APAC Polyurethane Market Outlook to 2030

Region:Asia

Author(s):Shivani Mehra

Product Code:KROD2850

November 2024

95

About the Report

APAC Polyurethane Market Overview

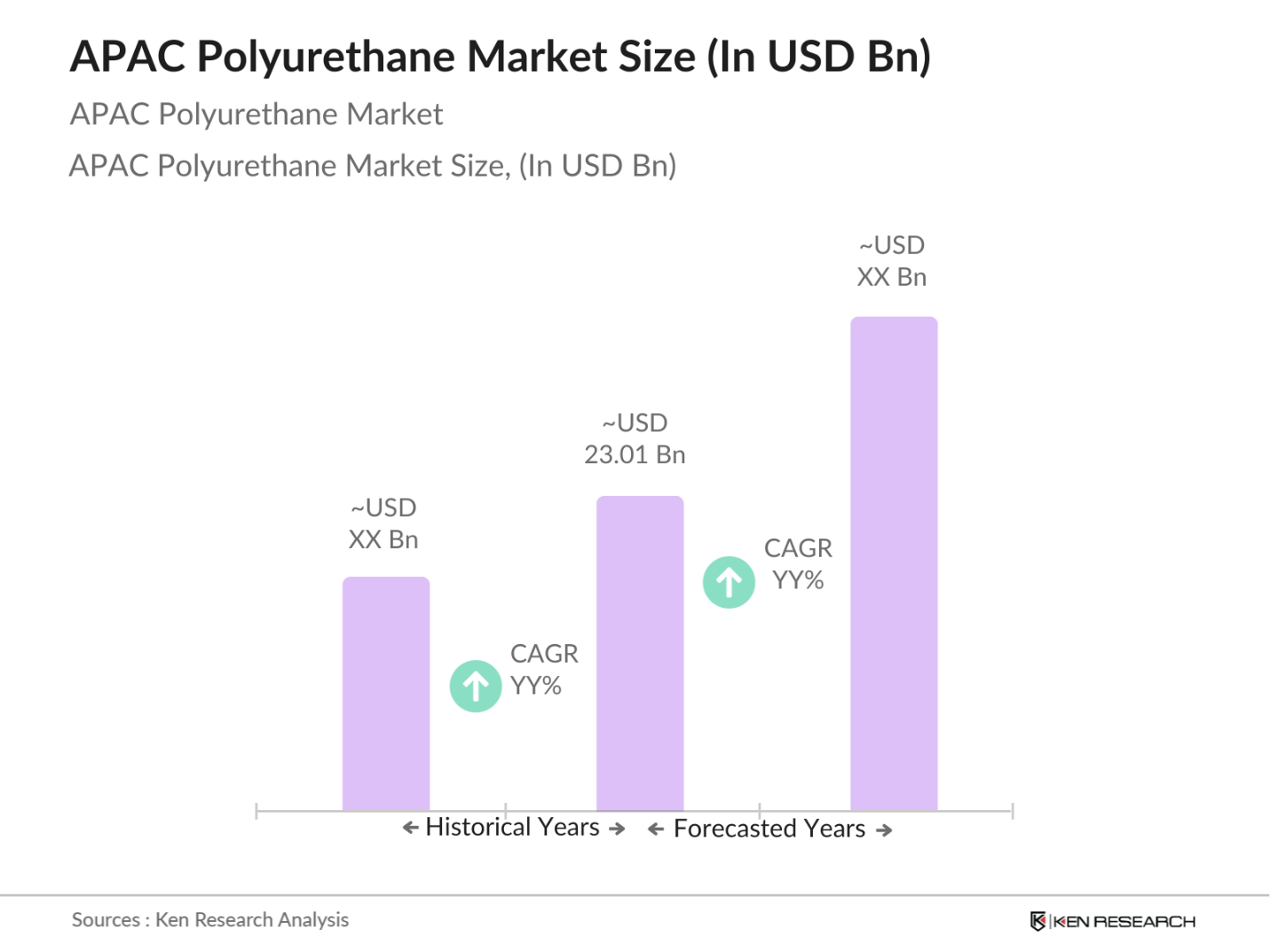

- The APAC Polyurethane Market is valued at USD 23.01 billion, driven by increasing applications in the construction and automotive sectors, which demand lightweight and durable materials. Polyurethane's versatility, particularly in foam applications for insulation, furniture, and bedding, has made it essential for both consumer and industrial goods. Rapid urbanization and infrastructure growth in emerging economies like China and India further bolster this market. Market sources like the International Energy Agency indicate a steady demand trajectory in line with the expansion of energy-efficient buildings and automotive lightweighting efforts.

