APAC Scarves and Shawls Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD6959

December 2024

90

About the Report

APAC Scarves and Shawls Market Overview

- The APAC Scarves and Shawls Market is valued at USD 8.73 billion, based on a five-year historical analysis. This market is driven by factors such as increasing consumer spending on fashion accessories, a surge in e-commerce activities, and the influence of traditional attire in various Asian cultures. High demand for luxury and sustainably sourced fabrics has further fueled market expansion, with 2023 figures showing robust market dynamics, supported by growing fashion consciousness among consumers.

- The market is primarily dominated by regions like China and India. Chinas dominance is attributed to its significant textile production capabilities, advanced manufacturing technologies, and a well-established domestic market. Indias strength lies in its rich heritage in shawl and scarf craftsmanship, with regions like Kashmir renowned for producing high-quality products. Both countries benefit from a strong base of skilled artisans and a growing middle class with increasing purchasing power.

- Governments in APAC countries have specific policies regulating the import and export of textiles. By 2023, trade data indicated that Indias export duties on certain textiles were reduced, facilitating higher trade volumes. This policy shift aimed to support local manufacturers and bolster the economy. Similar adjustments were noted in Thailand, where textile imports were streamlined to reduce costs for manufacturers sourcing foreign fabrics.

APAC Scarves and Shawls Market Segmentation

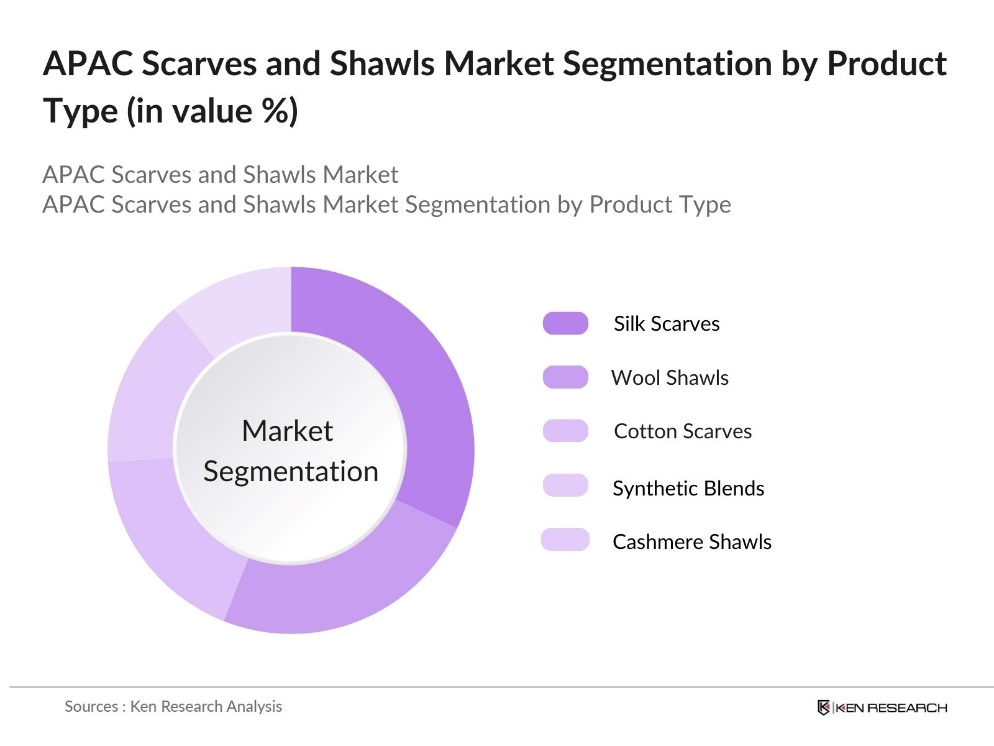

By Product Type: The market is segmented by product type into silk scarves, wool shawls, cotton scarves, synthetic blends, and cashmere shawls. Recently, silk scarves have a dominant market share due to their popularity as luxury fashion items and their association with high-status fashion. The rising demand for premium, elegant accessories and the versatility offered by silk products contribute to their leading position in this segment.

