APAC Project Portfolio Management Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD8426

November 2024

90

About the Report

APAC Project Portfolio Management Market Overview

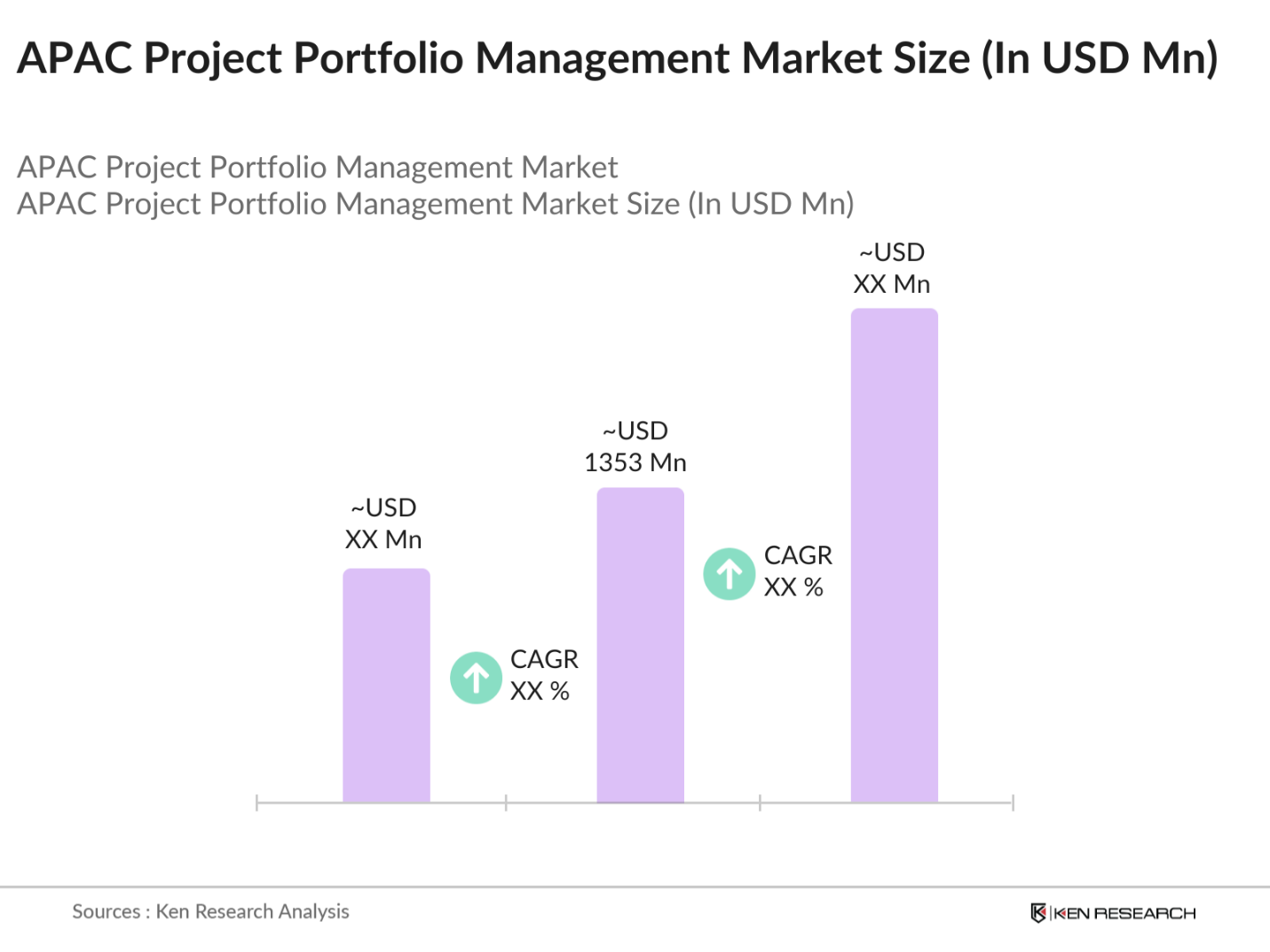

- The APAC Project Portfolio Management (PPM) market is valued at USD 1353 million, based on a five-year historical analysis. Key growth drivers include rapid digital transformation across industries and increased government focus on infrastructure development, especially in economies like China and India. These developments lead to significant demand for PPM solutions that streamline project workflows, enhance collaboration, and optimize resource utilization, making these solutions essential across sectors such as IT, telecommunications, and manufacturing.

