APAC Sterile Medical Packaging Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD7670

November 2024

93

About the Report

APAC Sterile Medical Packaging Market Overview

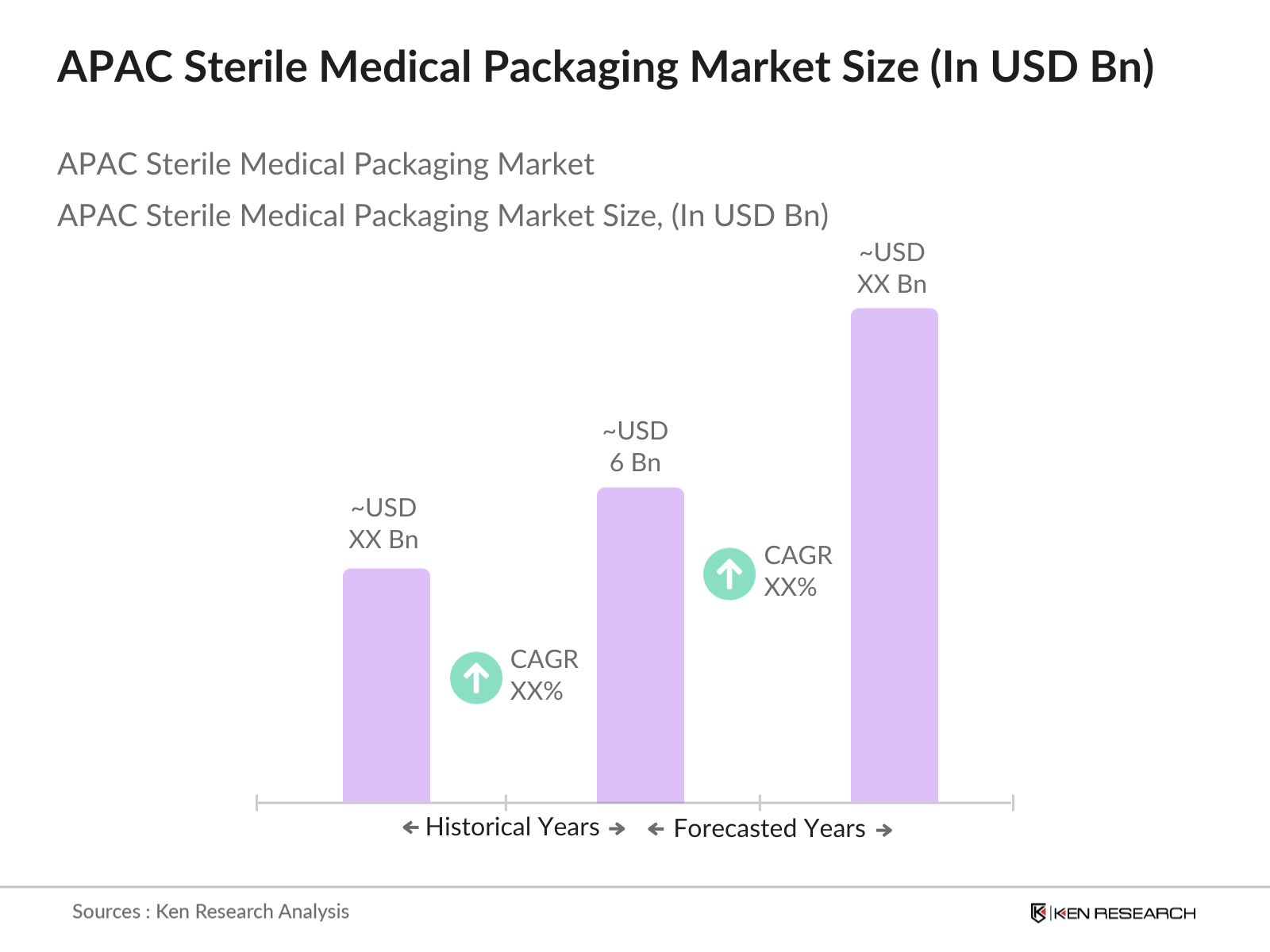

- The APAC Sterile Medical Packaging market is valued at USD 6 billion, based on a five-year historical analysis. This market is primarily driven by the increasing demand for safe and sterile packaging of medical devices, pharmaceuticals, and surgical instruments. Factors such as rising healthcare expenditure, the growing prevalence of chronic diseases, and advancements in packaging technologies contribute significantly to the growth of this market, especially as healthcare standards and hygiene regulations become stricter across the APAC region.