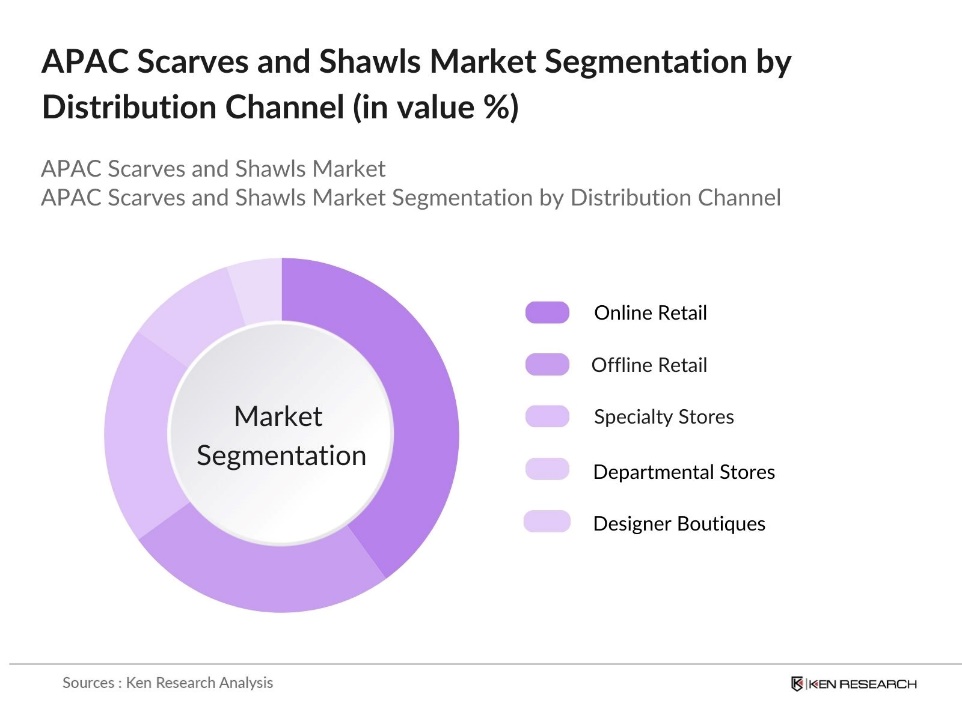

By Distribution Channel: The market is segmented by distribution channel into online retail, offline retail, specialty stores, departmental stores, and designer boutiques. Online retail holds a leading share, driven by the increasing preference for convenient shopping experiences and the availability of a wide range of products. The growth of major e-commerce platforms has amplified the accessibility of both luxury and affordable scarves and shawls.

APAC Scarves and Shawls Market Competitive Landscape

The APAC Scarves and Shawls market is competitive, with key players leveraging their branding, distribution networks, and product innovation to maintain market positions. The market is led by both luxury fashion houses and regional manufacturers known for high-quality products.

APAC Scarves and Shawls Industry Analysis

Growth Drivers

- Rising Disposable Income: The APAC region has witnessed significant growth in disposable income, which has fueled increased spending on non-essential items, including fashion accessories such as scarves and shawls. According to the World Bank, household consumption expenditure per capita in countries like China and India has shown consistent growth, reaching approximately $6,720 billion in China and $2,140 billion in India by 2023. This boost in spending capacity is driving demand for premium and mid-range fashion items. Higher incomes contribute to greater consumer interest in luxury goods, including traditional and contemporary scarves.

- Influence of Fashion Industry: The fashion industrys influence in the APAC region has been substantial, with the region becoming a central hub for both global and domestic fashion trends. The textile and apparel market in countries like Vietnam and Indonesia has shown growth supported by active trade and investments. In 2023, Vietnams garment exports totaled $45 billion, underscoring the strength of the fashion sector. The rising presence of global fashion brands in urban centers has further driven the popularity of scarves and shawls as versatile fashion pieces.