- China and India dominate the APAC PPM market due to robust IT infrastructure investments and government initiatives promoting digital transformation in various industries. Chinas emphasis on technological innovation and its vast manufacturing sector propels PPM solution demand. Meanwhile, Indias growth is supported by a growing technology sector and a surge in smart city projects, driving demand for PPM software that supports efficient project tracking, allocation, and budgeting.

- APAC organizations are increasingly adhering to ISO 21500 and PMBOK standards to align project management with global best practices. By 2024, over 45% of large enterprises in the region reported following these standards to improve project transparency and accountability. In countries like Japan, adopting PMBOK standards has become crucial for government-backed projects, ensuring standardized processes and regulatory compliance.

APAC Project Portfolio Management Market Segmentation

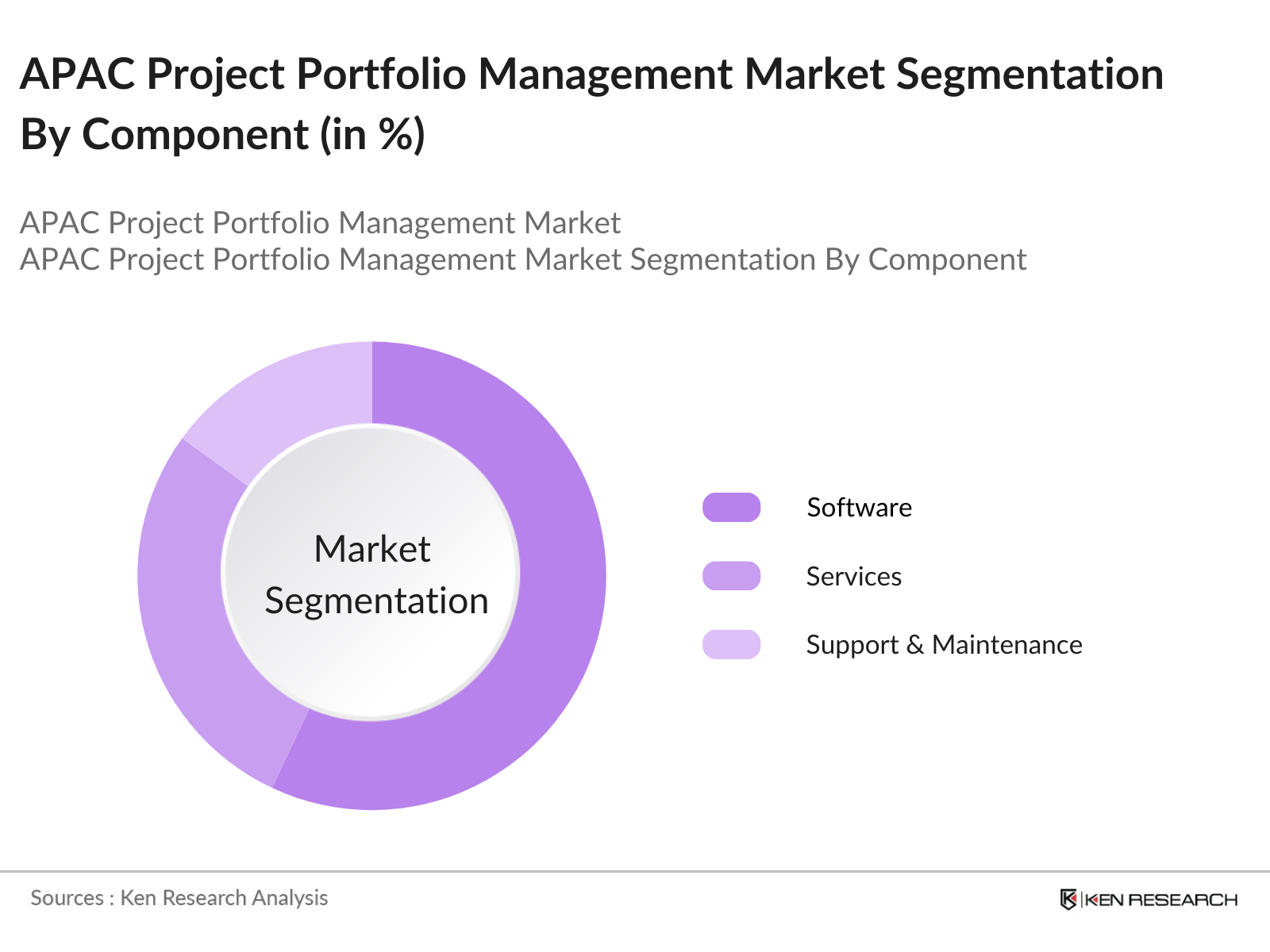

By Component: The market is segmented by component into software, services, and support & maintenance. Recently, software holds a dominant market share under this segmentation due to the rapid adoption of cloud-based project management tools that provide flexibility, real-time access, and lower upfront costs. Key players such as Microsoft and Oracle offer advanced PPM software that streamlines project planning, which has gained traction in industries like IT and BFSI.