- Countries such as China, India, and Japan dominate the market due to their large populations, rapidly growing healthcare sectors, and investments in healthcare infrastructure. China leads with significant manufacturing capabilities and a robust supply chain network. Meanwhile, India is growing due to increasing healthcare access and demand for medical devices, while Japan benefits from advanced healthcare technology and high standards of medical care.

- The regulatory environment for sterile medical packaging in APAC is shaped by stringent national standards. Chinas National Medical Products Administration (NMPA) requires extensive testing for packaging materials, while Japans Pharmaceuticals and Medical Devices Agency (PMDA) mandates adherence to ISO 11607 standards for medical packaging. In India, the Bureau of Indian Standards (BIS) is developing new guidelines to harmonize packaging regulations with global standards.

APAC Sterile Medical Packaging Market Segmentation

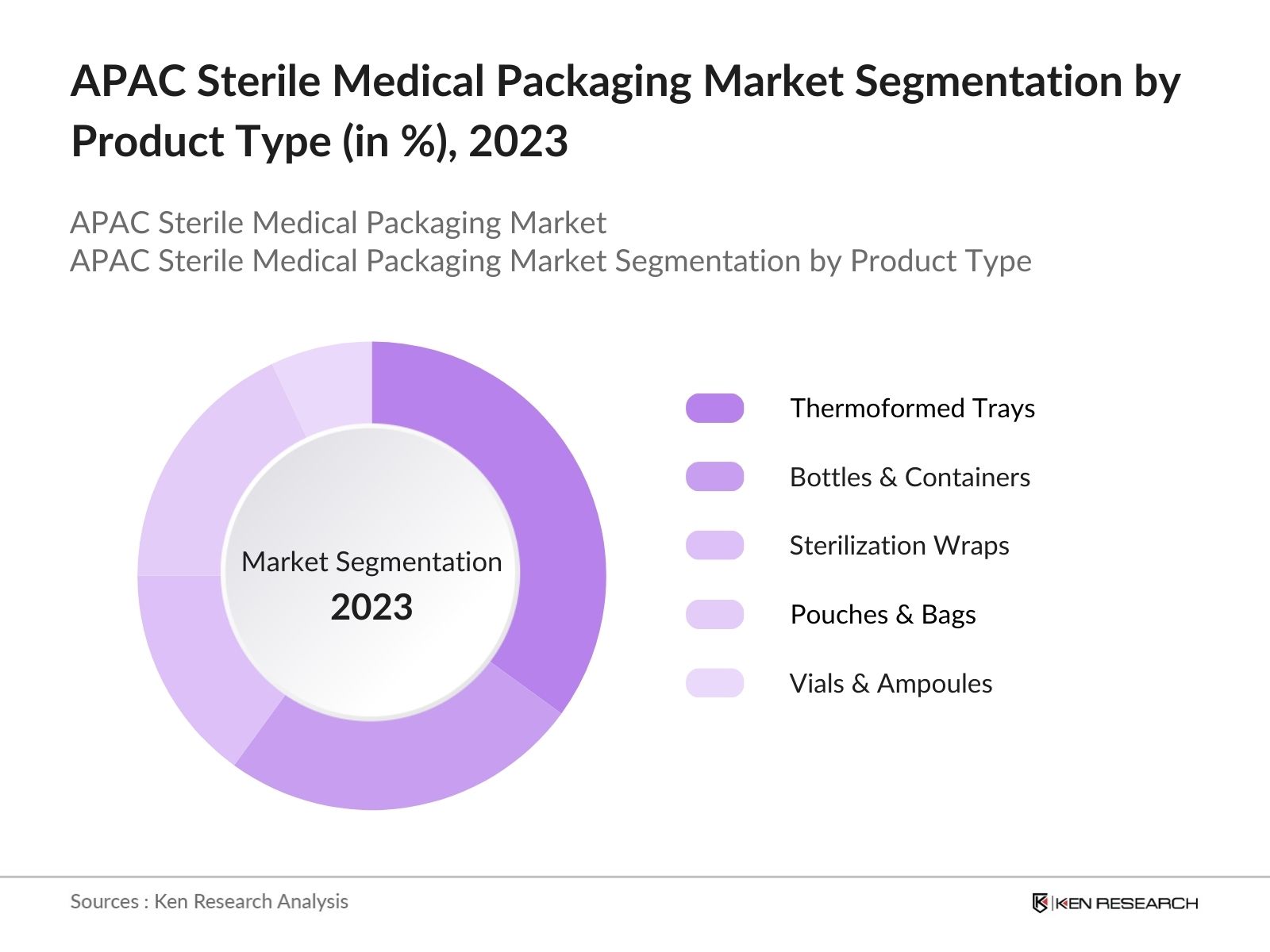

By Product Type: The APAC Sterile Medical Packaging market is segmented by product type into thermoformed trays, bottles & containers, sterilization wraps, pouches & bags, and vials & ampoules. Among these, thermoformed trays have a dominant market share due to their widespread use in packaging surgical instruments, medical devices, and implants. They offer a high level of protection and customization, making them an ideal choice for manufacturers of high-precision medical equipment.