- China, India, and Japan dominate the APAC Polyurethane Market due to their advanced manufacturing capabilities, robust industrial bases, and the growing consumer goods sector. China leads as a hub for polyurethane production, attributed to favorable government policies, significant investments in manufacturing, and high domestic demand for consumer products and automotive components.

- Governments in APAC are offering financial incentives to companies adopting sustainable practices. In 2023, India and Malaysia introduced tax breaks for manufacturers that incorporate renewable energy sources and recyclable materials in PU production. These incentives reduce costs for eco-conscious producers, encouraging sustainable development in the PU industry and aligning with APACs environmental objectives.

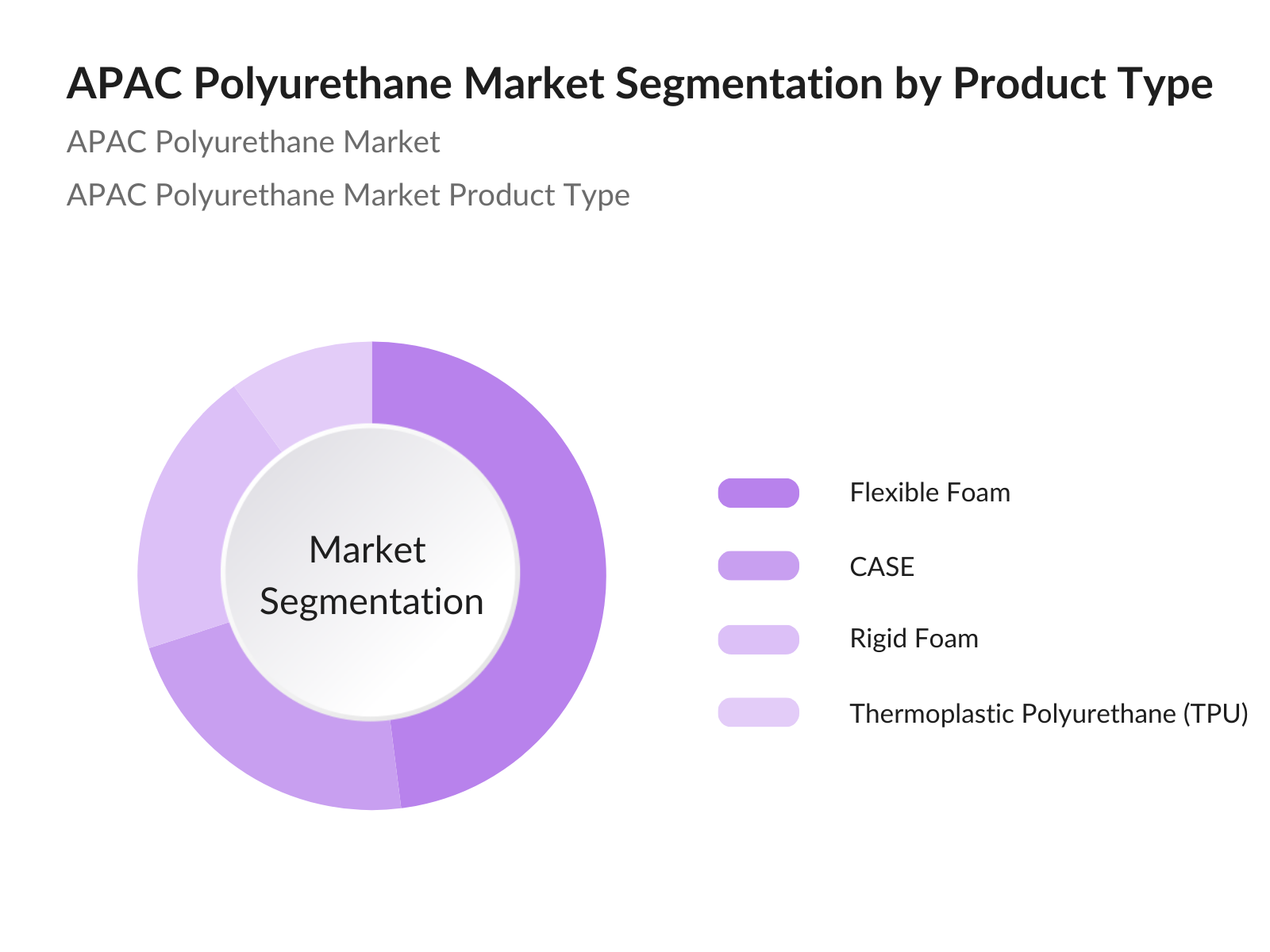

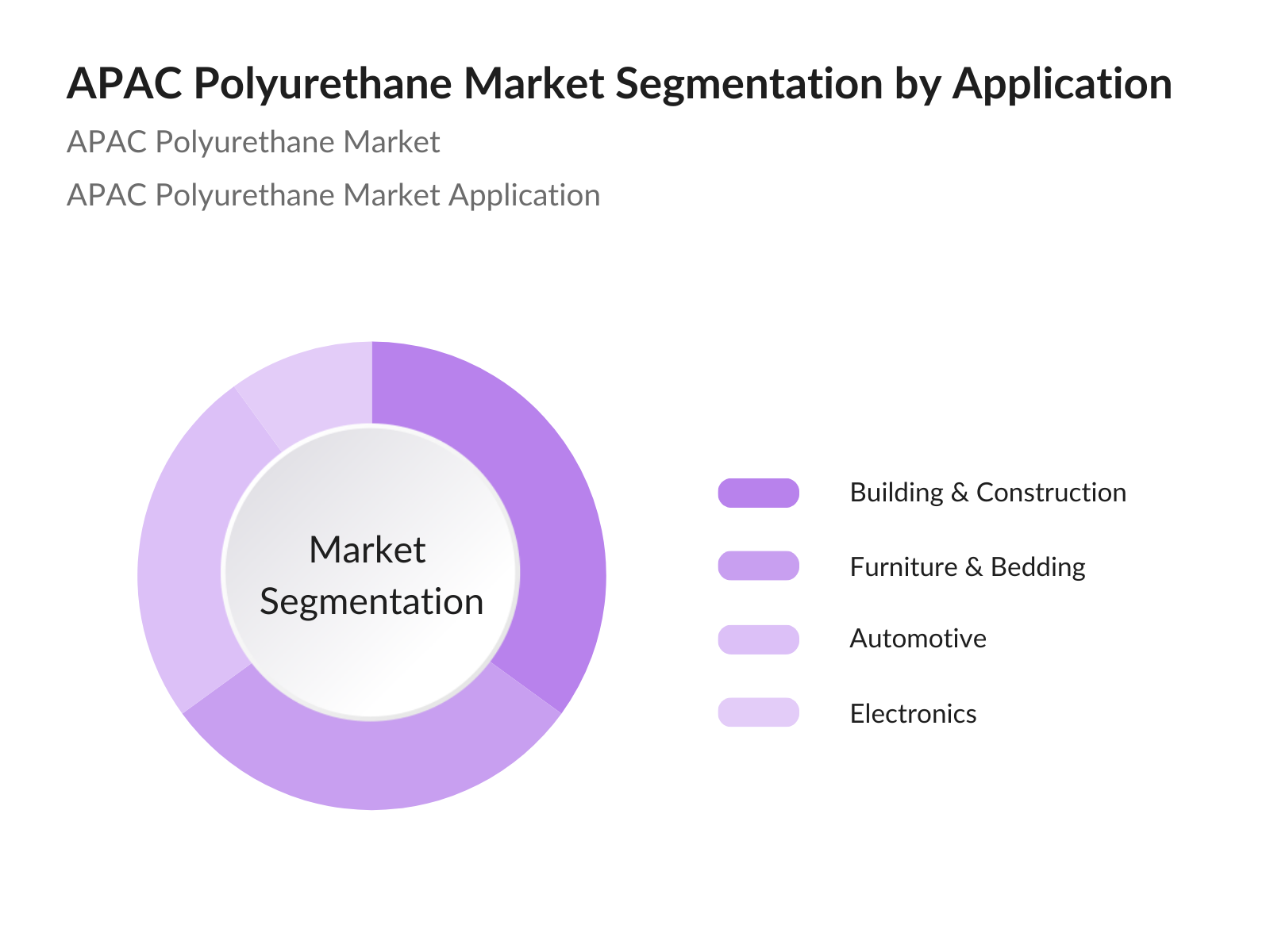

APAC Polyurethane Market Segmentation

By Product Type: The APAC Polyurethane Market is segmented by product type into rigid foam, flexible foam, coatings, adhesives, sealants, and elastomers (CASE), and thermoplastic polyurethane (TPU). Flexible foam holds a dominant market share due to its widespread use in furniture, bedding, and automotive seating. The comfort, durability, and versatility of flexible polyurethane foam make it the preferred choice for both consumer and industrial applications, particularly in rapidly urbanizing regions where affordable, comfortable housing materials are in high demand.

