APAC Solar Control Window Films Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD9228

December 2024

98

About the Report

APAC Solar Control Window Films Market Overview

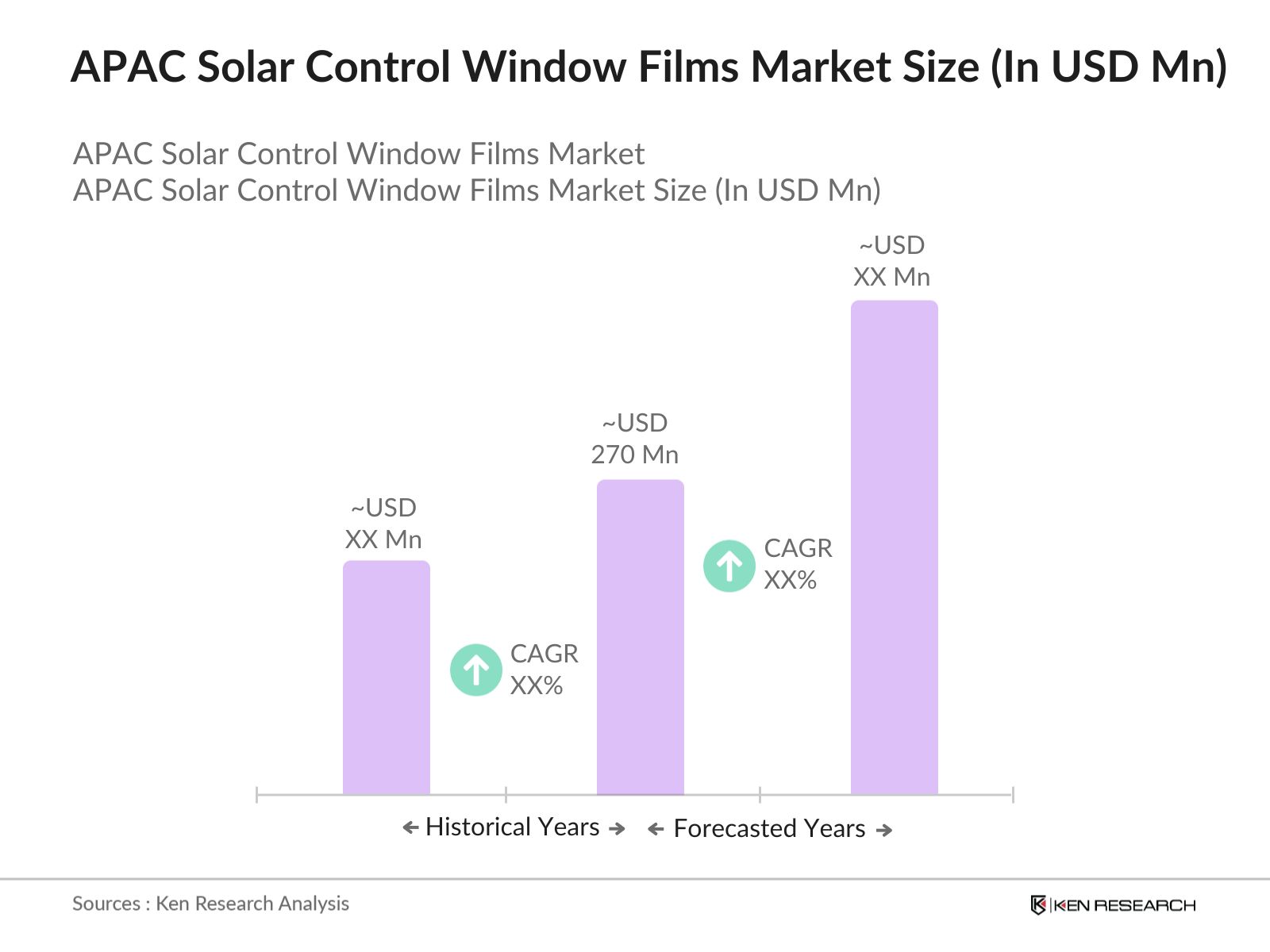

- The APAC solar control window films market is valued at USD 270 million, has experienced substantial growth, driven by the increasing focus on energy efficiency and environmental sustainability across the region. The market's expansion is supported by rising urbanization and the adoption of green building codes, which prioritize energy-saving solutions.

