APAC Telecom Analytics Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD5206

December 2024

82

About the Report

APAC Telecom Analytics Market Overview

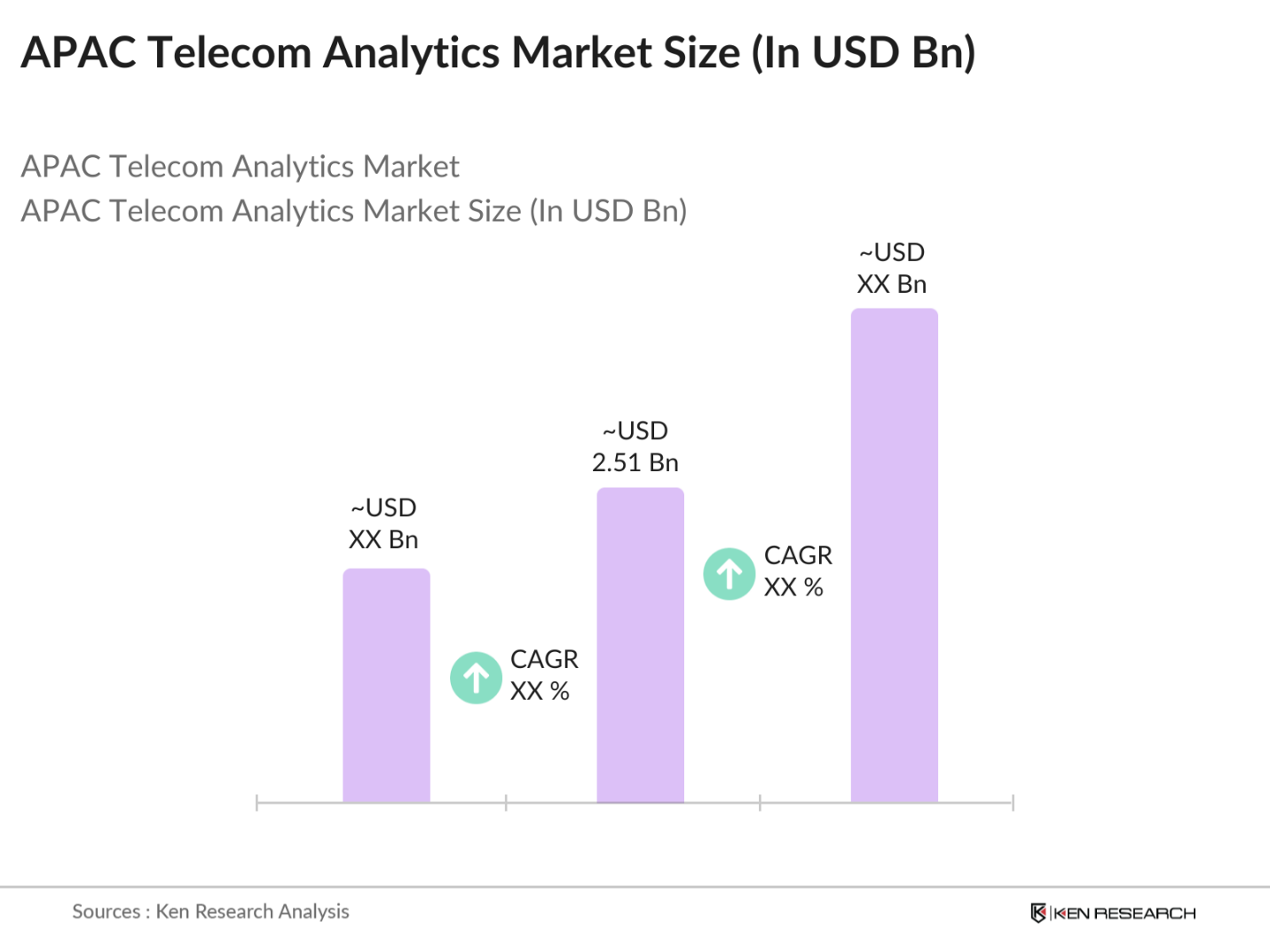

- The APAC Telecom Analytics market is valued at USD 2.51 billion, based on a five-year historical analysis. This market is primarily driven by the expansion of 5G networks, increasing data traffic, and the adoption of AI-driven analytics. Telecom operators are focusing on optimizing network performance and improving customer experience through real-time analytics and predictive insights. As data consumption continues to rise, driven by mobile devices and the shift to cloud-based services, the demand for advanced telecom analytics solutions is accelerating in the region.