- Expanding E-commerce Channels: E-commerce is reshaping the fashion landscape in APAC, driving increased sales of scarves and shawls. Improved internet access and digital payment options have boosted online shopping, making platforms like Shopee and Alibaba popular channels for fashion items. Enhanced logistics and cross-border shopping opportunities provide fashion retailers with broader market access, allowing consumers across the region to enjoy a variety of traditional and modern styles.

Market Challenges

- Fluctuations in Raw Material Prices: The production of scarves and shawls in APAC depends heavily on raw materials like wool, silk, and cotton. Price volatility, driven by global supply chain disruptions and geopolitical factors, has impacted production costs for manufacturers in key regions. This variability poses challenges in maintaining competitive pricing and stable profit margins.

- Counterfeit Products: Counterfeit fashion products are widespread in APAC, affecting the growth of authentic scarf and shawl brands. This issue undermines brand reputation and leads to revenue losses for legitimate manufacturers. Tackling this challenge requires stronger enforcement of intellectual property rights across the region.

APAC Scarves and Shawls Market Future Outlook

The APAC Scarves and Shawls market is poised for continued growth, driven by the expansion of e-commerce, increasing interest in sustainable fashion, and the resurgence of traditional attire in contemporary styles. Consumer trends towards premium and ethically sourced materials will further shape market dynamics. The market is expected to witness advancements in material technology, enhancing product quality and consumer satisfaction.

Market Opportunities

- Innovative Fabric Blends: The fashion industry is witnessing growing interest in fabric blends that seamlessly combine traditional and modern materials. These blends often include eco-friendly fibers such as bamboo and Tencel, appealing to environmentally conscious consumers while retaining the luxurious feel expected from high-quality scarves and shawls. This shift is driven by increased awareness and demand for sustainable and premium fashion.

- Customization and Personalization Trends: The trend of customization is gaining momentum across the APAC market, as consumers increasingly seek products that reflect their personal style. Major e-commerce platforms in the region have reported significant growth in searches for customizable fashion accessories. This surge highlights a consumer preference for unique items tailored to individual tastes, presenting an opportunity for brands to develop personalized product offerings and capitalize on this growing demand.

Scope of the Report

|

Product Type |

Silk Scarves Wool Shawls Cotton Scarves Synthetic Blends Cashmere Shawls |

|

Distribution Channel |

Online Retail Offline Retail Specialty Stores Departmental Stores Designer Boutiques |

|

End-User |

Women Men Children |

|

Material Type |

Natural Fibers Synthetic Fibers Blended Materials |

|

Region |

East South Southeast Oceania |

Products

Key Target Audience

Fashion Industry

Textile Manufacturers

Online and E-commerce Platforms

Luxury Brands and Boutiques

Supply Chain and Logistics Companies

Government and Regulatory Bodies (e.g., Ministry of Commerce, APAC Trade Commissions)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Herms International

LVMH Group

Burberry Group PLC

Chanel S.A.

Zara (Inditex Group)

Tissura

Pashma

Max Mara

Louis Vuitton

Valentino

Table of Contents

1. APAC Scarves and Shawls Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Market Segmentation Overview

2. APAC Scarves and Shawls Market Size (In USD Mn)

2.1. Historical Market Analysis

2.2. Key Market Developments and Trends

2.3. Regional Contribution Analysis

3. APAC Scarves and Shawls Market Analysis

3.1. Growth Drivers

3.1.1. Rising Disposable Income

3.1.2. Influence of Fashion Industry

3.1.3. Expanding E-commerce Channels

3.1.4. Cultural Significance of Traditional Attire

3.2. Market Challenges

3.2.1. Fluctuations in Raw Material Prices

3.2.2. Counterfeit Products

3.2.3. Seasonal Demand Variability

3.3. Opportunities

3.3.1. Innovative Fabric Blends

3.3.2. Customization and Personalization Trends

3.3.3. Expansion into Untapped Markets

3.4. Trends

3.4.1. Adoption of Sustainable Fabrics

3.4.2. Collaboration with Fashion Influencers

3.4.3. Integration of Smart Textiles

3.5. Government Regulation

3.5.1. Textile Import-Export Policies

3.5.2. Tariff Structures and Trade Agreements

3.5.3. Compliance Standards for Textile Manufacturing

3.5.4. Environmental Protection Regulations

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. APAC Scarves and Shawls Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Silk Scarves