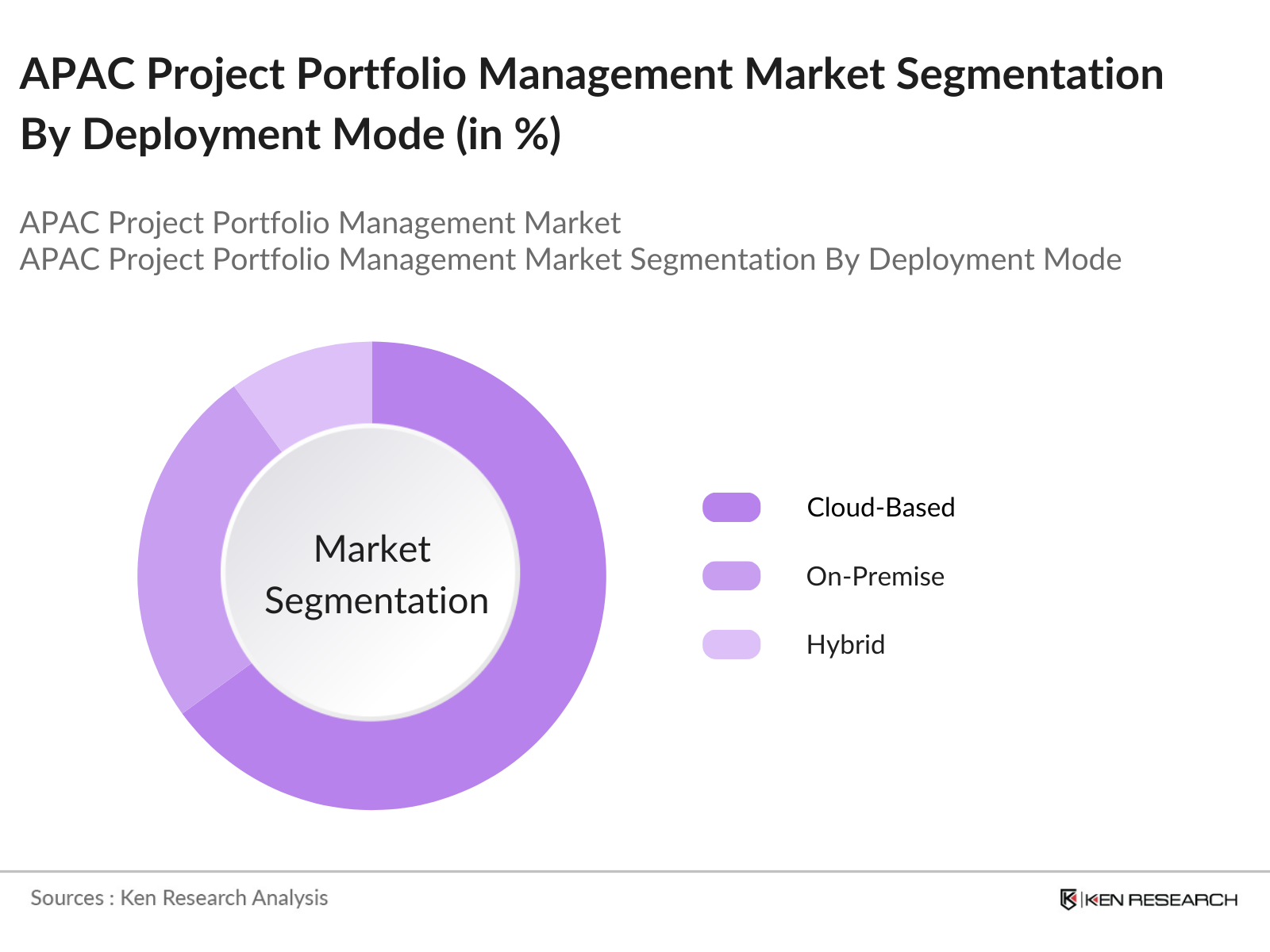

By Deployment Mode: The APAC PPM market by deployment mode is segmented into on-premise, cloud-based, and hybrid. Cloud-based solutions dominate this segment as they allow remote access, scalability, and lower IT maintenance costs. Cloud-based deployment also supports collaboration among geographically distributed teams, aligning with the digital transformation goals of organizations across APAC, making it the preferred choice, particularly among mid-sized and large enterprises.

