APAC Recycled Plastic Market Outlook to 2030

Region:Asia

Author(s):Mukul

Product Code:KROD6445

October 2024

94

About the Report

APAC Recycled Plastic Market Overview

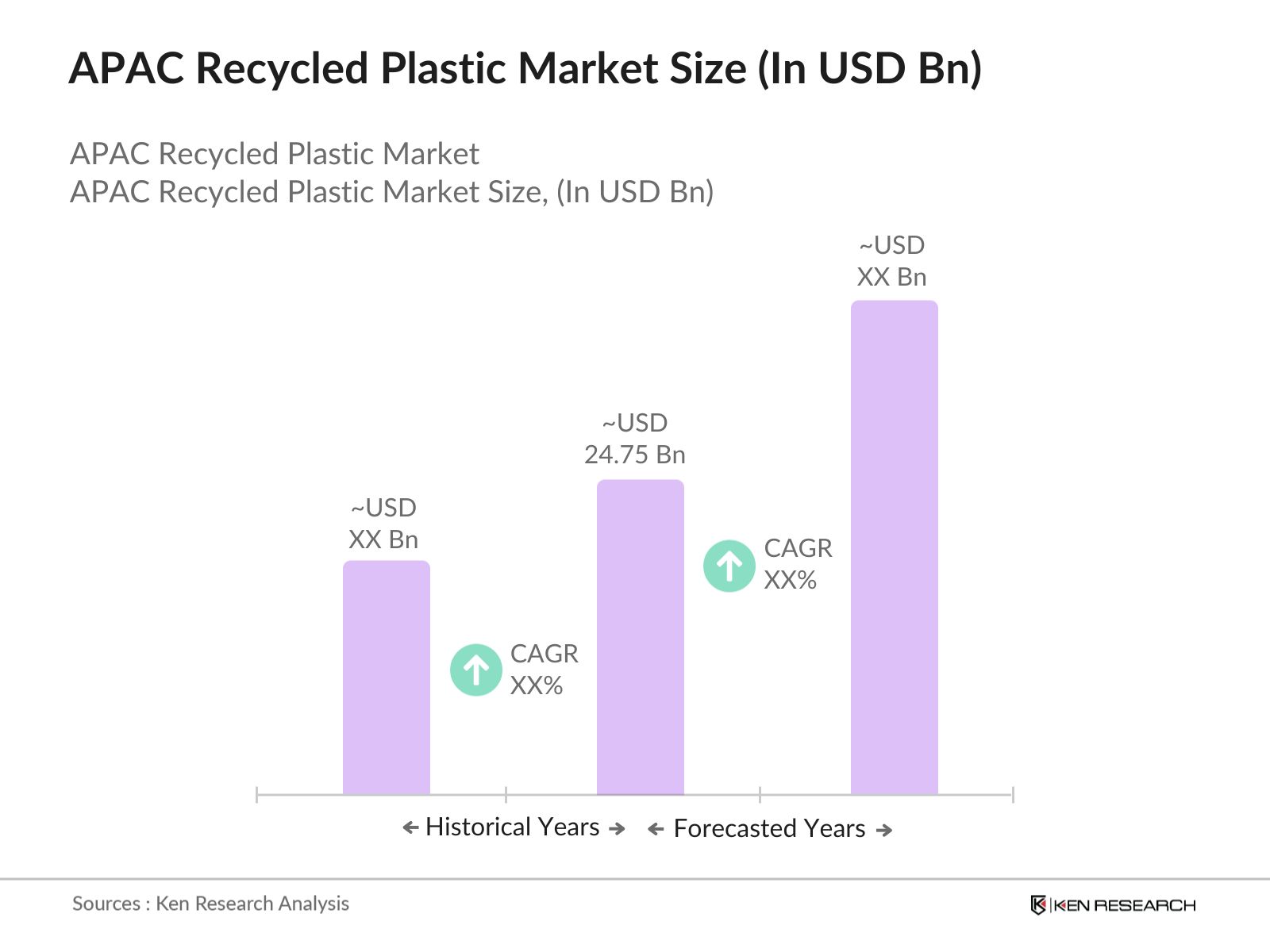

- The APAC Recycled Plastic Market is valued at USD 24.75 billion, driven by growing demand for sustainable materials in various industries, particularly packaging and construction. Major corporations are increasingly focusing on the use of recycled plastic to meet corporate ESG (Environmental, Social, and Governance) mandates. The market is also boosted by government regulations aimed at reducing plastic waste and promoting a circular economy, alongside advancements in recycling technology that enable higher recycling rates.

