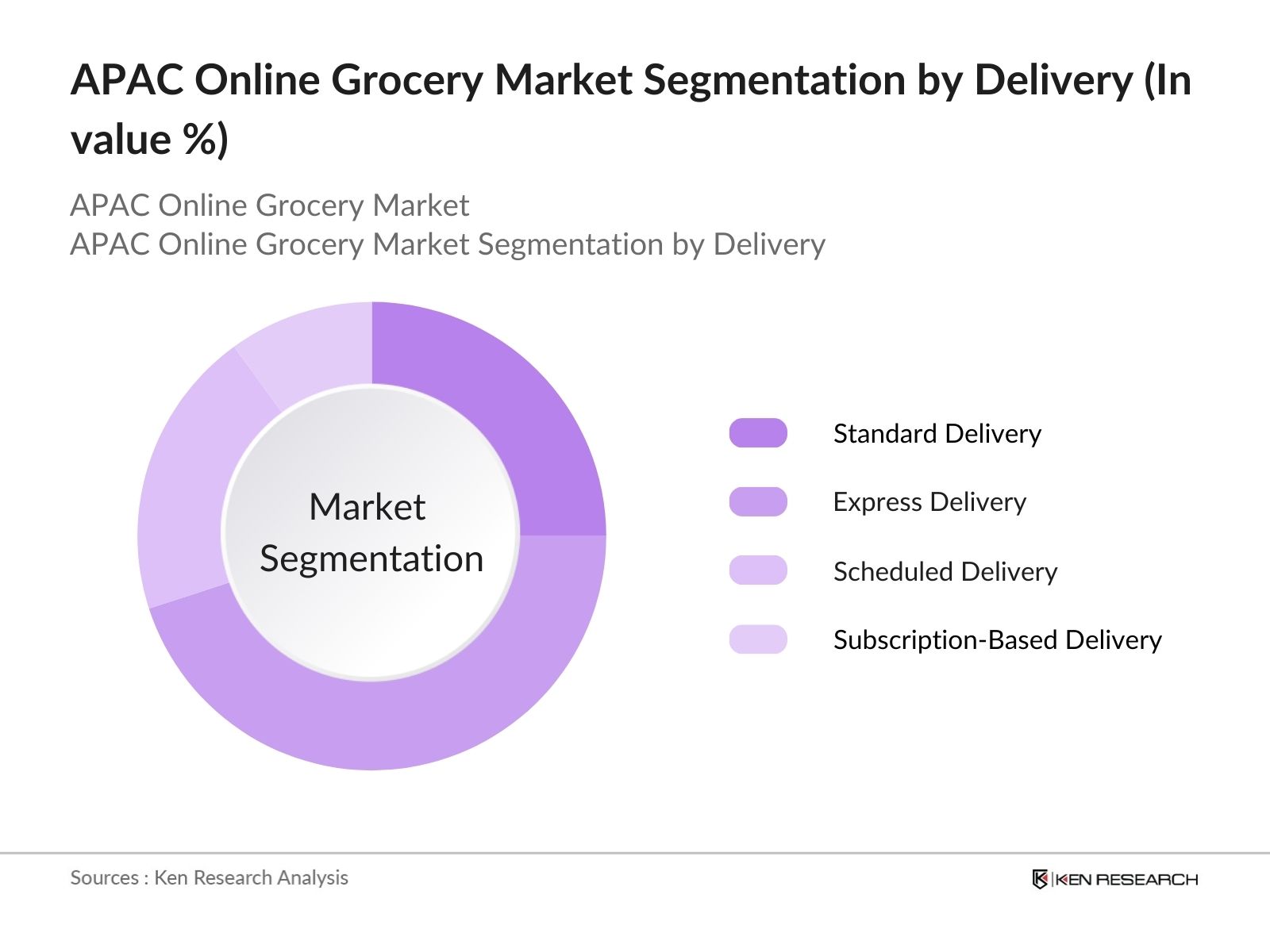

- By Delivery Type: The market is segmented by delivery type into standard delivery, express delivery, scheduled delivery, and subscription-based delivery. The express delivery segment holds the largest market share, driven by the increasing consumer expectation for quick and efficient service. The COVID-19 pandemic has heightened the demand for rapid delivery solutions, as more consumers prioritize convenience and immediacy in their shopping experiences. The rise of quick-commerce players and innovations in last-mile delivery services have also significantly contributed to the growth of this segment, catering to the fast-paced lifestyle of urban consumers.