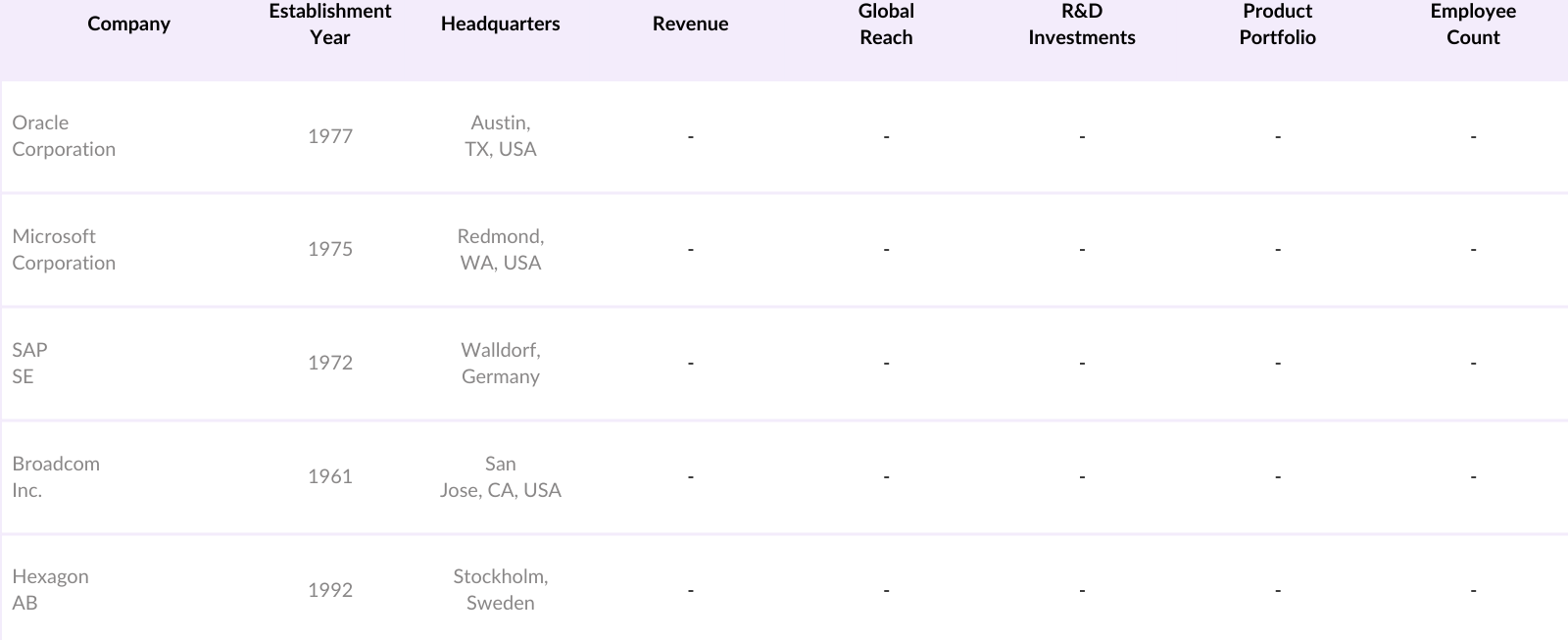

APAC Project Portfolio Management Market Competitive Landscape

The APAC Project Portfolio Management market is led by several key players who emphasize innovation and strategic partnerships to capture market share. Market leaders include Oracle, Microsoft, and SAP, whose strong product offerings have enabled them to meet the demands of APACs rapidly digitizing industries.

APAC Project Portfolio Management Industry Analysis

Growth Drivers

- Increased Digital Transformation (Key Sectors): Digital transformation is reshaping critical sectors like finance, healthcare, and manufacturing, with major developments being fueled by government and corporate investments. As of 2024, over 50% of global corporations in the Asia-Pacific region prioritize digital solutions in their growth strategies, driving demand for efficient project portfolio management (PPM) software. For instance, the healthcare industry has observed a 23% increase in digital adoption, enabling streamlined processes and enhanced project oversight within healthcare portfolios.

- Expansion of IT Infrastructure (Enterprise Demand): With an increasing need for scalable IT infrastructure, enterprises are investing heavily in project management solutions to optimize workflows and project outcomes. For example, South Koreas IT sector spending reached $8.1 billion in 2024, highlighting the demand for project management tools across public and private sectors. Additionally, enterprises are strategically upgrading their IT systems, resulting in an estimated 29% increase in project implementation efficiency in the last two years.

- Government Initiatives for Digitalization (Regional Policies): Governments across the APAC region is actively promoting digitalization, allocating significant budgets to accelerate project portfolio digital adoption. Notably, Singapore invested $2.4 billion into its Smart Nation initiative, enabling more integrated and technology-forward project management frameworks. These government initiatives lead to an increase in digital projects requiring robust project portfolio management to ensure alignment with national policies.