- China, Japan, and India dominate the APAC solar control window films market due to their massive construction and automotive industries. China leads the market because of its expansive urban infrastructure development and the implementation of government policies encouraging energy-efficient building solutions. Japans strict building energy codes and early adoption of advanced materials also place it among the key players.

- APAC governments are increasingly implementing energy efficiency building codes that mandate or incentivize the use of energy-saving technologies, including solar control window films. The changes came into effect in stages, with significant provisions starting from May 2023, and full compliance required by January 2024. South Australia specifically will implement these standards from October 1, 2024. These codes promote the adoption of energy-efficient solutions, driving demand for solar control films in both new construction and retrofitting projects.

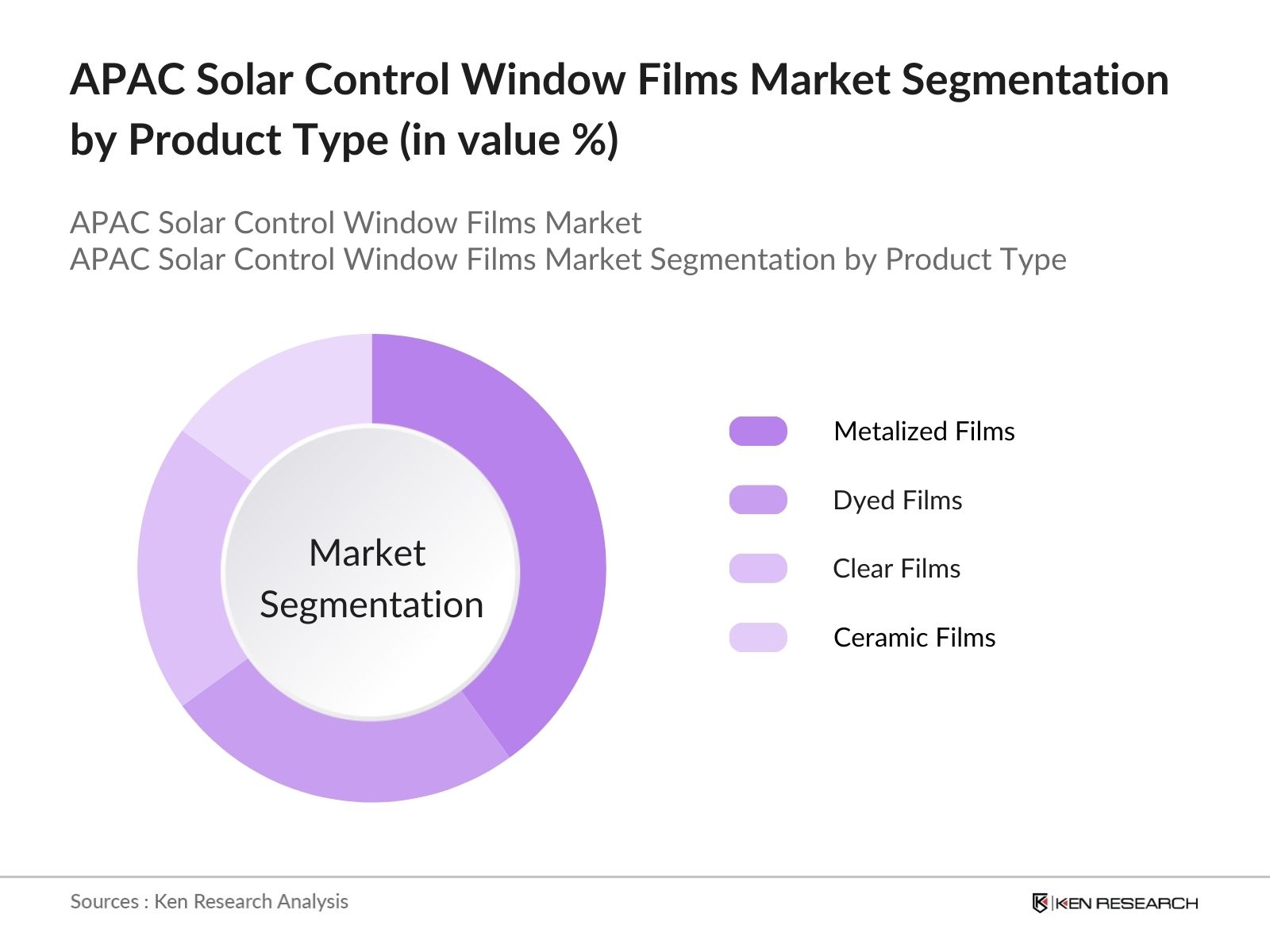

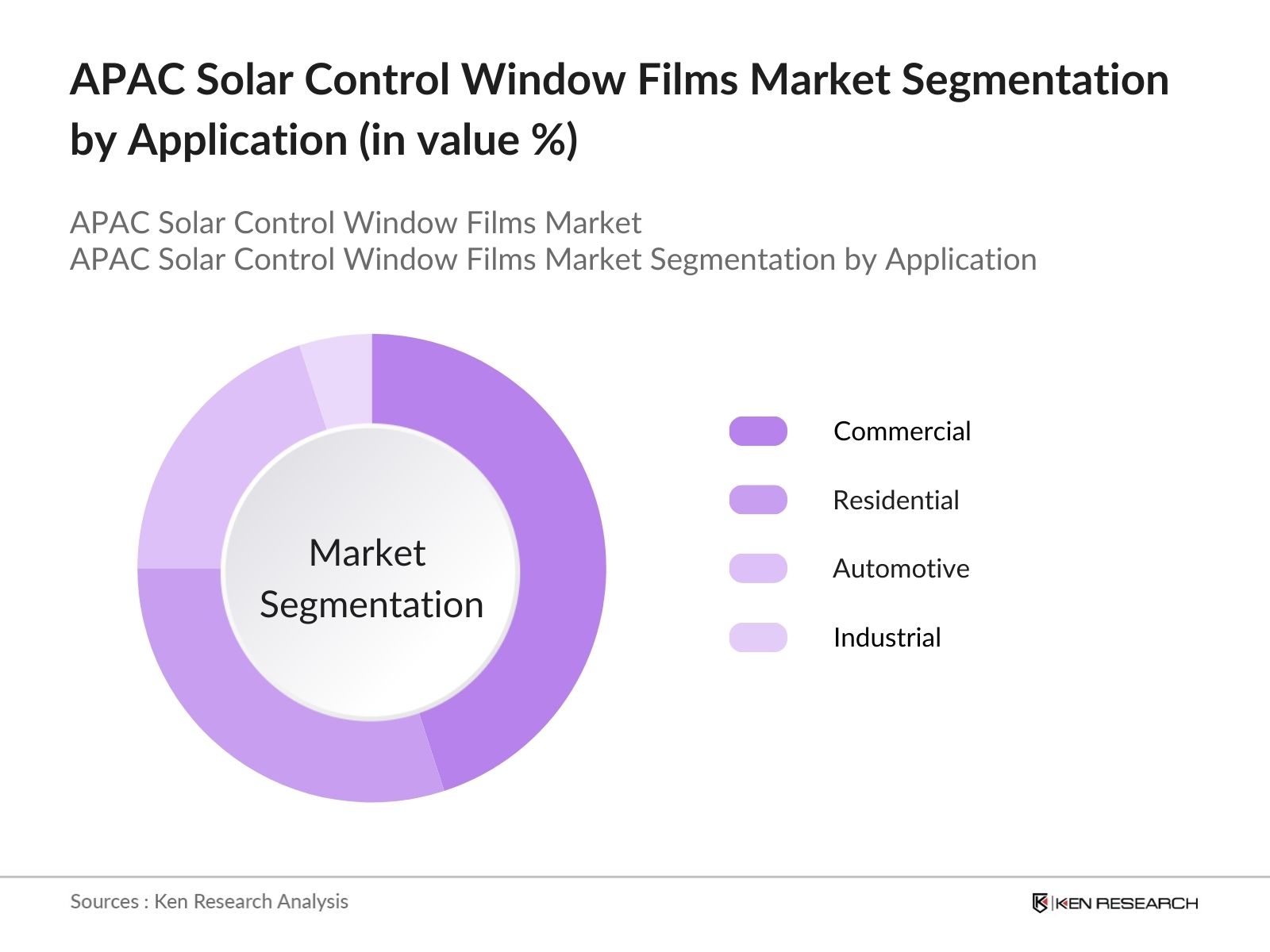

APAC Solar Control Window Films Market Segmentation

By Product Type: The market is segmented by product type into dyed films, clear films, metalized films, and ceramic films. Among these, metalized films hold a dominant market share due to their superior heat rejection properties and cost-effectiveness. These films reflect solar energy while maintaining optical clarity, making them popular for both residential and commercial buildings. Additionally, metalized films are widely used in the automotive industry, especially in countries like Japan and China, where regulatory frameworks emphasize energy efficiency.