- Countries like China and Japan dominate the recycled plastic market in APAC due to their well-established recycling infrastructure, strong government regulations, and growing demand from the manufacturing sector. Chinas dominance can also be attributed to its large-scale plastic consumption and stringent waste management policies. Meanwhile, Japan leads in innovative recycling technologies, which enhances the quality and variety of recycled plastics available for industrial use.

- Governments across APAC are enforcing mandatory recycling targets to boost the recycling of plastics. South Korea has set a target to recycle 70% of its plastic waste by 2025, while Japan aims to recycle 2 million tons of plastic waste annually by the same year. These targets are supported by strict regulations that mandate businesses to incorporate recycled plastics into their production processes. This regulatory environment is creating opportunities for companies specializing in plastic recycling, particularly in sectors like packaging, construction, and automotive.

APAC Recycled Plastic Market Segmentation

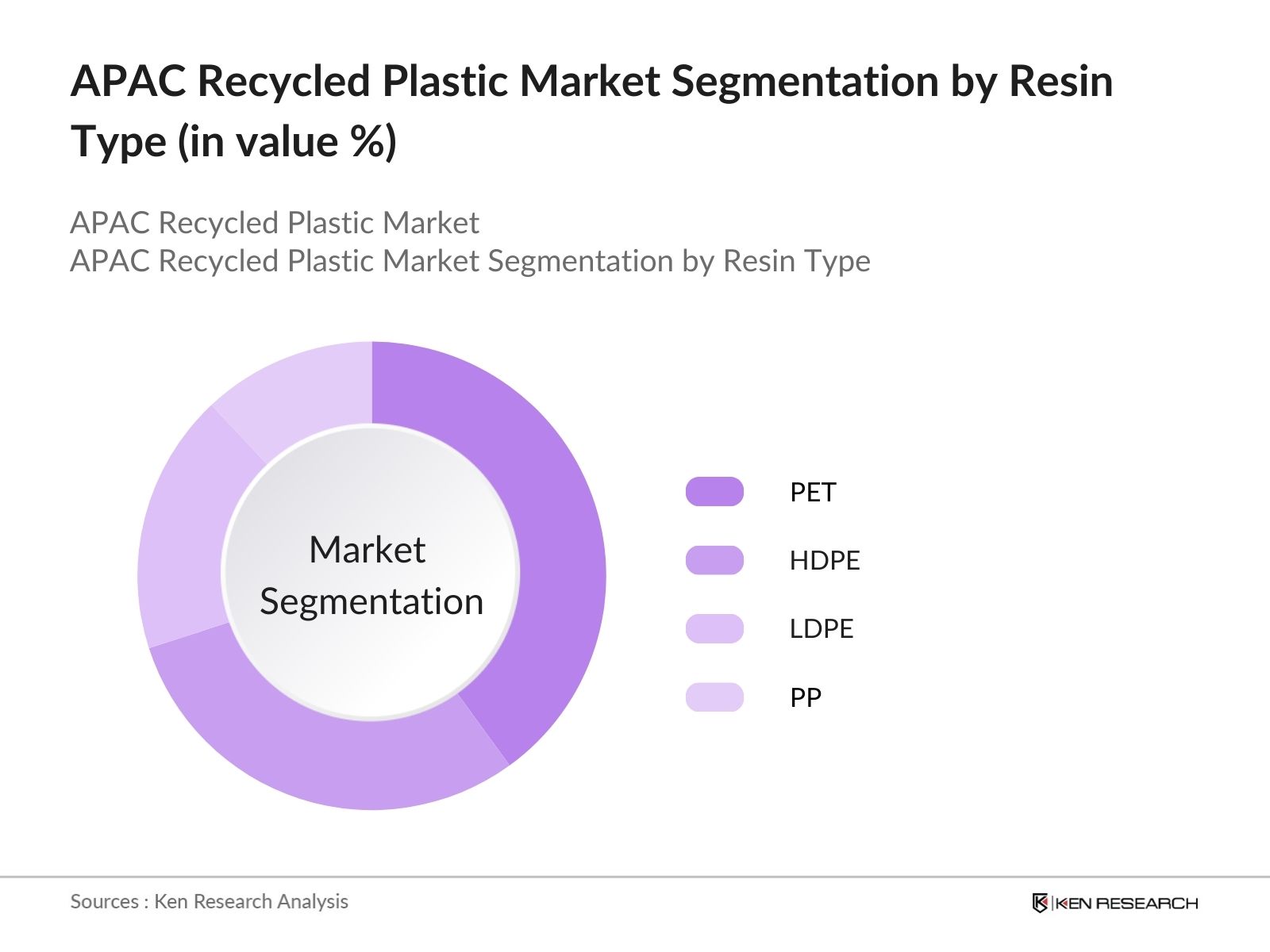

- By Resin Type: The APAC recycled plastic market is segmented by resin type into PET (Polyethylene Terephthalate), HDPE (High-Density Polyethylene), LDPE (Low-Density Polyethylene), PP (Polypropylene), and others. PET is currently the dominant resin type due to its widespread use in beverage packaging and its recyclability. The strong focus on sustainability in the beverage industry has increased the demand for PET, as major beverage companies commit to using higher percentages of recycled materials in their packaging.