Market Challenges

- High Implementation Costs (CapEx and OpEx Impact): High capital expenditure (CapEx) and operational expenditure (OpEx) in the APAC PPM market hinder widespread adoption, especially among SMEs. Data shows that implementing an advanced PPM solution can cost up to $300,000 annually, depending on project complexity, impacting both public and private sectors. Consequently, companies are cautious in investing, affecting adoption rates. For example, Australia's national CapEx on PPM infrastructure reached $1.1 billion in 2024, signaling the cost challenges companies face in deploying these solutions across larger portfolios.

- Data Security and Compliance Issues (GDPR, CCPA, etc.): Stringent data security regulations, including the General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA), complicate compliance for PPM systems handling sensitive data. These regulations significantly impact multi-national enterprises, where compliance costs per project can reach up to $1 million annually in the APAC region. Furthermore, governments across the region are introducing localized data regulations, adding complexity to cross-border projects. In 2024, 47% of companies in APAC reported compliance as a critical challenge in project management.

APAC Project Portfolio Management Market Future Outlook

Over the next few years, the APAC Project Portfolio Management market is expected to see substantial growth, driven by ongoing digital transformation and cloud adoption. Increased emphasis on project agility and efficiency is expected to stimulate demand for sophisticated project management solutions. Strategic partnerships and mergers among PPM vendors will likely streamline services and expand product capabilities to meet the APAC regions specific needs.