By Application: The market is segmented by application into residential, commercial, automotive, and industrial. The commercial sector currently dominates the market, accounting for a significant portion of the market share. This is due to the large-scale adoption of energy-efficient solutions in office buildings, malls, and other commercial infrastructures. The increasing number of skyscrapers and high-rise buildings in urban centers across China, Japan, and India, along with growing awareness of environmental sustainability, have significantly boosted the demand for solar control window films in this segment.

APAC Solar Control Window Films Market Competitive Landscape

The market is dominated by companies like 3M and Eastman Chemical Company, which have a global presence and a strong foothold in the APAC region. Other significant players include Garware Suncontrol, Avery Dennison Corporation, and Saint-Gobain, which offer a variety of solar control window films catering to different market segments. These companies leverage their extensive distribution networks and partnerships with contractors and builders to maintain their competitive edge.

APAC Solar Control Window Films Industry Analysis

Growth Drivers

- Increasing Energy Efficiency Demands (Energy savings and environmental impact): The demand for energy efficiency in the Asia Pacific region has surged due to increasing energy costs and environmental concerns. According to the International Energy Agency (IEA), buildings account for about 30% of global energy consumption, making energy-efficient solutions vital. Solar control window films can reduce energy costs by up to 30%, according to recent government reports in Australia and China. This reduction helps both in cutting energy bills and in lowering carbon emissions, aligning with the Paris Agreement's goals on climate change.