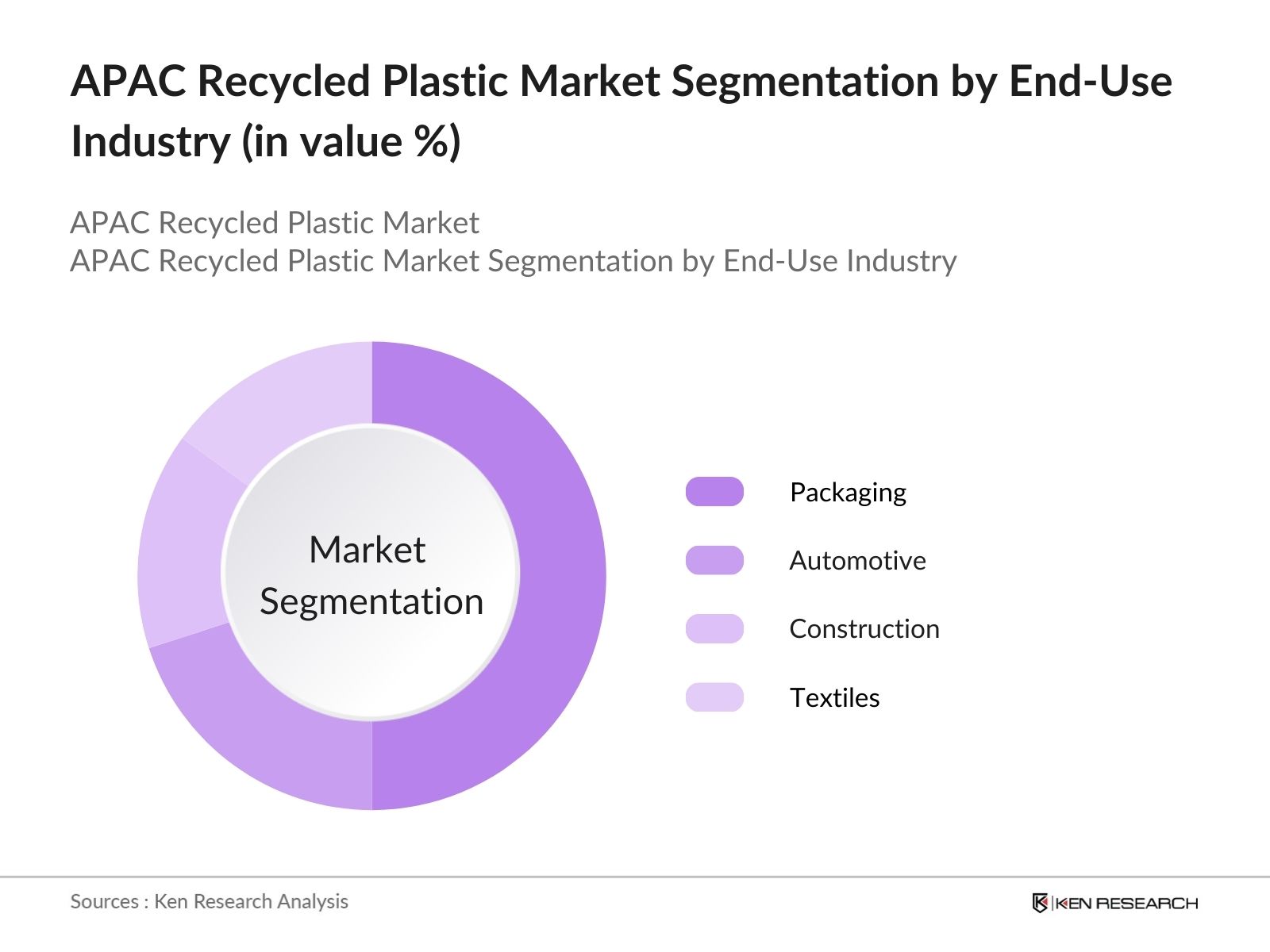

- By End-Use Industry: The APAC recycled plastic market is also segmented by end-use industries, including packaging, automotive, construction, textiles, and electrical & electronics. The packaging industry holds a dominant position due to increasing consumer demand for sustainable packaging solutions. Major brands, particularly in food and beverage, are incorporating recycled plastic into their product lines to comply with environmental regulations and meet consumer preferences for eco-friendly products.

APAC Recycled Plastic Market Competitive Landscape

The APAC Recycled Plastic Market is dominated by a mix of global and regional players. Companies are actively involved in research and development to improve recycling processes and expand their product portfolios. The market is competitive, with major players focusing on expanding their regional presence through acquisitions, partnerships, and the launch of advanced recycling technologies.

|

Company Name |

Establishment Year |

Headquarters |

Processing Capacity |

Geographic Presence |

Revenue (USD Bn) |

Sustainability Certification |

Recycled Content % |

Partnerships |

|

Veolia |

1853 |

Paris, France |

||||||

|

Indorama Ventures |

1994 |

Bangkok, Thailand |

||||||

|

Suez Recycling & Recovery |

1880 |

Paris, France |

||||||

|

Alpla Group |

1955 |

Hard, Austria |

||||||

|

Cleanaway Waste Management |

1989 |

Melbourne, Australia |

APAC Recycled Plastic Industry Analysis

Market Growth Drivers

- Increasing Plastic Waste: The APAC region generates approximately 200 million tons of plastic waste annually, with a significant portion coming from China, India, and Southeast Asia. Rapid urbanization, industrial growth, and increasing consumerism are driving this surge. By 2024, projections suggest that the volume of plastic waste will grow as populations in these regions expand. Governments are recognizing the critical need for improved waste management, as improper disposal leads to environmental degradation and threats to marine life. The World Bank reports that developing nations in the region have been particularly affected by this rise in waste, necessitating stronger recycling efforts.