By Application: The market segmentation by application includes building & construction, automotive, furniture & bedding, and electronics. The building & construction segment dominates due to the rising demand for polyurethane-based insulation materials, which enhance energy efficiency and provide high thermal resistance. Polyurethane's application in construction as an insulating material aligns well with green building initiatives across the APAC region, especially in countries focused on reducing energy consumption in residential and commercial buildings.

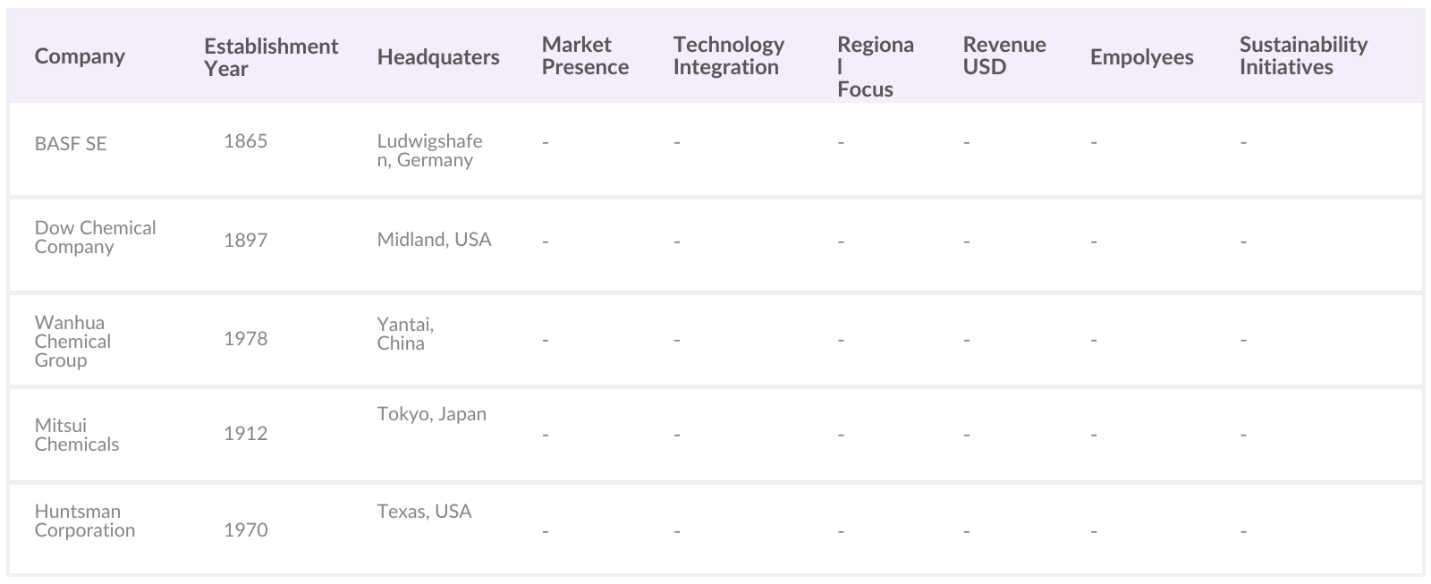

APAC Polyurethane Market Competitive Landscape

The APAC Polyurethane Market is led by several multinational companies with extensive R&D capabilities and strong manufacturing networks, allowing them to deliver customized solutions. Dominant players such as BASF SE and Dow Chemical leverage their technological expertise to meet the rising demand for high-performance polyurethane products across various applications.

APAC Polyurethane Market Analysis

Market Growth Drivers

- Rising Demand in Automotive and Construction Sectors: The automotive and construction sectors drive demand for polyurethane (PU) in APAC. China and India alone accounted for over 50 million cars on the road in 2023, highlighting the need for lightweight materials like PU in automotive components. In construction, South Korea and Japan are experiencing rapid adoption of PU in insulation and sealants, crucial in energy-efficient building practices. The demand is further reinforced by APAC’s infrastructure projects, with China allocating over $500 billion for construction under the Belt and Road Initiative.