- Rising Construction and Infrastructure Projects (Building and automotive sectors): Asia Pacifics booming construction industry is driven by rapid urbanization and infrastructure development, particularly in countries like India, China, and Southeast Asia. The Ministry of Housing and Urban Affairs has indicated that this growth is driven by a robust housing market and significant government infrastructure investments, positioning India to become the third-largest construction market globally by 2025. The adoption of solar control films in these markets, particularly in new high-rise buildings and automotive sectors, supports green initiatives by reducing the reliance on air conditioning and improving fuel efficiency in cars.

- Consumer Awareness Regarding UV Protection: Growing awareness of the harmful effects of UV radiation, such as skin damage and increased cancer risks, is driving demand for solar control window films in the Asia Pacific. These films, with high UV rejection properties, provide protection in both homes and vehicles. Consumers are increasingly opting for these solutions to safeguard their health while also protecting interior furnishings from sun damage.

Market Challenges

- High Initial Installation Costs (Price sensitivity, cost of retrofitting): One major challenge in adopting solar control window films is the high upfront cost of installation, which can be a significant barrier, especially in emerging markets. Price sensitivity, particularly in lower-income regions, makes it difficult for smaller businesses to justify the investment. Despite the potential for long-term energy savings, the initial expense often deters widespread adoption of these films.