- Key countries dominating the APAC Telecom Analytics Market include China, Japan, and India. China is leading due to its expansive mobile subscriber base and aggressive investments in 5G infrastructure. Japan follows with its technologically advanced telecom networks and widespread adoption of IoT. India is gaining traction as telecom companies continue to expand their analytics capabilities to improve customer retention in a highly competitive market. These countries are characterized by strong government backing for telecom infrastructure development and digital transformation initiatives.

- Spectrum allocation and licensing policies are vital to the development of telecom analytics in APAC, particularly with the rollout of 5G networks. By 2023, countries such as China, South Korea, and Australia had allocated significant portions of the 5G spectrum to telecom operators, enabling faster data transmission and enhanced analytics capabilities. Spectrum pricing remains a key concern, with governments working to balance affordable spectrum costs while ensuring optimal utilization of telecom infrastructure.

APAC Telecom Analytics Market Segmentation

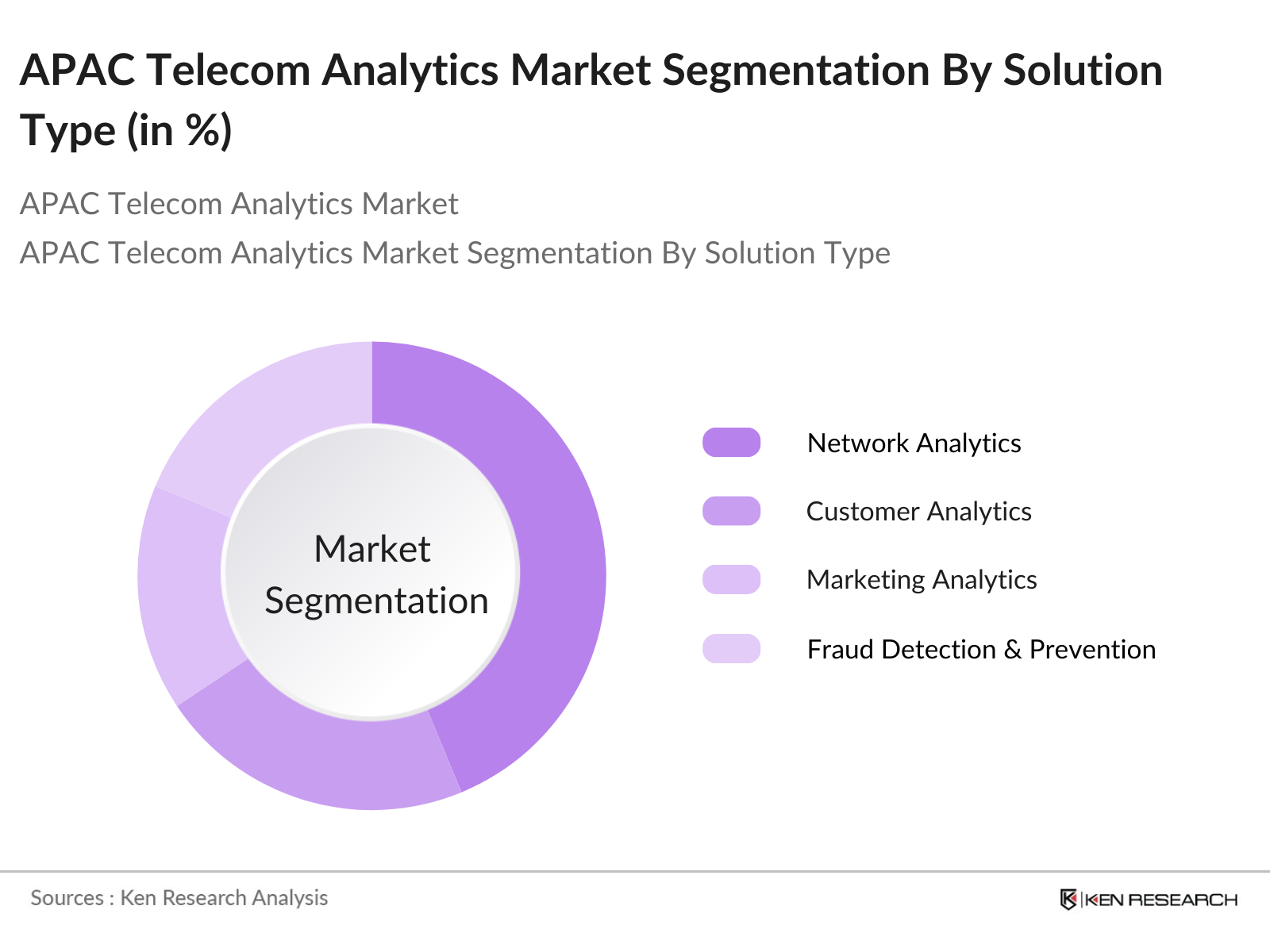

By Solution Type: The market is segmented by solution type into network analytics, customer analytics, marketing analytics, fraud detection and prevention, and operational analytics. Among these, network analytics holds a dominant market share due to the ongoing expansion of 5G networks in the region. Telecom operators rely heavily on network analytics to manage and optimize their growing data traffic, particularly in markets like China and South Korea.

By Application: The market is further segmented by application into customer retention, network management, revenue management, marketing campaigns, and risk and compliance management. Customer retention leads this segment as telecom companies in markets like India and Southeast Asia face intense competition and high churn rates.

APAC Telecom Analytics Market Competitive Landscape

The APAC Telecom Analytics market is dominated by both regional and global players that offer comprehensive analytics solutions to telecom operators. This market is highly competitive, with players investing in AI-driven analytics platforms and cloud-based solutions to stay ahead. Some of the key players are working closely with telecom companies to enhance network efficiency and offer personalized customer experiences.

APAC Telecom Analytics Industry Analysis

Growth Drivers