- Increased Urbanization and Infrastructure Development: Urbanization in APAC has increased sharply, with nearly of APAC’s population residing in cities in 2023. The rapid urban migration has spurred large-scale infrastructure projects, from residential buildings to industrial complexes, driving the demand for PU materials, especially in insulation, flooring, and coatings. China and India are investing in smart cities and transportation infrastructure, with India allocating $30 billion for urban transport projects this year alone, accelerating PU demand in the region’s construction sector.

- Growing Demand for Sustainable and Lightweight Materials: With an expanding focus on sustainability, APAC’s manufacturers are opting for lightweight PU materials in multiple industries, including packaging, electronics, and consumer goods. Polyurethane’s strength-to-weight ratio makes it ideal for products requiring durability and reduced environmental impact. South Korea and Japan, major electronics producers, integrate PU foams in lightweight designs, with Japan’s Ministry of Economy supporting initiatives to reduce material waste, thereby enhancing PU adoption in eco-friendly applications.

Market Challenges:

- Volatility in Raw Material Prices: The APAC polyurethane market faces fluctuations in raw material prices, particularly for petrochemicals used in PU production. Since 2022, crude oil prices have ranged between $75 and $100 per barrel, affecting PU costs. Nations like India and Indonesia, reliant on raw material imports, experience higher costs that directly impact PU production pricing. Additionally, exchange rate volatility in APAC countries has created further unpredictability in raw material imports, constraining industry expansion.

- Environmental and Health Concerns: PU production raises concerns over environmental and health risks due to the release of volatile organic compounds (VOCs) and other emissions. According to regional health reports, exposure to VOCs impacts over 300,000 workers in APAC’s manufacturing sector, particularly affecting China, which has a large workforce in PU manufacturing. Consequently, regulatory bodies are increasing scrutiny and imposing restrictions on VOC emissions, influencing manufacturing protocols and creating compliance costs for PU producers.

APAC Polyurethane Market Future Outlook

Over the next five years, the APAC Polyurethane Market is expected to experience significant growth, driven by expanding infrastructure, automotive production, and demand for lightweight materials. The shift towards sustainable, bio-based polyurethane products and the implementation of strict environmental regulations will further shape market dynamics. Key players are likely to increase investment in eco-friendly alternatives and innovative polyurethane applications, including insulation and lightweight automotive components.

Market Opportunities:

- Growth in Electric Vehicle Production: The rise of electric vehicles (EVs) in APAC fuels demand for lightweight materials to enhance energy efficiency. By 2024, APAC accounted for nearly 30 million EV units, with China leading the market. PU components, crucial for reducing vehicle weight and enhancing battery life, are widely used in EV interiors and undercarriages. Increased EV production, especially in China and South Korea, positions the PU market for growth as manufacturers integrate PU to meet efficiency standards.

- Development of Bio-based Polyurethane: Bio-based PU is gaining traction in APAC, with regional initiatives supporting sustainable production methods. Malaysia and Thailand have incentivized bio-based materials by investing approximately $500 million into research and development grants for eco-friendly products. Bio-based PU provides a biodegradable alternative to traditional PU, meeting the region’s increasing environmental concerns and aligning with consumer demand for sustainable products.

Scope of the Report

|

By Product Type |

Rigid Foam Flexible Foam Coatings, Adhesives, Sealants, and Elastomers (CASE) Thermoplastic Polyurethane (TPU) |

|

By Application |

Building & Construction Automotive Furniture & Bedding Electronics |

|

By End-User Industry |

Consumer Goods Packaging Footwear Textile |

|

By Distribution Channel |

Direct Sales Distributors Online Sales Retail Stores |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Automotive Manufacturers

Construction Material Suppliers

Consumer Goods Manufacturers

Packaging Companies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies(Ministry of Industry and Information Technology, China)

Electronics Manufacturers

Environmental Sustainability Organizations

Companies

Players Mention in the Report

BASF SE

Dow Chemical Company

Huntsman Corporation

Mitsui Chemicals

Covestro

Tosoh Corporation

Nippon Polyurethane

Wanhua Chemical Group

Bayer AG

Yantai Wanhua Polyurethanes

SKC Company

Kumho Mitsui Chemicals

Era Polymers

Vencorex Chemicals

Hanwha Solutions

Table of Contents

01.APAC Polyurethane Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02.APAC Polyurethane Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03.APAC Polyurethane Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand in Automotive and Construction Sectors