- Compatibility Issues with Low-E Windows (Compatibility with new construction standards): Low-emissivity (Low-E) windows, widely used in new energy-efficient constructions, can present compatibility challenges when combined with solar control films. Applying these films on Low-E glass can interfere with the window's thermal insulation, reducing performance or voiding warranties. This creates obstacles in integrating solar control films with the increasingly popular Low-E technology in newer buildings.

APAC Solar Control Window Films Market Future Outlook

The APAC solar control window films market is set to witness considerable growth, driven by ongoing urbanization, the increasing adoption of green building initiatives, and rising consumer awareness regarding energy efficiency. Government policies promoting the reduction of carbon footprints and incentivizing the use of energy-saving materials in the construction and automotive sectors will further fuel demand for solar control window films. Additionally, the rapid growth of electric vehicles in countries like China and Japan is expected to drive the demand for solar films in the automotive sector.

Market Opportunities

- Technological Advancements in Film Manufacturing (Innovations in nanotechnology, multi-layer films): Technological innovations, particularly in nanotechnology, have led to the development of more advanced solar control window films with improved thermal performance and UV protection. Multi-layered films incorporating nanomaterials provide better durability and energy efficiency, making them suitable for both residential and commercial applications. These advancements are creating new opportunities for widespread adoption, especially in regions focusing on energy-efficient building solutions.

- Expanding Applications in the Automotive Industry (Solar control film adoption in EVs): The growing popularity of electric vehicles (EVs) in the Asia Pacific region has led to increased use of solar control window films, which help improve vehicle energy efficiency. By reducing the need for air conditioning, these films contribute to longer battery life in EVs. As the region continues to embrace electric mobility, the automotive sector is seeing greater adoption of these films to enhance energy savings and passenger comfort.

Scope of the Report

|

Product Type |

Dyed Films Clear Films Metalized Films Ceramic Films |

|

Application |

Residential Commercial Automotive Industrial |

|

Technology |

Passive Films Smart Films |

|

Installation Type |

Retrofit New Construction |

|

Region |

China Japan South Korea India Australia Southeast Asia |

Products

Key Target Audience

Automotive Manufacturers

Facility Management Companies

Energy Efficiency Consultants

Government and Regulatory Bodies (APAC Green Building Councils, National Energy Efficiency Authorities)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

M Company

Eastman Chemical Company

Saint-Gobain Performance Plastics

Garware Suncontrol

Avery Dennison Corporation

Johnson Window Films

Madico Inc.

LINTEC Corporation

V-KOOL International

Polytronix Inc.

Table of Contents

1. APAC Solar Control Window Films Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. APAC Solar Control Window Films Market Size (in USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. APAC Solar Control Window Films Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Energy Efficiency Demands (Energy savings and environmental impact)

3.1.2 Rising Construction and Infrastructure Projects (Building and automotive sectors)

3.1.3 Government Regulations on Energy Consumption (Sustainability, green building codes)

3.1.4 Consumer Awareness Regarding UV Protection

3.2 Market Challenges

3.2.1 High Initial Installation Costs (Price sensitivity, cost of retrofitting)

3.2.2 Compatibility Issues with Low-E Windows (Compatibility with new construction standards)

3.2.3 Limited Awareness in Emerging Markets (Market penetration challenges)

3.3 Opportunities

3.3.1 Technological Advancements in Film Manufacturing (Innovations in nanotechnology, multi-layer films)

3.3.2 Expanding Applications in the Automotive Industry (Solar control film adoption in EVs)

3.3.3 Increasing Adoption in Commercial Buildings (Green building initiatives, corporate demand)

3.4 Trends

3.4.1 Rising Adoption of Smart Window Films (Integration with smart homes, IoT-enabled films)

3.4.2 Eco-friendly Window Films (Development of biodegradable and recyclable films)

3.4.3 Advanced Anti-Glare and UV Rejection Films (Health benefits and skin protection focus)

3.5 Government Regulation

3.5.1 Energy Efficiency Building Codes (Standards for solar control, LEED certifications)

3.5.2 Import and Export Tariffs on Solar Films (Trade regulations and international policies)

3.5.3 Renewable Energy Incentives (Government grants for energy-saving retrofits)

3.6 SWOT Analysis

3.7 Stake Ecosystem (Raw material suppliers, distributors, installers, end-users)

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape (Competitive pricing strategies, innovation, market share)