- Rising Mobile Data Consumption (Mobile Data Usage, 5G Rollout): In 2024, APAC continues to experience exponential growth in mobile data consumption, driven by an increasing number of smartphone users and the proliferation of video streaming, online gaming, and other data-intensive applications. For instance, mobile data traffic in APAC surpassed 76 exabytes per month in 2023. The rollout of 5G networks further fuels this surge, with more than 300 million 5G connections reported in 2023 across key markets like China, Japan, and South Korea.

- Growing Demand for Predictive Analytics (AI Integration, Big Data Adoption): As telecom operators in APAC embrace digital transformation, the demand for predictive analytics solutions has surged, primarily fueled by AI integration and big data adoption. In 2023, over 70% of telecom operators in the region deployed AI-based analytics solutions to optimize network performance and improve customer retention. Governments across APAC have been investing in AI research, with countries like Singapore allocating $180 million towards AI initiatives to support industries, including telecommunications.

- Increase in Cloud-Based Analytics Solutions (Cloud Migration, SaaS Platforms): The APAC region is witnessing a rapid increase in the adoption of cloud-based analytics solutions, particularly with the migration of telecom operators to cloud platforms for enhanced scalability and flexibility. In 2022, cloud infrastructure investments in APAC exceeded $150 billion, according to the World Bank, as companies shifted to cloud-based software-as-a-service (SaaS) platforms.

Market Challenges

- High Costs of Implementation (Capital Investment, Ongoing Maintenance): The high costs of implementing advanced telecom analytics systems remain a significant challenge for many operators in the APAC region. In 2023, capital expenditures (CAPEX) for telecom companies in APAC averaged $120 billion, with a substantial portion directed toward the deployment of 5G and advanced analytics infrastructure. The ongoing costs of maintenance, combined with the initial capital investment, create financial strain, particularly for smaller operators.

- Data Privacy and Security Concerns (Compliance with Data Regulations, Cybersecurity Threats): Data privacy and security issues continue to challenge the telecom analytics market in APAC. With the introduction of stringent data protection laws, such as the Personal Data Protection Act (PDPA) in Singapore and the Cybersecurity Law in China, telecom companies are under pressure to ensure compliance. In 2023, data breaches in APAC telecom firms cost an average of $4 million per incident, according to government cybersecurity reports.