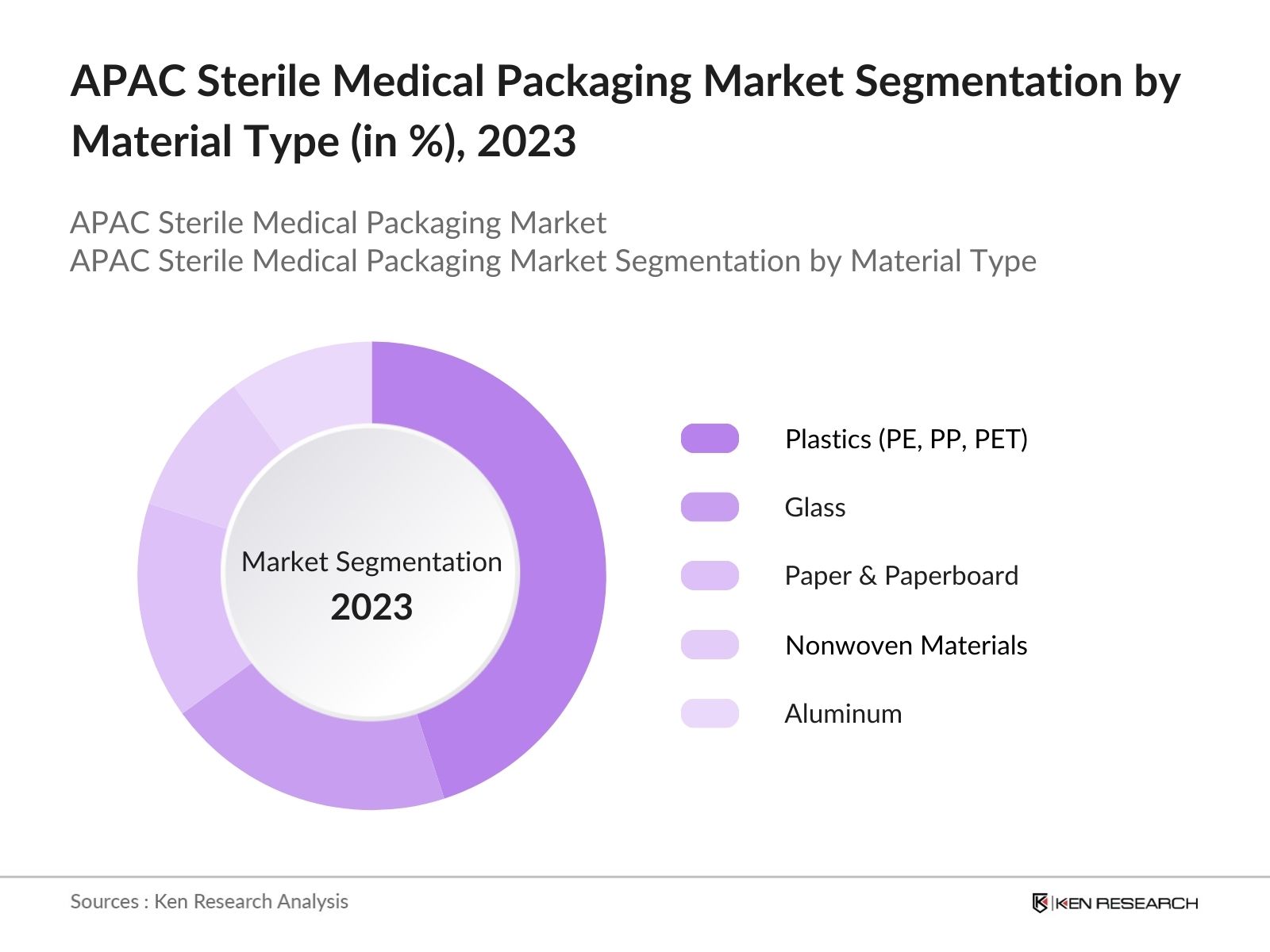

By Material Type: The market is also segmented by material type, including plastics (polyethylene, polypropylene, PET), glass, paper & paperboard, nonwoven materials, and aluminum. Plastics dominate this segment with the largest share, owing to their versatility, cost-effectiveness, and ability to be molded into various forms to meet specific packaging requirements. The increasing use of advanced polymers for durable and lightweight medical packaging solutions further drives the adoption of plastic materials in the industry.

APAC Sterile Medical Packaging Market Competitive Landscape

The APAC Sterile Medical Packaging market is characterized by the presence of several key players, which include both global giants and regional companies. The market is highly consolidated, with companies focusing on expanding their product offerings, improving sterilization technologies, and adhering to stringent regulatory standards. The competitive landscape is shaped by the focus on technological advancements in sterile packaging materials and the adoption of sustainable packaging solutions.

APAC Sterile Medical Packaging Industry Analysis

Growth Drivers

- Rising Healthcare Expenditure (Country-Wise): Healthcare expenditure in the Asia-Pacific (APAC) region has seen a substantial increase, driven by rising incomes and the expansion of universal healthcare programs in countries like China, India, and Japan. According to the World Bank, healthcare expenditure in China reached $1.2 trillion in 2023, while Indias healthcare expenditure was $253 billion. Japan, the region's largest healthcare spender, allocated approximately $480 billion to its healthcare sector in 2023.

- Increasing Demand for Medical Devices: The demand for medical devices in the APAC region has surged due to aging populations, rising chronic disease rates, and increased medical tourism. In 2024, China and India are among the largest consumers of medical devices, with China's medical device market valued at approximately $96 billion, driven by rising urbanization and access to healthcare. The increasing demand for devices such as syringes, diagnostic kits, and surgical tools requires efficient sterile packaging solutions to maintain safety and hygiene standards.