3.1.2. Increased Urbanization and Infrastructure Development

3.1.3. Growing Demand for Sustainable and Lightweight Materials

3.1.4. Advancements in Polyurethane Applications

3.2. Market Challenges

3.2.1. Volatility in Raw Material Prices

3.2.2. Environmental and Health Concerns

3.2.3. Regulatory Pressures on Hazardous Emissions

3.3. Opportunities

3.3.1. Expansion of Green Building Initiatives

3.3.2. Growth in Electric Vehicle Production

3.3.3. Development of Bio-based Polyurethane

3.4. Trends

3.4.1. Increased Use of Rigid Foam in Construction

3.4.2. Rise of Flexible Polyurethane in Consumer Products

3.4.3. Use of Polyurethane in Coatings and Adhesives

3.5. Government Regulation

3.5.1. National Emission Standards for VOCs

3.5.2. Restrictions on Hazardous Chemicals

3.5.3. Incentives for Sustainable Production

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Landscape

04.APAC Polyurethane Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Rigid Foam

4.1.2. Flexible Foam

4.1.3. Coatings, Adhesives, Sealants, and Elastomers (CASE)

4.1.4. Thermoplastic Polyurethane (TPU)

4.2. By Application (In Value %)

4.2.1. Building & Construction

4.2.2. Automotive

4.2.3. Furniture & Bedding

4.2.4. Electronics

4.3. By End-User Industry (In Value %)

4.3.1. Consumer Goods

4.3.2. Packaging

4.3.3. Footwear

4.3.4. Textile

4.4. By Country (In Value %)

4.4.1. China

4.4.2. India

4.4.3. Japan

4.4.4. South Korea

4.4.5. Southeast Asia

05.APAC Polyurethane Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. Dow Chemical Company

5.1.3. Huntsman Corporation

5.1.4. Mitsui Chemicals

5.1.5. Covestro

5.1.6. Tosoh Corporation

5.1.7. Nippon Polyurethane

5.1.8. Wanhua Chemical Group

5.1.9. Bayer AG

5.1.10. Yantai Wanhua Polyurethanes

5.1.11. SKC Company

5.1.12. Kumho Mitsui Chemicals

5.1.13. Era Polymers

5.1.14. Vencorex Chemicals

5.1.15. Hanwha Solutions

5.2 Cross Comparison Parameters (Revenue, Headquarters, Inception Year, Product Portfolio, R&D Investment, Regional Presence, Sustainability Certifications, Market Penetration Rate)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

06.APAC Polyurethane Market Regulatory Framework

6.1 Emission Standards for Manufacturing Plants

6.2 Certification and Compliance Requirements

6.3 Import and Export Regulations

07.APAC Polyurethane Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Growth

08.APAC Polyurethane Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Country (In Value %)

09.APAC Polyurethane Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Key Market Positioning Recommendations

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping the ecosystem of the APAC Polyurethane Market and defining the critical variables influencing market dynamics, such as raw material availability, technological advancements, and regulatory policies.

Step 2: Market Analysis and Construction

Historical data on segment performance and growth rates is analyzed, assessing polyurethane adoption in applications like automotive and construction. This ensures accurate revenue estimates and insights into market drivers and barriers.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through interviews with industry experts, gathering insights on challenges, growth factors, and technological trends that shape the market outlook.

Step 4: Research Synthesis and Final Output

The final stage synthesizes the gathered data and provides a comprehensive report on the APAC Polyurethane Market. Insights from industry players regarding sustainable materials and innovative applications are integrated to enhance market understanding.

Frequently Asked Questions

01. How big is the APAC Polyurethane Market?

The APAC Polyurethane Market is valued at USD 23.01 billion, driven by rising applications in construction and automotive sectors and a growing demand for durable, sustainable materials.

02. What are the challenges in the APAC Polyurethane Market?

Key challenges include volatility in raw material prices, environmental concerns, and regulatory pressures regarding emissions and the use of hazardous chemicals in production.

03. Who are the major players in the APAC Polyurethane Market?

Leading players include BASF SE, Dow Chemical Company, Huntsman Corporation, Mitsui Chemicals, and Wanhua Chemical Group, dominating due to their R&D capabilities and extensive manufacturing networks.

04. What are the growth drivers of the APAC Polyurethane Market?

The market is driven by increasing demand for energy-efficient buildings, advancements in polyurethane applications, and rapid infrastructure development in emerging economies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.