APAC Telecom Analytics Market Future Outlook

The APAC Telecom Analytics market is expected to witness significant growth over the next five years, driven by the rapid expansion of 5G networks, increased adoption of cloud-based analytics solutions, and growing reliance on AI and machine learning for predictive insights. Telecom companies in the region are projected to invest heavily in analytics platforms to enhance customer experiences, optimize network operations, and mitigate fraud.

Market Opportunities

- Expansion of 5G Networks (Network Performance, Data Traffic Optimization): The expansion of 5G networks across the APAC region presents significant opportunities for telecom analytics, particularly in enhancing network performance and optimizing data traffic. By 2023, more than 15 APAC countries had launched commercial 5G services, including China, Japan, and South Korea. These countries reported a significant reduction in network latency and improvements in data throughput, thanks to the implementation of real-time analytics solutions.

- Increasing Focus on Customer Experience Management (Real-Time Analytics, Personalized Services): The APAC telecom sector has been focusing on customer experience management (CEM), driven by the need to provide personalized services through real-time analytics. In 2023, over 60% of telecom operators in the region adopted customer-centric analytics platforms to deliver personalized services, such as tailored data plans and content recommendations. Real-time data analysis enables operators to monitor customer preferences and adapt their offerings accordingly, improving customer retention rates.

Scope of the Report

|

Solution Type |

Network Analytics Customer Analytics Marketing Analytics Fraud Detection and Prevention Operational Analytics |

|

Deployment Mode |

On-Premise Cloud-Based |

|

Application |

Customer Retention Network Management Revenue Management Marketing Campaigns Risk and Compliance Management |

|

Telecom Service Type |

Mobile Networks Fixed-Line Networks Broadband Services 5G Networks |

|

Region |

East Asia Southeast Asia South Asia Oceania |

Products

Key Target Audience

Telecom Service Providers

Cloud Service Providers

Government and Regulatory Bodies (e.g., Telecom Regulatory Authority of India, Infocomm Media Development Authority)

Telecom Equipment Manufacturers

AI and Data Analytics Companies

Investments and Venture Capitalist Firms

Telecom Infrastructure Developers

System Integrators

Companies

Players Mentioned in the Report

IBM Corporation

Nokia Corporation

Ericsson

Huawei Technologies

Oracle Corporation

SAS Institute Inc.

Teradata Corporation

SAP SE

TIBCO Software Inc.

ZTE Corporation

Table of Contents

1. APAC Telecom Analytics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. APAC Telecom Analytics Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. APAC Telecom Analytics Market Analysis

3.1. Growth Drivers

3.1.1. Rising Mobile Data Consumption (Mobile Data Usage, 5G Rollout)

3.1.2. Growing Demand for Predictive Analytics (AI Integration, Big Data Adoption)

3.1.3. Increase in Cloud-Based Analytics Solutions (Cloud Migration, SaaS Platforms)

3.1.4. Government Support and Policies (Telecom Infrastructure Development, Digitalization)

3.2. Market Challenges

3.2.1. High Costs of Implementation (Capital Investment, Ongoing Maintenance)

3.2.2. Data Privacy and Security Concerns (Compliance with Data Regulations, Cybersecurity Threats)

3.2.3. Legacy Systems and Interoperability Issues (Integration with Legacy Systems, Scalability)

3.3. Opportunities

3.3.1. Expansion of 5G Networks (Network Performance, Data Traffic Optimization)

3.3.2. Increasing Focus on Customer Experience Management (Real-Time Analytics, Personalized Services)

3.3.3. Growth of AI-Driven Telecom Solutions (Automation, AI in Network Management)

3.4. Trends

3.4.1. Adoption of AI and Machine Learning in Telecom Analytics (AI Algorithms, Predictive Insights)

3.4.2. Transition to Cloud-Based Analytics Platforms (Scalability, Flexibility)

3.4.3. Integration of IoT Data for Telecom Analytics (IoT in Telecom, Data Aggregation)

3.5. Government Regulation

3.5.1. APAC Telecom Policy Frameworks (Digital Transformation Policies, Data Governance Laws)

3.5.2. Spectrum Allocation and Licensing (5G Spectrum, Spectrum Pricing)

3.5.3. Telecom Data Protection Laws (GDPR-Like Regulations, Data Localization Policies)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. APAC Telecom Analytics Market Segmentation