- Technological Advancements in Packaging: Technological advancements in sterile medical packaging, such as the development of thermoformed trays and high-barrier pouches, are transforming the industry in the APAC region. With the rapid adoption of automated packaging systems in countries like Japan and South Korea, manufacturers are improving the efficiency and safety of sterile packaging solutions. In 2023, the use of advanced barrier materials like Tyvek has become a standard in sterile packaging, offering enhanced protection against contamination.

Market Challenges

- Stringent Regulatory Frameworks: The regulatory frameworks governing sterile medical packaging in the APAC region are complex, with countries like China and Japan implementing stringent standards to ensure product safety. For instance, Chinas National Medical Products Administration (NMPA) imposes strict regulations on medical packaging, including material testing and sterilization protocols. In Japan, manufacturers must adhere to ISO 11607 standards, which outline packaging requirements for terminally sterilized medical devices.

- High Manufacturing Costs: Manufacturing sterile medical packaging is capital-intensive, driven by the need for advanced machinery and quality control measures. In 2023, the average cost of setting up a sterile packaging facility in APAC ranged between $5 million to $15 million, depending on the size and technology used. The costs associated with maintaining sterilization processes, such as Ethylene Oxide (ETO) sterilization, are also significant, making it challenging for smaller manufacturers to compete.

APAC Sterile Medical Packaging Market Future Outlook

Over the next five years, the APAC Sterile Medical Packaging market is expected to experience robust growth, driven by the expansion of the healthcare sector, rising medical tourism, and the increasing demand for safe and reliable packaging solutions. Countries like China, India, and Japan will continue to lead the market due to their significant healthcare investments and growing demand for medical devices.