- Environmental Sustainability Goals: Countries across APAC are increasingly committing to environmental sustainability goals to reduce carbon emissions and improve ecological health. For example, Japan aims to recycle 2 million tons of plastic by 2025, aligning with its broader decarbonization goals. South Korea has implemented initiatives to cut down on plastic waste by 50% through aggressive recycling programs. The push toward net-zero emissions, particularly in countries like Australia and New Zealand, is supported by global agreements such as the Paris Agreement, compelling nations to adopt robust recycling systems to manage plastic waste sustainably.

- Regulatory Support for Recycling: Governments in the APAC region are implementing stricter regulations to enhance recycling rates. Chinas Solid Waste Law aims to strengthen its circular economy by enforcing stringent recycling guidelines for industries. Additionally, India's "Plastic Waste Management (Amendment) Rules" mandate a gradual phase-out of single-use plastics, driving the demand for recycled plastics. The ASEAN countries are collectively working on waste reduction strategies as part of their regional collaboration efforts. These regulatory frameworks encourage industries to adopt sustainable practices, offering significant opportunities for recycling companies in the region.

Market Restraints

- Limited Recycling Infrastructure: Despite growing demand for recycled plastics, APACs recycling infrastructure is underdeveloped, particularly in emerging economies like Vietnam and Indonesia. In Indonesia, less than 10% of plastic waste is recycled due to inadequate facilities and insufficient government investment in recycling technologies. Meanwhile, countries like India and the Philippines face challenges in scaling up recycling operations, as the existing infrastructure cannot handle the increasing volume of plastic waste. These limitations hinder the regions ability to meet growing sustainability goals, making significant government and private sector investments critical.

- High Processing Costs: The costs associated with processing recycled plastics remain high in APAC, particularly for advanced recycling technologies such as chemical recycling. In South Korea, processing costs can reach up to $200 per ton, compared to $50 per ton for traditional waste disposal. These costs are driven by the need for specialized equipment, energy consumption, and labor. Japan has invested in automation and AI-driven sorting systems to lower these costs, but such technologies are not yet widespread across the region. This economic barrier makes recycled plastics less competitive compared to virgin plastics.