APAC Online Grocery Market Competitive Landscape

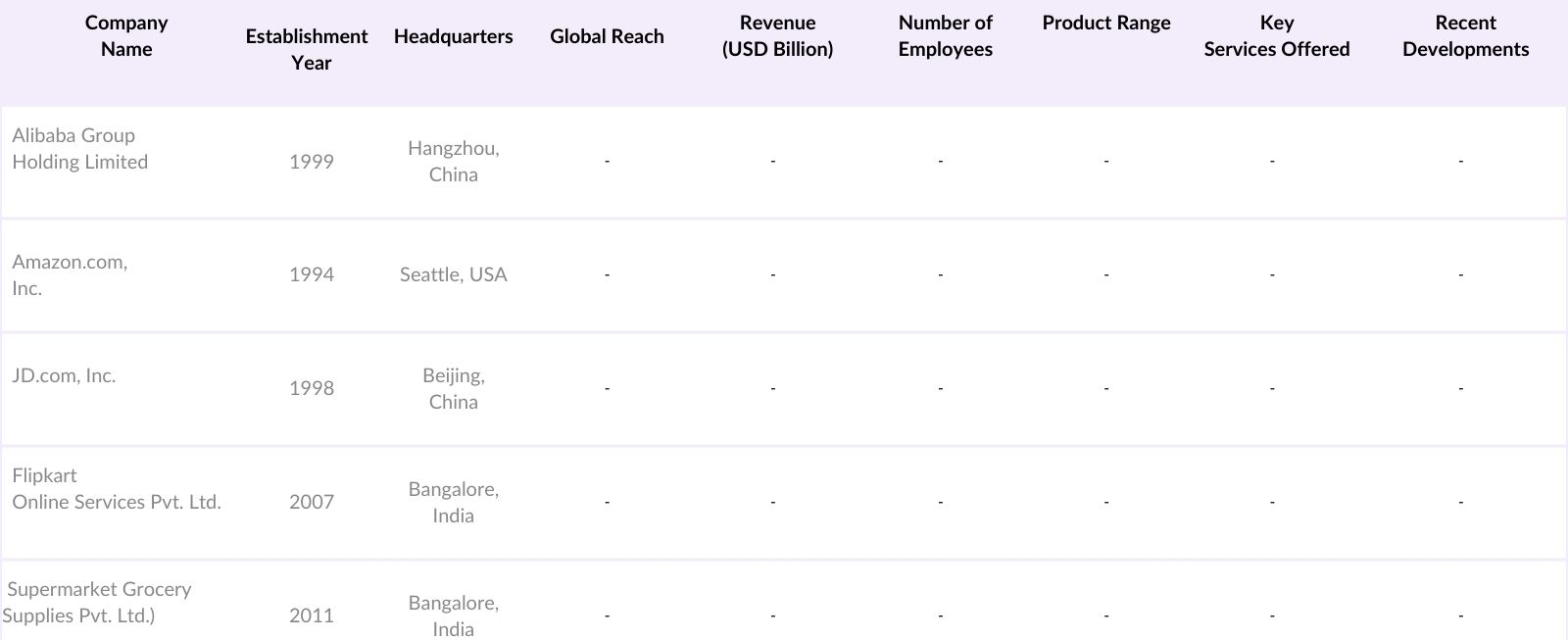

The APAC online grocery market is characterized by a competitive landscape dominated by major players such as Alibaba Group Holding Limited, Amazon.com, Inc., and JD.com, Inc. These companies leverage their extensive distribution networks, technological advancements, and strong brand recognition to maintain their leadership positions in the market.

APAC Online Grocery Market Analysis

Growth Drivers

- Increasing Demand for Convenience and Time-Saving Solutions: The growing preference for convenience among consumers is a significant driver of the online grocery market. As urban populations expand, consumers are increasingly seeking time-saving solutions that fit into their busy lifestyles. The proliferation of mobile technology and digital payment systems facilitates easy access to online grocery platforms, allowing consumers to shop from anywhere at any time. This shift towards convenience is reflected in the rise of express delivery services, which cater to the need for immediate access to grocery products, ultimately driving market growth.

- Expansion of E-commerce Platforms: The APAC e-commerce sector has seen exponential growth, with over 1.1 billion active online shoppers reported in 2024. Grocery e-commerce has been particularly significant, bolstered by innovations in app-based delivery and extensive product offerings. Companies now leverage over 4,000 e-commerce platforms regionwide, ensuring wider product variety and ease of access. Enhanced digital infrastructure, with 66 % of households having internet access, supports continuous customer engagement, directly impacting online grocery adoption. These figures underline e-commerce's foundational role in meeting modern grocery demands.