Market Opportunities

- Growth of Healthcare Infrastructure in Emerging APAC Economies: Emerging economies in the APAC region are experiencing significant healthcare infrastructure growth, creating opportunities for the sterile medical packaging market. For instance, in 2023, Vietnam announced plans to build 10 new hospitals and upgrade over 150 existing facilities, with an investment of $3.7 billion. Similarly, Indonesia allocated $11 billion to healthcare infrastructure development in 2024.

- Sustainable Packaging Solutions: The shift towards sustainable packaging in the APAC region presents a significant opportunity for the sterile medical packaging market. Governments are promoting eco-friendly solutions, with countries like Japan and South Korea setting ambitious targets to reduce plastic waste. In 2024, South Korea plans to reduce plastic packaging by 20%, driving demand for biodegradable and recyclable sterile packaging materials.

Scope of the Report

|

Product Type |

Thermoformed Trays Bottles & Containers Sterilization Wraps Pouches & Bags Vials & Ampoules |

|

Material Type |

Plastics (Polyethylene, Polypropylene, PET) Glass Paper & Paperboard Nonwoven Materials Aluminum |

|

Application |

Pharmaceuticals Surgical Instruments Diagnostic Devices Biologicals Others (IV equipment, Catheters) |

|

Sterilization Method |

Chemical Sterilization Radiation Sterilization Steam Sterilization Ethylene Oxide Sterilization |

|

Country |

China Japan India South Korea Australia |

Products

Key Target Audience

Medical Device Manufacturers

Pharmaceutical Companies

Healthcare Service Providers

Investments and Venture Capital Firms

Government and Regulatory Bodies (FDA, WHO, APAC Regional Governments)

Sterilization Technology Providers

Raw Material Suppliers

Packaging Solution Providers

Companies

Players Mentioned in the Report

Amcor Plc

DuPont de Nemours, Inc.

West Pharmaceutical Services, Inc.

3M Company

SteriPack Group

Berry Global, Inc.

Wipak Group

Sonoco Products Company

Nelipak Healthcare Packaging

Tekni-Plex, Inc.

Table of Contents

1. APAC Sterile Medical Packaging Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate and Key Developments

1.4 Market Segmentation Overview

2. APAC Sterile Medical Packaging Market Size (in USD Billion)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. APAC Sterile Medical Packaging Market Analysis

3.1 Growth Drivers

3.1.1 Rising Healthcare Expenditure (Country-Wise)

3.1.2 Increasing Demand for Medical Devices

3.1.3 Government Policies for Healthcare Development

3.1.4 Technological Advancements in Packaging

3.2 Market Challenges

3.2.1 Stringent Regulatory Frameworks

3.2.2 High Manufacturing Costs

3.2.3 Supply Chain Constraints in Emerging Markets

3.3 Opportunities

3.3.1 Growth of Healthcare Infrastructure in Emerging APAC Economies

3.3.2 Sustainable Packaging Solutions

3.3.3 Strategic Partnerships and Mergers in the Medical Packaging Sector

3.4 Trends

3.4.1 Adoption of Biodegradable and Eco-Friendly Materials

3.4.2 Innovations in Sterile Packaging Technologies (such as Thermoformed Trays, Pouches)

3.4.3 Increased Focus on Minimizing Packaging Waste

3.5 Government Regulations

3.5.1 Asia Pacific Regional Packaging Regulations (China, Japan, India, etc.)

3.5.2 Sterilization Standards (ISO 11607)

3.5.3 Import/Export Regulations on Medical Packaging Products

3.5.4 Initiatives for Eco-Friendly Packaging by Regional Governments

3.6 SWOT Analysis

3.7 Stake Ecosystem (Manufacturers, Suppliers, Distributors, End-Users)

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. APAC Sterile Medical Packaging Market Segmentation