APAC Recycled Plastic Market Future Outlook

The APAC Recycled Plastic Market is expected to witness robust growth over the next five years, driven by rising government initiatives to reduce plastic waste, technological advancements in recycling processes, and increased demand for sustainable materials. The packaging industry, in particular, is expected to lead the growth trajectory, as companies increasingly adopt recycled plastics to meet consumer expectations and regulatory requirements. Furthermore, developments in chemical recycling technologies could open new opportunities for processing a wider range of plastic types.

Market Opportunities

- Development of Advanced Recycling Technologies: Technological advancements in recycling are creating new opportunities in the APAC region. Japan, a leader in recycling innovation, has developed AI-driven sorting systems capable of processing 50,000 tons of plastic annually with minimal contamination. South Korea is investing in chemical recycling technologies, which can break down plastic polymers into their original monomers for reuse. These advancements not only improve recycling efficiency but also open up new markets for high-quality recycled plastics, particularly in packaging and automotive sectors, where demand for sustainability is growing.

- Growth in Demand for Recycled Plastics in Packaging: The APAC region is witnessing a surge in demand for recycled plastics in the packaging industry. China, the largest consumer of plastic packaging in the world, has committed to using 30% recycled plastic in its packaging by 2025. Similarly, Indias packaging industry, worth over $50 billion, is transitioning toward sustainable materials, driving the demand for recycled plastics. This shift is largely influenced by regulatory pressure and corporate sustainability goals, particularly among multinational corporations looking to reduce their environmental footprint across the region.

Scope of the Report

|

Resin Type |

PET, HDPE, LDPE, PP, Others |

|

Source |

Post-Consumer, Post-Industrial, Ocean Plastic |

|

End-Use Industry |

Packaging, Automotive, Construction, Textiles, Electrical & Electronics |

|

Recycling Method |

Mechanical Recycling, Chemical Recycling, Energy Recovery |

|

Region |

China, Japan, India, Southeast Asia, Oceania |

Products

Key Target Audience

Plastic Manufacturers

Packaging Companies

Automotive OEMs

Construction Material Suppliers

Textile Manufacturers

Government and Regulatory Bodies (APAC Plastic Waste Management Authorities)

Investment and Venture Capitalist Firms

Recycling Technology Providers

Companies

Players Mentioned in the Report:

Veolia

Suez Recycling & Recovery

Indorama Ventures

Alpla Group

Cleanaway Waste Management

Covestro

Borealis AG

Plastipak Holdings

GreenLine Polymers

MBA Polymers

Phoenix Technologies

Loop Industries

CarbonLite Recycling

Kuusakoski Recycling

Biffa

Table of Contents

1. APAC Recycled Plastic Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. APAC Recycled Plastic Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. APAC Recycled Plastic Market Analysis