Market Opportunities

- AI and Automation in Project Portfolio Management (Process Optimization): Artificial intelligence and automation are transforming project portfolio management, improving accuracy and efficiency in resource allocation. By 2024, 34% of APAC-based companies have integrated AI-driven tools into their project workflows, leading to a 25% improvement in task completion times. For instance, Japans Hitachi launched AI-driven PPM solutions that helped reduce project delays across sectors, underscoring this opportunity for AI adoption in PPM processes.

- Integration with Cloud Technologies (Scalability): Cloud-based project management solutions are increasingly popular due to their scalability and remote accessibility. Approximately 63% of APAC organizations, including public sector entities, are investing in cloud-based PPM tools. This trend is evident in China, where cloud technology adoption has enabled government projects to operate at a 33% faster rate. Cloud integration offers flexible project scaling, significantly reducing infrastructure needs across sectors.

Scope of the Report

|

Component |

Software Services Support and Maintenance |

|

Deployment Mode |

On-Premise Cloud-Based Hybrid |

|

Enterprise Size |

Large Enterprises SMEs |

|

End-User Industry |

IT and Telecommunications BFSI Healthcare Manufacturing Government and Defense |

|

Country |

China India Japan South Korea Southeast Asia (Indonesia, Singapore, Malaysia, etc.) |

Products

Key Target Audience

Project Management Offices (PMOs)

IT and Telecommunications Companies

Financial Services Firms (BFSI)

Healthcare and Pharmaceutical Organizations

Government and Regulatory Bodies (e.g., Ministry of Information Technology)

Large Enterprises across Industries

Venture Capital and Investment Firms

Manufacturing and Industrial Sector

Companies

Players Mentioned in the Report

Oracle Corporation

Microsoft Corporation

SAP SE

Broadcom Inc.

Hexagon AB

Planview, Inc.

ServiceNow, Inc.

Adobe Systems Inc.

Asana, Inc.

Wrike, Inc.

Table of Contents

1. Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. APAC Project Portfolio Management Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Market Dynamics