- Technological Advancements in Logistics and Delivery Systems: The continuous advancements in logistics and delivery technology play a crucial role in enhancing the efficiency of online grocery services. Innovations such as AI-driven supply chain management, real-time tracking systems, and automated warehouses are streamlining operations and reducing delivery times. Companies investing in these technologies are better positioned to meet consumer demands for faster service, thus attracting a larger customer base. Additionally, the integration of mobile applications enhances user experience and increases customer engagement, further driving market expansion.

Challenges

- Supply Chain Disruptions: One of the significant challenges facing the APAC online grocery market is the ongoing disruptions in the supply chain. Factors such as geopolitical tensions, natural disasters, and the COVID-19 pandemic have highlighted vulnerabilities in logistics and inventory management. These disruptions can lead to delays in product availability, increased operational costs, and ultimately affect customer satisfaction. Companies must develop robust supply chain strategies and establish reliable partnerships to mitigate these risks and ensure consistent service delivery.

- Regulatory Compliance: Compliance with varying regulations across the APAC region poses a challenge for online grocery retailers. Each Region has its own set of rules regarding food safety, e-commerce practices, and consumer rights. Adhering to these regulations can be complex and resource-intensive, potentially increasing operational costs for businesses. Retailers must remain vigilant and adaptable to changing regulations to maintain compliance and protect their brand reputation in the competitive online grocery landscape.

APAC Online Grocery Market Future Outlook

The APAC online grocery market is projected to experience substantial growth driven by evolving consumer preferences, technological advancements, and increased investments in infrastructure. As more consumers embrace online shopping, businesses will focus on enhancing their delivery capabilities and improving the overall customer experience. Additionally, the expansion of e-commerce platforms into rural areas will further broaden the market reach, creating new opportunities for growth.

Future Market Opportunities

- Expansion of Delivery Models: The emergence of new delivery models, including drone delivery and autonomous vehicles, presents significant opportunities for the online grocery market. These innovative solutions can reduce delivery times and operational costs, enhancing the customer experience. As technology continues to advance, companies that adopt these delivery models are likely to gain a competitive edge and attract more customers seeking convenience and efficiency in their grocery shopping.

- Sustainability Initiatives: Increasing consumer awareness regarding sustainability is driving demand for eco-friendly packaging and sourcing practices within the online grocery sector. Companies that prioritize sustainable operations and transparent supply chains are better positioned to capture market share as consumers increasingly favor brands aligned with their values. Investments in sustainable practices not only contribute to environmental goals but also enhance brand loyalty and consumer trust in the long run.

Scope of the Report

|

By Product Type |

Packaged Foods |

|

By Delivery Type |

Standard Delivery |

|

By Platform Type |

Mobile Applications |

|

By Payment Method |

Digital Wallets |

|

By Region |

China |

Products

Key Target Audience

E-commerce Platform Providers

Logistics and Delivery Service Providers

Retail Chains and Supermarkets

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (e.g., Ministry of Commerce, Food Safety Authorities)

Technology Solution Providers

Consumer Goods Manufacturers

Companies

Players Mentioned in the Report

Alibaba Group Holding Limited

Amazon.com, Inc.

JD.com, Inc.

Rakuten, Inc.

Woolworths Group Limited

Coles Group Limited

Tesco PLC

BigBasket (Supermarket Grocery Supplies Pvt. Ltd.)

Flipkart Online Services Pvt. Ltd.

Reliance Retail Limited

Aeon Co., Ltd.

Seven & i Holdings Co., Ltd.