4.1 By Product Type (in Value %)

4.1.1 Thermoformed Trays

4.1.2 Bottles & Containers

4.1.3 Sterilization Wraps

4.1.4 Pouches & Bags

4.1.5 Vials & Ampoules

4.2 By Material Type (in Value %)

4.2.1 Plastics (Polyethylene, Polypropylene, PET, etc.)

4.2.2 Glass

4.2.3 Paper & Paperboard

4.2.4 Nonwoven Materials

4.2.5 Aluminum

4.3 By Application (in Value %)

4.3.1 Pharmaceuticals

4.3.2 Surgical Instruments

4.3.3 Diagnostic Devices

4.3.4 Biologicals

4.3.5 Others (IV equipment, Catheters, etc.)

4.4 By Sterilization Method (in Value %)

4.4.1 Chemical Sterilization

4.4.2 Radiation Sterilization

4.4.3 Steam Sterilization

4.4.4 Ethylene Oxide Sterilization

4.5 By Country (in Value %)

4.5.1 China

4.5.2 Japan

4.5.3 India

4.5.4 South Korea

4.5.5 Australia

5. APAC Sterile Medical Packaging Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Amcor Plc

5.1.2 DuPont de Nemours, Inc.

5.1.3 West Pharmaceutical Services, Inc.

5.1.4 3M Company

5.1.5 SteriPack Group

5.1.6 Sonoco Products Company

5.1.7 Berry Global, Inc.

5.1.8 Wipak Group

5.1.9 Nelipak Healthcare Packaging

5.1.10 Tekni-Plex, Inc.

5.1.11 Oliver Healthcare Packaging

5.1.12 Bemis Healthcare Packaging

5.1.13 Sealed Air Corporation

5.1.14 Riverside Medical Packaging

5.1.15 Oracle Packaging

5.2 Cross Comparison Parameters

Market Share, Revenue, Manufacturing Capacity, R&D Spending, Product Portfolio, Sustainability Initiatives, Geographical Reach, Certification Standards

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants

5.8 Private Equity Investments

6. APAC Sterile Medical Packaging Market Regulatory Framework

6.1 Packaging Safety and Quality Standards (FDA, WHO, CE Marking)

6.2 Regional Packaging Guidelines for Medical Products

6.3 Certification Processes and Compliance Requirements

7. APAC Sterile Medical Packaging Future Market Size (in USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. APAC Sterile Medical Packaging Future Market Segmentation

8.1 By Product Type (in Value %)

8.2 By Material Type (in Value %)

8.3 By Application (in Value %)

8.4 By Sterilization Method (in Value %)

8.5 By Country (in Value %)

9. APAC Sterile Medical Packaging Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves identifying the major variables driving the APAC Sterile Medical Packaging Market, such as demand for medical devices, regulatory frameworks, and advancements in sterilization technologies. Key stakeholders like medical device manufacturers and regulatory bodies are identified through desk research and proprietary databases.

Step 2: Market Analysis and Construction

Historical data is collected and analyzed to understand the market penetration of sterile packaging solutions in the APAC region. This involves reviewing the production, distribution, and usage statistics for packaging materials like plastics and glass.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses are validated by consulting industry experts and practitioners. Computer-assisted interviews (CATIs) with professionals from leading companies such as Amcor Plc and 3M Company provide insights into emerging trends, opportunities, and challenges in the sterile packaging market.

Step 4: Research Synthesis and Final Output

The final stage involves consolidating data from primary and secondary research, validating findings with manufacturers, and producing the final report. This ensures that market projections and insights are accurate and reliable.

Frequently Asked Questions

01. How big is the APAC Sterile Medical Packaging Market?

The APAC Sterile Medical Packaging market is valued at USD 6 billion, based on a five-year historical analysis. This market is primarily driven by the increasing demand for safe and sterile packaging of medical devices, pharmaceuticals, and surgical instruments.

02. What are the challenges in the APAC Sterile Medical Packaging Market?

Challenges include stringent regulatory frameworks, high production costs, and supply chain disruptions, particularly in emerging economies like India and Indonesia.

03. Who are the major players in the APAC Sterile Medical Packaging Market?

Major players include Amcor Plc, DuPont de Nemours, Inc., West Pharmaceutical Services, and 3M Company. These companies dominate due to their innovation capabilities, geographical reach, and strong partnerships.

04. What are the growth drivers of the APAC Sterile Medical Packaging Market?

The market is driven by increasing healthcare expenditure, rising demand for medical devices, technological advancements in packaging materials, and stringent hygiene regulations across the region.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.