3.1. Growth Drivers (Government Regulations, Corporate ESG Mandates, Plastic Waste Management)

3.1.1. Increasing Plastic Waste

3.1.2. Environmental Sustainability Goals

3.1.3. Regulatory Support for Recycling

3.1.4. Circular Economy Initiatives

3.2. Market Challenges (Infrastructure, Recycling Costs, Consumer Behavior)

3.2.1. Limited Recycling Infrastructure

3.2.2. High Processing Costs

3.2.3. Low Awareness Among Consumers

3.2.4. Contamination in Recycled Plastics

3.3. Opportunities (Technological Advancements, Plastic Credits, Regional Trade)

3.3.1. Development of Advanced Recycling Technologies

3.3.2. Growth in Demand for Recycled Plastics in Packaging

3.3.3. Opportunities in Emerging Economies

3.4. Trends (Sustainability, Bans on Single-Use Plastics, Global Recycling Networks)

3.4.1. Rising Adoption of Recycled Plastics by Major Brands

3.4.2. Technological Innovations in Sorting and Recycling

3.4.3. Expansion of Chemical Recycling Technologies

3.5. Government Regulations (Plastic Waste Management Rules, Import/Export Bans)

3.5.1. Single-Use Plastic Bans

3.5.2. Mandatory Recycling Targets

3.5.3. Producer Responsibility Organizations (PRO)

3.5.4. Regional Agreements on Plastic Waste Reduction

3.6. SWOT Analysis

3.7. Stake Ecosystem (Collectors, Processors, Regulators)

3.8. Porters Five Forces (Suppliers, Buyers, New Entrants, Substitutes, Rivalry)

3.9. Competition Ecosystem

4. APAC Recycled Plastic Market Segmentation

4.1. By Resin Type (In Value %) 4.1.1. PET (Polyethylene Terephthalate)

4.1.2. HDPE (High-Density Polyethylene)

4.1.3. LDPE (Low-Density Polyethylene)

4.1.4. PP (Polypropylene)

4.1.5. Others (PVC, PS, etc.)

4.2. By Source (In Value %)

4.2.1. Post-Consumer

4.2.2. Post-Industrial

4.2.3. Ocean Plastic

4.3. By End-Use Industry (In Value %)

4.3.1. Packaging

4.3.2. Automotive

4.3.3. Construction

4.3.4. Textiles

4.3.5. Electrical & Electronics

4.4. By Recycling Method (In Value %)

4.4.1. Mechanical Recycling

4.4.2. Chemical Recycling

4.4.3. Energy Recovery

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. Southeast Asia

4.5.5. Oceania

5. APAC Recycled Plastic Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Veolia

5.1.2. Suez Recycling & Recovery

5.1.3. Indorama Ventures Public Company Limited

5.1.4. Alpla Group

5.1.5. Borealis AG

5.1.6. Plastipak Holdings, Inc.

5.1.7. Cleanaway Waste Management Limited

5.1.8. GreenLine Polymers

5.1.9. Kuusakoski Recycling

5.1.10. Covestro

5.1.11. Loop Industries

5.1.12. CarbonLite Recycling

5.1.13. Phoenix Technologies

5.1.14. MBA Polymers

5.1.15. Biffa

5.2. Cross Comparison Parameters (Processing Capacity, Geographic Presence, Revenue, Partnerships, Recycled Content % Compliance, Product Innovation, Market Share, Sustainability Certification)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Circular Economy Collaborations, Partnerships, Expansion Plans)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. APAC Recycled Plastic Market Regulatory Framework

6.1. Plastic Waste Management Standards

6.2. Compliance Requirements

6.3. Certification Processes (ISO 14001, Global Recycled Standard, RecyClass Certifications)

7. APAC Recycled Plastic Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. APAC Recycled Plastic Future Market Segmentation

8.1. By Resin Type (In Value %)

8.2. By Source (In Value %)

8.3. By End-Use Industry (In Value %)

8.4. By Recycling Method (In Value %)

8.5. By Region (In Value %)

9. APAC Recycled Plastic Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In this phase, we map out all the major stakeholders involved in the APAC Recycled Plastic Market, including manufacturers, recycling facilities, regulatory bodies, and end-users. The ecosystem map is constructed using a mix of secondary and proprietary data sources, which allows us to pinpoint critical market variables that influence growth, including recycling rates, regulatory frameworks, and material demand.

Step 2: Market Analysis and Construction

This stage involves analyzing historical data for the APAC recycled plastic market, focusing on regional differences in recycling practices, resin type preferences, and consumption patterns. A combination of market penetration rates and service provider data is assessed to establish the market's revenue generation potential.

Step 3: Hypothesis Validation and Expert Consultation

Through consultations with industry experts, such as recycling facility managers and corporate sustainability officers, we validate our market hypotheses. These insights are collected through interviews and surveys to ensure that our market projections are grounded in practical, on-the-ground knowledge.

Step 4: Research Synthesis and Final Output

In this final stage, we consolidate data from primary research and expert consultations to produce a comprehensive analysis of the APAC recycled plastic market. This includes the integration of key financial metrics, material flows, and consumer behavior, ensuring a fully validated and accurate market assessment.

Frequently Asked Questions

01. How big is the APAC Recycled Plastic Market?

The APAC recycled plastic market is valued at USD 24.75 billion, driven by demand for sustainable materials, increased recycling regulations, and corporate ESG commitments.

02. What are the challenges in the APAC Recycled Plastic Market?

Challenges in this market include insufficient recycling infrastructure in some regions, contamination of plastic waste, and high processing costs that impact profitability.

03. Who are the major players in the APAC Recycled Plastic Market?

Key players include Veolia, Indorama Ventures, Suez Recycling & Recovery, Alpla Group, and Cleanaway Waste Management, all of which dominate due to their global presence and advanced recycling technologies.

04. What are the growth drivers of the APAC Recycled Plastic Market?

Growth is fueled by government regulations, the increasing demand for sustainable materials, and advancements in recycling technology that allow for more efficient processing and higher-quality recycled plastics.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.