4.1. By Solution Type (In Value %)

4.1.1. Network Analytics

4.1.2. Customer Analytics

4.1.3. Marketing Analytics

4.1.4. Fraud Detection and Prevention

4.1.5. Operational Analytics

4.2. By Deployment Mode (In Value %)

4.2.1. On-Premise

4.2.2. Cloud-Based

4.3. By Application (In Value %)

4.3.1. Customer Retention

4.3.2. Network Management

4.3.3. Revenue Management

4.3.4. Marketing Campaigns

4.3.5. Risk and Compliance Management

4.4. By Telecom Service Type (In Value %)

4.4.1. Mobile Networks

4.4.2. Fixed-Line Networks

4.4.3. Broadband Services

4.4.4. 5G Networks

4.5. By Region (In Value %)

4.5.1. East Asia

4.5.2. Southeast Asia

4.5.3. South Asia

4.5.4. Oceania

5. APAC Telecom Analytics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. IBM Corporation

5.1.2. Nokia Corporation

5.1.3. Ericsson

5.1.4. Huawei Technologies

5.1.5. Oracle Corporation

5.1.6. SAS Institute Inc.

5.1.7. Teradata Corporation

5.1.8. SAP SE

5.1.9. TIBCO Software Inc.

5.1.10. ZTE Corporation

5.1.11. NEC Corporation

5.1.12. Cisco Systems Inc.

5.1.13. Hewlett Packard Enterprise

5.1.14. Amdocs Ltd.

5.1.15. Viavi Solutions

5.2. Cross Comparison Parameters (Revenue, Market Share, Innovation Capabilities, Global Footprint, Telecom Analytics Solutions Portfolio, AI Integration, Key Partnerships, R&D Investment)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. APAC Telecom Analytics Market Regulatory Framework

6.1. Telecom Data Governance Standards

6.2. Data Sovereignty and Localization Policies

6.3. Compliance and Certification Requirements

7. APAC Telecom Analytics Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. APAC Telecom Analytics Future Market Segmentation

8.1. By Solution Type (In Value %)

8.2. By Deployment Mode (In Value %)

8.3. By Application (In Value %)

8.4. By Telecom Service Type (In Value %)

8.5. By Region (In Value %)

9. APAC Telecom Analytics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the major stakeholders within the APAC Telecom Analytics market. Through detailed desk research and database analysis, we pinpoint the key variables influencing the market, such as technological advancements, government regulations, and consumer preferences.

Step 2: Market Analysis and Construction

In this step, historical market data is compiled, focusing on market penetration and revenue generation across telecom service types. The analysis ensures the accuracy of revenue estimates by cross-referencing multiple data points, including service quality statistics.

Step 3: Hypothesis Validation and Expert Consultation

Our market hypotheses are validated by engaging in expert consultations with telecom industry specialists. These insights are crucial in refining the data and understanding operational trends in network management and customer analytics.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all research findings, combining insights from telecom service providers and analytics vendors. This allows us to provide a comprehensive market analysis and validate the data collected from a bottom-up approach.

Frequently Asked Questions

1. How big is the APAC Telecom Analytics Market?

The APAC Telecom Analytics market is valued at USD 2.51 billion, based on a five-year historical analysis. This market is primarily driven by the expansion of 5G networks, increasing data traffic, and the adoption of AI-driven analytics.

2. What are the challenges in the APAC Telecom Analytics Market?

Challenges include high implementation costs, data privacy concerns, and legacy system integration issues. Telecom operators also face difficulties in scaling analytics solutions across large and complex networks.

3. Who are the major players in the APAC Telecom Analytics Market?

Key players in the market include IBM Corporation, Nokia Corporation, Ericsson, Huawei Technologies, and Oracle Corporation. These companies dominate due to their comprehensive telecom analytics solutions and strategic partnerships with telecom service providers.

4. What are the growth drivers of the APAC Telecom Analytics Market?

The market is primarily driven by the expansion of 5G networks, growing data traffic, and increasing adoption of AI-driven analytics solutions. Government support for digital transformation further boosts market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.