4.1.2. Wool Shawls

4.1.3. Cotton Scarves

4.1.4. Synthetic Blends

4.1.5. Cashmere Shawls

4.2. By Distribution Channel (In Value %)

4.2.1. Online Retail

4.2.2. Offline Retail

4.2.3. Specialty Stores

4.2.4. Departmental Stores

4.2.5. Designer Boutiques

4.3. By End-User (In Value %)

4.3.1. Women

4.3.2. Men

4.3.3. Children

4.4. By Material Type (In Value %)

4.4.1. Natural Fibers

4.4.2. Synthetic Fibers

4.4.3. Blended Materials

4.5. By Region (In Value %)

4.5.1. East Asia

4.5.2. South Asia

4.5.3. Southeast Asia

4.5.4. Oceania

5. APAC Scarves and Shawls Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. LVMH Group

5.1.2. Herms International S.A.

5.1.3. Burberry Group PLC

5.1.4. Kering S.A.

5.1.5. Gucci

5.1.6. Alexander McQueen

5.1.7. Chanel S.A.

5.1.8. Tissura

5.1.9. Pashma

5.1.10. Louis Vuitton

5.1.11. Mulberry

5.1.12. Christian Dior SE

5.1.13. Valentino

5.1.14. Max Mara

5.1.15. Zara (Inditex Group)

5.2. Cross Comparison Parameters (Headquarters, Inception Year, Employee Count, Revenue, Product Portfolio, Regional Presence, Distribution Strategy, Brand Positioning)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Support Programs

6. APAC Scarves and Shawls Market Regulatory Framework

6.1. Trade and Import Regulations

6.2. Textile Quality Standards

6.3. Certification Requirements

7. APAC Scarves and Shawls Market Future Segmentation

7.1. By Product Type (In Value %)

7.2. By Distribution Channel (In Value %)

7.3. By End-User (In Value %)

7.4. By Material Type (In Value %)

7.5. By Region (In Value %)

8. APAC Scarves and Shawls Market Analysts Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Consumer Behavior Analysis

8.3. Strategic Marketing Initiatives

8.4. White Space Identification

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research process begins with mapping all major stakeholders in the APAC Scarves and Shawls Market. This involves desk research and consultation of secondary databases to gather reliable market data and identify crucial variables affecting market growth.

Step 2: Market Analysis and Construction

This step involves compiling historical data to analyze the markets penetration and distribution strategies, supported by regional and segment-specific revenue data. The analysis helps verify the consistency and accuracy of industry trends.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary hypotheses are tested through interviews with industry professionals using CATI and CAPI methods. Expert consultations provide insights that corroborate the data and enhance the credibility of market findings.

Step 4: Research Synthesis and Final Output

The final step integrates insights from primary and secondary research, cross-referenced with direct input from industry participants. This ensures the report reflects a validated and thorough market analysis, culminating in a comprehensive overview of the APAC Scarves and Shawls market.

Frequently Asked Questions

01 How big is the APAC Scarves and Shawls Market?

The APAC Scarves and Shawls market is valued at USD 8.73 billion, driven by high consumer demand for fashion accessories and increased e-commerce penetration.

02 What are the challenges in the APAC Scarves and Shawls Market?

Challenges in APAC Scarves and Shawls market include fluctuations in raw material prices, competition from counterfeit products, and seasonal variability in demand.

03 Who are the major players in the APAC Scarves and Shawls Market?

Key players in APAC Scarves and Shawls market include Herms International, LVMH Group, Burberry Group PLC, Chanel S.A., and Zara (Inditex Group).

04 What drives the growth of the APAC Scarves and Shawls Market?

The APAC Scarves and Shawls market growth is driven by increasing consumer spending, the rise of e-commerce platforms, and the cultural significance of scarves and shawls in the APAC region.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.