Carrefour SA

Metro AG

Costco Wholesale Corporation

Table of Contents

1. APAC Online Grocery Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

1.5 Market Size (In USD Million)

1.6 Historical Market Size

1.7 Year-On-Year Growth Analysis

1.8 Key Market Developments and Milestones

2. APAC Online Grocery Market Analysis

2.1 Growth Drivers

2.1.1 Urbanization and Changing Consumer Lifestyles

2.1.2 Expansion of E-commerce Platforms

2.1.3 Technological Advancements in Delivery Services

2.1.4 Government Initiatives Promoting Digital Economy

2.2 Challenges

2.2.1 Logistical and Supply Chain Complexities

2.2.2 High Competition Among Market Players

2.2.3 Consumer Trust and Product Quality Concerns

2.3 Opportunities

2.3.1 Integration of AI and Machine Learning for Personalization

2.3.2 Expansion into Rural and Underserved Areas

2.3.3 Strategic Partnerships and Collaborations

2.4 Trends

2.4.1 Rise of Quick Commerce and 10-Minute Deliveries

2.4.2 Increased Adoption of Subscription-Based Models

2.4.3 Growth of Private Label Products

2.5 Government Regulations

2.5.1 E-commerce Policies and Regulations

2.5.2 Food Safety and Quality Standards

2.5.3 Data Protection and Consumer Privacy Laws

3. APAC Online Grocery Market SWOT Analysis

3.1 Stakeholder Ecosystem

3.2 Porter’s Five Forces Analysis

4. APAC Online Grocery Market Competitive Landscape

4.1 Market Segmentation

4.1.1 By Product Type (In Value %)

Packaged Foods

Fresh Foods

Beverages

Personal Care Products

Household Essentials

4.1.2 By Delivery Type (In Value %)

Standard Delivery

Express Delivery

Scheduled Delivery

Subscription-Based Delivery

4.1.3 By Platform Type (In Value %)

Mobile Applications

Websites

Third-Party Aggregators

4.1.4 By Payment Method (In Value %)

Digital Wallets

Credit/Debit Cards

Cash on Delivery

Bank Transfers

4.1.5 By Region (In Value %)

China

India

Japan

South Korea

Australia

Rest of APAC

4.2 Competitive Analysis 4.3 Detailed Profiles of Major Companies

Alibaba Group Holding Limited

Amazon.com, Inc.

JD.com, Inc.

Rakuten, Inc.

Woolworths Group Limited

Coles Group Limited

Tesco PLC

BigBasket (Supermarket Grocery Supplies Pvt. Ltd.)

Flipkart Online Services Pvt. Ltd.

Reliance Retail Limited

Aeon Co., Ltd.

Seven & i Holdings Co., Ltd.

Carrefour SA

Metro AG

Costco Wholesale Corporation

4.4 Cross Comparison Parameters

Number of Employees, Headquarters, Inception Year, Revenue, Market Share, Product Offerings, Delivery Network, Technological Innovations

4.5 Market Share Analysis

4.6 Strategic Initiatives

Mergers and Acquisitions

Investment Analysis

Venture Capital Funding

Government Grants

Private Equity Investments

5. APAC Online Grocery Market Regulatory Framework

5.1 E-commerce Regulations

5.2 Food Safety and Standards

5.3 Consumer Protection Laws

5.4 Data Privacy Regulations

6. APAC Online Grocery Market Future Projections

6.1 Future Market Size (In USD Million)

6.2 Future Market Size Projections

6.3 Key Factors Driving Future Market Growth

6.4 Future Market Segmentation

By Product Type (In Value %)

By Delivery Type (In Value %)

By Platform Type (In Value %)

By Payment Method (In Value %)

By Region (In Value %)

7. APAC Online Grocery Market Analysts' Recommendations

7.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

7.2 Customer Cohort Analysis

7.3 Marketing Initiatives

7.4 White Space Opportunity Analysis

8. Disclaimer

8.1 Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the APAC Online Grocery Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the APAC Online Grocery Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple online grocery retailers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the APAC Online Grocery Market.

Frequently Asked Questions

01. How big is the APAC Online Grocery Market?

The APAC online grocery market is valued at USD 140 billion, primarily driven by the increasing adoption of e-commerce platforms, urbanization, and evolving consumer lifestyles seeking convenience in grocery shopping.

02. What are the challenges in the APAC Online Grocery Market?

Key challenges in the APAC online grocery market include supply chain disruptions and regulatory compliance across diverse countries in the region. Companies must address logistics complexities and adapt to varying regulations to maintain efficient operations.

03. Who are the major players in the APAC Online Grocery Market?

Major players in the APAC online grocery market include Alibaba Group Holding Limited, Amazon.com, Inc., JD.com, Inc., Flipkart, and BigBasket. These companies lead due to extensive distribution networks, advanced technology adoption, and brand recognition.

04. What are the growth drivers of the APAC Online Grocery Market?

Growth drivers for the APAC online grocery market include increasing consumer demand for convenience, technological advancements in logistics and delivery systems, and the rise in mobile and digital payment platforms, making online grocery shopping more accessible.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.