4. APAC Solar Control Window Films Market Segmentation

4.1 By Product Type (in Value %)

4.1.1 Dyed Films

4.1.2 Clear Films

4.1.3 Metalized Films

4.1.4 Ceramic Films

4.2 By Application (in Value %)

4.2.1 Residential

4.2.2 Commercial

4.2.3 Automotive

4.2.4 Industrial

4.3 By Technology (in Value %)

4.3.1 Passive Films

4.3.2 Smart Films

4.4 By Installation Type (in Value %)

4.4.1 Retrofit

4.4.2 New Construction

4.5 By Region (in Value %)

4.5.1 China

4.5.2 Japan

4.5.3 South Korea

4.5.4 India

4.5.5 Australia

4.5.6 Southeast Asia

5. APAC Solar Control Window Films Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 3M Company

5.1.2 Eastman Chemical Company

5.1.3 Saint-Gobain Performance Plastics

5.1.4 Avery Dennison Corporation

5.1.5 Johnson Window Films

5.1.6 Garware Suncontrol

5.1.7 Polytronix Inc.

5.1.8 Madico Inc.

5.1.9 Solar Gard (a division of Saint-Gobain)

5.1.10 LINTEC Corporation

5.1.11 V-KOOL International

5.1.12 Hanita Coatings (Avery Dennison)

5.1.13 Huper Optik USA

5.1.14 Global Window Films

5.1.15 Armolan USA

5.2 Cross Comparison Parameters (Headquarters, Inception Year, Product Portfolio, Revenue, Market Share)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity and Venture Capital Funding

5.8 Government Grants and Subsidies

5.9 Research and Development (Innovation and product enhancements)

6. APAC Solar Control Window Films Market Regulatory Framework

6.1 Energy Efficiency Standards (Building and construction)

6.2 Automotive Solar Film Regulations (Vehicle safety and certification standards)

6.3 Compliance with Environmental Laws (Waste reduction and sustainability)

6.4 Certification and Licensing Processes

7. APAC Solar Control Window Films Future Market Size (in USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. APAC Solar Control Window Films Future Market Segmentation

8.1 By Product Type (in Value %)

8.2 By Application (in Value %)

8.3 By Technology (in Value %)

8.4 By Installation Type (in Value %)

8.5 By Region (in Value %)

9. APAC Solar Control Window Films Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing and Distribution Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 2: Market Analysis and Construction

In this phase, we conducted a thorough analysis of historical data related to the solar control window films market, focusing on the construction and automotive industries. Revenue generation, penetration rates, and other market dynamics were evaluated to construct reliable estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed based on the data collected and validated through interviews with industry experts from leading solar control window film manufacturers. These consultations provided operational and financial insights crucial to refining the market analysis.

Step 4: Research Synthesis and Final Output

The final phase involved direct engagement with manufacturers and distributors to validate product-level data. This step ensured that the market report was comprehensive, accurate, and reflective of the current market scenario in the APAC region.

Frequently Asked Questions

01. How big is the APAC Solar Control Window Films Market?

The APAC solar control window films market is valued at USD 270 million, driven by increasing demand for energy-efficient solutions in construction and automotive sectors across the region.

02. What are the major challenges in the APAC Solar Control Window Films Market?

Key challenges in APAC solar control window films market include high initial installation costs and the limited awareness of solar control window films in emerging markets, particularly in Southeast Asia.

03. Who are the major players in the C?

Leading players in APAC solar control window films market include 3M Company, Eastman Chemical Company, Saint-Gobain Performance Plastics, Garware Suncontrol, and Avery Dennison Corporation. These companies dominate due to their strong distribution networks and innovation in solar control technology.

04. What drives the APAC Solar Control Window Films Market?

The APAC solar control window films market is driven by the rising need for energy efficiency in buildings, government policies promoting sustainability, and the increasing use of solar films in the automotive industry.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.