3.1 Growth Drivers

3.1.1 Increased Digital Transformation (Key Sectors)

3.1.2 Expansion of IT Infrastructure (Enterprise Demand)

3.1.3 Government Initiatives for Digitalization (Regional Policies)

3.2 Market Challenges

3.2.1 High Implementation Costs (CapEx and OpEx Impact)

3.2.2 Data Security and Compliance Issues (GDPR, CCPA, etc.)

3.2.3 Talent Shortage in Project Management (Skills Gap)

3.3 Opportunities

3.3.1 AI and Automation in Project Portfolio Management (Process Optimization)

3.3.2 Integration with Cloud Technologies (Scalability)

3.3.3 Market Penetration in Emerging Economies (Untapped Markets)

3.4 Trends

3.4.1 Adoption of Hybrid Project Management Models (Agile & Waterfall)

3.4.2 Emphasis on Portfolio Analytics (Data-Driven Decision Making)

3.4.3 Remote Project Collaboration Tools (Post-Pandemic Shift)

3.5 Regulatory Landscape

3.5.1 Compliance Standards (ISO 21500, PMBOK)

3.5.2 Regional Data Privacy Laws (Data Localization)

3.5.3 Government Subsidies for Technology Adoption

3.6 Competitive Forces Analysis (Porters Five Forces)

3.7 Ecosystem Overview (Stakeholder Mapping)

3.8 SWOT Analysis

3.9 Risk Assessment and Mitigation

4. APAC Project Portfolio Management Market Segmentation

4.1 By Component (In Value %)

4.1.1 Software

4.1.2 Services

4.1.3 Support and Maintenance

4.2 By Deployment Mode (In Value %)

4.2.1 On-Premise

4.2.2 Cloud-Based

4.2.3 Hybrid

4.3 By Enterprise Size (In Value %)

4.3.1 Large Enterprises

4.3.2 SMEs

4.4 By End-User Industry (In Value %)

4.4.1 IT and Telecommunications

4.4.2 BFSI (Banking, Financial Services, and Insurance)

4.4.3 Healthcare

4.4.4 Manufacturing

4.4.5 Government and Defense

4.5 By Country (In Value %)

4.5.1 China

4.5.2 India

4.5.3 Japan

4.5.4 South Korea

4.5.5 Southeast Asia (Indonesia, Singapore, Malaysia, etc.)

5. Competitive Landscape

5.1 Detailed Profiles of Key Competitors

5.1.1 Oracle Corporation

5.1.2 Microsoft Corporation

5.1.3 SAP SE

5.1.4 Broadcom Inc.

5.1.5 Hexagon AB

5.1.6 Planview, Inc.

5.1.7 ServiceNow, Inc.

5.1.8 Adobe Systems Inc.

5.1.9 Asana, Inc.

5.1.10 Wrike, Inc.

5.1.11 Smartsheet Inc.

5.1.12 Monday.com Ltd.

5.1.13 Clarizen, Inc.

5.1.14 Sciforma

5.1.15 Workfront, Inc.

5.2 Cross Comparison Parameters (Employee Count, Revenue, R&D Investments, HQ Location, Global Reach, Product Portfolio, Market Share, Strategic Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Venture Capital and Private Equity Investments

5.7 Technological Partnerships

5.8 Innovation and Product Launches

5.9 Joint Ventures and Alliances

6. APAC Project Portfolio Management Regulatory Framework

6.1 Industry Standards (PMI, PRINCE2)

6.2 Data Governance Policies

6.3 Compliance Certifications (ISO, CMMI)

7. Future Market Size Projection (In USD Bn)

7.1 Forecasted Market Value

7.2 Key Drivers of Future Market Growth

8. Future Market Segmentation

8.1 By Component (Projected Growth %)

8.2 By Deployment Mode (Projected Growth %)

8.3 By Enterprise Size (Projected Growth %)

8.4 By End-User Industry (Projected Growth %)

8.5 By Country (Projected Growth %)

9. Market Analysts Recommendations

9.1 TAM (Total Addressable Market), SAM (Serviceable Available Market), SOM (Serviceable Obtainable Market) Analysis

9.2 Customer Segmentation and Targeting

9.3 Suggested Marketing Strategies

9.4 White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

We started by mapping the APAC Project Portfolio Management ecosystem, identifying stakeholders and performing secondary research. This stage aimed to define core variables affecting market dynamics, including technology trends, user demand, and competitive intensity.

Step 2: Market Analysis and Construction

Historical data collection involved analyzing market penetration and revenue metrics within the APAC PPM sector. Market segmentation by deployment and component was assessed, with a focus on end-user adoption trends.

Step 3: Hypothesis Validation and Expert Consultation

Developed market hypotheses were validated through interviews with industry experts and leaders from top companies. These consultations refined market estimates and provided strategic insights into the markets evolving structure.

Step 4: Research Synthesis and Final Output

Through engagements with PPM vendors, we verified revenue forecasts and derived key performance metrics across user industries. This integration ensured the report accurately represents market trends and competitive positioning.

Frequently Asked Questions

01. How big is the APAC Project Portfolio Management Market?

The APAC Project Portfolio Management (PPM) market is valued at USD 1353 million, based on a five-year historical analysis.

02. What challenges does the APAC Project Portfolio Management Market face?

Challenges in the APAC PPM market include high implementation costs and data security concerns, which can hinder adoption, especially in regions with limited technical infrastructure.

03. Who are the major players in the APAC Project Portfolio Management Market?

Key players include Oracle Corporation, Microsoft Corporation, SAP SE, Broadcom Inc., and Hexagon AB. These companies lead due to their innovative product offerings, strong financial base, and strategic partnerships.

04. What drives growth in the APAC Project Portfolio Management Market?

The markets growth is propelled by increased adoption of cloud-based PPM solutions and the digital transformation of industries across the APAC region, which creates demand for agile, scalable solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.